What is a balance sheet?

A balance sheet is a financial statement showing a company’s assets, liabilities, and shareholders’ equity at a specific time.

Assets are anything a company owns, including cash, accounts receivable, inventory, and property. Liabilities are any debts or obligations a company owes, such as accounts payable, loans, and leases.

Shareholders’ equity is the portion of a company’s ownership that the shareholders hold; it includes both common stock and retained earnings.

Is a balance sheet important?

Yes, the balance sheet is one of the three most important financial statements, along with the income and cash flow statements. Together, these statements give investors a clear picture of a company’s financial health.

The Balance Sheet

All public companies are mandated to provide a balance sheet as part of standard accounting procedures. The balance sheet allows one to compare where the money is coming from (liabilities), what it is being spent on (assets), and the accumulated value of the company (equity). It states the company’s net worth by subtracting the liabilities from the assets.

The balance sheet should always be in balance.

The balance sheet formula

Assets = Liabilities + Shareholder Equity

The balance sheet formula is Assets = Liabilities + Equity. If you add all the Liabilities and the Shareholder Equity, it should always equal the value of the assets.

Balance sheet assets

Balance sheet assets are investments and property a company owns and the cash it has on hand. These assets can be either long-term or short-term. Long-term assets are investments a company intends to hold for more than a year, such as buildings or machinery. Short-term assets are cash or investments a company expects to convert to cash within a year, such as inventory or accounts receivable.

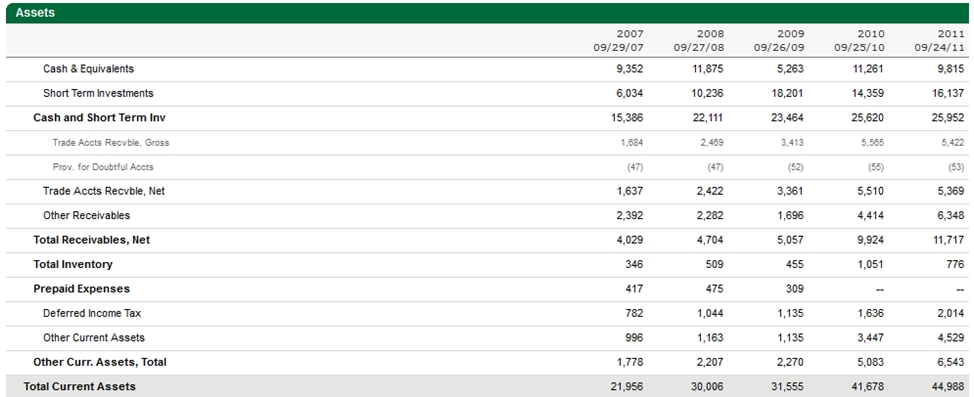

Balance sheet current assets example

Cash and equivalents on the balance sheet

Cash and equivalents are considered the most liquid assets a company has. This includes things like cash, marketable securities, and short-term investments. Companies usually try to keep a good amount of cash on hand to meet their liabilities when they come due easily.

Short-term investments on the balance sheet

Short-term investments are assets that are not as liquid as cash but are still relatively easy to sell. This can include things like government bonds, corporate bonds, and CDs. Companies usually invest in these types of assets because they offer a higher rate of return than cash, but they can also be more volatile.

Trade accounts receivable on the balance sheet

Trade accounts receivable is money that a company is owed by its customers. This can be for products or services that have been sold on credit. The receivables will usually be due within 30 days, but sometimes they can be extended to 90 days or more.

Companies need to keep track of their trade receivables, as they can significantly impact cash flow. If customers take a long time to pay their invoices, it can strain the company’s finances.

Inventory on the balance sheet

Inventory is a major asset for many businesses. It can include raw materials, work-in-progress (WIP), and finished goods. Companies use inventory to produce their products or services, which can be a major source of revenue.

Prepaid expenses

Prepaid expenses are costs that a company has paid for in advance. This can include things like insurance premiums, rent, and advertising. These expenses will usually be incurred in the future, but the company has already paid for them.

