Mean Reversion Trading Strategy Explained with Examples

The mean reversion trading strategy suggests prices and returns eventually move back toward the mean or average. Reliable indicators like Stochastics, RSI, and Bollinger bands are based on mean reversion to identify overbought and oversold conditions.

How to Trade the Rising Wedge Pattern’s 81% Success Rate

According to multi-year testing, the rising wedge pattern has a solid 81% success rate in bull markets with an average potential profit of +38%. The ascending wedge is a reliable, accurate pattern, and if used correctly, gives you an edge in trading.

Money Flow Index (MFI) Explained: Best Settings & Reliability Tested

The Money Flow Index (MFI) is a momentum indicator in technical analysis that measures the in and outflows of money into a stock. It oscillates between 0 to 100 and is used to identify price reversals, market tops, and bottoms.

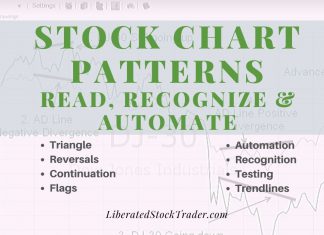

5 Best Candlestick & Chart Pattern Recognition Software 2024

Our 20-point test reveals the best stock chart candlestick pattern recognition software are TrendSpider, TradingView, and Finviz.

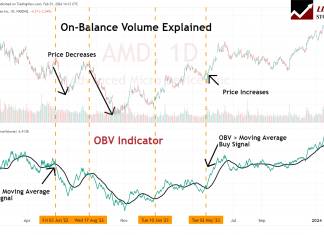

OBV Indicator: Best Settings & Trading Strategy Explained

On-balance volume (OBV) is a cumulative indicator in technical analysis designed to show the volume flow relative to a security's price movements. The OBV reflects the collective buying and selling pressure crystallized through the volume trend.

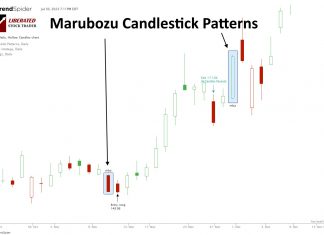

We Test Bullish & Bearish Marubozu Candles for Reliability

Our research shows Bearish Marubozu candles are among the most profitable patterns. Based on 568 years of data, it has a 56.1% success rate and an average win of 4.1%. Conversely, the Bullish Marubozu is one of the worst.

Optimal Tick Chart Settings, Strategies & TradingView Examples

Tick charts are uniquely constructed by plotting price movement after a certain number of transactions occur. Unlike traditional time-based OHLC or candlestick charts representing price action over a set period, tick charts update after a predefined trading volume is reached.

How to Trade a Falling Wedge’s 74% Chance of a 38%...

A falling wedge is a technical analysis pattern with a predictive accuracy of 74%. The pattern can break out up or down but is primarily considered bullish, rising 68% of the time.

Stochastic Oscillator Explained: Best Strategy & Settings Tested

The Stochastic Oscillator momentum indicator compares an asset's closing price to a range of its previous prices. It oscillates between 0 and 100; below 20 indicates oversold, and above 80 suggests an overbought market.

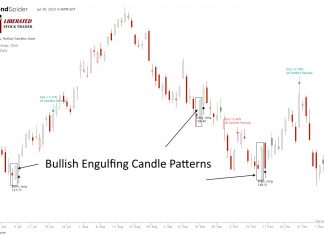

3,735 Bullish Engulfing Candle Trades Test its Reliability

Our research shows the Bullish Engulfing candle is not as bullish as most traders believe. Based on 568 years of data, it has a 55% success rate and an average win of 3.5%.

Hull Moving Average Trading Tested with 960 Years of Data

The Hull Moving Average (HMA) is a highly responsive technical analysis indicator designed to reduce lag. Our research reveals it outperforms other moving averages.

How to Trade an Ascending Triangle Pattern’s 83% Success Rate!

According to two decades of trading research, the ascending triangle pattern has an outstanding 83% success rate with an average potential profit of +43%. It's a well-known, reliable, accurate pattern that can generate good profits.

We Test the Inverted Hammer Candle Pattern! Is It Worth It?

Our research shows the Inverted Hammer is the most accurate and profitable candlestick pattern. Used as a bullish signal, it has a 60% success rate and an average win of 4.2%, based on 588 years of data.

Weighted Moving Average (WMA) Explained & Reliability Tested

Our research reveals the WMA underperforms other moving averages with only a 7% win rate on a standard OHLC chart. However, using it on Heikin Ashi charts produces excellent results.

23 Best Stock Chart Patterns Proven Reliable By Data Testing

Published research shows the most reliable and profitable stock chart patterns are the inverse head and shoulders, double bottom, triple bottom, and descending triangle. Each has a proven success rate of over 85%, with an average gain of 43%.

How to Backtest Trading Strategies in 2024 with Examples & Tools

Experienced investors backtest their trading strategies to optimize their portfolios. Backtesting is a critical step that enables traders to assess the potential viability of a trading strategy by applying it to historical data.

How to Trade Pivot Points in Stocks Based on 66,480 Trades

Traders utilize pivot point indicators to predict when stock prices will reverse direction. But does it work? I tested 66,480 trades on 210 years of data, and the results are surprising.

What is EMA? Best Exponential Moving Average Settings Tested

An exponential moving average (EMA) technical indicator reduces the lag associated with simple moving averages (SMA) by applying a multiplier to the most recent data. EMAs provide improved sensitivity, enhancing the accuracy of trend analysis.

How to Trade a Double Bottom Pattern’s 88% Success Rate

Decades of research reveal the double bottom pattern has an 88% success rate in bull markets and an average profit potential of +50%. The double-bottom chart pattern is one of the most reliable and accurate chart indicators in technical analysis.

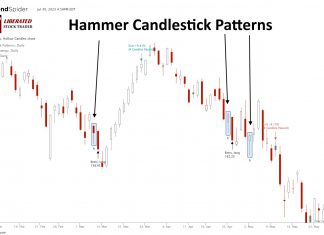

Hammer Candlesticks Patterns Explained & Reliability Tested

According to 2,219 tested trades, a Hammer is extremely unreliable and unprofitable. It has a low % accuracy rate of 52.1%, resulting in a razor-thin 0.18% profit per trade.

Our Best Training & Strategies

Liberated Stock Trader Pro: Learn Stock Market Investing

Learn stock market investing with the complete online stock trading course by Barry D. Moore, a certified financial analyst from the International Federation of Technical Analysts (IFTA).

ETF Investing Strategy: MOSES Improves Performance & Lowers Risk

The MOSES ETF investing strategy is a powerful suite of indicators meticulously backtested over 100 years. Designed to empower you to outperform the market, it equips you with the tools to navigate major stock market crashes and unlock greater investing performance.

Our LST Strategy Beat the Stock Market’s S&P 500 By 102%...

Decades of research and testing unveiled the Liberated Stock Trader Beat the Market System. Our 9-year, backtested, and proven strategy targets 35 financially healthy high-growth stocks, producing a track record of beating the S&P 500 by 102%.