The 1929 stock market crash was caused by an equities bubble fueled by lax monetary policy and easy access to credit.

People believed the US stock market was a sure-fire winner, and irrational exuberance caused the crash.

Historians call the 1929 stock market crash the greatest economic calamity in history, and it is easy to see why.

What Caused the Stock Market Crash of 1929?

A breakdown in investor confidence caused the 1929 stock market crash. The Dow had risen by over 100% in the previous five years, led by the general public’s unrestricted access to credit, which they used to buy stocks on margin. High unemployment and an unregulated, unsustainably high stock market led to a collapse in confidence, which caused the stock market crash.

Ultimately, the cause of the 1929 Stock Market Crash was an asset and equity bubble driven by the general public’s unrestricted access to credit. Easy access to credit fueled a wave of highly speculative and risky investments in the stock market. Eventually, prices were unsustainably high, and the overheated stock market crashed.

What Happened After the Stock Market Crash of 1929?

Millions lost their homes and jobs when the bubble burst, and over 4,000 US banks went bankrupt. The impact of the collapse spread worldwide.

Specifically, the Stock Market Crash started the Great Depression, which led to World War II, the most destructive conflict in human history. Also, World War II led to the Cold War, which lasted until the 1990s.

Consequently, the Great Stock Market Crash of 1929 shaped the 20th Century. For instance, World War II drove disruptive technologies, including electronics, computers, nuclear weapons, jets, long-range aircraft, missiles, and frozen food.

Listen To This Article Via Our Podcast

Stock Market Crashes over the Last 100 Years.

How the 1929 Stock Market Crash Changed Our World

The American welfare state was born during the New Deal of the Great Depression. Meanwhile, the British welfare state, the German economic miracle, the Japanese economic miracle, and the European Union originated in the aftermath of World War II.

Another consequence of World War II was the destruction of the British and other colonial empires. Thus, many countries are independent today, partially because of the Crash.

Finally, modern China began when the Japanese invasion of the 1930s fatally weakened the nationalist regime. That provided an opening for Mao Zedong’s communists to win the Chinese Civil War and begin building a strong Chinese state. Thus, even China’s recent economic boom originated from the stock market crash.

[Related Article: How To Detect & Avoid The Next Stock Market Crash]

The 1929 Stock Market Crash What Happened?

The Stock Market Crash was first regarded as a simple correction when the Dow Jones fell by 11% on “Black Thursday” on October 24, 1929. However, observers noted something was wrong when trading volumes tripled.

The market corrected slightly on Friday, October 25, 1929, because Wall Street bankers bought large amounts of stock. Subsequently, the market fell by 13% on Black Monday, October 28, 1929, and 12% on Black Tuesday, October 29, 1929.

The 1929 Crash Documentary

How Did the Stock Market Crash Cause the Great Depression?

The Stock Market Crash caused the Great Depression by destroying confidence in the United States Economy, which enjoyed an unprecedented boom.

The crash burst a massive asset bubble in the United States, including real estate and stocks. Moreover, the American economy was the engine that drove global prosperity. Consequently, the crash led to depression in other countries like Japan, Germany, and the United Kingdom.

The stock market crash started the greatest bear market in history. The Dow Jones index lost 90% of its value, falling from 305.85 on Black Thursday, 1929, to 41.22 on July 8, 1932.

Incredibly, the Dow did not return to its September 3, 1929, high of 383 until November 23, 1954. This means it took 25 years and two months for the American stock market to recover from the Great Crash.

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you're trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

Explore TradingView – Your Gateway to Smarter Trading!

The Cause of the 1929 Crash Was 10 Years in the Making

The cause of the Stock Market Crash was an asset and equity bubble driven by the irrational exuberance of the Roaring Twenties. An overheated American economy grew dramatically because of new technologies. For instance, electrification created massive markets for radio, appliances, refrigeration, and movies. Additionally, automobiles drove the boom by providing the middle class with unprecedented mobility.

The new technologies led to new industries like movie production, chain grocery stores, discount stores, trucking, airlines, and broadcasting. New technologies also drove the expansion of older industries, such as advertising, retail, publishing, real estate, construction, home building, mining, oil, and steel.

