NASDAQ 100 Company List by Sector, Market Cap, PE & EPS

Our up-to-date NASDAQ 100 companies lists included ticker, sector classification, market capitalization, PE Ratio, EPS, and employee count. We also show you how to export this list to Excel.

Inverse/Short ETFs List by Market Cap & Expense Ratio

Our regularly updated inverse/short ETFs list shows you what ETFs are currently active and provides the ticker, market capitalization, and expense ratios.

11 Stock Market Sectors & Best Stocks Per Sector 2024

Our 10 years of research reveal the best stock market sectors that out-performed the S&P500 are Technology +381%, Consumer Cyclical +181%, and Healthcare +34%. These 3 sectors significantly beat the market averages.

ETF Investing Strategy: MOSES Improves Performance & Lowers Risk

The MOSES ETF investing strategy is a powerful suite of indicators meticulously backtested over 100 years. Designed to empower you to outperform the market, it equips you with the tools to navigate major stock market crashes and unlock greater investing performance.

35 Best Growth Stocks To Buy Now To Beat The Market

Find the best growth stocks to buy now using a 9-year tested and proven strategy system that selects stocks that outperform the S&P 500. Instead of following stock tips from financial websites, you can adopt a structured approach to find stocks with a proven track record of beating the market.

Our LST Strategy Beat the Stock Market’s S&P 500 By 102%...

Decades of research and testing unveiled the Liberated Stock Trader Beat the Market System. Our 9-year, backtested, and proven strategy targets 35 financially healthy high-growth stocks, producing a track record of beating the S&P 500 by 102%.

Forex Trading: How to Do It & The Pitfalls to Avoid

Forex trading, also known as foreign exchange or currency trading, is the leveraged buying and selling of currencies on the global market. Traders can take advantage of this constantly fluctuating market by betting on which direction prices will move.

Buffett Indicator Explained: Market Valuation Exposed

The Buffett Indicator helps gauge stock market valuation. It compares total market capitalization to GDP, offering a macroeconomic perspective on market value.

What Companies Does Warren Buffett Own? BRK.A Subsidiaries

Through Berkshire Hathaway's subsidiaries, CEO Warren Buffett owns 62 companies and has a major stakeholding in hundreds of companies in a broad market portfolio. Warren Buffett owns many companies via Berkshire Hathaway. He owns stocks and entire companies such as Dairy Queen & GEICO.

13 Best Stock Portfolio Examples & How To Implement Them

Our years of performance testing reveal the world's best-performing stock portfolios are Berkshire Hathaway, CANSLIM, GreenBlatt's Magic Formula, and the FAANG portfolio. We share examples and show you how to implement them.

How to Buy-and-Hold Stocks: 12 Proven Strategies

Based on our 30-year research, adopting a buy-and-hold stocks strategy is annually 4% more profitable than actively trading stocks or investing in alternative assets such as corporate bonds, real estate, gold, or treasuries.

13 Legendary Investor’s Beat the Market Strategies Explained

To consistently beat the market is difficult but not impossible. O'Neill, Greenblatt, Buffett, and Klarman are legendary investors who have beaten the market. I test the strategies and show you the best ways to implement them.

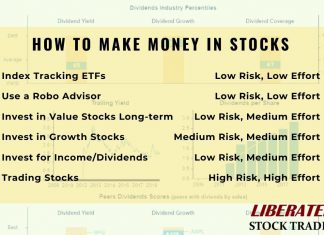

6 Time-Tested Proven Ways to Make Money in Stocks

The six best time-tested proven ways to make money in the stock market are investing in long-term ETFs, using a Robo Advisor, investing in value stocks, a portfolio of growth stocks, dividend investing, and stock trading. Each has its unique risk and reward characteristics.

What is CANSLIM Investing & Does It Work? I Test It!

CANSLIM is an active investment strategy that utilizes specific screening criteria such as earnings, market leadership, product innovation, institutional ownership, and stock price trends. These key criteria play a vital role in the process of stock selection.

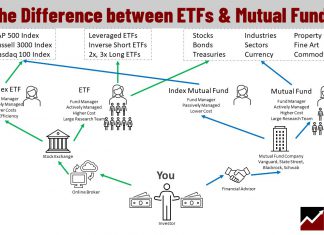

The Difference Between ETFs and Mutual Funds is Capital Flow

The difference between ETFs and mutual funds is ETFs are normally sold and bought on an exchange, while mutual funds are valued, traded, and priced at the end of a trading day. ETFs have lower fees, averaging 0.35%, and Mutual fund fees are over 1%.

Value vs. Growth Stocks: Which is Best? We Test The Data!

Our data analysis for the past decade shows that growth stocks have outperformed value stocks. Growth investing has shown a remarkable return rate of 523%, while value investing has yielded 247%.

Alpha: Calculate, Find & Profit from High-Alpha Stocks

Alpha measures a stock, fund, or asset's performance relative to its benchmark. It is often expressed as a percentage. For example, if an investment increases in value by 10 percent but the market benchmark increases by 5 percent, then the alpha would be +5%.

The Best CANSLIM Stock Screener & How To Find CANSLIM Stocks

The best CANSLIM stock screeners to accurately find growth stocks are Stock Rover for US investors and TradingView for international traders. Stock Rover has 3 pre-built CANSLIM screeners, and one is available for free.

Cyclical Stocks: What Are They & How & When To Trade...

A cyclical stock's price is influenced by macroeconomic or systemic changes within the broader economy. These stocks are renowned for mirroring the economic cycles through the growth, boom, bust, and recovery phases.

13 Best Ways To Find Undervalued Stocks: Ratios & Tools Explained

To find undervalued stocks, use established financial ratios such as discounted cash flow, the margin of safety, PEG, price to book, or the price to Graham number. Each ratio provides a unique insight into a company to determine if it is undervalued.

Our Best Training & Strategies

Liberated Stock Trader Pro: Learn Stock Market Investing

Learn stock market investing with the complete online stock trading course by Barry D. Moore, a certified financial analyst from the International Federation of Technical Analysts (IFTA).

ETF Investing Strategy: MOSES Improves Performance & Lowers Risk

The MOSES ETF investing strategy is a powerful suite of indicators meticulously backtested over 100 years. Designed to empower you to outperform the market, it equips you with the tools to navigate major stock market crashes and unlock greater investing performance.

Our LST Strategy Beat the Stock Market’s S&P 500 By 102%...

Decades of research and testing unveiled the Liberated Stock Trader Beat the Market System. Our 9-year, backtested, and proven strategy targets 35 financially healthy high-growth stocks, producing a track record of beating the S&P 500 by 102%.