The price buyers determine stock prices, and sellers are willing to pay to exchange the stock.

If there are more buyers than sellers, the bid price increases until the seller’s asking price is reached.

If there are more sellers than buyers, the asking price decreases until the seller’s bid price is reached. Essentially, stock prices are determined by supply and demand.

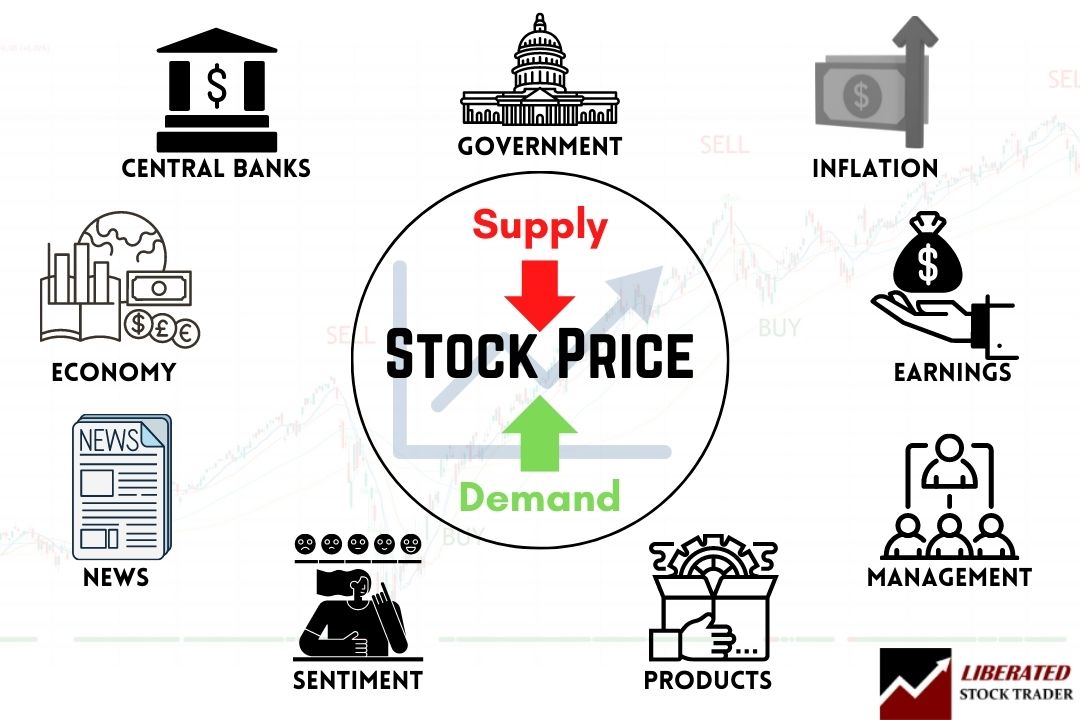

Now that we know that stock prices are determined by supply and demand, the important question is what factors affect supply and demand in stocks.

How are stock prices determined?

Stock prices are determined by the interactions of buyers and sellers in a free market. They constantly change as new information becomes available and investor expectations about the future change. Factors affecting stock prices are earnings reports, economic news, and government and central bank policy.

However, in the short term, stock prices are affected by supply and demand. If there are more buyers than sellers, the price will go up, and if there are more sellers than buyers, the price will go down.

What factors affect a stock’s price?

Over the long term, many factors affect stock prices, including the business climate, macroeconomics, monetary policy, interest rates, business cycle, regulations, profitability, and a company’s products and services.

The stock market is a complex system with many variables affecting stock prices. These factors include a company’s stock market capitalization, earnings, dividends paid to shareholders, and the inflation rate.

All of these factors can have a significant impact on stock prices. For example, if a company experiences strong earnings growth, its stock price will likely rise. Conversely, if a company’s earnings decline, its stock price will likely fall.

Dividends

Dividends also play an important role in stock prices. A company that pays uninterrupted growing dividends is seen as more stable and less risky than one that doesn’t pay dividends.

Conversely, suppose a company pays out too much of its profits as dividends and is not investing enough in product development. In that case, stock prices might decrease as investors see that the company is not investing in the future or has run out of innovative ideas. Finally, very high dividend payouts might suggest the company cannot cover dividend payments in the future and the stock price is not sustainable at these levels.

The stock market is also affected by the broader economy. For example, when the housing market is booming, stock prices also tend to rise. This is because a strong housing market indicates that consumers have more disposable income and are more likely to invest in stocks.

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you're trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

Explore TradingView – Your Gateway to Smarter Trading!