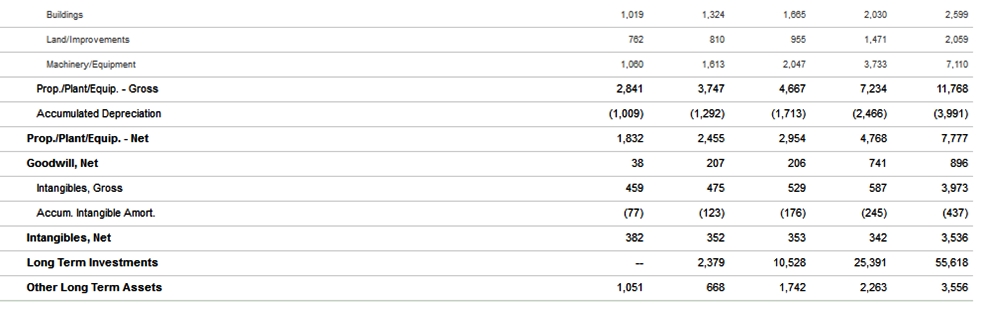

Balance sheet other assets example

Long term assets

Long-term assets are assets that a company plans to use for more than one year. This can include things like property, equipment, and patents. Long-term assets are usually listed at the purchase cost or the estimated fair market value.

Companies usually have to depreciate long-term assets over time, slowly writing them off as they are used.

Intangible assets

Intangible assets are assets that a company has but lack physical form. This can include things like trademarks, copyrights, and goodwill. Intangible assets are often very valuable to a company but can be difficult to value.

Goodwill is an intangible asset; this could be the brand’s inherent value or the extra price paid while buying a company that is above the business’s book value.

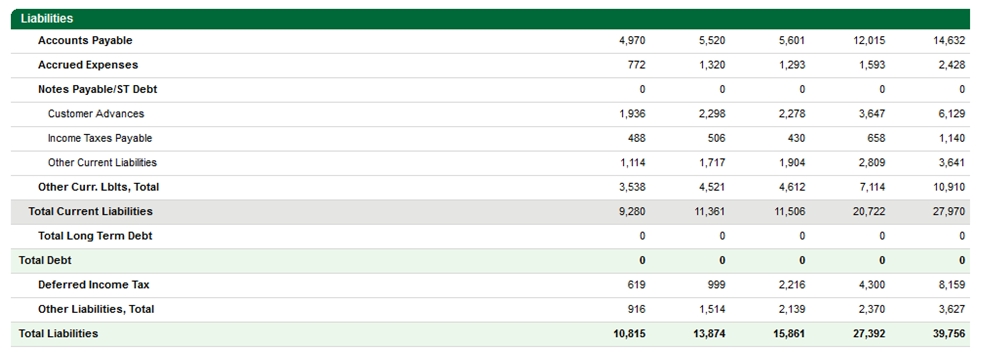

Balance sheet liabilities

The liability section of the balance sheet lists the debts a company owes, such as loans and bonds. This section includes any money aside for expenses, such as taxes or interest payments.

Balance sheet liabilities are the money that a company owes to others. This can include things like loans, accounts payable, and taxes owed. It is important to keep track of these liabilities, as they can majorly impact a company’s financial health.

Balance sheet liabilities example

Accounts payable

Accounts payable is one of the most common types of balance sheet liabilities. This is money that a company owes to its suppliers for goods or services purchased on credit. Companies usually have a 30-day grace period to pay their accounts payable, but after that, they will start accruing interest charges.

Accrued expenses

Accrued expenses are the exact opposite of the prepaid expenses mentioned earlier, primarily any short-term obligations that will be paid off shortly.

Loans

Loans are another type of liability that appears on the balance sheet. These are typically longer-term debts a company has taken from a bank or other financial institution. The loan terms will dictate when it needs to be repaid, and there may be penalties for early repayment.

Deferred income tax

Deferred income tax is, as you can imagine, the taxes owed to the government or region authorities but not yet paid. Taxes owed are also a common type of liability. Companies must pay various taxes, such as income, property, and payroll. Failure to pay these taxes can result in hefty fines and penalties.

Ever Dreamed of Beating the Stock Market

Most people think that they can't beat the market, and stock picking is a game only Wall Street insiders can win. This simply isn't true. With the right strategy, anyone can beat the market.

The LST Beat the Market Growth Stock Strategy is a proven system that has outperformed the S&P500 in 8 of the last 9 years. We provide all of the research and data needed to make informed decisions, so you no longer have to spend hours trying to find good stocks yourself.

