Our review testing finds that M1 Finance is a high-quality automated investing robo-advisor with a broad platform of financial products and a clear visibility into its investing performance. With $0 fees and a $100 minimum balance, M1 is worth trying.

☆ Research You Can Trust ☆

My analysis, research, and testing stems from 25 years of trading experience and my Financial Technician Certification with the International Federation of Technical Analysts.

Overall, M1 allows you to have granular control over your portfolio or take advantage of the M1 expert portfolios (Pies). M1, like the industry, is growing fast, and it offers a full suite of services, including checking accounts and borrowing.

However, when it comes to automated investment, M1 is one of the leaders and one of the few offering automated investing for free with zero commissions.

Review Test Results & Ratings

| M1 Rating |

4.7/5.0 |

| 💸 Fees |

★★★★★ |

| 🚦 Trading |

★★★★✩ |

| 📡 Tax Harvesting | ★★★★✩ |

| 📰 Portfolio |

★★★★★ |

| 📈 Performance | ★★★★★ |

| 🔍 Rebalancing | ★★★★✩ |

| 🖱 Usability |

★★★★★ |

M1 Automated Advisor Service Details

M1 Finance is the only robo-advisor service in our review that offers commission-free trading for their customers. This means your account will have no management fee whatsoever.

This is very positive for the service, but the question is, how do they make money? They mostly make money from short-term lending of available cash funds to the overnight inter-bank market if you utilize their borrowing facility or invest in an M1 Plus account. Finally, they will receive small rebates from liquidity providers for their order flow. This is all quite normal and used throughout the industry.

Another great bonus of this mature service from M1 is that tax-loss harvesting is automatically integrated into the account. This means that when you withdraw funds from your account, the algorithms will consider which securities to sell, prioritizing those incurring losses so that they can offset future gains.

In addition, M1 promotes the purchase of fractional shares as a unique selling point; this means that if your portfolio dictates purchasing a stock at a high price, you can still be fully invested by purchasing a fraction of the share.

Another excellent addition is an integrated checking account, M1 Plus, which includes a Visa card for quick access to funds.

M1 Review: Key Features

| ⚡ Features |

Fractional Shares, Credit, Margin, Robo-Advisor |

| 🏆 Unique Features |

Expert Portfolio Pies |

| 🎯 Best for | Long-term Investors |

| ♲ Minimum Balance | $100 |

| 💰 Commissions/Fees | $0 |

| 💻 OS | Web Browser |

| ✂ Bonuses | Special Joining Bonuses |

| 🌎 Region | USA |

We independently research and recommend the best products. We also work with partners to negotiate discounts for you and may earn a small fee through our links.

Pros

★ Commission Free automated investing.

★ Low minimum accounts balance of $500.

★ Allows you to buy fractional shares of any stock or fund.

★ Military-grade 4096-bit encryption and two-factor authentication for security.

★ Offers lines of credit.

★ M1 Securities are insured for up to $500,000 by SIPC.

★ American accounts are insured up to $250,000 by FDIC.

Cons

✘ Unavailable Outside the USA.