Moreover, there was a real estate boom in the 1920s United States as automobiles and railroads opened large amounts of new land for development. Notably, the Florida Real Estate Bubble, which burst in 1926, had similarities to the mortgage crisis of 2007-2008.

Thus, the cause of the Crash was an overheated economy, which drove an asset bubble in the stock market. The bursting of the Florida Bubble helped trigger the Stock Market Crash by driving money from real estate to stocks.

Why Did the Stock Market Crash in 1929?

New technologies and industries led to lucrative stocks. Plus, the economic boom pushed up the price of older stocks. Consequently, interest in the stock market increased as ordinary people bought equities.

A poorly regulated stock market magnified the effects of the bubble. For instance, many investors bought the stock on “margin.” To elaborate, an investor could buy $100 worth of stock by putting as little as 10% or $10 down.

The hope was that rising stock prices would allow the investor to sell the sock and pay the lender back at a price. However, many investors could not pay off loans when the market crashed.

Consequently, both the brokers, who were also margin lenders, and the investors lost all their money. Additionally, many of the investors were middle and working-class Americans who invested all their savings in the margin.

Thus, many average people lost everything and their confidence in the economy and capitalism in the crash. This helped trigger the depression because many people quit buying consumer goods and investing.

What Events Led to the Stock Market Crash of 1929?

A series of events that made the crash inevitable started long before Black Thursday. Thus, the stock market showed signs of collapse for some time, but the public was unaware of it until October 24, 1929.

Try Powerful Financial Analysis & Research with Stock Rover

10 Events that Led To the Stock Market Crash of 1929

- 1914-1918 World War One destroys the international economic and political order. In particular, the war devastated the German economy, which never truly recovered.

- 1919 – The Treaty of Versailles imposed sanctions on Germany, which the defeated nation could not repay. This hurts the global economy by crippling the world’s second-largest economy.

- 1920 United States Gross Domestic Product (GDP) is at $697.7 billion

- 1920s – The US economy grew by 42% in a decade. Economic growth inspires optimism and leads to irrational exuberance and absolute faith in the market.

- 1922 United States Gross Domestic Product reached $709.3 billion.

- In 1923, the United States’ GDP reached $802.6 billion. Thus, America’s Gross Domestic Product grew by nearly $100 billion, or around 12%, in one year.

- 1920s—American Farm Crisis. World War I spurred agricultural overproduction and a commodities bubble. The bursting of the bubble led to an agricultural depression in the United States that lasted until World War II. One result of the farm crisis was a massive drop in commodities prices that drove more money into stocks.

- 1920s—Income Inequality in the United States rose to new highs. By 1929, the top 1% of the US population controlled 14.5% of the nation’s wealth.

- 1924 – 1929: US Stock Market value increases by 20% yearly or 100% growth in five years. This inspires what British Chancellor of the Exchequer Philip Snowden describes as a “perfect orgy of speculation” driving markets to unprecedented highs.

- 1925 – British Chancellor of the Exchequer Winston S. Churchill returns the Pound Sterling to the gold standard to restore its position as the world’s reserve currency.

- The pound and the British economy are weakened by tying the currency to a commodity.

The Overheated Roaring Twenties Fueled the Crash

- 1926 – United States GDP reaches $902.1 billion/

- 1926 – Florida Real Estate Bubble bursts, shaking American confidence in property investments, which drives investors into stocks.

- November 1928 – Herbert Hoover (R-California) won the US presidential election by a wide margin, showing popular faith in the free market and the US economy. Hoover’s election increases optimism and faith in the market, fueling speculation.

- 1929 – United States Gross Domestic Product reaches $977 billion.

The Start of the 1929 Crash

- March 1929: The US Stock Market dropped by 10%. However, there was no panic, and the market rebounded.

- 1929 – Joseph P. Kennedy Sr., a major American stock speculator and father of President John F. Kennedy (D-Massachusetts), pulls all of his money out of an overheated stock market. Strangely Joe Kennedy claims he pulled his money out of stocks when a shoeshine boy gave him stock tips. This convinced Kennedy that too many people did not know what they were doing in the market.

- August 8, 1929 – The Federal Reserve Bank of New York tried to slow the overheated economy by raising its discount rate to 6%.

