Original stock research into offbeat companies, and stock market datasets that might conjure inspirational ideas in you.

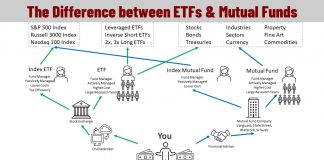

The Difference Between ETFs and Mutual Funds is Capital Flow

The difference between ETFs and mutual funds is ETFs are normally sold and bought on an exchange, while mutual funds are valued, traded, and priced at the end of a trading day. ETFs have lower fees, averaging 0.35%, and Mutual fund fees are over 1%.

What are Index Funds & How Do They Work?

Index funds are the best thing to happen to individual investors since the inception of the stock market. Find out more about index fund and their extensive benefit and negative traits.

LiberatedStockTrader’s Guide to Investing in Index Funds

Investing in index funds is a great way to diversify your portfolio and reduce risk. Index funds track the performance of major stock market indices, such as the S&P 500 or Dow Jones Industrial Average. Index funds are low-cost and have been shown to outperform actively managed mutual funds in the long run.

Don’t Invest In Index ETFs Until You Read These 13 Pro...

You can safely invest in index funds through mutual fund companies or as an index ETF directly through your broker. Investing in an index fund ETF is the most cost-effective, liquid, and efficient way to diversify your portfolio.

ETFs vs. Mutual Funds: Compounding, Fees & Performance Examined

ETF tax efficiency, liquidity, and low costs are perfect for independent investors. If you want someone to manage your money then mutual funds.

ETFs vs. Mutual Funds vs. Index Funds Explained

The difference between ETFs, mutual funds, and index funds is ETFs trade like stocks on an exchange, mutual funds are actively managed private investments, and an index fund can be either an ETF or a mutual fund.

Which is Better for Investors, ETFs or Stocks?

Exchange-traded funds (ETFs) and stocks represent two popular investments. Stock strategies can produce higher returns but require experience and time to manage. ETFs are simple, easy to buy, and can provide a more diversified portfolio over the long term.

18 Liquid 3X Leveraged ETFs & The Strategies To Trade Them

Gain insights from a seasoned ex-Wall Street trader with 40 years of experience, as he imparts knowledge on leveraged 3X ETF trading. Explore the intricacies of risks, rewards, and effective strategies.

How to Buy the Total Stock Market Using Global Index Funds

Investing in the total stock market through global index funds can be an excellent strategy for long-term investors seeking broad market exposure, low costs, and diversification.

20 Leading Robo-Advisor Profits & Fees Compared

Our research into robo-advisor fees and returns shows M1 Invest, SigFig, and Wealthfront are innovative leaders in the industry. There are many robo-advisors available now, and the list is growing.

Are Robo-Advisors Safe To Use? We Take a Look!

Although robo-advisors are a new technology, those offered by the major investment houses are safe. But that does not mean all are safe.

Robo-advisors offer...

Are Robo-Advisors a Good Idea? What Are The Pro & Cons?

Robo-advisors are good if you want to save time managing your investments. They automate tax-loss harvesting and rebalancing and provide commission-free trading in ETFs and stocks.

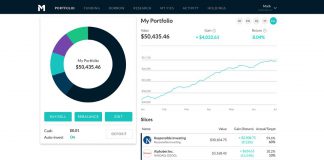

M1 Invest’s Robo-Advisor Tested & Rated for 2024

Our review testing finds that M1 Finance is a high-quality automated investing robo-advisor with a broad platform of financial products and a clear visibility into its investing performance. With $0 fees and a $100 minimum balance, M1 is worth trying.

Are Robo-Advisors Worth It? What Are The Alternatives?

Robo-advisors are worth it if you want to automate tax-loss harvesting & low-cost access to ETFs and mutual funds, saving you money. They also provide automatic portfolio construction, rotation & adjustment based on your risk and preferences.

Which is Better, Robo-Advisors or Human Financial Advisors?

Robo-Advisors vs. Financial Advisors: All Pros & Cons Comparing Costs, Fees, Services, Portfolio Management, Rebalancing & Tax Loss Harvesting.

How Do Robo-Advisors & Automated Investing Work?

Robo-advisors automate the complex task of creating and managing a portfolio by selecting investments according to your risk profile. Time-consuming tasks like purchasing stocks, portfolio rotation, and tax loss harvesting are performed automatically by the best robo-advisors.

Robo-Advisors, AI-Advisors and Hybrid-Advisors Explained

A robo-advisor is a fully automated investing service; a hybrid advisor adds the human touch to investing, and the AI robo-advisor uses algorithms and machine learning to make investments on your behalf.

Do Robo-Advisors Outperform the Stock Market?

Robo-advisors do not beat the stock market's average performance. Most Robo-advisors are designed to passively invest in index ETFs and, therefore, have practically no chance to outperform the market.

Firstrade vs. TD Ameritrade, E-Trade, Schwab & Fidelity

Considering Firstrade's selection of commission-free stocks, ETFs, and option contracts, our comparison shows it excels vs. TD Ameritrade, E-Trade, Schwab, and Fidelity

Jordan Belfort’s Real Net Worth. The Wolf of Wall Street Scam!

