How to Trade the DMI Indicator Profitably: 9,764 Trades Tested

Our testing, based on 9,764 trades over 25 years, proves the DMI indicator is profitable and reliable, outperforming the S&P 500 index.

Liberated Stock Trader PRO Training Dashboard

The Premium Liberated Stock Trader PRO Training Course. 17 Modules, 16 Hours of Professional Stock Market Analysis Training - Print Book "The Liberated Stock Trader" + Private Facebook Group for Student Q&A and Support

8 Steps to Build a Balanced & Profitable Portfolio

To build a balanced investment portfolio, determine how much to invest, your risk tolerance, portfolio allocation, and your investing strategy. Next, choose the right tools to screen and research the ideal stocks and ETFs to enable you to manage your portfolio effectively.

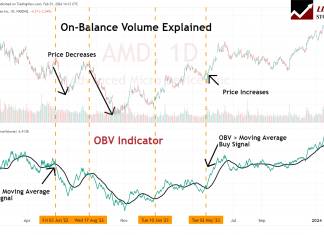

OBV Indicator: Best Settings & Trading Strategy Explained

On-balance volume (OBV) is a cumulative indicator in technical analysis designed to show the volume flow relative to a security's price movements. The OBV reflects the collective buying and selling pressure crystallized through the volume trend.

How to Research Stocks to Find the Hidden Gems

To research stocks, investors need to use trustworthy research tools and reports to find good investments. The ability to understand the research and hone an investing strategy is paramount.

Commodity Trading: Is it Profitable/Risky? We Look at the Research!

Commodities are tangible goods such as food, metals, and energy that traders can buy or sell in the financial markets. These commodities are traded on global exchanges, and their prices fluctuate based on supply and demand.

Price Action Trading: Mastering Day & Swing Trading Strategy

Price action trading is a method of day trading that relies on technical analysis but ignores conventional fundamental indicators, focusing instead on the movement of prices.

Is Day Trading Gambling? Yes! But Not How You Think

If you are a beginner day trader with limited skills and no strategy, then day trading is gambling. However, at a professional level, day trading and gambling are more like running a business; both require a systematic methodology, risk management, skill, and experience to be successful.

Tick Charts: Settings, Strategies & Examples Explained

Tick charts are uniquely constructed by plotting price movement after a certain number of transactions occur. Unlike traditional time-based OHLC or candlestick charts representing price action over a set period, tick charts update after a predefined trading volume is reached.

Leading Indicators: Super-Charging Your Investing Strategy

Leading indicators are predictive signals that forecast future economic activity and market trends, allowing investors to anticipate changes before they occur.

21 Gifts for Stock Traders They’ll Totally Love in 2024

Are you looking for that perfect gift for the stock trader in your life? Our curated list of 21 gifts for traders provides inspiration for any special occasion.

The Best Month to Buy Stocks: 53 Years of Analysis

According to our research, using 53 years of stock exchange data, the best time to buy stocks is in October, and the best time to sell stocks is in July.

Trading the Rising Wedge Pattern’s 81% Success Rate

According to multi-year testing, the rising wedge pattern has a solid 81% success rate in bull markets with an average potential profit of +38%. The ascending wedge is a reliable, accurate pattern, and if used correctly, gives you an edge in trading.

Buy the Rumor, Sell the News Explained with Examples

The adage "buy the rumor, sell the news" is a contrarian trading strategy predicated on anticipating market reactions to rumors and news announcements.

Technical Analysis: How To Read Stock Charts

Learn technical analysis and how to read stock charts. This helps you understand the movement of stock prices, stock trends, and the supply-demand equation. Stock chart indicators and market sentiment are all important factors.

Broker Reviews & Comparisons

In-Depth Research, Comparisons & Reviews of the Best Online Discount Stock Brokers Including Research Into U.S. Robo Advisor Performance & Security

Stochastic Oscillator Explained: Best Strategy & Settings Tested

The Stochastic Oscillator momentum indicator compares an asset's closing price to a range of its previous prices. It oscillates between 0 and 100; below 20 indicates oversold, and above 80 suggests an overbought market.

Stock Analyst Ratings Explained: Reliable or Inaccuate? We Test It

Stock analyst ratings provide investors with guidance about the future growth and profitability of a company. Unfortunately, our data shows that analyst ratings are 95% inaccurate and are heavily "Buy" or "Strong Buy" biased.

How to Calculate Warren Buffett’s Margin of Safety: Formula + Excel

Calculating Buffett's margin of safety formula requires understanding cash flow, discounting, and intrinsic value.

How to Backtest Trading Strategies in 2024 with Examples & Tools

Experienced investors backtest their trading strategies to optimize their portfolios. Backtesting is a critical step that enables traders to assess the potential viability of a trading strategy by applying it to historical data.

Our Best Training & Strategies

Liberated Stock Trader Pro: Learn Stock Market Investing

Learn stock market investing with the complete online stock trading course by Barry D. Moore, a certified financial analyst from the International Federation of Technical Analysts (IFTA).

ETF Investing Strategy: MOSES Improves Performance & Lowers Risk

The MOSES ETF investing strategy is a powerful suite of indicators meticulously backtested over 100 years. Designed to empower you to outperform the market, it equips you with the tools to navigate major stock market crashes and unlock greater investing performance.

Our LST Strategy Beat the Stock Market’s S&P 500 By 102%...

Decades of research and testing unveiled the Liberated Stock Trader Beat the Market System. Our 9-year, backtested, and proven strategy targets 35 financially healthy high-growth stocks, producing a track record of beating the S&P 500 by 102%.

TradingView Review 2024: Tested by LiberatedStockTrader

LiberatedStockTrader's review testing awards TradingView 4.8 stars due to excellent stock chart analysis, pattern recognition, screening, and backtesting. TradingView is our top recommendation for US and international traders.

Stock Rover Review 2024: Tested by LiberatedStockTrader

LiberatedStockTrader's review testing awards Stock Rover 4.7 stars. Its advanced screening, research, and portfolio tools are ideal for US value, income, and growth investors. With 650 financial metrics on 10,000 stocks and 44,000 ETFs, we rate Stock Rover the number one stock screener.

Trade Ideas Review 2024: AI Tested by LiberatedStockTrader

Our in-depth testing shows Trade Ideas is the ultimate black box AI-powered day trading signal platform with built-in automated bot trading. Three automated Holly AI systems pinpoint trading signals for day traders.

TrendSpider Review: Big 2024 Updates! Is It Now The Best?

Our TrendSpider testing finds it is ideal for US traders wanting AI-automated charting, pattern recognition, and backtesting of stocks, indices, futures, and currencies.

Benzinga Pro Review 2024: Tested by LiberatedStockTrader

Our testing shows Benzinga Pro is best for US traders who want a high-speed, actionable, real-time news feed at 1/10th of the price of a Bloomberg terminal. I recommended Benzinga Pro for active day traders and investors who trade news events.

MetaStock Review 2024: Tested by LiberatedStockTrader

Our MetaStock review and test reveal an excellent platform for traders, with 300+ charts and indicators for stocks, ETFs, bonds & forex globally. Metastock has solid backtesting and forecasting, and Refinitiv/Xenith provides powerful real-time news and screening.