How to Find the Best Dividend Growth Stocks: 5 Step Strategy

To find the best dividend growth stocks, we need to screen for specific criteria. Find stocks with a 10+ year history of growing dividends, a sustainable payout ratio, 5-year sales growth over 4%, and a margin of safety greater than 0.

25 Best Warren Buffett Quotes On Success to Inspire Your Future

Warren Buffett undeniably embodies remarkable success in business, investing, and life. Quotes like "the people who are most successful are those who are doing what they love." are inspirational.

7 Best Stock Portfolio Trackers for Investors 2024

Our research shows the best portfolio trackers are Stock Rover and Portfolio 123, with powerful screening, watchlists, and portfolio management features. M1 Finance and Tickeron enable the easy construction of balanced portfolios. Finally, Firstrade provides retirement portfolios and free stock trading.

The Ultimate Guide to Robo-Advisors

At its core, a robo-advisor is a computer algorithm that provides automated advice and portfolio management. It combines modern investment theories with technology to create portfolios tailored to individual goals.

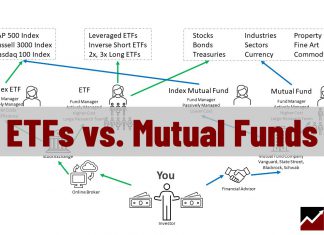

ETFs vs. Mutual Funds: Compounding, Fees & Performance

ETF tax efficiency, liquidity, and low costs are perfect for independent investors. If you want someone to manage your money then mutual funds.

The Best CANSLIM Stock Screener & How To Find CANSLIM Stocks

The best CANSLIM stock screeners to accurately find growth stocks are Stock Rover for US investors and TradingView for international traders. Stock Rover has 3 pre-built CANSLIM screeners, and one is available for free.

Is Value Investing Dead? We Look at the Data!

Day traders and hedge fund managers would have you believe that value investing is dead, but published research by French and Fama shows value still outperforms growth.

S&P 500 Companies by Number of Employees 2024

A Complete Listing of All The Companies in the S&P 500 Index Sorted By Number of Employees & Industry Sectors

Ordinary vs. Qualified Dividends Less Tax & More Profit

Ordinary dividends are taxed at the individual investor's marginal rate, while qualified dividends are subject to a lower tax rate. Qualified dividends must also meet certain criteria like holding period and stock ownership.

How to Calculate Warren Buffett’s Margin of Safety: Formula + Excel

Calculating Buffett's margin of safety formula requires understanding cash flow, discounting, and intrinsic value.

Are Robo-Advisors Safe? Security of Assets Examined

Robo advisors are a relatively new technology, and the safety of their services is still an open question. On the one hand, they can...

How to Invest in Index Funds: 12 Expert Tips Revealed

You can safely invest in index funds through mutual fund companies or as an index ETF directly through your broker. Investing in an index fund ETF is the most cost-effective, liquid, and efficient way to diversify your portfolio.

13 Legendary Investor’s Beat the Market Strategies Explained

To consistently beat the market is difficult but not impossible. O'Neill, Greenblatt, Buffett, and Klarman are legendary investors who have beaten the market. I test the strategies and show you the best ways to implement them.

4 Best Value Investing Stock Screeners of 2024

The best Benjamin Graham & Warren Buffett stock screeners for value investing are Stock Rover, Portfolio 123, TradingView, and TC2000.

How To Protect Your 401k From a Stock Market Crash

To protect your 401k from a market crash, you can liquidate your assets, use dollar-cost averaging, or diversify and rebalance your portfolio.

20 Warren Buffett Rules of Investing & How To Implement Them

Warren Buffett's rules of investing include "Never lose money," "Always have a margin of safety," and "Be fearful when others are greedy, and greedy when others are fearful." This timeless wisdom will help you be a better investor.

Do Robo-Advisors Have Market-Beating Performance?

Surprisingly, robo-advisors do not beat the market or even attempt to outperform a broad market index. They are designed to automatically create and manage a balanced portfolio of stocks and ETFs based on your risk profile.

11 Stock Market Sectors & Best Stocks Per Sector 2024

Our 10 years of research reveal the best stock market sectors that out-performed the S&P500 are Technology +381%, Consumer Cyclical +181%, and Healthcare +34%. These 3 sectors significantly beat the market averages.

13 Best Stock Portfolio Examples & How To Implement Them

Our years of performance testing reveal the world's best-performing stock portfolios are Berkshire Hathaway, CANSLIM, GreenBlatt's Magic Formula, and the FAANG portfolio. We share examples and show you how to implement them.

Value vs. Growth Stocks: Which is Best? We Test The Data!

Our data analysis for the past decade shows that growth stocks have outperformed value stocks. Growth investing has shown a remarkable return rate of 523%, while value investing has yielded 247%.

Our Best Training & Strategies

Liberated Stock Trader Pro: Learn Stock Market Investing

Learn stock market investing with the complete online stock trading course by Barry D. Moore, a certified financial analyst from the International Federation of Technical Analysts (IFTA).

ETF Investing Strategy: MOSES Improves Performance & Lowers Risk

The MOSES ETF investing strategy is a powerful suite of indicators meticulously backtested over 100 years. Designed to empower you to outperform the market, it equips you with the tools to navigate major stock market crashes and unlock greater investing performance.

Our LST Strategy Beat the Stock Market’s S&P 500 By 102%...

Decades of research and testing unveiled the Liberated Stock Trader Beat the Market System. Our 9-year, backtested, and proven strategy targets 35 financially healthy high-growth stocks, producing a track record of beating the S&P 500 by 102%.