Limit, market, and stop limit orders, help ensure you get the best possible stock purchase price. Stop limit, stop market, and trailing stop orders help sell your stocks for profit or limit your risk.

Understanding the differences in stock market order types is the key to effective stock trading.

When you’re ready to buy or sell stocks, you must understand the types of orders available.

Buy Orders Quick Reference:

- Market Order: Allows an investor to buy or sell stock at the current market price. It’s quick and guarantees execution, but not the price.

- Limit Order: An investor can buy or sell stock at a specific price or better. It gives the investor control over the price but doesn’t guarantee execution.

- Stop Limit Order: A combination of a stop and a limit order. It becomes a limit order once a certain price level (stop price) is reached. It gives the investor more control, but the trade may not be executed if the stock never reaches the specified limit price.

Each order type has its own benefits and risks, so choosing the one best suited for your trading strategy is important.

Sell Orders Quick Reference:

- Stop Loss: Sells stock when it reaches a certain price, used to limit an investor’s loss on a security position.

- Sell Market Order: Sells stock at the current market price. It guarantees execution but not the selling price.

- Limit Order Sell: Sells stock at a specific price or better. It allows for price control but doesn’t guarantee the sale will occur.

- Stop Market Order: A stop order that becomes a market order once a certain price level (stop price) is reached. It guarantees execution but not the price.

- Stop Limit Order: This becomes active as a limit order once a certain price level (stop price) is reached. It provides more control over price but doesn’t guarantee execution.

- Trailing Stops: Set at a percentage level below the market price – for a long position. The trailing stop price is adjusted as the price fluctuates.

- Bracket Order: Enter a new position along with a target/exit and a stop-loss order. Once the main order is executed, the system will place two more orders (profit-taking and stop-loss).

Opening a stock trade – Buy

When you open a stock trade, you buy or sell the stock at the current market price. You can use three types of orders: market, limit, and stop-limit.

You buy or sell the stock with a market order at the current market price. This is the simplest type of order used when you want to buy or sell the stock as quickly as possible.

With a limit order, you specify the maximum or minimum price you are willing to pay or receive for the stock. A limit order will only execute if the stock is traded at your price or better. This type of order is useful when you want to buy or sell a stock but don’t want to pay the current market price.

With a stop-limit order, you set a stop price and a limit price. The stop price is the maximum price you are willing to pay for the stock, and the limit price is the minimum price you are willing to sell it for. If the stock reaches your stop price, your order becomes a limit order and will only execute if the stock is traded at your limit price or better. This type of order is useful when you want to protect yourself against a sudden drop in stock price.

Market Order

A market order is the most basic type of order. When you place a market order, you instruct your broker to buy or sell shares at the current market price. Market orders are typically filled very quickly, but there is no guarantee that you will get the exact price you hoped for.

Opening a market order on a stock means you wish to buy that stock at the current market “Ask” price. This is the quickest executing type of order, as it means you will accept the Ask price closest to the current market price. The price you get may differ from the displayed price on the exchange when you place the order because of factors related to volatility and liquidity.

Limit Order

A limit order is an instruction to buy or sell shares at a specific price. Limit orders give you more control over the price you pay (or receive) for a stock, but they may not be filled immediately if the stock’s market price does not reach your specified limit.

A limit order indicates the highest price you are willing to pay or the lowest price you are willing to accept to sell a security. This helps to protect you from sudden swings in prices that you may suffer while executing a market order. Still, it may also take longer to execute as the trade will only be executed when the market order conditions are hit.

Limit Order Example

Joe wants to buy Apple Inc. for $600 per share. The current price is $601. He places a limit order for 100 shares of Apple for $600. If Apple’s price drops sharply to $595, his trade may execute at $595. However, if the stock price never moves down and continues to rise to $610, his order will never be executed.

Stop Limit Order

A stop limit order is similar to a limit order but with an additional “stop” instruction. A stop-limit order becomes a limit order when the stock’s market price reaches your specified “stop” price. This type of order can protect against downside risk by ensuring you do not pay more than you are comfortable with for a stock.

Global Financial Analysis for Free on TradingView

Closing a stock trade – Sell

When you’re ready to sell your stock, you can choose from a few different types of orders. A market order will sell your shares at the best available price, while a limit order will only sell them at a certain price or better. If you want to set a stop-loss order, that will automatically trigger an order to sell once the stock reaches a certain price. Several types of trailing stops allow you to protect your profits as the stock price rises or falls. When you’re ready to close out your position, read through all these options to make the best decision for yourself!

Stop Loss

A stop loss is an instruction to sell shares if they fall below a certain price. Stop losses can help you limit losses on a losing trade, but they can also cause you to miss out on potential profits if the stock’s price recovers quickly.

The simplest way to sell your stock is to place a market order to sell it. This is the quickest-executed type of trade. Of course, if the stock price moves very quickly between the time you click the sell button and when the trade is executed, you may not receive what you expect when selling the stock.

Sell Market Order

A sell market order is an instruction to sell shares at the current market price. Like buy market orders, sell market orders are typically filled very quickly, but there is no guarantee that you will get the exact price you hoped for.

Limit Order Sell

A limit order sell is an instruction to sell shares at a specific price. Limit orders give you more control over the price you pay (or receive) for a stock, but they may not be filled immediately if the stock’s market price does not reach your specified limit.

