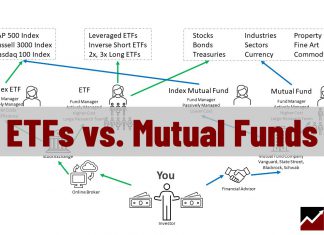

ETFs vs. Mutual Funds: Compounding, Fees & Performance Examined

ETF tax efficiency, liquidity, and low costs are perfect for independent investors. If you want someone to manage your money then mutual funds.

Are Dividend Reinvestment Plans (DRIPs) Worth It?

Dividend reinvestment plans are an effective way to reinvest dividends directly with a company to accumulate more shares over time without having to pay commission fees for each transaction. This allows for a steady stream of cost-effective income for the investor and stability for the company.

5 Smart Ways To Find & Invest In The Best Blue...

A blue-chip stock is a well-established, financially sound company with an excellent track record of strong performance. Blue chips are large companies in mature industries that pay regular dividends. Examples of blue-chip stocks include Apple, Microsoft, Boeing, Coca-Cola, IBM, and Visa.

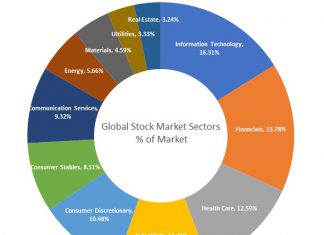

Is a Sector Rotation Strategy Profitable? We Check the Data!

Sector rotation theory and research into market cycles have been around for over 200 years. But is it profitable, and should you implement sector rotation in your stock portfolio?

Are Reinvested Dividends Taxable & How To Reduce It?

Reinvested dividends are generally taxable. The tax rate usually depends on the type of dividend received and your income tax bracket. For example, qualified...

7 Strategies to Find Quality Value Stocks Paying Dividends

Our research combines criteria for selecting value stocks and dividend-paying stocks to create seven strategies for finding under-valued dividend stocks. We include the exact criteria to use and a step-by-step guide to implementing them into a stock screener.

Is Gold a Good Investment During a Stock Market Crash?

Contrary to popular belief, gold is not a good long-term investment compared to stocks. However, it can provide a good alternative investment asset during the early stages of a stock market crash.

Ordinary vs. Qualified Dividends Less Tax & More Profit

Ordinary dividends are taxed at the individual investor's marginal rate, while qualified dividends are subject to a lower tax rate. Qualified dividends must also meet certain criteria like holding period and stock ownership.

Understanding Preferred Stock Dividends

Preferred stock dividends are a form of payment made to preferred stock shareholders. Preferred stock is a type of ownership in a company granting privileges such as priority over common stockholders in the event of bankruptcy or liquidation.

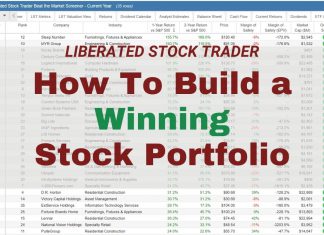

8 Steps to Build a Balanced & Profitable Portfolio

To build a balanced investment portfolio, determine how much to invest, your risk tolerance, portfolio allocation, and your investing strategy. Next, choose the right tools to screen and research the ideal stocks and ETFs to enable you to manage your portfolio effectively.

Find Great Defensive Stocks with Ben Grahams Protection Strategy

The best way to find defensive stocks is by using Benjamin Graham's timeless rules for the defensive investor: Stability, earnings, dividends, price-to-book ratio, and the price-to-Graham number.

Forecasting Stock Market Returns with 154 Years of Data

154 years of S&P 500 stock research data from 1871 to 2024 forecasts a 90% chance that the next ten years will be profitable, averaging 6.2% profit per year. The average positive gains year will be 16.54%, and the average negative year will be 13.69%.

Our 5 Step Guide to Screening for CANSLIM Growth Stocks

The best CANSLIM stock screeners to accurately find growth stocks are Stock Rover for US investors and TradingView for international traders. Stock Rover has 3 pre-built CANSLIM screeners, and one is available for free.

LiberatedStockTrader’s Guide to Dividend Investing

Our step-by-step guide covers four dividend strategies: high yield, safe dividends, long-term dividend growth, and dividend value stocks. It also shows you the tools and screening criteria you need to find high-quality dividend stocks.

How To Implement 13 Legendary Stock Portfolio Examples

Our years of performance testing reveal the world's best-performing stock portfolios are Berkshire Hathaway, CANSLIM, GreenBlatt's Magic Formula, and the FAANG portfolio. We share examples and show you how to implement them.

The 26 Best Warren Buffett Investing Quotes of All Time

Warren Buffett's best investing quotes are "You might want a larger margin of safety," "Never invest in a business you don't understand," and "Don't bet on miracles."

13 Best Ratios & Tools To Find Undervalued Stocks Easily

To find undervalued stocks, use established financial ratios such as discounted cash flow, the margin of safety, PEG, price to book, or the price to Graham number. Each ratio provides a unique insight into a company to determine if it is undervalued.

M.O.S.E.S. Investing Strategy Training Dashboard

Welcome to MOSES I hope you see the benefit of avoiding major stock market crashes and preserving the value of your investments.

By Using This...

What is CANSLIM Investing & Does It Work? I Test It!

CANSLIM is an active investment strategy that utilizes specific screening criteria such as earnings, market leadership, product innovation, institutional ownership, and stock price trends. These key criteria play a vital role in the process of stock selection.

What is a Hybrid Robo-Advisor & Should You Use One?

A hybrid robo-advisor offers automated investment management services but also provides access to a human financial advisor. Hybrid robo-advisors use algorithms with help from a financial expert.

Our Best Training & Strategies

Liberated Stock Trader Pro: Learn Stock Market Investing

Learn stock market investing with the complete online stock trading course by Barry D. Moore, a certified financial analyst from the International Federation of Technical Analysts (IFTA).

ETF Investing Strategy: MOSES Improves Performance & Lowers Risk

The MOSES ETF investing strategy is a powerful suite of indicators meticulously backtested over 100 years. Designed to empower you to outperform the market, it equips you with the tools to navigate major stock market crashes and unlock greater investing performance.

LiberatedStockTrader’s Strategy Beat the Market By 102%

Decades of research and testing unveiled the Liberated Stock Trader Beat the Market System. Our 9-year, backtested, and proven strategy targets 35 financially healthy high-growth stocks, producing a track record of beating the S&P 500 by 102%.