Mutual funds can be a reasonable but costly investment option for people who want to invest their money but don’t have the time or knowledge to pick individual stocks. But is it worth investing in mutual funds?

We’ll examine what mutual funds are and how they work. We’ll also provide tips on choosing the right mutual fund for your investment goals.

What are mutual funds?

A mutual fund is an investment vehicle comprising a pool of funds from many investors. The money in the fund is used to purchase various investments, including stocks, bonds, and other assets. The fund is managed by a professional money manager, who decides how to invest the money in the fund.

Mutual funds are among the most popular investment options for many people because they offer a way to diversify your investment portfolio without purchasing individual stocks or bonds.

A quick history of mutual funds

The mutual fund is one of the most common investment vehicles in the United States. Almost half of U.S. households invest in mutual funds, perhaps as part of a 401k or retirement plan.

The idea behind creating mutual funds over 20 years ago was to form a company to invest the investors’ money on their behalf. If you invest in the mutual fund, you would be investing in the company; they would then take your money and invest it in an array of assets, stocks, bonds, or treasuries.

How do mutual funds work?

Mutual funds are an investment vehicle that allows people to pool their money together and invest in various assets. This can include stocks, bonds, and other types of securities. Mutual funds work by allowing investors to buy shares in the fund. This gives them a proportional ownership stake in the fund’s underlying assets. The fund’s managers then use the money to buy and sell assets to generate returns for the investors.

How do you make money from mutual funds?

As an owner of a piece of the mutual fund, you will be able to earn money from potentially three revenue streams:

- Income earned from the dividends paid on the assets the mutual fund owns should be distributed to the shareholders.

- If the underlying assets of the mutual fund increase, this should be reflected in the worth of the fund. The NAV should be calculated every day by the fund.

- If the fund realizes any gains from the sale of assets it owns, this capital gain can be passed on to the fundholder.

What are the benefits of mutual funds?

The key benefits of mutual funds are diversification, professional fund managers, economies of scale, and liquidity.

One of the most appealing aspects is that mutual funds provide diversification. This means that you can spread your risk across various assets by investing in a mutual fund. This can help protect your investment and give you a greater chance of seeing returns. Additionally, mutual funds are generally managed by professionals with extensive market experience. Knowing that your money is in good hands can give you peace of mind.

Diversification in the fund’s asset base should mean less risk in terms of spreading the capital amongst differing asset types. Economies of scale can be achieved as a more substantial fund will pay less in transaction costs for the assets it deals in.

Liquidity is another benefit, as the shares in the fund can be cashed in at any point.

What are the risks of mutual funds?

The risks of mutual funds are costs, volatility, fund manager track records, and complicated cost structures. As with any investment, there are always risks involved.

Volatility

One of the biggest risks associated with mutual funds is that they are subject to market volatility. This means that the value of your investment can go up or down depending on the performance of the markets.

Fees

Mutual funds also charge higher fees and expenses to cover the overhead of paying for star fund managers and the company’s management hierarchy. These fees can eat into your returns and should be considered when making an investment decision.

Fund Manager Success

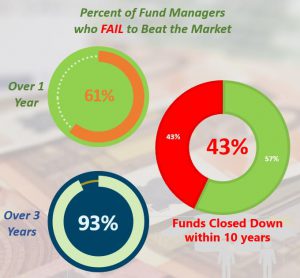

Standard & Poor’s annual SPIVA report shows that most Fund Managers fail to beat the market. This means that they fail to return more in returns than the underlying indices to which the assets belong.

Over the last ten years, 82.23% of active fund managers have failed to beat the market index, and in any single year, 60% failed to outperform the S&P 500.

According to our stock market statistics, 60% of highly paid fund managers fail to beat the S&P500 benchmark.

Complicated Cost Structures

The fees involved in owning a mutual fund can vary depending on the business’s costs and the management team’s profit targets. The expenses presented to the customer can be challenging to understand, and if they exceed a few percentage points can often wipe out the profits gained from the underlying assets.

For example, your mutual fund made an annual return of 5%. If the S&P500 Index made a return of 8%, you could consider that your fund managers have not succeeded. Also, if from the 5% you earned from the fund, you had a 2% management fee, you could consider your net gain to be 3%, which would have grossly underperformed the stock market.

Always compare your mutual fund’s performance against a standard index such as the Dow Jones Industrials (DJ-30) or the Standard & Poor’s 500 (S&P500) over five years to see which performed better.

Beat The Market, Avoid Crashes & Lower Your Risks

Nobody wants to see their hard-earned money disappear in a stock market crash.

