A robo-advisor is a fully automated investing service; a hybrid advisor adds the human touch to investing, and the AI robo-advisor uses algorithms and machine learning to make investments on your behalf.

☆ Research You Can Trust ☆

My analysis, research, and testing stems from 25 years of trading experience and my Financial Technician Certification with the International Federation of Technical Analysts.

Robo-advisors are automated investment services that use computer algorithms to manage users’ money. They require little to no human interaction and typically have an automated portfolio rebalancing feature.

Hybrid advisors combine the best of both worlds – robo-investment advice and traditional advice from human financial advisors. With a hybrid advisor, users can get a tailored portfolio created from a combination of investments and exchange-traded funds (ETFs).

On the other hand, AI advisors utilize artificial intelligence to make decisions about which investments to make. They consider individual goals, financial objectives, and risk factors while also monitoring external factors such as market fluctuations and economic indicators.

This allows investors to have more control over their portfolios with less effort while benefiting from an AI advisor’s expertise.

What Is A Robo-Advisor?

A robo-advisor is an automated online investment advisor that provides portfolio management services with minimal human interaction. It uses algorithms to analyze your financial situation, investments, and objectives and then builds a custom portfolio tailored to meet your needs. Robo-advisors provide diversified portfolios of low-cost exchange-traded funds (ETFs), index funds, and individual stocks, with services that are more affordable and accessible than traditional financial advisors.

They can also provide access to financial advice, tax-loss harvesting, rebalancing, and other services unavailable from a typical broker. Robo-advisors typically require no minimum balance, making them an attractive option for beginner investors without the funds or expertise to manage their portfolios successfully.

However, “robo” and “bot” are financial-industry slang terms for digital financial applications. For example, trading robots or trade bots handle most trades on the world’s financial markets.

Interestingly, news reports indicate many financial industry professionals hate the terms “robo” and “bot.” However, those words are the standard industry technology for digital advisors.

The idea behind robo-advisors is that software is more accurate, honest, and less biased than human advisors. For instance, a robo-advisor is not likely to receive a commission or kickback on equities or securities it sells.

In addition, promoters claim that robo-advisors are less likely to make mistakes than people. Notably, algorithms are better at math than most humans.

Lastly, robo-advisors will not suffer from the emotional decision-making that most investors and traders try to battle against.

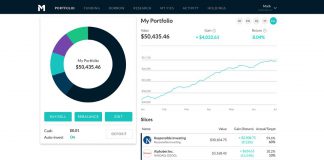

M1 Invest Won Our Robo Advisor Comparison & Testing

☆ Tailored investment options: Access 6,000 stocks & ETFs ☆

☆ Explore Model Portfolios ☆

☆ Enjoy zero commission trading or management fees ☆

☆ Effortlessly rebalance with just one click ☆

The History of Robo-Advisors

The first known robo-advisor was a semi-automated financial manager offered by Mint in 2006. More sophisticated robo-advisors appeared during the Great Financial Meltdown in 2008. Robo-advisors’ appearance resulted from the popular distrust of human financial advisors and investment bankers.

In 2010, John Stein launched Betterment, the first robo-advisor marketed to the general public. Over the next few years, traditional asset managers like Vanguard, Morgan Stanley, Charles Schwab, and JPMorgan Chase entered the robo-advisor market.

By 2017, robo-advisors were managing $200 billion in assets, Barrons estimates. Vanguard’s Personal Advisor Services was the largest robo-advisor, overseeing $101 billion in assets. Schwab is the second-largest robo-advisor, managing $27 billion in assets. Also, government agencies like the Nevada State Treasurer are turning to robo-advisors to manage public investments.

Moreover, some regulatory agencies, like the Monetary Authority of Singapore, are issuing licenses to Robot Advisors. The US Securities and Exchange Commission (SEC) grants them the same legal status as human financial advisors.

The amount of funds controlled by robo-advisors is growing dramatically worldwide; they could manage over $13 trillion in assets by 2025.

What Is An AI Robo-Advisor?

New, more sophisticated robo-advisors that utilize artificial intelligence (AI) and machine learning to analyze investments are entering the market. Interestingly, some of these robo-advisors will do far more than offer financial advice. Moreover, many new robo-advisors are also smartphone apps.

For example, Numerai is trying to build an artificial intelligence hedge fund linked to a cryptocurrency called Numeraire. Meanwhile, creators envision an app called Daneel as a combination of robo-advisor and personal assistant you can access through your phone.

Other mobile robot advisors include Japan’s Theo and Bamboo. Companies like Infinity Partners are also developing robot wealth managers for rich clients.

Will Artificial Intelligence (AI) Advisors Replace Robo-Advisors?

Investment banks are working with artificial intelligence because robo-advisors have been a hard sell to affluent clients. Reuters reports that UBS sold its SmartWealth British robot advisor to SigFig in 2018. The Swiss bank sold SmartWealth because it was not making money.