The M1 Investing Methodology

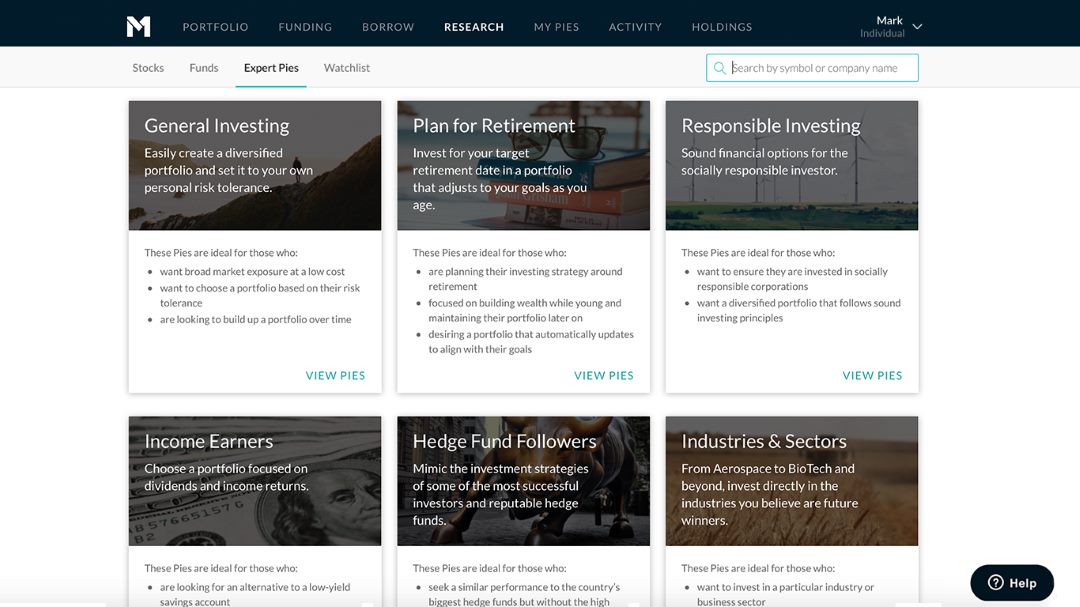

M1’s investing approach is based on expertly curated portfolios. Each portfolio is called a “Pie”; each pie comprises multiple stocks with specific weightings based on what risk or exposure you seek.

There are close to 100 expert pies with varying returns and past performance levels. You can select an expert pie or even build your own. The great thing is that when you send funds to your account, the money is automatically fully invested into your pie based on your allocation rules. Because there are no fees, this will not impact your account’s bottom line.

M1 Investing Performance

M1 provides so many expert portfolios to choose from; depending on when you open an account and decide to invest, the returns on your investment can vary. Suffice it to say, M1 claims that, on average, their expert portfolios (pies) are within or slightly above the underlying market return. Of the 20 Robo-Advisors we researched, M1 appeared to have the best returns, typically within or above the underlying index by 1-2%.

Portfolio Management

Managing your portfolio with M1 is a breeze. Once your account is set up, you can select to invest your money in one or more expert portfolios or choose the stocks or ETFs you want to invest in.

I particularly like that M1 provides pre-selected socially responsible investment portfolios; not many robo-advisor platforms do this.

M1 is an automated advisor or robo-advisor that helps you construct a portfolio based on your risk/reward goals and investing preferences, such as growth, income, or even ethical investing style. M1 Finance will also automatically perform buying, selling, balancing, and tax loss harvesting for you. And the best thing is, the stock trades are free.

| M1 Stock Portfolio Management Features | M1 Finance |

| Watchlist Tracking: The ability to see the up-to-date stock pricing, win/loss per stock & position sizes | ✓ |

| Research & News: Services offering news & research reports into your stocks provide a clear advantage when managing your portfolio & making investment decisions | X |

| Profit & Loss Reporting: Report on the overall profit & loss of your entire stock portfolio | ✓ |

| Performance Reporting: Portfolio analytics allow you to evaluate the portfolio’s risk and rate of return annually and throughout its lifecycle. | ✓ |

| Portfolio Weighting & Rebalancing: Features to enable you to calculate the weight of the stocks in your portfolio and assist you with rebalancing the weightings | ✓ |

| Portfolio Weighting & Rebalancing: Features to enable you to calculate the weight of the stocks in your portfolio and assist you with rebalancing the weightings | ✓ |

| Broker Integration | ✓ |

| Future Income & Dividend Reporting: The service helps predict and estimate your future dividend income based on your existing or planned portfolio structure | ✓ |