- September 3, 1929 – The Dow reaches an unprecedented height of 381.77 points. The Dow grew by 27% in a year. Incredibly, the Dow will not reach this number again until November 23, 1954.

10 Triggers of the 1929 Stock Market Crash.

- September 20, 1929 – Famous British investor Clarence Hatry is exposed as a fraudster and arrested. Hatry overextended himself in a failed hostile takeover of British steel companies. Moreover, Hatry made the situation worse by issuing fake securities to cover his losses.

- September 1929—Hatry’s arrest and the collapse of the companies he controlled triggered the Hatry Crisis, destroying confidence in the British stock market. Newspaper coverage of the Hatry Crisis spread the bear market in British stocks across the Atlantic to Wall Street.

- September 26, 1929 – Falling gold prices and the Hatry Crisis drive the Bank of England to raise its discount rate to protect the gold standard and the value of the Pound Sterling.

- October 3, 1929 – British Chancellor of the Exchequer Philip Snowden undermines public confidence by calling the US stock market a “speculative orgy.”

- October 4, 1929: The Wall Street Journal and The New York Times further undermined confidence in the stock market by reporting Snowden’s remarks and agreeing with them.

- October 23, 1929 – The Dow has fallen by 20% from its September 3 high of 381.77 points to 305.416.

- October 24, 1929 – the Dow falls by 11% on Black Friday.

- October 25, 1929 – a false correction. The Dow rises by 1%.

- October 28, 1929 – the Dow falls by 13% on Black Monday.

- October 29, 1929—Black Tuesday. The Dow dropped by 12%, and frightened investors sold 16.41 million shares in one day.

Try TradingView, Our Recommended Tool for International Traders

Global Community, Charts, Screening, Analysis & Broker Integration

Global Financial Analysis for Free on TradingView

The Effects of the 1929 Stock Market Crash

The devastating effects of the 1929 crash included the Dow losing 90% of its value, 10% deflation, Economic Growth falling by 50%, and the economy shrank by 8.5%. Perhaps the worst effects were a 25% surge in unemployment and increased homelessness and crime.

A Timeline of the Worst Effects of the 1929 Crash

- 1929-1932 – The Dow loses 90% of its value, falling to 41.22 on July 8, 1932.

- 1929-1932 – Deflation in the United States. US prices fall by 10%.

- 1929-1934 – US Economic Growth falls by 50%.

- 1929-1933 – US Consumer Price Index drops by 27%.

- 1930 – US Economy shrinks by 8.5% to $893.55 billion.

- 1929-1933 – 4,000 American banks fail.

- 1931 – US Gross Domestic Product falls by 6.5% to $835.85 billion.

- 1932 – US Gross Domestic Product drops by 12.9% to $728.02 billion. Hence, the US GDP fell by 27.9% in three years.

- November 1932 – Angry US voters chose left-wing New York Governor Franklin D. Roosevelt (D) over Hoover.

- 1933- US Unemployment rate peaks at 24.9%.

Stagnation and Recovery

- March 1933 – Roosevelt, or FDR, became president and launched a program of radical left-wing economic reforms popularly called the New Deal. In particular, FDR implemented Keynesian economics in the United States to spur economic growth.

- 1933-1940 – US economic growth remains stagnant, and unemployment rates stay high. The only significant growth is driven by New Deal government spending.

- 1940-1945: World War II spurred an industrial boom that launched the United States into full economic recovery.

- November 23, 1954. Dow finally returned to its September 3, 1929, record high of 381.77, 25 years later.

Beat The Market, Avoid Crashes & Lower Your Risks

Nobody wants to see their hard-earned money disappear in a stock market crash.