Our calculations suggest Jordan Belfort's net worth is close to -$40 million when considering his sizable income and outstanding -$97.5 million debt to 1,513 victims of the Stratton Oakmont scam.

TikTok Stock: Who Owns TikTok & How to Buy TikTok Shares

TikTok stock is not available to buy on any stock exchange. You can invest in TikTok by buying shares in SoftBank or KKR, which owns stock in ByteDance, TikTok's parent company.

Burger King Stock: 4 Great Ways to Invest In Fast Food

Burger King has no stock ticker symbol as it is not publicly traded on a stock exchange. Its owner, Restaurant Brands International (QSR), is listed on the New York Stock Exchange.

OnlyFans Stock: 3 Great Ways To Invest Streaming Video

OnlyFans stock interests investors because it has garnered massive media attention through its celebrities and is the fastest-growing social media site on the internet.

Red Bull Stock: 4 Epic Energy Drink Investments

Red Bull stock is not available to buy on any stock exchange because Red Bull is a private company. 100% of Red Bull stock is owned by Mark Mateschitz and cofounder Chaleo Yoovidhya.

Rolex Stock: 5 Great Ways to Invest In Luxury Goods

Rolex stock is not available to buy on any stock exchange. There is no publicly available Rolex stock because Rolex SA is a privately held company 100% owned by The Hans Wilsdorf Foundation, a Swiss charity.

Stripe Stock: 3 Top Ways to Investest in Fintech

Stripe stock is currently unavailable on any public stock exchange as it remains a privately held company under the control of its founders, the Collison brothers. However, it does have notable investors, including venture capital firms Andreessen Horowitz and Sequoia Capital.

Popeyes Stock: 4 Top Ways to Invest in Fast Food

Popeyes stock is not available to buy on any stock exchange. You can invest in Popeyes by buying shares in Restaurant Brands International (Ticker: QSR), the parent company owning 100% of Popeyes stock.

ByteDance Stock: 6 Ways To Invest In Social Media

You cannot buy ByteDance stock directly because ByteDance is not a publicly listed company. You can buy stock in the private equity companies that own ByteDance, KKR, and Softbank.

Chick-fil-A Stock: 5 Great Fast-Food Investments

Unfortunately, you cannot buy Chick-fil-A stock. Chick-fil-A is a privately held company, meaning it does not trade on any stock exchange and has no stock ticker symbol or stock price.

Shein Stock: IPO, Ticker, Scandals & Secrecy Uncovered

Shein stock is highly sought after, but it cannot be purchased as it is a privately held company. But would you want to buy Shein stock or its clothing considering its alleged pollution, sweatshops, and design theft?

Lego Stock: 4 Ways To Invest In The Profitable Toy Market

Lego stock is not available on any stock exchange and has no stock symbol because it is a privately held, family-owned business based in Denmark. Lego's history of success, profitability, and powerful branding has not gone unnoticed by investors. We share interesting insights into Lego and highlight four great toy companies worth investing in.

Bose Stock: 3 Ways to Invest In Audio Perfection

You cannot buy Bose stock; it is not available on any stock exchange because it is privately held. Amar G Bose founded the firm in 1964, and in 2011, he donated his shares to the Massachusetts Institute of Technology, making MIT the majority shareholder in Bose.

Blue Origin Stock: 3 Great Ways to Invest In Space

Blue Origin & SpaceX are Making Investing In Space Exciting. So How Can You Invest Profitably In Space Companies Today? We Share 3 Options.

SpaceX Stock: 3 Innovative Space Investments

SpaceX stock is not available to buy on any listed stock exchange because it is a privately held company, and the majority stakeholder is Elon Musk. Musk has raised $10.5 billion in private equity capital from 10 companies.

7 Top Metaverse Stocks & ETFs for 2024

Meta Platforms, Apple, Microsoft, Alphabet, Nvidia, Roblox, and Adobe are among the top Metaverse stocks, known for their profitability and success.

IKEA Stock: 3 Ways to Invest In Home Furnishings

Investing In IKEA Stock A Challenge Because Of Its Secretive & Complex Business Model & Ownership. We Have 3 Alternative Ways You Can Invest.

Riot Games Stock: Investing In 3 Top Games Companies

You cannot buy stock in Riot Games directly because Riot Games is not a publicly listed company. You can buy stock in the company that owns Riot Games, Tencent Holdings ADR (OTCMKTS: TCHEY), as Riot Games is a subsidiary of Tencent Holdings.

Investment Courses You Might Enjoy

Liberated Stock Trader Pro: Learn Stock Market Investing

Learn stock market investing with the complete online stock trading course by Barry D. Moore, a certified financial analyst from the International Federation of Technical Analysts (IFTA).

ETF Investing Strategy: MOSES Improves Performance & Lowers Risk

The MOSES ETF investing strategy is a powerful suite of indicators meticulously backtested over 100 years. Designed to empower you to outperform the market, it equips you with the tools to navigate major stock market crashes and unlock greater investing performance.

35 Best Growth Stocks To Buy Now To Beat The Market

Find the best growth stocks to buy now using a 9-year tested and proven strategy system that selects stocks that outperform the S&P 500. Instead of following stock tips from financial websites, you can adopt a structured approach to find stocks with a proven track record of beating the market.