Entrepreneurs like those behind Numerai hope to succeed where UBS failed by building AI advisors that can do everything human investment bankers and fund managers can. Companies like Numerai aim to create an AI that manages money without human help. However, today’s AI advisors are far from achieving that goal. On the other hand, many organizations are trying to build AI advisors that “think” for themselves.

What Types Of Robo-advisors Are There?

Today, there are many robo-advisors on the market. The most popular robo-advisors are simple investment apps like Vanguard’s Personal Advisor Services.

In detail, these simple investment apps manage accounts and make trades under specific conditions. For instance, an investment app could sell a stock if its price-earnings ratio (PE Ratio) is too high.

Automatic investment apps like M1 and Robin Hood offer instant, low-cost access to investment markets. For instance, M1 allows users to pick stocks or ETFs or access 80 managed portfolios.

Meanwhile, artificial intelligence-powered apps, like Numerai and Sharpe Capital, use cutting-edge mechanisms like machine learning and prediction markets to make complex decisions. For instance, Numerai will try to predict market outcomes and bet against the markets.

In addition, next-generation robo-advisors are controlling hedge funds, mutual funds, and even bank accounts. Hence, robo-advisors could soon manage your money and offer financial advice.

What Is A Hybrid Robo-Advisor?

A hybrid robo-advisor combines a digital algorithm with a human investment advisor. The idea is to add a human touch to robo-investing. Hybrid robo-advisors exist because many customers will feel better if there is a person to talk to, and some people are uncomfortable with machines managing their finances.

Specifically, the average robo-advisor combines a standard package of algorithms with a person. The robot advisor will handle most of the investment chores. However, customers can talk to a human whenever they want to.

An obvious use for hybrids is to get people comfortable with robo-advisors. Asset managers often use hybrid advisors to deal with older customers and people who know little about finance.

How Do Hybrid Robo-Advisors Work?

Interestingly, hybrid financial advisors are becoming popular. An Accenture survey estimates 68% of affluent investors prefer hybrid advisors, Investment News reports. Moreover, hybrid advisors could manage 40% of the investment wealth in the United States by 2025.

A human financial advisor could recommend robo-advisors or algorithms to customers. The human advisor could also interview a customer and decide which robo-advisor is right for her.

Under those circumstances, hybrid advisors could be the future of wealth management in the United States. An obvious advantage to hybrids is that they will enable human financial advisors to keep their jobs.

On the other hand, some investors could be more comfortable with robo-advisor than human financial advisors. Many people distrust financial advisors because they view them as salespeople.

Moreover, younger people who grew up playing video games, surfing the internet, and using apps could prefer robo-advisor. In particular, people under 35 could view a robo-advisor as another useful app rather than a threat.

Hybrid Advisors vs. Robo-Advisors

Some wealth management firms like Wealthfront refuse to use human financial professionals. Instead, Wealthfront uses algorithms and bots for everything. For example, Wealthfront advertises Automated Financial Management.

However, traditional investment firms like Morgan Stanley and mutual fund managers like Vanguard prefer hybrid advisors. Such organizations use hybrids because they work with customers of all ages and backgrounds.

Notably, those unfamiliar with the financial markets and investing are less trusting of innovations like robo-advisors. However, robo-advisors are more efficient and work better with large numbers of customers.

Strangely, robo-advisor can provide a higher level of customer service. For instance, a robo-advisor can instantly respond to phone calls and emails and operate 24 hours a day, seven days a week. Besides, a robo-advisor can instantly fulfill simple requests such as selling or buying equities or providing a balance.

Finally, smartphones and the internet can provide instant connectivity to robo-advisor. Thus, a robo-advisor is perfect for people who want constant control over their investments.

List of Robo-Advisors – Advantages, Disadvantages & Fees

| Robo Advisor Name | Pros | Cons | Annual % Fee AUM From | Performance Details | Performance Rating |

|---|---|---|---|---|---|

| M1 Finance | ★ Commission Free automated investing. ★ Allows you to buy fractional shares of any stock or fund. ★ American accounts are insured up to $250,000 by Federal Deposit Insurance Corporation. ★ M1 Securities are insured for up to $500,000 by SIPC. ★ Military grade 4096-bit encryption and two-factor authentication for security. ★ Offers lines of credit. ★ Low minimum accounts balance of $100. | ✘ Focused on US customers Only. ✘ No hybrid advisors available. | 0% | M1 claims its funds offer a 9.87% rate of return. Typically within 2% of the comparative benchmark | ★★★★ Winner |

