According to four academic research papers, you should own at least ten stocks to achieve 90% diversification. If you own 20 to 30 stocks, your portfolio will perform better than average.

Are you wondering about the ideal number of stocks for your portfolio? This article delves into portfolio management and the role of diversification research in guiding your stock selection process. Gain insights into optimizing your portfolio composition while maintaining clarity, elegance, and readability.

We will also recommend the number of stocks we believe are ideal for most investors. We start by briefly discussing portfolio management and diversification.

What is portfolio management?

Portfolio management is selecting and controlling a portfolio of assets to achieve a given financial goal. The selection of stocks, bonds, mutual funds, and other securities for inclusion in a portfolio can be based on quantitative and qualitative factors.

Portfolio diversification is an important aspect of portfolio management. It reduces risk by spreading it across several asset classes. This is done by selecting a combination of stocks with low correlations, allowing for greater protection against market volatility and reducing the overall risk in the portfolio.

What is Portfolio Diversification?

Portfolio diversification is a strategy investors use to mitigate their risk exposure by investing in various asset classes. By diversifying, investors can protect themselves against market volatility and reduce the overall risk of their portfolio. It involves selecting a combination of stocks with low correlations, allowing for greater protection against market fluctuations.

Portfolio diversification can also include investments in different sectors, countries, industries, and asset classes. This allows investors to spread their investments across different market segments and reduce dependence on any single sector or asset class.

Additionally, diversified portfolios may include a combination of cash, bonds, stocks, and other investments, such as real estate. By investing in a variety of assets, investors can reduce the risk associated with holding too many positions.

How to Measure Portfolio Diversification?

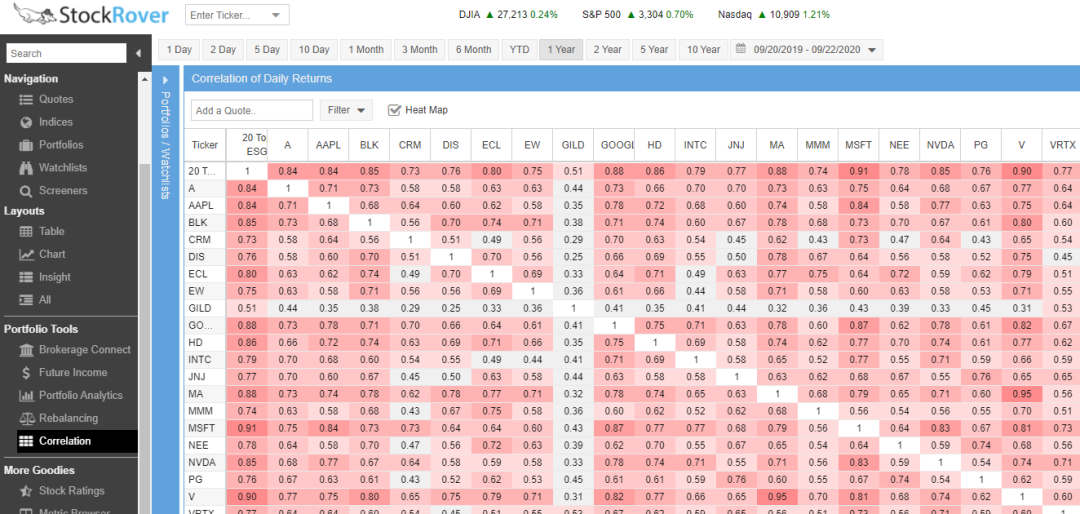

The simplest way to measure portfolio diversification is through correlation coefficients. These indicate how closely related two assets are, and a low coefficient indicates that the assets move independently. Investors can ensure that their portfolios are diversified by selecting investments with low correlations.

While measuring correlation coefficients may sound complicated, it is made easy with Stock Rover.

Get Portfolio Management & Research Free in Stock Rover

Finally, investors may also want to measure their performance against a benchmark index such as the S&P 500 to gauge how well they diversify their portfolios.

Results: Academic Research on Portfolio Diversification

Markowitz’s Research & Modern Portfolio Theory

The research paper of Harry Markowitz and Modern Portfolio Theory (MPT) focuses on maximizing returns while managing risk. MPT suggests that investors should diversify their portfolios by investing in many non-correlated assets, such as stocks, bonds, and commodities. This approach reduces risk because no single asset or sector will move in the same direction at any given time.

