Investment Strategies & Research

Growth, Value & Dividend Investing Strategy & ResearchOur research covers three core investment strategies. Growth, value, and dividend investing are proven methods for achieving...

9 Step Stock Market Investing Strategy (Videos + eBook)

The stock market strategy blueprint is a handcrafted process to help you to understand all the factors at play in the stock market.

Stock Beta: Using High, Low & Negative Beta in Trading!

Beta is a financial ratio measuring volatility for individual stocks or portfolios. It quantifies the anticipated fluctuation in stock price in relation to overall market movements. A beta greater than 1.0 implies that the stock is more volatile than the broader market, whereas a beta below 1.0 indicates a stock with lower volatility.

Unlock the Secrets of Money Markets: A Beginner’s Guide

Money markets play a crucial role in greasing the wheels of economic activity, ensuring a smooth flow of funds from those who have it to those who need to borrow it. Investors can use money markets to protect capital from inflation.

How to Invest in REITs? 5 Smart Tips & Strategies.

Real Estate Investment Trusts (REITs) are publicly-traded entities that own or finance income-generating real estate assets. By investing in REITs, individuals can participate in the real estate market without directly purchasing physical properties.

Best Bull Leveraged ETFs 2x/3x For Trading

Leveraged/Long/Bull ETFs Enable You To Increase Your Profit In Bull Markets. We List the Best Leveraged ETFs by Assets, Liquidity & Expense Ratio

Are Robo Advisors Good? Pro and Cons Uncovered!

Robo Advisors can be a great idea for the right person. They are essentially automated financial advisors who use algorithms and computer programs to...

S&P 500 Companies by Number of Employees 2024

A Complete Listing of All The Companies in the S&P 500 Index Sorted By Number of Employees & Industry Sectors

What is a Dividend Reinvestment Plan (DRIP)? Is it Worth It?

Dividend reinvestment plans are an effective way to reinvest dividends directly with a company to accumulate more shares over time without having to pay commission fees for each transaction. This allows for a steady stream of cost-effective income for the investor and stability for the company.

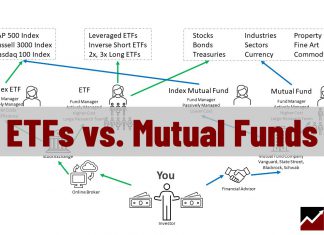

ETFs vs. Mutual Funds: Compounding, Fees & Performance

ETF tax efficiency, liquidity, and low costs are perfect for independent investors. If you want someone to manage your money then mutual funds.

Ordinary vs. Qualified Dividends Less Tax & More Profit

Ordinary dividends are taxed at the individual investor's marginal rate, while qualified dividends are subject to a lower tax rate. Qualified dividends must also meet certain criteria like holding period and stock ownership.

How to Calculate Intrinsic/Fair Value of Stocks + Excel Calculator

To calculate the intrinsic value of a stock, estimate a company's future cash flow, discount it by the compounded inflation rate, and divide the result by the number of shares outstanding. The result is a stock's fair value.

How to Buy-and-Hold Stocks: 12 Proven Strategies

Based on our 30-year research, adopting a buy-and-hold stocks strategy is annually 4% more profitable than actively trading stocks or investing in alternative assets such as corporate bonds, real estate, gold, or treasuries.

7 Best Stock Portfolio Trackers for Investors 2024

Our research shows the best portfolio trackers are Stock Rover and Portfolio 123, with powerful screening, watchlists, and portfolio management features. M1 Finance and Tickeron enable the easy construction of balanced portfolios. Finally, Firstrade provides retirement portfolios and free stock trading.

Buy and Hold Strategy: 30-Year Test Proves If It’s Worth It!

Our research suggests that long-term buy-and-hold investing leads to significant profits. Over the past 30 years, annual stock market returns averaged 10.7%, while bonds and real estate yield 4.8%, and gold returns 6.8%.

Finding High-Yield Dividend Stocks: 3 Tested Strategies

To find high-yield dividend stocks requires scanning for key criteria such as dividend yield, growth, payout ratio, and EPS. A safer and more profitable strategy will incorporate value investing criteria like margin of safety and price to sales.

We Analyze 138 Inspirational Warren Buffett Investing Quotes

Warren Buffett is far more than the most successful investor in a generation. Buffett is also a businessman, philosopher, and writer who offers deep...

Robo-Advisor, AI-Advisor and Hybrid-Advisors Explained

A robo-advisor is a fully automated investing service; a hybrid advisor adds the human touch to investing, and the AI robo-advisor uses algorithms and machine learning to make investments on your behalf.

7 Best Stock Picking & Advisory Services 2024

Our stock advisor review and tests show the best stock picking services are Motley Fool Stock Advisor, Morningstar, AAII, and Zacks. Stock Rover is the best stock research tool as an alternative to stock picking services.

What Is Qualified Dividend & How Can You Take advantage?

Curious about Qualified Dividends and how they contribute to your long-term stock investment profits? Let's explore their importance and unravel the potential benefits they...

Our Best Training & Strategies

Liberated Stock Trader Pro: Learn Stock Market Investing

Learn stock market investing with the complete online stock trading course by Barry D. Moore, a certified financial analyst from the International Federation of Technical Analysts (IFTA).

ETF Investing Strategy: MOSES Improves Performance & Lowers Risk

The MOSES ETF investing strategy is a powerful suite of indicators meticulously backtested over 100 years. Designed to empower you to outperform the market, it equips you with the tools to navigate major stock market crashes and unlock greater investing performance.

Our LST Strategy Beat the Stock Market’s S&P 500 By 102%...

Decades of research and testing unveiled the Liberated Stock Trader Beat the Market System. Our 9-year, backtested, and proven strategy targets 35 financially healthy high-growth stocks, producing a track record of beating the S&P 500 by 102%.