Over the past century, the US stock market has had 6 major crashes that have caused investors to lose trillions of dollars.

The MOSES Index ETF Investing Strategy will help you minimize the impact of major stock market crashes. MOSES will alert you before the next crash happens so you can protect your portfolio. You will also know when the bear market is over and the new rally begins so you can start investing again.

MOSES Helps You Secure & Grow Your Biggest Investments

★ 3 Index ETF Strategies ★

★ Outperforms the NASDAQ 100, S&P500 & Russell 3000 ★

★ Beats the DAX, CAC40 & EURO STOXX Indices ★

★ Buy & Sell Signals Generated ★

MOSES Helps You Sleep Better At Night Knowing You Are Prepared For Future Disasters

What are the different types of mutual funds?

Different types of mutual funds include stock, bond, money market, and balanced mutual funds. Each type of mutual fund has different risk and return characteristics.

Stock mutual funds invest in stocks, which represent ownership in a company. Stock mutual funds can be divided into growth, value, and income subcategories. Growth stock mutual funds invest in companies that are expected to experience above-average growth in earnings. Value stock mutual funds invest in companies believed to be undervalued by the market. Income stock mutual funds invest in dividend-paying stocks.

Bond mutual funds invest in bonds, which are debt securities issued by corporations and governments. Bond mutual funds can be divided into short-term, intermediate-term, and long-term subcategories. Short-term bond mutual funds invest in bonds with maturities of five years or less. Intermediate-term bond mutual funds have maturities of five to ten years. Long-term bond funds have maturities of ten years or more.

Money market mutual funds invest in short-term debt securities, such as Treasury bills and commercial paper. Money market mutual funds are very low-risk and provide a stable source of income.

Balanced mutual funds invest in both stocks and bonds. Balanced mutual funds are also known as hybrid or asset-allocation funds. The asset allocation of a balanced mutual fund is typically 60% stocks and 40% bonds. Balanced mutual funds can be further divided into growth and income subcategories.

How can I choose the right mutual fund for me?

The answer to this question depends on several factors, including investment goals, risk tolerance, and time horizon. However, a few general tips can help you choose the right mutual fund for your needs.

1. Define your investment goals.

Before you can choose the right mutual fund, you need to know what your investment goals are. Are you trying to grow your wealth over the long term, or are you more interested in generating income in the short term? Once you know your goals, you can narrow down your options.

2. Consider your risk tolerance.

Mutual funds come with different risk levels, so choosing a fund that matches your tolerance is important. If you’re uncomfortable with risks, you might want to avoid funds investing in volatile assets like stocks. On the other hand, if you’re willing to take on more risk in pursuit of higher returns, you might be more interested in funds that invest in growth-oriented assets.

3. Consider your time horizon.

Your time horizon is another important factor when choosing a mutual fund. If you’re investing long-term, you can afford to take on more risk in pursuit of higher returns. However, if you’re investing for the short term, you’ll need to be more conservative to protect your capital.

4. Research your options.

Once you’ve defined your goals, considered your risk tolerance, and decided on your time horizon, it’s time to start researching your options. Thousands of different mutual funds are available, so it’s important to narrow down your choices before making a final decision.

5. Speak with a financial advisor.

If you’re still unsure which mutual fund is right for you, speaking with a financial advisor is a good idea. A qualified advisor can help you assess your goals, risk tolerance, and time horizon and recommend a fund that’s well-suited to your needs.

Other types of investments seek to minimize the drawbacks of mutual funds while providing many benefits, such as exchange-traded funds and index trackers.

Are mutual funds a good investment?

Some believe mutual funds are a good investment because they offer a diversified portfolio. Others believe mutual funds are not a good investment because the fees can be high. Ultimately, it is up to the individual investor to decide whether or not mutual funds are a good investment for them.

Are mutual funds worth it?

The capital inflows into ETFs suggest mutual funds are no longer worth it. The fees associated with mutual funds can be high, negatively impacting an investment’s long-term profitability. However, others invest in mutual funds because financial advisors say it is a good idea.

ETFs vs. Mutual Funds: Compounding, Fees & Performance Examined

Related Articles:

- What is an Index Fund, & How do Index Funds Work?

- Investing in Index Funds: Everything You Need to Know

- How to Invest in Index Funds to Maximize Long-term Profits

- ETFs vs. Mutual Funds vs. Index Funds: Explained

PODCAST – Investing in Mutual Funds – Should You Do It

Diving into the massive mutual fund industry and looking at the positives and numerous negatives of banking your future on mutual funds

- Published: Sun, 04 Feb 2018 23:00:00 GMT

- Duration: 00:08:15