Don’t Invest In Index ETFs Until You Read These 13 Pro...

You can safely invest in index funds through mutual fund companies or as an index ETF directly through your broker. Investing in an index fund ETF is the most cost-effective, liquid, and efficient way to diversify your portfolio.

18 Liquid 3X Leveraged ETFs & The Strategies To Trade Them

Gain insights from a seasoned ex-Wall Street trader with 40 years of experience, as he imparts knowledge on leveraged 3X ETF trading. Explore the intricacies of risks, rewards, and effective strategies.

S&P 500 Companies List by Sector, Market Cap & PE Ratio...

Our regularly updated S&P 500 companies list shows you what companies are currently in the S&P 500 index and provides the ticker symbol, capitalization, and PE Ratio.

S&P 500 Companies List by Market Capitalization 2024

Our regularly updated S&P 500 companies list shows you what companies are currently in the S&P 500 index and provides the ticker symbol, their industry sector, and market capitalization.

S&P 500 Companies by Number of Employees 2024

A Complete Listing of All The Companies in the S&P 500 Index Sorted By Number of Employees & Industry Sectors

Bull Leveraged 2x & 3x ETFs Lists & Live Charts for...

Leveraged/Long/Bull ETFs Enable You To Increase Your Profit In Bull Markets. We List the Best Leveraged ETFs by Assets, Liquidity & Expense Ratio

NASDAQ 100 Company List by Sector, Market Cap, PE & EPS

Our up-to-date NASDAQ 100 companies lists included ticker, sector classification, market capitalization, PE Ratio, EPS, and employee count. We also show you how to export this list to Excel.

Inverse Short ETFs List with Live Charts | LiberatedStockTrader

Our regularly updated inverse/short ETFs list shows you what ETFs are currently active and provides the ticker, market capitalization, and expense ratios.

11 Stock Market Sectors & Top Stocks Per Sector 2024

Our ten-year research reveals the best stock market sectors outperforming the S&P 500 are Technology +381%, Consumer Cyclical +181%, and Healthcare +34%. These three sectors significantly beat the market averages.

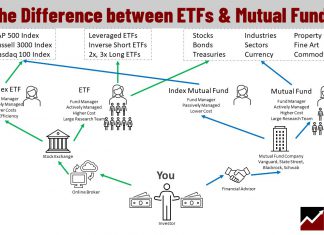

The Difference Between ETFs and Mutual Funds is Capital Flow

The difference between ETFs and mutual funds is ETFs are normally sold and bought on an exchange, while mutual funds are valued, traded, and priced at the end of a trading day. ETFs have lower fees, averaging 0.35%, and Mutual fund fees are over 1%.

What are Index Funds & How Do They Work?

Index funds are the best thing to happen to individual investors since the inception of the stock market. Find out more about index fund and their extensive benefit and negative traits.

LiberatedStockTrader’s Guide to Investing in Index Funds

Investing in index funds is a great way to diversify your portfolio and reduce risk. Index funds track the performance of major stock market indices, such as the S&P 500 or Dow Jones Industrial Average. Index funds are low-cost and have been shown to outperform actively managed mutual funds in the long run.

ETFs vs. Mutual Funds: Compounding, Fees & Performance Examined

ETF tax efficiency, liquidity, and low costs are perfect for independent investors. If you want someone to manage your money then mutual funds.

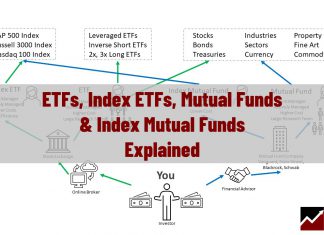

ETFs vs. Mutual Funds vs. Index Funds Explained

The difference between ETFs, mutual funds, and index funds is ETFs trade like stocks on an exchange, mutual funds are actively managed private investments, and an index fund can be either an ETF or a mutual fund.

Which is Better for Investors, ETFs or Stocks?

Exchange-traded funds (ETFs) and stocks represent two popular investments. Stock strategies can produce higher returns but require experience and time to manage. ETFs are simple, easy to buy, and can provide a more diversified portfolio over the long term.

How to Buy the Total Stock Market Using Global Index Funds

Investing in the total stock market through global index funds can be an excellent strategy for long-term investors seeking broad market exposure, low costs, and diversification.

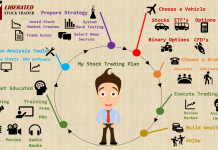

M.O.S.E.S. Investing Strategy Training Dashboard

Welcome to MOSES I hope you see the benefit of avoiding major stock market crashes and preserving the value of your investments.

By Using This...

16 Insights To Trade Leveraged ETFs Successfully

To successfully trade leveraged ETFs, you must understand the importance of ETF decay, liquidity, volume, fees, assets under management, and potential risks.

ETF Investing Strategy: MOSES Improves Performance & Lowers Risk

The MOSES ETF investing strategy is a powerful suite of indicators meticulously backtested over 100 years. Designed to empower you to outperform the market, it equips you with the tools to navigate major stock market crashes and unlock greater investing performance.

Our Best Training & Strategies

Liberated Stock Trader Pro: Learn Stock Market Investing

Learn stock market investing with the complete online stock trading course by Barry D. Moore, a certified financial analyst from the International Federation of Technical Analysts (IFTA).

ETF Investing Strategy: MOSES Improves Performance & Lowers Risk

The MOSES ETF investing strategy is a powerful suite of indicators meticulously backtested over 100 years. Designed to empower you to outperform the market, it equips you with the tools to navigate major stock market crashes and unlock greater investing performance.

LiberatedStockTrader’s Strategy Beat the Market By 102%

Decades of research and testing unveiled the Liberated Stock Trader Beat the Market System. Our 9-year, backtested, and proven strategy targets 35 financially healthy high-growth stocks, producing a track record of beating the S&P 500 by 102%.

TradingView Review 2024: Tested by LiberatedStockTrader

LiberatedStockTrader's review testing awards TradingView 4.8 stars due to excellent stock chart analysis, pattern recognition, screening, and backtesting. TradingView is our top recommendation for US and international traders.

Stock Rover Review 2024: Tested by LiberatedStockTrader

LiberatedStockTrader's review testing awards Stock Rover 4.7 stars. Its advanced screening, research, and portfolio tools are ideal for US value, income, and growth investors. With 650 financial metrics on 10,000 stocks and 44,000 ETFs, we rate Stock Rover the number one stock screener.

Trade Ideas Review 2024: AI Tested by LiberatedStockTrader

Our in-depth testing shows Trade Ideas is the ultimate black box AI-powered day trading signal platform with built-in automated bot trading. Three automated Holly AI systems pinpoint trading signals for day traders.

TrendSpider Review 2024: Certified Analyst Test & Rating

Our TrendSpider testing finds it is ideal for US traders wanting AI-automated charting, pattern recognition, and backtesting of stocks, indices, futures, and currencies.

Benzinga Pro Real-time News Tested by LiberatedStockTrader

Our testing shows Benzinga Pro is best for US traders who want a high-speed, actionable, real-time news feed at 1/10th of the price of a Bloomberg terminal. I recommended Benzinga Pro for active day traders and investors who trade news events.

MetaStock Review 2024: Tested by LiberatedStockTrader

Our MetaStock review and test reveal an excellent platform for traders, with 300+ charts and indicators for stocks, ETFs, bonds & forex globally. Metastock has solid backtesting and forecasting, and Refinitiv/Xenith provides powerful real-time news and screening.