We Analyze 138 Inspirational Warren Buffett Investing Quotes

Warren Buffett is far more than the most successful investor in a generation. Buffett is also a businessman, philosopher, and writer who offers deep...

How to Manage a Stock Portfolio: 7 Steps of Pro Portfolio...

Managing a stock portfolio entails seven crucial tasks: conducting research, analyzing performance, rebalancing holdings, assessing correlations, planning future income, optimizing tax benefits, and analyzing future performance.

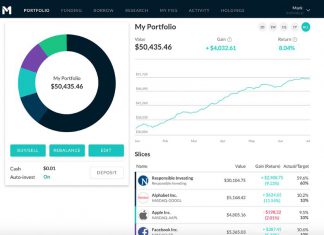

M1 Finance Review 2024: Automated Robo-Advisor Tested

Our review testing finds that M1 Finance is a high-quality automated investing robo-advisor with a broad platform of financial products and a clear visibility into its investing performance. With $0 fees and a $100 minimum balance, M1 is worth trying.

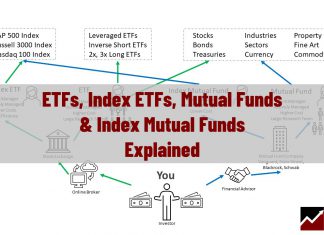

ETFs vs. Mutual Funds vs. Index Funds Explained

The difference between ETFs, mutual funds, and index funds is ETFs trade like stocks on an exchange, mutual funds are actively managed private investments, and an index fund can be either an ETF or a mutual fund.

Blue Chip Stocks List: Smart Ways To Find The Best Blue...

A blue-chip stock is a well-established, financially sound company with an excellent track record of strong performance. Blue chips are large companies in mature industries that pay regular dividends. Examples of blue-chip stocks include Apple, Microsoft, Boeing, Coca-Cola, IBM, and Visa.

How to Calculate Intrinsic/Fair Value of Stocks + Excel Calculator

To calculate the intrinsic value of a stock, estimate a company's future cash flow, discount it by the compounded inflation rate, and divide the result by the number of shares outstanding. The result is a stock's fair value.

S&P 500 Companies Listed Alphabetically 2024

A Complete Listing of All The Companies in the S&P 500 Index Sorted Alphabetically + Industry Sector & Market Capitalization

Creating the Best Dividend Stock Screener: 4 Strategies & Criteria

Our research shows you how to create the best dividend stock screener; you must decide on a high-yield, safe, or dividend growth strategy. Next, choose our tested criteria for your screener, like payout ratio, yield, and coverage.

20 Inspirational Warren Buffett Quotes on Life

Warren Buffett's quotes on life are inspirational, such as “If you are stuck in a hole, stop digging.” Join us as we explore the Oracle of Omaha's life lessons.

8 Steps to Build a Balanced & Profitable Portfolio

To build a balanced investment portfolio, determine how much to invest, your risk tolerance, portfolio allocation, and your investing strategy. Next, choose the right tools to screen and research the ideal stocks and ETFs to enable you to manage your portfolio effectively.

Robo-Advisor, AI-Advisor and Hybrid-Advisors Explained

A robo-advisor is a fully automated investing service; a hybrid advisor adds the human touch to investing, and the AI robo-advisor uses algorithms and machine learning to make investments on your behalf.

Alpha: Calculate, Find & Profit from High-Alpha Stocks

Alpha measures a stock, fund, or asset's performance relative to its benchmark. It is often expressed as a percentage. For example, if an investment increases in value by 10 percent but the market benchmark increases by 5 percent, then the alpha would be +5%.

Buffett Indicator Explained: Market Valuation Exposed

The Buffett Indicator helps gauge stock market valuation. It compares total market capitalization to GDP, offering a macroeconomic perspective on market value.

S&P 500 Companies List by Sector, Market Cap & PE Ratio...

Our regularly updated S&P 500 companies list shows you what companies are currently in the S&P 500 index and provides the ticker symbol, capitalization, and PE Ratio.

26 Best Warren Buffett Quotes On Investing of All Time

Warren Buffett's best investing quotes are "You might want a larger margin of safety," "Never invest in a business you don't understand," and "Don't bet on miracles."

Is Gold a Good Investment During a Stock Market Crash?

Contrary to popular belief, gold is not a good long-term investment compared to stocks. However, it can provide a good alternative investment asset during the early stages of a stock market crash.

10 Best Robo-Advisors Tested & Compared 2024

The best robo-advisors, according to our research, are M1 Invest, Betterment, Wealthfront Ellevest, and Fidelity Go. In a competitive market, the quality and benefits of automated investing are improving every year.

Stock Beta: Using High, Low & Negative Beta in Trading!

Beta is a financial ratio measuring volatility for individual stocks or portfolios. It quantifies the anticipated fluctuation in stock price in relation to overall market movements. A beta greater than 1.0 implies that the stock is more volatile than the broader market, whereas a beta below 1.0 indicates a stock with lower volatility.

13 Best Ways To Find Undervalued Stocks: Ratios & Tools Explained

To find undervalued stocks, use established financial ratios such as discounted cash flow, the margin of safety, PEG, price to book, or the price to Graham number. Each ratio provides a unique insight into a company to determine if it is undervalued.

S&P 500 Companies List by Market Capitalization 2024

Our regularly updated S&P 500 companies list shows you what companies are currently in the S&P 500 index and provides the ticker symbol, their industry sector, and market capitalization.

Our Best Training & Strategies

Liberated Stock Trader Pro: Learn Stock Market Investing

Learn stock market investing with the complete online stock trading course by Barry D. Moore, a certified financial analyst from the International Federation of Technical Analysts (IFTA).

ETF Investing Strategy: MOSES Improves Performance & Lowers Risk

The MOSES ETF investing strategy is a powerful suite of indicators meticulously backtested over 100 years. Designed to empower you to outperform the market, it equips you with the tools to navigate major stock market crashes and unlock greater investing performance.

Our LST Strategy Beat the Stock Market’s S&P 500 By 102%...

Decades of research and testing unveiled the Liberated Stock Trader Beat the Market System. Our 9-year, backtested, and proven strategy targets 35 financially healthy high-growth stocks, producing a track record of beating the S&P 500 by 102%.