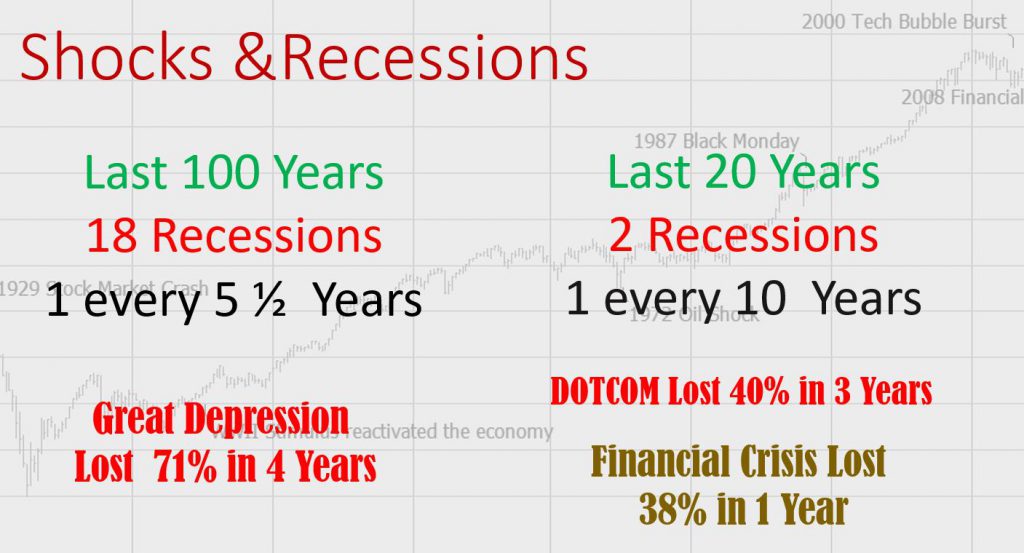

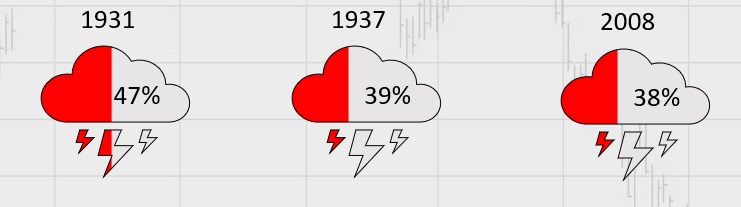

Over the past century, the US stock market has had 6 major crashes that have caused investors to lose trillions of dollars.

The MOSES Index ETF Investing Strategy will help you minimize the impact of major stock market crashes. MOSES will alert you before the next crash happens so you can protect your portfolio. You will also know when the bear market is over and the new rally begins so you can start investing again.

MOSES Helps You Secure & Grow Your Biggest Investments

★ 3 Index ETF Strategies ★

★ Outperforms the NASDAQ 100, S&P500 & Russell 3000 ★

★ Beats the DAX, CAC40 & EURO STOXX Indices ★

★ Buy & Sell Signals Generated ★

MOSES Helps You Sleep Better At Night Knowing You Are Prepared For Future Disasters

What Can We Learn from the Stock Market Crash of 1929?

Even though nearly 90 years separate us from the Stock Market Crash, there is a lot we can learn from that catastrophic event. The most important lessons we can learn from the crash of 1929 include the following:

- Overheated markets are dangerous. The American economy was headed for disaster in 1929 because it was overheated.

- Markets can stay heated for a long time. The US economy had been overheated for nearly a decade when it finally crashed.

- Crashes do not begin suddenly or come from nowhere. The Dow had been falling for over a month, and the Hatry Crisis created chaos in the City of London for over a month before Black Thursday.

- Crises elsewhere will affect other markets. You can make a good case that the 1929 crash began in the City of London with the Hatry Crisis and spread to Wall Street.

- Panic and hysteria spread fast. Notably, the hysteria the Hatry Crisis triggered in London kept spreading.

- The media plays a role in financial panics. For example, newspaper coverage of the Hatry Crisis and Snowden’s remarks in London caused markets to fall in New York.

- Once a crash begins, it is hard to stop. For instance, Wall Street bankers could not stem the deluge by buying stocks in 1929.

- Some people will anticipate the crash. Specifically, Joseph Kennedy Sr. foresaw the debacle of 1929, and Steve Eisman correctly anticipated the meltdown of 2007-2008.

- You cannot get it back easily once public confidence in the market is gone. The Dow did not return to 1929 levels again until 1954.

- Bear markets and market crashes are not sudden. Instead, a crash is more like a slow-moving train wreck, a series of jolts followed by a sudden smashup.

Finally, the Stock Market Crash 1929 teaches us that all good markets will end. Thus, no Bull Market is forever, so you should always be ready for corrections and have a process to identify a potential stock market crash.