Markowitz’s research suggests that investors should hold at least 20 to 30 different stocks to reduce their exposure to market volatility and enhance returns.

Extensive research has been conducted on diversification and portfolio management. In 1952, Harry Markowitz conducted one of the most famous studies on this topic. Markowitz’s study showed that diversification could help reduce risk while providing the potential for high returns. Markowitz is the father of modern portfolio theory (MPT).

Source: Portfolio Selection – Harry Markowitz

Try Powerful Financial Analysis & Research with Stock Rover

Surz & Price’s Academic Research on Portfolio Diversification

Surz and Price recommend a minimum of 20 stocks in a portfolio, according to their research in 2000.

In their academic paper “The Truth About Diversification by the Numbers,” Ronald J. Surz and Mitchell Price discuss the research on portfolio diversification and recommend the number of stocks to own in a portfolio.

They begin by noting that there is no perfect number of stocks to own, as this will vary depending on an individual’s risk tolerance and investment goals. However, they provide a general rule of thumb based on modern portfolio theory (MPT) that suggests owning between 20 and 30 stocks to achieve adequate diversification.

Surz and Price explain that MPT is a theory that suggests that it is possible to improve the risk-return profile of an investment portfolio by including a variety of different assets. This is done by spreading the risk across different asset classes, which helps minimize the impact of any security or market segment on the overall portfolio.

Surz and Price recommend owning between 20 and 30 stocks to achieve adequate diversification.

Source: The Truth About Diversification by the Numbers”, Ronald J. Surz and Mitchell Price (2000)

Alexeev & Tapon: The Number of Stocks Needed in a Portfolio

This research paper examines the number of stocks needed in a portfolio to achieve optimal diversification. They studied five developed markets and found that the number of stocks necessary to achieve diversification varies from market to market. They recommend a minimum of 30 stocks in a portfolio to achieve diversification.

Vitali Alexeev & Francis Tapon recommend at least 30 stocks in a portfolio in the 2012 research paper, “Equity portfolio diversification: how many stocks are enough?”

The study found that the number of stocks necessary to achieve diversification decreases as the market capitalization of the stocks in the portfolio increases. They also found that portfolios with a higher number of stocks tend to have lower volatility and higher returns.

The authors recommend that, in addition to a minimum of 30 stocks, investors should consider investing in multiple asset classes and using a variety of investment vehicles, such as mutual funds and exchange-traded funds (ETFs), to achieve optimal diversification.

Alexeev & Dungey’s Equity Portfolio Diversification Research

In the 2014 paper “Equity portfolio diversification with high-frequency data,” Alexeev and Dungey suggest that ten equally weighted stocks in a portfolio can achieve 90% diversification.

“We find that for investors wishing to diversify away 85% (90%) of the risk, equally-weighted portfolios of 7 (10) stocks will suffice.”

They explore how factors such as company size, industry, and country play into the benefits of diversification.

The study found that while industry and country-level diversification are important, company size is not a significant factor in reducing risk. This suggests that investors would be better served by allocating their capital across a larger number of companies rather than focusing on industries or countries.

This research is important for investors looking to minimize their risk without sacrificing too much potential return. Following the study’s advice, investors can create a more diversified portfolio that is less likely to experience sharp declines in value during tough economic times.

Source: Equity portfolio diversification with high-frequency data” by Vitali Alexeev and Mardi Dungey (2014)

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you're trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

Explore TradingView – Your Gateway to Smarter Trading!

How Many Stocks Should You Own?

Based on four highly regarded academic research papers, you should own at least ten stocks, and investors with larger portfolios should try to own at least 20 to 30 different stocks. This will help to ensure that your portfolio is properly diversified and that you are not taking on too much risk.

Of course, you must adjust this number based on your specific circumstances and investment goals. Ultimately, it is up to you to decide how many stocks you should own in your portfolio.

What is the Best Software For a Diversified Portfolio?