Limit Order Sell Example

In this example, Joe wants to sell Apple Inc. at $610 per share; he places a sell limit order. The stock price moves from $601 to $611, and his sell limit order will execute at or above $610.

However, if the stock only moves down from $601 to $590, his sell order will never execute.

Stop Market Order

A stop market order is similar to a limit order but requires an additional “stop” instruction. A stop market order becomes a market order when the stock’s market price reaches your specified “stop” price. This type of order can protect against downside risk by ensuring you do not pay more than you are comfortable with for a stock.

A stop market order is similar to the previous example, except that when the order price is hit, it executes at the current market price. Essentially, it means you wish that your stop order becomes a market order once the target price is hit.

Example: Stop market order to sell.

Bobby places a stop market order for Exxon Mobil at $85. The stock price hits $85, and the trade is activated. The market is volatile, and instantly, the stock moves to $84.50 before the trade is executed because the order has become a market order after activation. Bobby gets only $84.50 per stock.

Stop Limit Order

A stop-limit order is similar to a limit order but with an additional “stop” instruction. A stop-limit order becomes a limit order when the stock’s market price reaches your specified “stop” price. This type of order can protect against downside risk by ensuring you do not pay more than you are comfortable with for a stock.

Using a stop-limit order means you want your order to be executed at a specific price and guarantee that when that activation price is met, the execution of the order is also at or better than the target price.

Example: Stop limit order to sell.

Susie wants to sell IBM at $200 per share; the current stock price is $199. She opens a limit order with an activation price of $200 and a limit price for the order at $200. IBM’s stock price moves for a split second to $200 but quickly slips back to $199.90. The trade is now activated but not executed. Thirty minutes later, the stock price moves back up to $200.50. The activated trade is now executed, and the sale is made.

This type of order gives you maximum security that you will get the price you wish for your sale.

Trailing Stops

Trailing stops are instructions to sell shares if they fall below a certain price, but they will automatically adjust downward as the stock’s price rises. This order can help you lock in profits on a winning trade while giving you some upside potential.

A trailing stop is a very different market order, best described in an example.

Example: Trailing Stop Sell

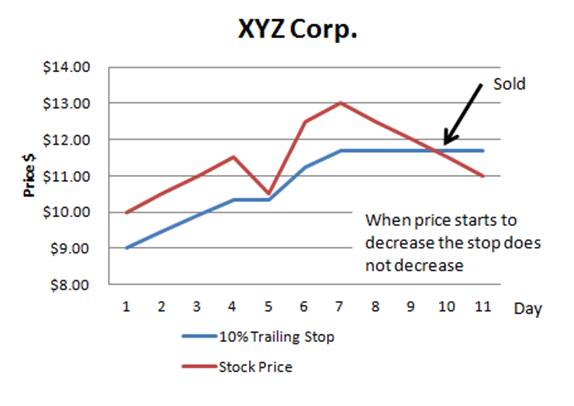

Take a look at the following chart and read the example text below.

Bernard owns a $10 stock and places a 10% trailing stop. The stop is initially set at $9, 10% under the stock price.

- Day 1 through 4, the stock increases in value.

- The trailing stop remains 10% behind the stock price.

- On day five, the stock falls, but the trailing stop does not. It remains at 10% behind the previous high since its initiation.

- On day 6, the stock continued higher.

- Day 8 through 10, the stock starts to fall, but the trailing stop does not.

- On day ten, the stock price falls through the value of the trailing stop, and the sell order is executed.

The trailing stop can be a very flexible and useful way of taking care of your risk while you are away and trying to seek some extra gain.

Bracket Order

A bracket order is a stop order that includes instructions for buying and selling. With a bracket order, you can specify a target price at which you would like to take profits and a stop price at which you would like to cut your losses. This type of order can help you manage your risk and protect your profits on a trade.

A bracket or conditional order allows a trader to place multiple leg orders with a broker.

This means you can combine previous market orders into a rule that executes the logic.

For example, Billy Jean wants to buy Suntech Corp at $5 and ensure that if it falls to $4.50, she sells it. She also thinks a 20% gain on the stock is a good profit and would like to sell it at that price ($6) automatically.

The stock price is currently at $4.80.

Billy Jean is going on holiday, so she decides to open a bracket order to handle the trading for her.

In one trade entry, she opens three orders.

- A market order at $5

- A conditional stop market order at $4.50

- A conditional stop-limit order at $6

This means that Billy Jean’s stock will be purchased at market price when the stock hits $5 (1).

If the stock goes to $4.50, the stock will be sold at market price (2), and (3) will be canceled.

If the stock goes to $6, the stock is sold at or above $6 (3), and (2) will be canceled.

Bracket orders are a very flexible way to establish rules upfront and ensure you stick to them.

Stock Market Orders Summary

This section reviewed a quick start checklist to help you organize the things you need to start investing in the stock market.

Now that you know the different orders available, it’s time to start placing some trades! Remember to always do your research before making any investment decisions. Happy trading!

Investing In Stocks Can Be Complicated, Stock Rover Makes It Easy.

Stock Rover is our #1 rated stock investing tool for:

★ Growth Investing - With industry Leading Research Reports ★

★ Value Investing - Find Value Stocks Using Warren Buffett's Strategies ★

★ Income Investing - Harvest Safe Regular Dividends from Stocks ★

"I have been researching and investing in stocks for 20 years! I now manage all my stock investments using Stock Rover." Barry D. Moore - Founder: LiberatedStockTrader.com