7 Best Stock Picking & Advisory Services 2024

Our stock advisor review and tests show the best stock picking services are Motley Fool Stock Advisor, Morningstar, AAII, and Zacks. Stock Rover is the best stock research tool as an alternative to stock picking services.

Hybrid Robo-Advisors Explained! Can You Trust Them?

A hybrid robo-advisor offers automated investment management services but also provides access to a human financial advisor. Hybrid robo-advisors use algorithms with help from a financial expert.

16 Insights To Trade Leveraged ETFs Successfully

To successfully trade leveraged ETFs, you must understand the importance of ETF decay, liquidity, volume, fees, assets under management, and potential risks.

Find the Best Defensive Stocks: Ben Grahams Protection Strategy

Defensive stocks withstand economic recessions and bear markets by providing critical human services. The best way to find defensive stocks is by using Benjamin Graham's timeless rules for the defensive investor: Stability, earnings, dividends, price-to-book ratio, and the price-to-Graham number.

What Is Qualified Dividend & How Can You Take advantage?

Curious about Qualified Dividends and how they contribute to your long-term stock investment profits? Let's explore their importance and unravel the potential benefits they...

Are Robo Advisors Good? Pro and Cons Uncovered!

Robo Advisors can be a great idea for the right person. They are essentially automated financial advisors who use algorithms and computer programs to...

Best Bull Leveraged ETFs 2x/3x For Trading

Leveraged/Long/Bull ETFs Enable You To Increase Your Profit In Bull Markets. We List the Best Leveraged ETFs by Assets, Liquidity & Expense Ratio

Our LST Strategy Beat the Stock Market’s S&P 500 By 102%...

Decades of research and testing unveiled the Liberated Stock Trader Beat the Market System. Our 9-year, backtested, and proven strategy targets 35 financially healthy high-growth stocks, producing a track record of beating the S&P 500 by 102%.

Robo-Advisor vs. Human Financial Advisors Compared

Robo-Advisors vs. Financial Advisors: All Pros & Cons Comparing Costs, Fees, Services, Portfolio Management, Rebalancing & Tax Loss Harvesting.

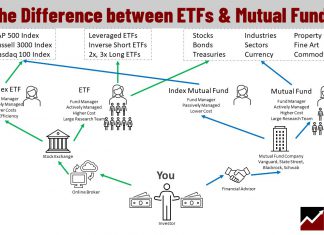

The Difference Between ETFs and Mutual Funds is Capital Flow

The difference between ETFs and mutual funds is ETFs are normally sold and bought on an exchange, while mutual funds are valued, traded, and priced at the end of a trading day. ETFs have lower fees, averaging 0.35%, and Mutual fund fees are over 1%.

Finding High-Yield Dividend Stocks: 3 Tested Strategies

To find high-yield dividend stocks requires scanning for key criteria such as dividend yield, growth, payout ratio, and EPS. A safer and more profitable strategy will incorporate value investing criteria like margin of safety and price to sales.

Our Best Training & Strategies

Liberated Stock Trader Pro: Learn Stock Market Investing

Learn stock market investing with the complete online stock trading course by Barry D. Moore, a certified financial analyst from the International Federation of Technical Analysts (IFTA).

ETF Investing Strategy: MOSES Improves Performance & Lowers Risk

The MOSES ETF investing strategy is a powerful suite of indicators meticulously backtested over 100 years. Designed to empower you to outperform the market, it equips you with the tools to navigate major stock market crashes and unlock greater investing performance.

Our LST Strategy Beat the Stock Market’s S&P 500 By 102%...

Decades of research and testing unveiled the Liberated Stock Trader Beat the Market System. Our 9-year, backtested, and proven strategy targets 35 financially healthy high-growth stocks, producing a track record of beating the S&P 500 by 102%.