The LST Beat the Market System Selects 35 Growth Stocks and Averages a 25.6% Annual Return

★ 35 Stocks That Already Beat The Market ★

★ Buy The Stocks & Hold For 12 Months - Then Rotate ★

★ Fully Documented Performance Track Record ★

★ Full Strategy Videos & eBook ★

Take The Pain Out Of Stock Selection With a Proven Strategy

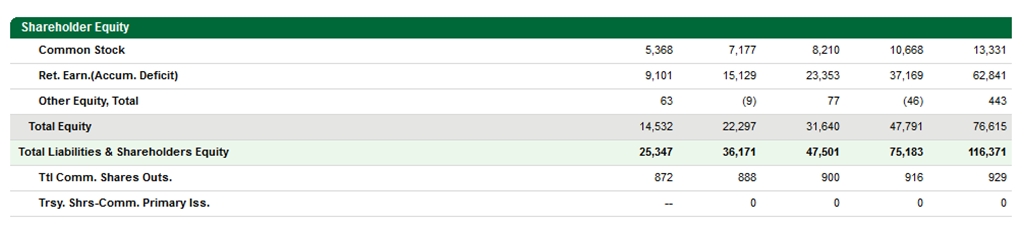

Shareholder Equity

The shareholders’ equity section of the balance sheet shows a shareholder’s ownership in a company. This section includes information on the preferred and common stock and retained earnings.

When you subtract the liabilities (debts) from the assets, the shareholder equity is left.

Balance sheet shareholders equity example

Common stock is the par value of the stock. So even though Apple’s actual stock price might be $500, this might be recorded as a $1 par value per stock. This means you may only receive $1 per share you own during liquidation. You may be lucky even to receive that, as the shareholders are the last to receive any payment, as creditors and bondholders have priority.

Retained Earnings are the reinvested profits from the company taken from the Income statement.

Book Value

The book value of a company is derived from its balance sheet. It tells you what the company would be worth if it sold all its assets and paid its debts.

Book Value = Total common shareholders’ equity / Average number of common shares outstanding.

FAQs

What is accumulated depreciation on a balance sheet?

Accumulated depreciation is a term used to describe the total depreciation taken on an asset. This figure will be listed on the balance sheet under the heading of long-term assets.

An asset’s accumulated depreciation can be different from its current market value, which is the price the asset would sell for on the open market.

What is depreciation?

Depreciation is a term used to describe an asset’s value decrease over time. Several factors, including wear and tear, obsolescence, and depletion, can cause this. Depreciation is often used to calculate an asset’s book value.

What is stockholders’ equity on a balance sheet?

Stockholders’ equity is the portion of a company’s balance sheet that represents the value of its shareholders’ investments. It includes things like common stock, preferred stock, and retained earnings.

What is goodwill on a balance sheet?

Goodwill is an intangible asset representing the value of a company’s trademarks, copyrights, and other intangible assets. It is often listed on the balance sheet at the acquisition cost, although its value can be difficult to estimate.

How do you calculate net income from the balance sheet?

First, calculate net income from the balance sheet. Take a company’s total revenue and subtract its expenses. This will give you the company’s net income, which you can then find on the income statement.

Net income is calculated by subtracting a company’s revenue from its expenses. This figure is listed on the company’s income statement.

What are retained earnings on a balance sheet?

Retained earnings are a company’s profits that have been reinvested into the business. They are listed on the balance sheet as a part of stockholders’ equity.

A company’s retained earnings can be used to calculate its book value, which is the cost of the company’s assets minus any depreciation that has been incurred.

Beat The Market, Avoid Crashes & Lower Your Risks

Nobody wants to see their hard-earned money disappear in a stock market crash.

Over the past century, the US stock market has had 6 major crashes that have caused investors to lose trillions of dollars.

The MOSES Index ETF Investing Strategy will help you minimize the impact of major stock market crashes. MOSES will alert you before the next crash happens so you can protect your portfolio. You will also know when the bear market is over and the new rally begins so you can start investing again.

MOSES Helps You Secure & Grow Your Biggest Investments

★ 3 Index ETF Strategies ★

★ Outperforms the NASDAQ 100, S&P500 & Russell 3000 ★

★ Beats the DAX, CAC40 & EURO STOXX Indices ★

★ Buy & Sell Signals Generated ★

MOSES Helps You Sleep Better At Night Knowing You Are Prepared For Future Disasters

Summary

When reading a balance sheet, it is important to remember that the numbers are at a specific point in time. The balance sheet might not reflect the company’s current financial situation. For example, a company might have sold some assets since the balance sheet was prepared, which would impact its current financial position.

It is also important to remember that the balance sheet is just one piece of information to consider when making investment decisions. Investors should also look at the income and cash flow statements to understand a company’s finances.