Fear & Greed Index: 10 Stock Sentiment Charts

Our live fear and greed index charts enable you to see the sentiment of investors, the turning points between bull and bear stock markets, and know when to buy and sell stocks.

Don’t Invest In Index ETFs Until You Read These 13 Pro...

You can safely invest in index funds through mutual fund companies or as an index ETF directly through your broker. Investing in an index fund ETF is the most cost-effective, liquid, and efficient way to diversify your portfolio.

9 Top Robo-Advisors Tested & Compared for 2024

The best robo-advisors, according to our research, are M1 Invest, Betterment, Wealthfront Ellevest, and Fidelity Go. In a competitive market, the quality and benefits of automated investing are improving every year.

MOSES: Our Stock Market Crash Early Warning System

A stock market crash early warning system is something every trader needs. Our Early Warning System alerts you to any potential signs of a crash in the markets. We call the system MOSES.

Is Gold a Good Investment During a Stock Market Crash?

Contrary to popular belief, gold is not a good long-term investment compared to stocks. However, it can provide a good alternative investment asset during the early stages of a stock market crash.

Is Commodity Trading Profitable or Risky? We Investigate!

Commodities are tangible goods such as food, metals, and energy that traders can buy or sell in the financial markets. These commodities are traded on global exchanges, and their prices fluctuate based on supply and demand.

LiberatedStockTrader’s Strategy Beat the Market By 102%

Decades of research and testing unveiled the Liberated Stock Trader Beat the Market System. Our 9-year, backtested, and proven strategy targets 35 financially healthy high-growth stocks, producing a track record of beating the S&P 500 by 102%.

7 Best Stock Portfolio Trackers for Investors 2024

Our research shows the best portfolio trackers are Stock Rover and Portfolio 123, with powerful screening, watchlists, and portfolio management features. M1 Finance and Tickeron enable the easy construction of balanced portfolios. Finally, Firstrade provides retirement portfolios and free stock trading.

8 Steps to Build a Balanced & Profitable Portfolio

To build a balanced investment portfolio, determine how much to invest, your risk tolerance, portfolio allocation, and your investing strategy. Next, choose the right tools to screen and research the ideal stocks and ETFs to enable you to manage your portfolio effectively.

Mastering Value Investing: A Complete Strategy Workbook +pdf

Value investing is an investment strategy focused on buying stocks trading at a discount relative to their intrinsic or fair value. Academic research shows value investing generates lower risk and higher long-term returns than dividend and growth investing.

Building the Best Buffett Stock Screener for Value Investing

The best Buffett and Graham stock screener is Stock Rover, which provides eight fair value, intrinsic value, and forward cash flow calculations to help you build a great portfolio.

39 Epic Screening Criteria All Smart Value Investors Use

The essential screening criteria to find great value stocks are intrinsic value, margin of safety, the PEG ratio, price to Graham number, and earnings power value.

Using the Buffett Indicator to Understand Market Valuation

The Buffett Indicator helps gauge stock market valuation by dividing the total market capitalization by GDP, offering a macroeconomic perspective on market value.

Are Robo-Advisors a Good Idea? What Are The Pro & Cons?

Robo-advisors are good if you want to save time managing your investments. They automate tax-loss harvesting and rebalancing and provide commission-free trading in ETFs and stocks.

A 5 Step Screening Strategy To Find Top Dividend Growth Stocks

To find the best dividend growth stocks, we need to screen for specific criteria. Find stocks with a 10+ year history of growing dividends, a sustainable payout ratio, 5-year sales growth over 4%, and a margin of safety greater than 0.

13 Best Ratios & Tools To Find Undervalued Stocks Easily

To find undervalued stocks, use established financial ratios such as discounted cash flow, the margin of safety, PEG, price to book, or the price to Graham number. Each ratio provides a unique insight into a company to determine if it is undervalued.

Forecasting Stock Market Returns with 154 Years of Data

154 years of S&P 500 stock research data from 1871 to 2024 forecasts a 90% chance that the next ten years will be profitable, averaging 6.2% profit per year. The average positive gains year will be 16.54%, and the average negative year will be 13.69%.

18 Liquid 3X Leveraged ETFs & The Strategies To Trade Them

Gain insights from a seasoned ex-Wall Street trader with 40 years of experience, as he imparts knowledge on leveraged 3X ETF trading. Explore the intricacies of risks, rewards, and effective strategies.

The 26 Best Warren Buffett Investing Quotes of All Time

Warren Buffett's best investing quotes are "You might want a larger margin of safety," "Never invest in a business you don't understand," and "Don't bet on miracles."

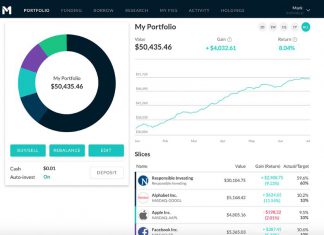

M1 Finance’s Robo-Advisor Tested & Rated for 2024

Our review testing finds that M1 Finance is a high-quality automated investing robo-advisor with a broad platform of financial products and a clear visibility into its investing performance. With $0 fees and a $100 minimum balance, M1 is worth trying.

Our Best Training & Strategies

Liberated Stock Trader Pro: Learn Stock Market Investing

Learn stock market investing with the complete online stock trading course by Barry D. Moore, a certified financial analyst from the International Federation of Technical Analysts (IFTA).

ETF Investing Strategy: MOSES Improves Performance & Lowers Risk

The MOSES ETF investing strategy is a powerful suite of indicators meticulously backtested over 100 years. Designed to empower you to outperform the market, it equips you with the tools to navigate major stock market crashes and unlock greater investing performance.

LiberatedStockTrader’s Strategy Beat the Market By 102%

Decades of research and testing unveiled the Liberated Stock Trader Beat the Market System. Our 9-year, backtested, and proven strategy targets 35 financially healthy high-growth stocks, producing a track record of beating the S&P 500 by 102%.