3X Leveraged ETF Trading Strategy & Best ETFs to Trade

Gain insights from a seasoned ex-Wall Street trader with 40 years of experience, as he imparts knowledge on leveraged 3X ETF trading. Explore the intricacies of risks, rewards, and effective strategies.

Value Stock Investing: Strategy, Research & Software for Value Investors.

Value stocks are a key investing strategy, the biggest stock market profits cycles between value stocks and growth stocks. These investing strategies and educational articles provide you with value stock screening strategies to help you be successful.

How to Calculate Dividend Yield & Triple Your Profits

To calculate dividend yield, divide the stock's annual dividend per share by the stock's current market price. The dividend yield increases as share prices drop, so to triple your yields, buy stock price panic crashes.

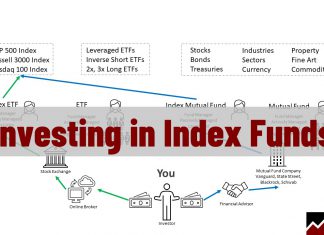

Investing in Index Funds Explained – Beginners Guide

Investing in index funds is a great way to diversify your portfolio and reduce risk. Index funds track the performance of major stock market indices, such as the S&P 500 or Dow Jones Industrial Average. Index funds are low-cost and have been shown to outperform actively managed mutual funds in the long run.

20 Warren Buffett Rules of Investing & How To Implement Them

Warren Buffett's rules of investing include "Never lose money," "Always have a margin of safety," and "Be fearful when others are greedy, and greedy when others are fearful." This timeless wisdom will help you be a better investor.

Inverse/Short ETFs List by Market Cap & Expense Ratio

Our regularly updated inverse/short ETFs list shows you what ETFs are currently active and provides the ticker, market capitalization, and expense ratios.

Hybrid Robo-Advisors Explained! Can You Trust Them?

A hybrid robo-advisor offers automated investment management services but also provides access to a human financial advisor. Hybrid robo-advisors use algorithms with help from a financial expert.

Are Robo Advisors Good? Pro and Cons Uncovered!

Robo Advisors can be a great idea for the right person. They are essentially automated financial advisors who use algorithms and computer programs to...

Find the Best Defensive Stocks: Ben Grahams Protection Strategy

Defensive stocks withstand economic recessions and bear markets by providing critical human services. The best way to find defensive stocks is by using Benjamin Graham's timeless rules for the defensive investor: Stability, earnings, dividends, price-to-book ratio, and the price-to-Graham number.

7 Strategies to Find the Best Value Dividend Stocks

Our research combines criteria for selecting value stocks and dividend-paying stocks to create seven strategies for finding under-valued dividend stocks. We include the exact criteria to use and a step-by-step guide to implementing them into a stock screener.

Ultimate Guide to Dividend Investing with 4 Proven Strategies!

Dividend investing is a low-risk route into the stock market. Your income investing journey starts by grasping dividend yield, payouts, profit expectations, and our trying four time-tested strategies.

Value vs. Growth Stocks: Which is Best? We Test The Data!

Our data analysis for the past decade shows that growth stocks have outperformed value stocks. Growth investing has shown a remarkable return rate of 523%, while value investing has yielded 247%.

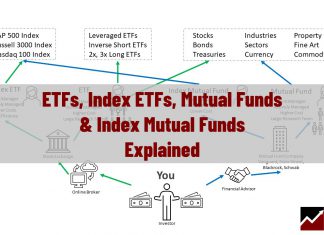

ETFs vs. Mutual Funds vs. Index Funds Explained

The difference between ETFs, mutual funds, and index funds is ETFs trade like stocks on an exchange, mutual funds are actively managed private investments, and an index fund can be either an ETF or a mutual fund.

S&P 500 Companies by Number of Employees 2024

A Complete Listing of All The Companies in the S&P 500 Index Sorted By Number of Employees & Industry Sectors

We Analyze 138 Inspirational Warren Buffett Investing Quotes

Warren Buffett is far more than the most successful investor in a generation. Buffett is also a businessman, philosopher, and writer who offers deep...

35 Best Growth Stocks To Buy Now To Beat The Market

Find the best growth stocks to buy now using a 9-year tested and proven strategy system that selects stocks that outperform the S&P 500. Instead of following stock tips from financial websites, you can adopt a structured approach to find stocks with a proven track record of beating the market.

25 Best Warren Buffett Quotes On Success to Inspire Your Future

Warren Buffett undeniably embodies remarkable success in business, investing, and life. Quotes like "the people who are most successful are those who are doing what they love." are inspirational.

A Stock Market Crash Early Warning System

A stock market crash early warning system is something every trader needs. Our Early Warning System alerts you to any potential signs of a crash in the markets. We call the system MOSES.

How to Ensure Your Portfolio is Diversified & Balanced

A well-diversified stock portfolio should have a low correlation to the broader market. This means that your portfolio won't necessarily follow suit when the broad market goes down.

The Best CANSLIM Stock Screener & How To Find CANSLIM Stocks

The best CANSLIM stock screeners to accurately find growth stocks are Stock Rover for US investors and TradingView for international traders. Stock Rover has 3 pre-built CANSLIM screeners, and one is available for free.

Our Best Training & Strategies

Liberated Stock Trader Pro: Learn Stock Market Investing

Learn stock market investing with the complete online stock trading course by Barry D. Moore, a certified financial analyst from the International Federation of Technical Analysts (IFTA).

ETF Investing Strategy: MOSES Improves Performance & Lowers Risk

The MOSES ETF investing strategy is a powerful suite of indicators meticulously backtested over 100 years. Designed to empower you to outperform the market, it equips you with the tools to navigate major stock market crashes and unlock greater investing performance.

Our LST Strategy Beat the Stock Market’s S&P 500 By 102%...

Decades of research and testing unveiled the Liberated Stock Trader Beat the Market System. Our 9-year, backtested, and proven strategy targets 35 financially healthy high-growth stocks, producing a track record of beating the S&P 500 by 102%.