A Financial Analyst’s Guide to Trading the Volume Indicator

Stock volume, or trading volume, is the total number of shares traded during a specific period. Volume indicates buying and selling pressure and potential changes in a stock's trend direction and quality.

9 Best Stock Chart Types For Traders & Investors Explained

Our research shows the most effective chart types for traders are Heikin Ashi, Candlestick, OHLC, Raindrop, and Renko charts. These charts provide the best balance of price and trend reversal information to help investors build effective trading strategies.

How to Draw Trendlines on Stock Charts Like a Boss

Drawing trendlines on stock charts is a powerful way to assess the direction of the market. Trendlines help you understand the trend direction and timeframe to set expectations for future market moves.

Does Ichimoku Cloud Work? Success Rates & Settings Tested

Ichimoku Cloud, or "Ichimoku Kinko Hyo", is a moving average based chart indicator that visualizes the market's direction, momentum, and support/resistance levels.

12 Ways to Master Stock Chart Indicators by a Certified Analyst

Professional market analysts build trading strategies using chart indicator techniques like divergences, multi-time frame analysis, indicator combinations, and rigorous backtesting.

Head & Shoulders Pattern: Trade an 81% Success Rate

The head and shoulders pattern is one of the most accurate technical analysis reversal patterns, with a reliability of 81%. A head and shoulders top occurs when the price peaks on three separate occasions, with two peaks forming the "shoulders" and the central peak forming the head.

7 Parabolic SAR Trading Strategies Tested by LiberatedStockTrader

The Parabolic Stop and Reverse (PSAR) technical indicator identifies asset price reversals. Relying on parabolic time/price systems it creates effective trailing stop-losses for trading signals.

Fibonacci Retracement Trading Explained: I Test If It Works

In technical analysis, Fibonacci retracement is used by traders to predict levels of support and resistance by drawing horizontal lines according to the Fibonacci sequence. But Does It Work?

How to Read Candlestick Charts Using 5 Reliable Patterns

You can read candlestick charts using pattern recognition software to identify five reliable patterns, the Inverted Hammer, Bearish Marubozu, Gravestone Doji, Bearish Engulfing, and Bullish Harami Cross.

Advance/Decline (A/D) Line Explained by a Certified Analyst

The advance/decline (A/D) line indicator measures market breadth by identifying how many stocks participate in a market advance or decline. It is calculated by taking the number of advancing stocks minus the declining stocks.

6 Principles of Dow Theory Explained with Examples & Video

Dow theory's six principles underpin technical analysis: The market discounts everything; it has three trends and phases; the averages must confirm each other; volume confirms the trend and a trend continues until it reverses.

What are Market Profile Charts & Best Software To Use?

A market profile chart is a day-trading tool that displays the price activity to identify a time price opportunity (TPO). It helps traders identify the most traded prices and develop strategies to exploit these areas.

How to Read Stock Charts Like a Boss: Beginners Guide +pdf

To read stock charts you need to use stock charting software, select your chart type, configure your timeframe, determine price direction using trendlines and use indicators to estimate future prices.

Avoid Equivolume & Use These 6 Proven Charts

Equivolume charts have lost their popularity over time due to poor performance in testing and weak data visualization. I demonstrate why equivolume is no longer in use and introduce six charts proven superior by data.

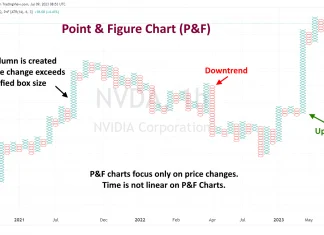

The Best Free Point & Figure Charts & How To Use...

Point and Figure (P&F) charts are a unique form of technical analysis that focuses solely on price action, disregarding time and volume. They utilize 'Xs and 'Os to depict price movements, with 'X' representing an increase and 'O' a decrease.

Stock Market Trends: 6 Steps for Better Trend Analysis

All stock market trends can be described by using the following definitions. Market timeframes are short-term-medium-term, and long-term. Market direction is described using uptrend, downtrend, or consolidation.

Elliott Wave Theory: Usage, Rules & Reliability Tested

Elliott Wave Theory is a scientifically unproven technical analysis indicator used to attempt to predict price movements in financial markets. I highly recommend avoiding this indicator.

Hull Moving Average Trading Tested with 960 Years of Data

The Hull Moving Average (HMA) is a highly responsive technical analysis indicator designed to reduce lag. Our research reveals it outperforms other moving averages.

Ascending Triangle: Trade An 83% Successful Pattern

According to two decades of trading research, the ascending triangle pattern has an outstanding 83% success rate with an average potential profit of +43%. It's a well-known, reliable, accurate pattern that can generate good profits.

We Test the Inverted Hammer Candle Pattern! Is It Worth It?

Our research shows the Inverted Hammer is the most accurate and profitable candlestick pattern. Used as a bullish signal, it has a 60% success rate and an average win of 4.2%, based on 588 years of data.

Our Best Training & Strategies

Liberated Stock Trader Pro: Learn Stock Market Investing

Learn stock market investing with the complete online stock trading course by Barry D. Moore, a certified financial analyst from the International Federation of Technical Analysts (IFTA).

ETF Investing Strategy: MOSES Improves Performance & Lowers Risk

The MOSES ETF investing strategy is a powerful suite of indicators meticulously backtested over 100 years. Designed to empower you to outperform the market, it equips you with the tools to navigate major stock market crashes and unlock greater investing performance.

Our LST Strategy Beat the Stock Market’s S&P 500 By 102%...

Decades of research and testing unveiled the Liberated Stock Trader Beat the Market System. Our 9-year, backtested, and proven strategy targets 35 financially healthy high-growth stocks, producing a track record of beating the S&P 500 by 102%.