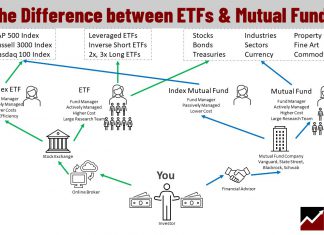

The Difference Between ETFs and Mutual Funds is Capital Flow

The difference between ETFs and mutual funds is ETFs are normally sold and bought on an exchange, while mutual funds are valued, traded, and priced at the end of a trading day. ETFs have lower fees, averaging 0.35%, and Mutual fund fees are over 1%.

9 Step Stock Market Investing Strategy (Videos + eBook)

The stock market strategy blueprint is a handcrafted process to help you to understand all the factors at play in the stock market.

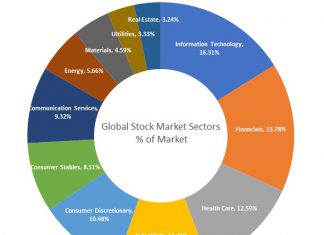

Sector Rotation Explained: Is It Profitable? We Check the Data!

Sector rotation theory and research into market cycles have been around for over 200 years. But is it profitable, and should you implement sector rotation in your stock portfolio?

Investing in Index Funds Explained – Beginners Guide

Investing in index funds is a great way to diversify your portfolio and reduce risk. Index funds track the performance of major stock market indices, such as the S&P 500 or Dow Jones Industrial Average. Index funds are low-cost and have been shown to outperform actively managed mutual funds in the long run.

Robo-Advisor, AI-Advisor and Hybrid-Advisors Explained

A robo-advisor is a fully automated investing service; a hybrid advisor adds the human touch to investing, and the AI robo-advisor uses algorithms and machine learning to make investments on your behalf.

S&P 500 Companies Listed Alphabetically 2024

A Complete Listing of All The Companies in the S&P 500 Index Sorted Alphabetically + Industry Sector & Market Capitalization

Commodity Trading: Is it Profitable/Risky? We Look at the Research!

Commodities are tangible goods such as food, metals, and energy that traders can buy or sell in the financial markets. These commodities are traded on global exchanges, and their prices fluctuate based on supply and demand.

8 Steps to Build a Balanced & Profitable Portfolio

To build a balanced investment portfolio, determine how much to invest, your risk tolerance, portfolio allocation, and your investing strategy. Next, choose the right tools to screen and research the ideal stocks and ETFs to enable you to manage your portfolio effectively.

Is Value Investing Dead? We Look at the Data!

Day traders and hedge fund managers would have you believe that value investing is dead, but published research by French and Fama shows value still outperforms growth.

How to Invest in Index Funds: 12 Expert Tips Revealed

You can safely invest in index funds through mutual fund companies or as an index ETF directly through your broker. Investing in an index fund ETF is the most cost-effective, liquid, and efficient way to diversify your portfolio.

How to Manage a Stock Portfolio: 7 Steps of Pro Portfolio...

Managing a stock portfolio entails seven crucial tasks: conducting research, analyzing performance, rebalancing holdings, assessing correlations, planning future income, optimizing tax benefits, and analyzing future performance.

Are Robo-Advisors Worth It? What Are The Alternatives?

Are robo-advisors worth it? Robo-advisors are a type of automated financial advisor that relies on algorithms to create investment portfolios for clients.

3X Leveraged ETF Trading Strategy & Best ETFs to Trade

Gain insights from a seasoned ex-Wall Street trader with 40 years of experience, as he imparts knowledge on leveraged 3X ETF trading. Explore the intricacies of risks, rewards, and effective strategies.

Top 20 Best Robo-Advisor Returns & Fees Compared

Our research into robo-advisor fees and returns shows M1 Invest, SigFig, and Wealthfront are innovative leaders in the industry. There are many robo-advisors available now, and the list is growing.

How to Calculate Dividend Yield & Triple Your Profits

To calculate dividend yield, divide the stock's annual dividend per share by the stock's current market price. The dividend yield increases as share prices drop, so to triple your yields, buy stock price panic crashes.

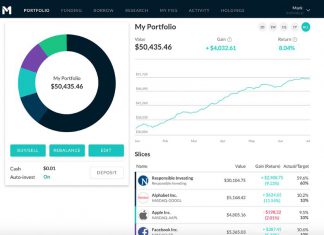

M1 Finance Review 2024: Automated Robo-Advisor Tested

Our review testing finds that M1 Finance is a high-quality automated investing robo-advisor with a broad platform of financial products and a clear visibility into its investing performance. With $0 fees and a $100 minimum balance, M1 is worth trying.

Our 30-Year Test Proves Buy-and-Hold Strategies Are Worth It!

Our research shows that long-term buy-and-hold investing leads to significant profits. Over the past 30 years, annual stock market returns have averaged 10.7%, bonds and real estate yielded 4.8%, and gold returned 6.8%.

Buffett Indicator Explained: Market Valuation Exposed

The Buffett Indicator helps gauge stock market valuation. It compares total market capitalization to GDP, offering a macroeconomic perspective on market value.

ETF Investing Strategy: MOSES Improves Performance & Lowers Risk

The MOSES ETF investing strategy is a powerful suite of indicators meticulously backtested over 100 years. Designed to empower you to outperform the market, it equips you with the tools to navigate major stock market crashes and unlock greater investing performance.

Our Best Training & Strategies

Liberated Stock Trader Pro: Learn Stock Market Investing

Learn stock market investing with the complete online stock trading course by Barry D. Moore, a certified financial analyst from the International Federation of Technical Analysts (IFTA).

ETF Investing Strategy: MOSES Improves Performance & Lowers Risk

The MOSES ETF investing strategy is a powerful suite of indicators meticulously backtested over 100 years. Designed to empower you to outperform the market, it equips you with the tools to navigate major stock market crashes and unlock greater investing performance.

Our LST Strategy Beat the Stock Market’s S&P 500 By 102%...

Decades of research and testing unveiled the Liberated Stock Trader Beat the Market System. Our 9-year, backtested, and proven strategy targets 35 financially healthy high-growth stocks, producing a track record of beating the S&P 500 by 102%.