9 Top Robo-Advisors Tested & Compared for 2024

The best robo-advisors, according to our research, are M1 Invest, Betterment, Wealthfront Ellevest, and Fidelity Go. In a competitive market, the quality and benefits of automated investing are improving every year.

Are Robo-Advisors a Good Idea? What Are The Pro & Cons?

Robo-advisors are good if you want to save time managing your investments. They automate tax-loss harvesting and rebalancing and provide commission-free trading in ETFs and stocks.

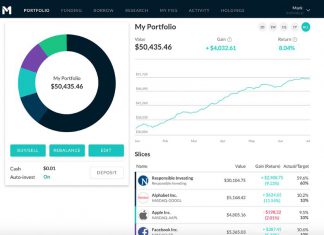

M1 Finance’s Robo-Advisor Tested & Rated for 2024

Our review testing finds that M1 Finance is a high-quality automated investing robo-advisor with a broad platform of financial products and a clear visibility into its investing performance. With $0 fees and a $100 minimum balance, M1 is worth trying.

20 Leading Robo-Advisor Profits & Fees Compared

Our research into robo-advisor fees and returns shows M1 Invest, SigFig, and Wealthfront are innovative leaders in the industry. There are many robo-advisors available now, and the list is growing.

Are Robo-Advisors Safe To Use? We Take a Look!

Although robo-advisors are a new technology, those offered by the major investment houses are safe. But that does not mean all are safe.

Robo-advisors offer...

Are Robo-Advisors Worth It? What Are The Alternatives?

Robo-advisors are worth it if you want to automate tax-loss harvesting & low-cost access to ETFs and mutual funds, saving you money. They also provide automatic portfolio construction, rotation & adjustment based on your risk and preferences.

Which is Better, Robo-Advisors or Human Financial Advisors?

Robo-Advisors vs. Financial Advisors: All Pros & Cons Comparing Costs, Fees, Services, Portfolio Management, Rebalancing & Tax Loss Harvesting.

How Do Robo-Advisors & Automated Investing Work?

Robo-advisors automate the complex task of creating and managing a portfolio by selecting investments according to your risk profile. Time-consuming tasks like purchasing stocks, portfolio rotation, and tax loss harvesting are performed automatically by the best robo-advisors.

Robo-Advisors, AI-Advisors and Hybrid-Advisors Explained

A robo-advisor is a fully automated investing service; a hybrid advisor adds the human touch to investing, and the AI robo-advisor uses algorithms and machine learning to make investments on your behalf.

Do Robo-Advisors Outperform the Stock Market?

Robo-advisors do not beat the stock market's average performance. Most Robo-advisors are designed to passively invest in index ETFs and, therefore, have practically no chance to outperform the market.

What is a Hybrid Robo-Advisor & Should You Use One?

A hybrid robo-advisor offers automated investment management services but also provides access to a human financial advisor. Hybrid robo-advisors use algorithms with help from a financial expert.

A Definitive Guide to Robo-Advisors by LiberatedStockTrader

At its core, a robo-advisor is a computer algorithm that provides automated advice and portfolio management. It combines modern investment theories with technology to create portfolios tailored to individual goals.

Our Best Training & Strategies

Liberated Stock Trader Pro: Learn Stock Market Investing

Learn stock market investing with the complete online stock trading course by Barry D. Moore, a certified financial analyst from the International Federation of Technical Analysts (IFTA).

ETF Investing Strategy: MOSES Improves Performance & Lowers Risk

The MOSES ETF investing strategy is a powerful suite of indicators meticulously backtested over 100 years. Designed to empower you to outperform the market, it equips you with the tools to navigate major stock market crashes and unlock greater investing performance.

LiberatedStockTrader’s Strategy Beat the Market By 102%

Decades of research and testing unveiled the Liberated Stock Trader Beat the Market System. Our 9-year, backtested, and proven strategy targets 35 financially healthy high-growth stocks, producing a track record of beating the S&P 500 by 102%.