| Automated Portfolio Management | ✓ |

| Visit M1 Finance |

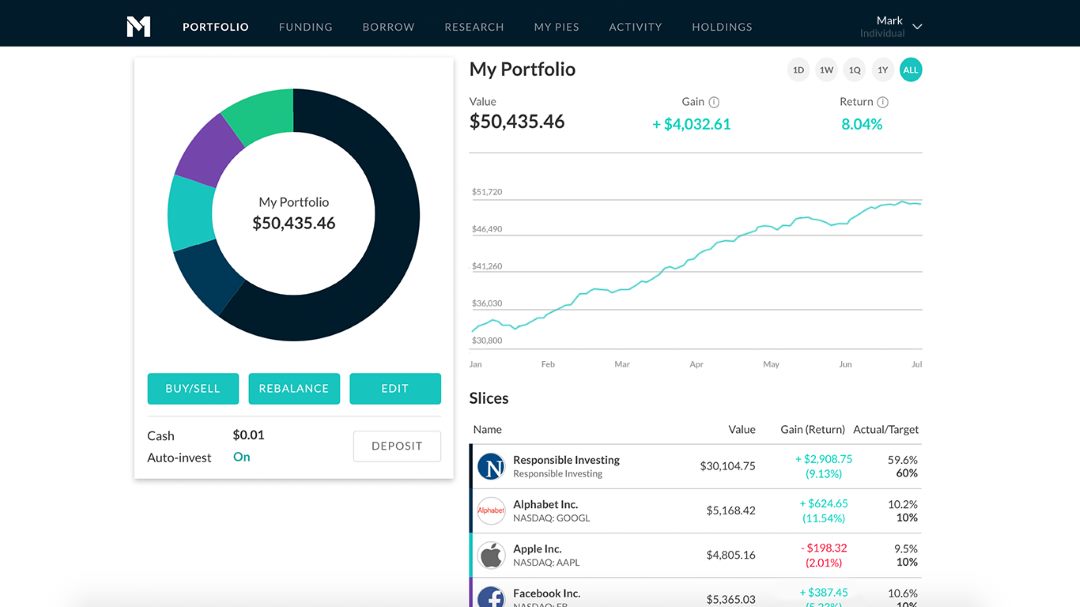

The M1 Portfolio Dashboard

Controllability, visibility, and insight into your investments are the key advantages robo-advisors or automated investing services offer the independent investor.

You can easily see your portfolio’s value, gain, and return here.

M1 Finance Smart Money Management Apps

Often, a company’s Mobile or smartphone app quality lets it down. A poor app experience can frustrate customers, especially the younger generations, who seemingly do everything on their mobiles. The M1 mobile app has excellent ratings on the app stores, ensuring that your experience will be first-class.

- M1 Finance Smart Money Management App – Apple Store – Rating 4.7 Stars with 9,600 ratings

- M1 Finance Smart Money Management App – Rating 4.6 Stars with 4,200 ratings

Dividend Services

Essential to any automated investment service is the ability to harvest and reinvest dividends earned from stocks or ETFs in your portfolio. M1 offers a Dividend Reinvestment Plans (DRIPS) service, and you can decide whether to reinvest the dividends by buying more stock or have the income added to your account balance for spending.

Our original trading research is powered by TrendSpider. As a certified market analyst, I use its state-of-the-art AI automation to recognize and test chart patterns and indicators for reliability and profitability.

✔ AI-Powered Automated Chart Analysis: Turns data into tradable insights.

✔ Point-and-Click Backtesting: Tests any indicator, pattern, or strategy in seconds.

✔ Never Miss an Opportunity: Turn backtested strategies into auto-trading bots.

Don't guess if your trading strategy works; know it with TrendSpider.

Portfolio Rebalancing

The ability to rebalance your portfolio is essential, as M1 says:

“Rebalancing restores an investment portfolio to its original target allocations. As prices of securities change over time, a user’s initial target allocations will drift. This may result in a portfolio no longer aligning with your risk profile or investing style. Rebalancing allows you to reallocate funds to align your portfolio with your accepted risk tolerance and financial goals. Remember that any time you rebalance your portfolio, you will generally initiate a series of buy and sell transactions. Usually, every sale of a security has a tax effect, which may be a gain or a loss.”

Fractional Share Purchase

This is useful as it means all your investment dollars can be put to work. For example, imagine you have decided to invest in Berkshire Hathaway (Ticker: BRK.B). You have $150 uninvested in your portfolio, but the BRK.B stock is $200 per share. M1’s fractional share purchase would allow you to buy a 3/4 fraction of that stock, meaning you can still take advantage of any price gains without having the full stock purchase amount. This service is unavailable to retail investors with traditional stock brokerage houses.

Berkshire Hathaway Buffett Portfolio Pie

Another thing I like is the Berkshire Hathaway portfolio, which seeks to mimic the world’s most successful investor, Warren Buffett. Buffett is the CEO and chief stock picker at Berkshire Hathaway. He owns many companies outright through this company but is also invested in many public companies currently floated on stock exchanges. It is these companies that the Berkshire Hathaway Portfolio is targeting.

- Related Article: 20 Insights Into Warren Buffett Stocks + Full Portfolio Analysis

M1 Retirement Portfolios

Finally, M1 also allows you to select when you plan to retire and suggests portfolios based on Modern Portfolio Theory, the industry standard for allocating funds based on risk profile.

