This section reviews a quick start checklist to help you organize the things you need to start investing in the stock market.

We then look at the practical side of stocks, such as stock prices, stock splits, stop losses, and market order types.

Stock Trading Tools Checklist

It would be best if you made several tooling decisions to start trading in the stock market.

- Choosing an online broker

- Using a stock screener

- Charting Tools

- Using a portfolio management system

1. Choose an Online Broker

There is a lot of competition today in the online broker space, and the commissions and services offered change regularly. Here, we will detail some of the critical things to look for.

- Commission Charges – ensure that your broker is competitive (under $1 per trade, preferably free stock trades)

- Real-Time Charting (should be free in the base package)

- Access to news (preferably streaming news)

- Access to level II quotes.

- Stop Losses and Rules to enable you to place alerts and automated actions while away from the Office.

- Original Market Research and Valuations

- Compare the interest rate on the Cash Account.

- Customer service: read online customer reviews.

2. Select Your Charting Tools

Charting tools enable you to view the history of a stock using mathematical visualizations of the price, volume, and various indicators. Choosing the right charting software for you can be very time-consuming but is worth the time invested.

LiberatedStocktrader.com has completed an in-depth analysis of the best free internet stock charting software available and organized this side-by-side comparison to fast-track this decision-making process. This is invaluable information and lets you see what is essential in a charting package.

The critical choice is to use free internet stock charting packages or paid-for subscription-based software.

- Follow this link for the Top Ten Best Free Internet Charting Packages Review.

3. Choose a Stock Screener

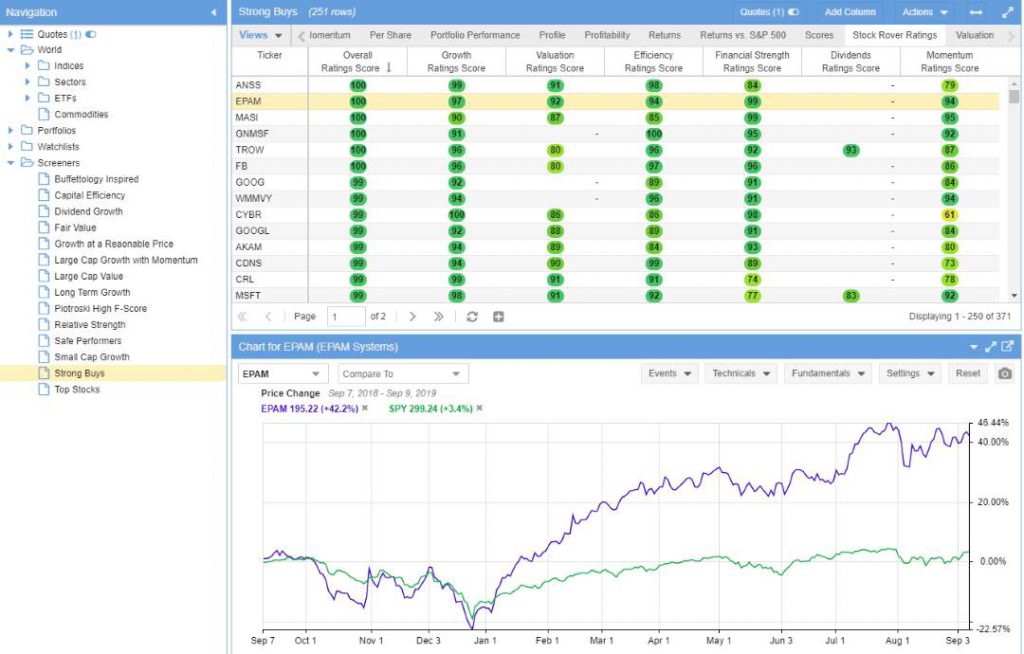

Stock screeners enable you to filter all stocks by your requirements, such as Earnings per Share and profit Margins. Finding the right Screener is an essential building block to successful trading.

The liberated Stock Trader reviewed the best free Internet stock Screens available and performed a head-to-head comparison. This will save you much time and effort in selecting the right one. Stock Screening and filtering options exist in “subscription-based” Charting Software Packages. For example, Telechart offers compelling screening capabilities.

4. Use a Professional Portfolio Management & Research Service

Portfolio management systems enable you to visualize and manage your entire portfolio accordingly. This will allow you to calculate the %gain and $ gain automatically for you.

Stock Rover, Our Favorite Portfolio Management & Stock Research SoftwareYou mostly have three options to choose from.

- Free Portfolio Management Tools

- Online Brokers Portfolio Management Tools

- Tracking Manually with a Spreadsheet.

We have covered all the core essentials to set yourself up as a Stock Trader. The most important by far is to educate yourself, always think for yourself, and be responsible for your own decisions.