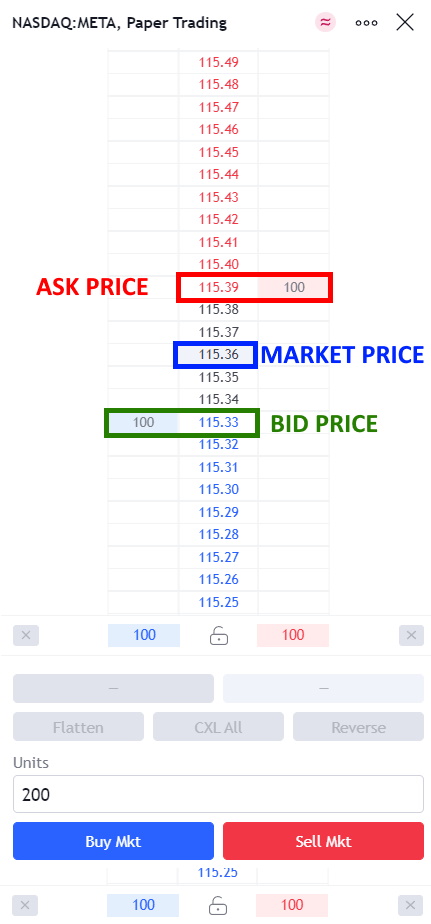

How is stock price determined in real-time?

Stock prices are determined in real-time by short-term factors such as the current bid/ask prices, their direction of movement, the volume of shares traded, market conditions, and breaking financial news.

These factors can all impact stock prices, and it is important to understand how they work to make informed investment decisions.

How bid/ask prices affect the stock price.

The current bid/ask prices are the most important factors determining the price of a stock. These prices are where buyers and sellers agree to transfer stock ownership, and they are influenced heavily by the stock’s supply and demand.

If there are more buyers than sellers, the stock price will be bid up (bid price increases). If there are more sellers than buyers, the stock’s asking price will decrease.

Volume

The volume of shares traded is also a major factor in determining stock prices because it tells us how much interest there is in a particular stock. If there is a lot of trading volume and the price increases, there are more buyers than sellers. High volume on increasing stock prices encourages traders to buy more stock, as this is a very bullish signal in technical analysis; this, in turn, can positively affect the stock price.

The relationship between stock price movement and volume is covered extensively in this article: Stock Volume: How to Use Volume in Charts Like a Pro.

News

Financial news events affect the short-term direction of stocks because traders can get a significant edge by reacting quickly to positive or negative developments in the market. Quarterly earnings surprises or FDA approvals can dramatically affect a stock’s price and future trend direction. If a trader is the first to hear market-moving news, they can use it to gain an advantage.

For example, if a company is being acquired or has received a large contract, its stock prices may increase as investors bet on increased future profits. Similarly, if a company has filed for bankruptcy or laid off workers, its stock prices may decline as investors sell their shares.

Find out more about how to trade real-time news events.

Market conditions

Overall, market conditions can also impact stock prices. If market conditions are good for business, then the stock will tend to go up. Low interest rates, light regulation, good consumer demand, and low unemployment are all considered positive market conditions.

If the stock market is doing well, stock prices will likely increase. However, if the market is not doing well, stock prices will likely drop.

Stock options

Stock options prices do not directly affect stock prices, but indirectly, the expiration and exercise of stock options can impact stock prices.

For example, many companies use stock options to incentivize executives and employees. When employees’ stock option grants reach maturity, heavy buying and selling can occur, which affects stock prices. Source:https://hbr.org/2000/03/what-you-need-to-know-about-stock-options

Another example of how options can indirectly affect stock prices is when put options are sold. If the stock starts moving down aggressively, the put seller may be forced to buy the stock at a lower price to ensure they limit their exposure to the options they sold. If this scenario occurs on a large scale, the buying can impact the stock price.

Does exercising options affect stock price?

When someone exercises a stock option, they buy the stock at the strike price. This can have a big impact on stock prices because it increases the demand for the stock. If many people start exercising their stock options, it can increase the stock price.

Market capitalization

A company’s stock market capitalization, or “market cap,” affects its stock price in two ways. Firstly, investors view large-cap stocks positively, and index fund investing favors large-cap companies.

Firstly, long-term investors see large-cap companies as more stable and preferred. Market cap gives us an idea of how much the market values the company. A company with a high market cap is seen as more valuable and successful than one with a low market cap.

ETFs and index-tracking funds often invest in an entire market index or industry sector to replicate its performance, providing investors with stability and diversification. As a company’s market capitalization increases, it will be eligible to join an index.

In this example, Tesla (Ticker: TSLA) was eligible to join the Nasdaq 100 Index in July 2013 because its market capitalization was big enough to displace an existing index member.

When Tesla joined the Nasdaq 100, its stock price increased by 200% from $4 to $12 in 12 months, tripling its market capitalization. (See stock chart below)

However, it’s important to remember that stock prices can go up or down regardless of a company’s market cap. So, while the market cap is a factor in determining stock prices, it’s not the only factor.