I am enthusiastic about Stock Rover’s portfolio analytics, which allows you to compare your portfolios’ returns over a specific period. You can assess the portfolio’s correlation to the S&P500, evaluate the risk-adjusted return, and calculate the Sharpe ratio. Additionally, you can compare your portfolio’s different holdings, calculate drawdowns, and assess how they perform against the benchmarks.

Investing In Stocks Can Be Complicated, Stock Rover Makes It Easy.

Stock Rover is our #1 rated stock investing tool for:

★ Growth Investing - With industry Leading Research Reports ★

★ Value Investing - Find Value Stocks Using Warren Buffett's Strategies ★

★ Income Investing - Harvest Safe Regular Dividends from Stocks ★

"I have been researching and investing in stocks for 20 years! I now manage all my stock investments using Stock Rover." Barry D. Moore - Founder: LiberatedStockTrader.com

Moreover, with Stock Rover’s portfolio correlation reporting tools, investors can easily identify holdings with a high degree of correlation and replace them with less related investments. This helps create a well-diversified and balanced portfolio with minimal risk exposure.

Finally, Stock Rover’s portfolio analytics provides a complete overview of your investments and helps you make informed decisions about your portfolio. With the right data, investors can determine which stocks or ETFs best suit their goals and adjust their allocations accordingly.

FAQ

How many stocks should I own to diversify my portfolio?

Generally, investors should own at least 10 stocks, and larger portfolios should aim for 20-30 different stocks.

What's the benefit of owning multiple stocks?

Owning multiple stocks helps to reduce risk and volatility since it spreads investment money across multiple companies, markets, and sectors.

Does owning more stocks mean more risk?

Not necessarily, as research shows that having a diversified portfolio of at least 10-30 stocks can help reduce overall portfolio volatility and decrease downside risk.

Is there a maximum number of stocks I should own?

Academic research suggests 30 stocks is a good maximum. Of course, there is no limit to the maximum number of stocks you can own, but research shows with 10 stocks, you are 90% diversified, and any more than 30 stocks makes little difference to risk reduction and diversification.

Should I focus on buying small-cap or large-cap stocks?

Your choice depends on your appetite for risk, as typically, small-caps are more volatile than large-cap stocks with higher potential returns and losses.

Do I have to buy expensive stocks to diversify my portfolio?

No, depending on the size of your portfolio, you can purchase high-quality, low-cost ETFs or mutual funds which can provide broad market exposure in a single trade for minimal transaction costs.

What software is best for portfolio management and diversification?

Stock Rover is our choice for constructing and managing a balanced, diversified portfolio. Stock Rover is low-cost but provides industry-leading features and benefits for independent investors.

Can sector diversification help reduce risk?

Yes, by adding exposure to different sectors in your portfolio, you can help reduce overall volatility while still achieving long-term growth objectives.

Do ETFs offer good diversification opportunities?

Yes, ETFs offer investors the ability to gain exposure to broad markets while benefiting from low costs and efficient tax treatment, which can lead to greater returns over the long term when compared with investing directly into individual securities or mutual funds.

Can individual stock selection improve my results over time?

Yes, careful stock selection coupled with a good diversification strategy can potentially improve performance over time. Choosing industry leaders and undervalued companies with strong fundamentals could help outperform the broader market index over time.

What type of research should I do before buying a stock?

Researching a company's financials is essential before investing in any stock; we recommend Stock Rover for research. Look at revenue metrics, debt ratios, and balance sheets for clues on the company is health before making an investment decision.

Ever Dreamed of Beating the Stock Market

Most people think that they can't beat the market, and stock picking is a game only Wall Street insiders can win. This simply isn't true. With the right strategy, anyone can beat the market.

The LST Beat the Market Growth Stock Strategy is a proven system that has outperformed the S&P500 in 8 of the last 9 years. We provide all of the research and data needed to make informed decisions, so you no longer have to spend hours trying to find good stocks yourself.

The LST Beat the Market System Selects 35 Growth Stocks and Averages a 25.6% Annual Return

★ 35 Stocks That Already Beat The Market ★

★ Buy The Stocks & Hold For 12 Months - Then Rotate ★

★ Fully Documented Performance Track Record ★

★ Full Strategy Videos & eBook ★

Take The Pain Out Of Stock Selection With a Proven Strategy