M1 Invest Summary

M1 Finance is the perfect option for investing in low-cost index funds and ETFs. It allows you to customize your portfolio while taking advantage of diversification’s power. With its zero-fee structure, you can invest as little or as much money as you like in individual stocks or ETFs, and it will automatically rebalance your portfolio when the market fluctuates.

In addition, M1 Finance offers a Retirement Planning tool that helps you plan and prepare for when you retire. Overall, M1 is a great option for those looking to start investing or want to take their investments to the next level.

Overall, the M1 approach to allowing you to have granular control over your portfolio or take advantage of the M1 expert portfolios (Pies) is excellent. M1, like the industry, is growing fast, and it offers a full suite of services, including checking accounts and borrowing.

FAQ

What is M1 Finance?

M1 Finance is a financial services platform that combines the best of digital investing, borrowing, and banking into one easy-to-use service. It enables users to build a portfolio of stocks and ETFs for free and automate their investments.

What is M1 Invest?

M1 Invest is a feature within M1 Finance that allows users to create custom investment portfolios. Users can select individual stocks or ETFs or choose from pre-built portfolios designed by M1 Finance's experts.

Is M1 Finance suitable for beginner investors?

Yes, M1 Finance offers a user-friendly platform and educational resources that make it suitable for beginners. Its automated investing and pre-built portfolios can help novice investors easily get started.

How does M1 Finance make money if investing is free?

M1 Finance generates revenue through its optional paid subscription service, M1 Plus, which offers additional features and benefits. They also earn interest on uninvested cash and from lending securities.

Can I borrow money with M1 Finance?

Yes, M1 Borrow is a feature that allows you to borrow up to 35% of your portfolio's value at low interest rates. This feature is available to users with a minimum account balance of $10,000.

What types of accounts can I open with M1 Finance?

M1 Finance supports various account types, including individual brokerage accounts, joint accounts, retirement accounts (IRAs), trusts, and more.

Is my money safe with M1 Finance?

Yes, M1 Finance is a member of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC), which protects securities customers of its members up to $500,000.

Does M1 Finance offer any tax advantages?

M1 Finance offers a feature called M1 Tax Minimization, which uses a lot selling strategy to minimize the taxes you owe when you sell securities.

Can I automate my investments with M1 Finance?

Yes, with M1 Finance's automated investing feature, you can set up recurring deposits, and the platform will automatically invest your money according to your preset allocations.

What are the fees associated with M1 Finance?

M1 Finance offers commission-free investing but does charge fees for certain activities like account termination or outgoing transfers. More information can be found on their website.

What are M1 Pies?

M1 Pies are pre-built portfolios created by M1 Finance that are tailored to your risk profile and financial goals. It is a great way for beginners and experienced investors to start building a portfolio. You can also customize an existing Pie or create your own from scratch.

Does M1 offer protection against fraudulent activity?

Yes, M1 Finance provides a secure platform regularly monitored for suspicious activity. All accounts are held with Apex Clearing Corporation, an industry-leading broker-dealer providing world-class security to investors. Additionally, all funds and securities Apex holds are FDIC-insured up to $500,000 per account type.

Can I use M1 as my primary financial account?

Yes, M1 is a good choice for your primary financial account. With features like automated investments and fractional shares, you can easily manage your investing needs from one place. Additionally, M1 allows you to link up external accounts, such as checking or savings accounts, to easily move money in and out of your M1 Invest account.

M1 Finance's Robo-Advisor Tested & Rated for 2024

Our review testing finds that M1 Finance is a high-quality automated investing robo-advisor with a broad platform of financial products and a clear visibility into its investing performance. With $0 fees and a $100 minimum balance, M1 is worth trying.

Product SKU: NA

Product Brand: M1 Invest

4.7

Pros

- Commission Free automated investing.

- Low minimum accounts balance of $500.

- Allows you to buy fractional shares of any stock or fund.

- Military-grade 4096-bit encryption and two-factor authentication for security.

- Offers lines of credit.

- M1 Securities are insured for up to $500,000 by SIPC.

- American accounts are insured up to $250,000 by FDIC.

Cons

- Unavailable Outside the USA.

Hi

Sadly M1 Finance is NOT entertaining Non US Citizens to open their Account which, going forward they should consider at the earliest.

Thanks & Regards!

Prakash

Mumbai, INDIA.