Consumer price index

A high consumer price index (CPI) affects the stock market by pushing prices down because central banks are forced to increase interest rates to combat inflation, which reduces company profit margins. Reduced profit margins affect company earnings, leading to lower stock prices.

The consumer price index (CPI) measures inflation. It’s a broad index that tracks the prices of goods and services, including food, housing, transportation, and medical care.

Why does the consumer price index affect stocks?

The consumer price index (CPI) is important for stock investors because it can affect stock prices. For example, if the CPI increases, the cost of living also increases. In response, companies may raise their prices because transportation, energy, fuel, and commodity costs are increasing. As a result, stock prices may fall due to decreased demand for goods and services.

A Hawkish vs. Dovish central bank policy is the single biggest long-term factor that influences stock prices.

Hawks vs. Doves Explained: How Fed Decisions Impact Investors

How does inflation affect stock prices?

Inflation indirectly affects stock prices by reducing a company’s profitability and demand for its goods; lower profits equals lower stock prices. Inflation decreases the purchasing power of a currency, making imports more expensive and exports less valuable, thus impacting a company’s bottom line, meaning reduced profits.

You want to be a successful stock investor but don’t know where to start.

Learning stock market investing on your own can be overwhelming. There’s so much information out there, and it’s hard to know what’s true and what’s not.

Liberated Stock Trader Pro Investing Course

Our pro investing classes are the perfect way to learn stock investing. You will learn everything you need to know about financial analysis, charts, stock screening, and portfolio building so you can start building wealth today.

★ 16 Hours of Video Lessons + eBook ★

★ Complete Financial Analysis Lessons ★

★ 6 Proven Investing Strategies ★

★ Professional Grade Stock Chart Analysis Classes ★

How do stock prices affect a company?

Theoretically, a stock price should not affect the company’s day-to-day operations, but in reality, it changes management behaviors. For example, a company with a high stock price and market capitalization can use its equity to purchase competitors in an all-stock takeover. A company with a very low stock valuation may be subject to takeovers from competitors or be influenced by activist investors.

A continually decreasing stock price can also pressure management to instigate change or turn around to improve the business performance.

Dark pools

Dark pools are private stock exchanges where large investors can trade stocks while minimally affecting the stock price. Dark pools do not have the same regulatory requirements as public stock exchanges, which means less transparency. As a result, dark pools can be used to manipulate stock prices. For example, if a large investor wants to sell a stock, they may do so in a dark pool to avoid immediately affecting the stock price. Source: Dark Pools

Does the stock market affect housing prices?

There is a positive correlation between stock prices and housing prices. When stock prices increase, housing prices also tend to increase. This is because people have more money to spend and are willing to invest in assets that provide stability and growth potential.

Are stock prices manipulated?

While theoretically, stock price manipulation is illegal, companies, news agencies, central banks, and governments constantly manipulate stock prices.

The stock market is a complex system where various factors determine stock prices. While stock price manipulation is illegal, it is common in the stock market.

One way that stock prices can be manipulated is by spreading false information to manipulate investors. For example, a company might artificially spread false information about its financial health or prospects to boost its stock price. Similarly, a news agency might unwittingly release false information about an industry or stock to manipulate investors into buying or selling stocks.

Central banks can also manipulate stock prices by using their monetary policy to influence the stock market. For example, the Federal Reserve might increase or decrease interest rates to affect the economy, which in turn affects the stock market. Additionally, the Fed might inject money into the economy or take money out of the economy, which in turn affects stock markets.

Finally, governments can also manipulate stock markets by injecting large fiscal stimulus, which boosts company profits and, therefore, stock prices.

What makes stocks go up and down?

The stock market is a complex system that is constantly fluctuating. While the actions of individual investors certainly play a role in stock prices, several other factors also contribute. This article examines how the consumer price index affects stock prices and why it’s important for investors.

We’ve also explored how inflation affects stocks and why the Federal Reserve increases interest rates to fight it. Finally, we looked at how stock prices can affect companies and some of the ways in which they can impact management decisions.

Dark pools were also discussed as a way to manipulate stock prices. Investors must consider all these factors when deciding where to invest their money.

Beat The Market, Avoid Crashes & Lower Your Risks

Nobody wants to see their hard-earned money disappear in a stock market crash.

Over the past century, the US stock market has had 6 major crashes that have caused investors to lose trillions of dollars.

The MOSES Index ETF Investing Strategy will help you minimize the impact of major stock market crashes. MOSES will alert you before the next crash happens so you can protect your portfolio. You will also know when the bear market is over and the new rally begins so you can start investing again.

MOSES Helps You Secure & Grow Your Biggest Investments

★ 3 Index ETF Strategies ★

★ Outperforms the NASDAQ 100, S&P500 & Russell 3000 ★

★ Beats the DAX, CAC40 & EURO STOXX Indices ★

★ Buy & Sell Signals Generated ★

MOSES Helps You Sleep Better At Night Knowing You Are Prepared For Future Disasters