How to Calculate Warren Buffett’s Margin of Safety: Formula + Excel

Calculating Buffett's margin of safety formula requires understanding cash flow, discounting, and intrinsic value.

Is Gold a Good Investment During a Stock Market Crash?

Contrary to popular belief, gold is not a good long-term investment compared to stocks. However, it can provide a good alternative investment asset during the early stages of a stock market crash.

4 Experts Reveal Favorite Dividend Investing Strategies

All dividend stocks share one big similarity: their ability to produce earnings. Pay attention to the history and safety of these companies' dividend payments and the potential for these payments to grow, and increasing wealth follows from there.

8 Steps to Build a Balanced & Profitable Portfolio

To build a balanced investment portfolio, determine how much to invest, your risk tolerance, portfolio allocation, and your investing strategy. Next, choose the right tools to screen and research the ideal stocks and ETFs to enable you to manage your portfolio effectively.

Mastering Value Investing: Our Complete Strategy Workbook +pdf

Value investing is an investment strategy focused on buying stocks trading at a discount relative to their intrinsic or fair value. Academic research shows value investing generates lower risk and higher long-term returns than dividend and growth investing.

10 Tips For Investing In Dividend Stocks Like A Pro

The best way to build long-term wealth is to invest discretionary income into high-quality dividend stocks, reinvest dividends, and let the magic of compounding work over time.

16 Insights To Trade Leveraged ETFs Successfully

To successfully trade leveraged ETFs, you must understand the importance of ETF decay, liquidity, volume, fees, assets under management, and potential risks.

20 Inspirational Warren Buffett Quotes on Life

Warren Buffett's quotes on life are inspirational, such as “If you are stuck in a hole, stop digging.” Join us as we explore the Oracle of Omaha's life lessons.

We Analyze 138 Inspirational Warren Buffett Investing Quotes

Warren Buffett is far more than the most successful investor in a generation. Buffett is also a businessman, philosopher, and writer who offers deep...

How To Protect Your 401k From a Stock Market Crash

To protect your 401k from a market crash, you can liquidate your assets, use dollar-cost averaging, or diversify and rebalance your portfolio.

7 Best Stock Picking & Advisory Services 2024

Our stock advisor review and tests show the best stock picking services are Motley Fool Stock Advisor, Morningstar, AAII, and Zacks. Stock Rover is the best stock research tool as an alternative to stock picking services.

Fear & Greed Index: 10 Stock Sentiment Charts

Our live fear and greed index charts enable you to see the sentiment of investors, the turning points between bull and bear stock markets, and know when to buy and sell stocks.

Investment Strategies & Research

Growth, Value & Dividend Investing Strategy & ResearchOur research covers three core investment strategies. Growth, value, and dividend investing are proven methods for achieving...

S&P 500 Companies List by Market Capitalization 2024

Our regularly updated S&P 500 companies list shows you what companies are currently in the S&P 500 index and provides the ticker symbol, their industry sector, and market capitalization.

9 Step Stock Market Investing Strategy (Videos + eBook)

The stock market strategy blueprint is a handcrafted process to help you to understand all the factors at play in the stock market.

How to Manage a Stock Portfolio: 7 Steps of Pro Portfolio...

Managing a stock portfolio entails seven crucial tasks: conducting research, analyzing performance, rebalancing holdings, assessing correlations, planning future income, optimizing tax benefits, and analyzing future performance.

Stock Beta: Using High, Low & Negative Beta in Trading!

Beta is a financial ratio measuring volatility for individual stocks or portfolios. It quantifies the anticipated fluctuation in stock price in relation to overall market movements. A beta greater than 1.0 implies that the stock is more volatile than the broader market, whereas a beta below 1.0 indicates a stock with lower volatility.

Blue Chip Stocks List: Smart Ways To Find The Best Blue...

A blue-chip stock is a well-established, financially sound company with an excellent track record of strong performance. Blue chips are large companies in mature industries that pay regular dividends. Examples of blue-chip stocks include Apple, Microsoft, Boeing, Coca-Cola, IBM, and Visa.

Find the Best Defensive Stocks: Ben Grahams Protection Strategy

Defensive stocks withstand economic recessions and bear markets by providing critical human services. The best way to find defensive stocks is by using Benjamin Graham's timeless rules for the defensive investor: Stability, earnings, dividends, price-to-book ratio, and the price-to-Graham number.

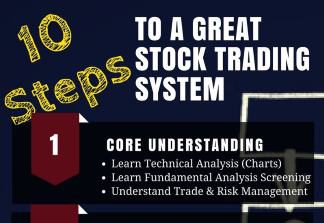

10 Step Guide to Create a Reliable Stock Trading Strategy

Creating a reliable stock trading strategy involves merging logic, expertise, experience, and data. A trader's approach to the market determines their success or failure.

Our Best Training & Strategies

Liberated Stock Trader Pro: Learn Stock Market Investing

Learn stock market investing with the complete online stock trading course by Barry D. Moore, a certified financial analyst from the International Federation of Technical Analysts (IFTA).

ETF Investing Strategy: MOSES Improves Performance & Lowers Risk

The MOSES ETF investing strategy is a powerful suite of indicators meticulously backtested over 100 years. Designed to empower you to outperform the market, it equips you with the tools to navigate major stock market crashes and unlock greater investing performance.

Our LST Strategy Beat the Stock Market’s S&P 500 By 102%...

Decades of research and testing unveiled the Liberated Stock Trader Beat the Market System. Our 9-year, backtested, and proven strategy targets 35 financially healthy high-growth stocks, producing a track record of beating the S&P 500 by 102%.