| Betterment | ★ Offers hybrid advisor services. ★ No minimum investment needed. ★ Offers a variety of products including Trust Accounts. ★ Special services like tax-loss harvesting and socially responsible investing available. ★ Focused on smaller investors. ★ Focuses on retirement. | ✘ Focuses on index funds rather than individual stocks. ✘ Could place some serious limits on investor choices and behavior. ✘ Claims to use “guardrails” to protect investors from themselves. ✘ No details of security arrangements available. | 0.25% | Betterment claims it offers 5% higher returns than the average US investor receives. | ★★★★ |

| Wealthfront | ★ Offers free financial planning. ★ Easy to Use App ★ Allows Passive Investing ★ Offers tax-loss harvesting and other loss-mitigation strategies. ★ One low fee. ★ Low $500 minimum investment required. | ✘ No hybrid advisors available. ✘ No human financial planning advice available. ✘ Completely automated strategies. ✘ No details of security arrangements available. | 0.25% | Typically 1% lower than comparative Benchmark | ★★★★ |

| Vanguard Personal Advisor Services | ★ Offers both hybrid investors and robo advisors. ★ Clear fee schedule ★ Custom Financial Plans available. ★ Low Fees ★ Phone support available to US customers. | ✘ $50,000 minimum investment required. ✘ Charges higher than average fees. ✘ Owned by a mutual-fund operator. So Vanguard has an incentive to push mutual funds. ✘ No details of security arrangements available. | 0.30% + Fund Fees | Depends on the funds. However, Vanguard’ claims its US stock funds offer a 7.51% rate of return - in line with S&P 500 avg returns | ★★★★ |

| Schwab Intelligent Portfolios | ★ No advisory fee and commissions on some accounts. ★ Hybrid advisors available. ★ A portion of the funds is held in an FDIC insured account at Schwab Bank. ★ A variety of accounts including IRAs, custodial accounts and trust accounts are available. ★ Schwab claims its robo advisor can automatically re-balance accounts to lower risks. | ✘ $5,000 minimum investment required. ✘ Tax-loss harvesting only available on portfolios over $50,000. ✘ Schwab admits to making money off sales ETFs and other investment products. ✘ No details of security arrangements available. | ETF Fees | No comparison to the S&P available because of the variety of portfolios offered. | Not Available |

| Fidelity Go | ★ No Minimum balance required to open accounts. ★ Hybrid advisor services available. ★ Open to any US resident over 18 years of age. ★ Fidelity will offset some additional fees with a variable fee credit. ★ You can start investing with as little $10. | ✘ Higher than average fees. ✘ The day-to-day investment trading decisions are made by 3rd party "Strategic Advisors LLC" ✘ May automatically invest in fee charging accounts like the Fidelity Government Reserves Fund. ✘ No banking services available. ✘ No details of security arrangements available. | 0.35% + Fund Fees | No comparison to the S&P available because of the variety of portfolios offered. | Not Available |

| TD Ameritrade Essential Portfolios | ★ Hybrid advisors available through professional Portfolio Management. ★ Socially aware investing available. ★ Personalized portfolios available. ★ Free tax-loss harvesting on all accounts. | ✘ $5,000 minimum deposit required. ✘ No banking services or insured accounts available. ✘ No details of security arrangements available. | 0.30% | No comparison to the S&P available because of the variety of portfolios offered. | Not Available |

| Ellevest | ★ $0 Minimum investment ★ Claims to be designed by women for women. ★ Female CEO Sallie Krawcheck ★ Claims investment algorithms are designed for women. ★ No penalty for withdrawals. ★ Offers algorithms that are supposedly tailored for a customer’s salary, gender, and lifespan. ★ Some hybrid services available on all accounts. ★ Private wealth management services available. | ✘ Charges additional fees for hybrid advisory services. ✘ It is not clear if tax-loss harvesting is available. ✘ No details of security arrangements available. ✘ Does not reveal the actual costs of the private wealth management services. | 0.25% | No comparison to the S&P available because of the variety of portfolios offered. | Not Available |

| Robinhood | ★ Offers cryptocurrency investment. ★ Offers option and ETF investment. ★ Claims to be commission free. ★ Offers Stock Investment. ★ No minimum investment required. | ✘ No hybrid advisors offered. ✘ No details of security arrangements available. ✘ Robinhood shut down its cash management services in 2018 after critisicm accounts were not insured. ✘ Serious lack of transparency. ✘ Claims cash management services are coming soon | 0% | No comparison to the S&P available because of the variety of portfolios offered. | Not Available |

| Morgan Stanley Access Investing | ★ Offers a detailed investment plan. ★ Bases portfolios on an investors’ risk tolerance. ★ Algorithm runs thousands of simulations to forecast portfolio performance. ★ Hybrid advisors available. | ✘ Higher than average fee. ✘ $5,000 minimum investment required. ✘ Simulations could offer unrealistic pictures of market performance ✘ No details of security arrangements available. | 0.35% | No comparison to the S&P available because of the variety of portfolios offered. | Not Available |

Note: There are other robo-advisors out there, and more companies are coming online daily, so it is always a good idea to shop around.