How to Research Stocks to Find the Hidden Gems

To research stocks, investors need to use trustworthy research tools and reports to find good investments. The ability to understand the research and hone an investing strategy is paramount.

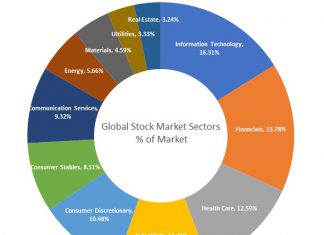

Sector Rotation Explained: Is It Profitable? We Check the Data!

Sector rotation theory and research into market cycles have been around for over 200 years. But is it profitable, and should you implement sector rotation in your stock portfolio?

Buffett Indicator Explained: Market Valuation Exposed

The Buffett Indicator helps gauge stock market valuation. It compares total market capitalization to GDP, offering a macroeconomic perspective on market value.

11 Real-World Investment Scams to Avoid in 2024

Investment scammers defrauded $8.8 billion from unsuspecting consumers in 2022, a staggering 30% year-on-year surge. Don't fall victim to NFT, Crypto, Forex, Ponzi, or offshore scams.

Wyckoff Method Explained: Accumulation & Distribution Trading

The Wyckoff Method is built upon three cardinal laws that govern the financial markets: the Law of Supply and Demand, the Law of Cause and Effect, and the Law of Effort versus Result.

Trading a Descending Triangle’s 87% Success Rate

Twenty years of trading research show the descending triangle pattern has an 87% success rate in bull markets and an average profit potential of +38%. The descending triangle pattern is popular because it is reliable, accurate, and generates a good average profit.

10 Bullish Chart Patterns Proven Effective & Profitable

Research shows the most reliable and accurate bullish patterns are the Cup and Handle, with a 95% bullish success rate, Head & Shoulders (89%), Double Bottom (88%), and Triple Bottom (87%). The most profitable chart pattern is the Bullish Rectangle Top, with a 51% average profit.

Commodity Trading: Is it Profitable/Risky? We Look at the Research!

Commodities are tangible goods such as food, metals, and energy that traders can buy or sell in the financial markets. These commodities are traded on global exchanges, and their prices fluctuate based on supply and demand.

Quad Witching Explained: Trading Volatility & Volume

Quadruple Witching refers to the concurrent expiration of four derivatives: stock index futures, stock index options, stock options, and single stock futures. It occurs quarterly, on the third Friday of March, June, September, and December, bringing unique opportunities for traders.

Stock Order Types: Using Market, Limit & Trailing Stops in Trading

Limit, market, and stop limit orders, help ensure you get the best possible stock purchase price. Stop limit, stop market, and trailing stop orders help sell your stocks for profit or limit your risk.

The Best CANSLIM Stock Screener & How To Find CANSLIM Stocks

The best CANSLIM stock screeners to accurately find growth stocks are Stock Rover for US investors and TradingView for international traders. Stock Rover has 3 pre-built CANSLIM screeners, and one is available for free.

Liberated Stock Trader PRO Training Dashboard

The Premium Liberated Stock Trader PRO Training Course. 17 Modules, 16 Hours of Professional Stock Market Analysis Training - Print Book "The Liberated Stock Trader" + Private Facebook Group for Student Q&A and Support

Our 30-Year Test Proves Buy-and-Hold Strategies Are Worth It!

Our research shows that long-term buy-and-hold investing leads to significant profits. Over the past 30 years, annual stock market returns have averaged 10.7%, bonds and real estate yielded 4.8%, and gold returned 6.8%.

9 Best Stock Chart Types For Traders & Investors Explained

Our research shows the most effective chart types for traders are Heikin Ashi, Candlestick, OHLC, Raindrop, and Renko charts. These charts provide the best balance of price and trend reversal information to help investors build effective trading strategies.

Stock Market Beginner’s Guide [2024 Elite Investor Edition]

Understanding stock market basics is a crucial first step for beginners. Understanding exchanges, indexes, buy-and-hold, and diversification is a good start. Risks, rewards, and goals are key to a solid foundation. Finally, charts, patterns, and indicators are the investor's toolbox.

5 Best Swing Trading Strategies: Backtested & Executed

The 5 important swing trading strategies are trend following, support and resistance, breakouts, momentum, and reversals. Automating the identification, testing, and execution of these strategies is the key to successful swing trading.

Leading Indicators: Super-Charging Your Investing Strategy

Leading indicators are predictive signals that forecast future economic activity and market trends, allowing investors to anticipate changes before they occur.

Trading Parabolic Stocks: Definition & Examples

Parabolic stocks are defined by a rapid and steep uptrend in price, increased volume, and limited price pullbacks. These moves are typically short-lived, with prices skyrocketing and quickly reversing course.

How to Read Stock Charts Like a Boss: Beginners Guide +pdf

To read stock charts you need to use stock charting software, select your chart type, configure your timeframe, determine price direction using trendlines and use indicators to estimate future prices.

Broker Reviews & Comparisons

In-Depth Research, Comparisons & Reviews of the Best Online Discount Stock Brokers Including Research Into U.S. Robo Advisor Performance & Security

Our Best Training & Strategies

Liberated Stock Trader Pro: Learn Stock Market Investing

Learn stock market investing with the complete online stock trading course by Barry D. Moore, a certified financial analyst from the International Federation of Technical Analysts (IFTA).

ETF Investing Strategy: MOSES Improves Performance & Lowers Risk

The MOSES ETF investing strategy is a powerful suite of indicators meticulously backtested over 100 years. Designed to empower you to outperform the market, it equips you with the tools to navigate major stock market crashes and unlock greater investing performance.

Our LST Strategy Beat the Stock Market’s S&P 500 By 102%...

Decades of research and testing unveiled the Liberated Stock Trader Beat the Market System. Our 9-year, backtested, and proven strategy targets 35 financially healthy high-growth stocks, producing a track record of beating the S&P 500 by 102%.

TradingView Review 2024: Tested by LiberatedStockTrader

LiberatedStockTrader's review testing awards TradingView 4.8 stars due to excellent stock chart analysis, pattern recognition, screening, and backtesting. TradingView is our top recommendation for US and international traders.

Stock Rover Review 2024: Tested by LiberatedStockTrader

LiberatedStockTrader's review testing awards Stock Rover 4.7 stars. Its advanced screening, research, and portfolio tools are ideal for US value, income, and growth investors. With 650 financial metrics on 10,000 stocks and 44,000 ETFs, we rate Stock Rover the number one stock screener.

Trade Ideas Review 2024: AI Tested by LiberatedStockTrader

LiberatedStockTrader's review testing awards Trade Ideas 4.7 stars. Its stock scanner and proven Holly AI algorithms are the most advanced and trustworthy auto-trading software for day traders.

TrendSpider Review: Big 2024 Updates! Is It Now The Best?

Our TrendSpider testing finds it is ideal for US traders wanting AI-automated charting, pattern recognition, and backtesting of stocks, indices, futures, and currencies.

Benzinga Pro Real-time News Tested by LiberatedStockTrader

Our testing shows Benzinga Pro is best for US traders who want a high-speed, actionable, real-time news feed at 1/10th of the price of a Bloomberg terminal. I recommended Benzinga Pro for active day traders and investors who trade news events.

MetaStock Review 2024: Tested by LiberatedStockTrader

Our MetaStock review and test reveal an excellent platform for traders, with 300+ charts and indicators for stocks, ETFs, bonds & forex globally. Metastock has solid backtesting and forecasting, and Refinitiv/Xenith provides powerful real-time news and screening.