Value Stock Investing: Strategy, Research & Software for Value Investors.

Value stocks are a key investing strategy; the biggest stock market profits cycle between value stocks and growth stocks. Our researched value investing strategies and educational articles provide you with value stock screening criteria and tactics to help you build a high-performing value portfolio.

The Best Value Investing Tools & Stock Screeners

Stock Rover Review 2024: Tested by LiberatedStockTrader

LiberatedStockTrader's review testing awards Stock Rover 4.7 stars. Its advanced screening, research, and portfolio tools are ideal for US value, income, and growth investors. With 650 financial metrics on 10,000 stocks and 44,000 ETFs, we rate Stock Rover the number one stock screener.

Top 4 Value Investing Screeners Tested by LiberatedStockTrader

The best value investing stock screener overall is Stock Rover because it has 650 screening metrics, including fair value, margin of safety, plus Graham and Greenblatt calculations.

10 Best Free & Paid Stock Screeners of 2024: Hands-on Test

Our rigorous testing shows the best free stock screeners are Stock Rover, TradingView, and Finviz. For premium screening, TrendSpider, Stock Rover, and Trade Ideas lead the pack.

Mastering Value Investing: A Complete Strategy Workbook +pdf

Value investing is an investment strategy focused on buying stocks trading at a discount relative to their intrinsic or fair value. Academic research shows value investing generates lower risk and higher long-term returns than dividend and growth investing.

Building the Best Buffett Stock Screener for Value Investing

The best Buffett and Graham stock screener is Stock Rover, which provides eight fair value, intrinsic value, and forward cash flow calculations to help you build a great portfolio.

39 Epic Screening Criteria All Smart Value Investors Use

The essential screening criteria to find great value stocks are intrinsic value, margin of safety, the PEG ratio, price to Graham number, and earnings power value.

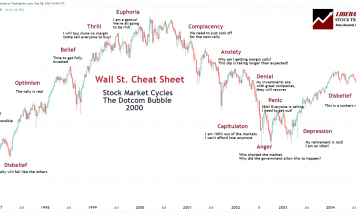

Using the Buffett Indicator to Understand Market Valuation

The Buffett Indicator helps gauge stock market valuation by dividing the total market capitalization by GDP, offering a macroeconomic perspective on market value.

13 Best Ratios & Tools To Find Undervalued Stocks Easily

To find undervalued stocks, use established financial ratios such as discounted cash flow, the margin of safety, PEG, price to book, or the price to Graham number. Each ratio provides a unique insight into a company to determine if it is undervalued.

The 26 Best Warren Buffett Investing Quotes of All Time

Warren Buffett's best investing quotes are "You might want a larger margin of safety," "Never invest in a business you don't understand," and "Don't bet on miracles."

How to Calculate Warren Buffett’s Margin of Safety: Formula + Excel

Calculating Buffett's margin of safety formula requires understanding cash flow, discounting, and intrinsic value.

Inspire Your Future With 25 Warren Buffett Quotes On Success

Warren Buffett undeniably embodies remarkable success in business, investing, and life. Quotes like "the people who are most successful are those who are doing what they love." are inspirational.

138 Inspirational Warren Buffett Investing Quotes Analyzed

My favorite Buffett quotes are "Rule No.1: Never lose money. Rule No.2: Never forget rule No.1." and "The stock market is a device for transferring money from the impatient to the patient."

20 Inspirational Warren Buffett Quotes on Life

Warren Buffett's quotes on life are inspirational, such as “If you are stuck in a hole, stop digging.” Join us as we explore the Oracle of Omaha's life lessons.

What Companies Does Warren Buffett Own? BRK Subsidiaries

Through Berkshire Hathaway's subsidiaries, CEO Warren Buffett owns 62 companies and has a major stakeholding in hundreds of companies in a broad market portfolio. Warren Buffett owns many companies via Berkshire Hathaway. He owns stocks and entire companies such as Dairy Queen & GEICO.

Important Value Investing Concepts & Strategy Explained

Value investing is a strategic approach to investing where stocks are selected that appear to be undervalued compared to their intrinsic value. The principle is to buy securities at less than their current market value, expecting their price to rise over time, leading to significant returns.

Is Value Investing Dead? LiberatedStockTrader Investigates!

Day traders and hedge fund managers would have you believe that value investing is dead, but published research by French and Fama shows value still outperforms growth.

We Analyze & Decipher Warren Buffett’s 20 Rules of Investing

Warren Buffett's rules of investing include "Never lose money," "Always have a margin of safety," and "Be fearful when others are greedy, and greedy when others are fearful." This timeless wisdom will help you be a better investor.

Value vs. Growth Stocks: Which is Better? We Test The Data!

Our data analysis for the past decade shows that growth stocks have outperformed value stocks. Growth investing has shown a remarkable return rate of 523%, while value investing has yielded 247%.

Training Courses You Might Enjoy

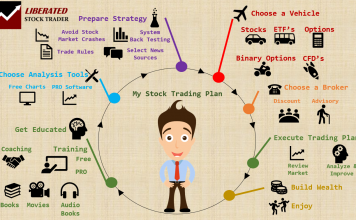

Liberated Stock Trader Pro: Learn Stock Market Investing

Learn stock market investing with the complete online stock trading course by Barry D. Moore, a certified financial analyst from the International Federation of Technical Analysts (IFTA).

ETF Investing Strategy: MOSES Improves Performance & Lowers Risk

The MOSES ETF investing strategy is a powerful suite of indicators meticulously backtested over 100 years. Designed to empower you to outperform the market, it equips you with the tools to navigate major stock market crashes and unlock greater investing performance.

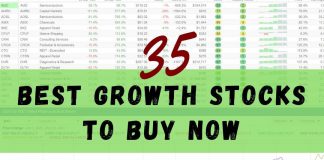

35 Best Growth Stocks To Buy Now To Beat The Market

Find the best growth stocks to buy now using a 9-year tested and proven strategy system that selects stocks that outperform the S&P 500. Instead of following stock tips from financial websites, you can adopt a structured approach to find stocks with a proven track record of beating the market.