9 Best Stock Chart Types For Traders & Investors Explained

Our research shows the most effective chart types for traders are Heikin Ashi, Candlestick, OHLC, Raindrop, and Renko charts. These charts provide the best balance of price and trend reversal information to help investors build effective trading strategies.

11 Real-World Investment Scams to Avoid in 2024

Investment scammers defrauded $8.8 billion from unsuspecting consumers in 2022, a staggering 30% year-on-year surge. Don't fall victim to NFT, Crypto, Forex, Ponzi, or offshore scams.

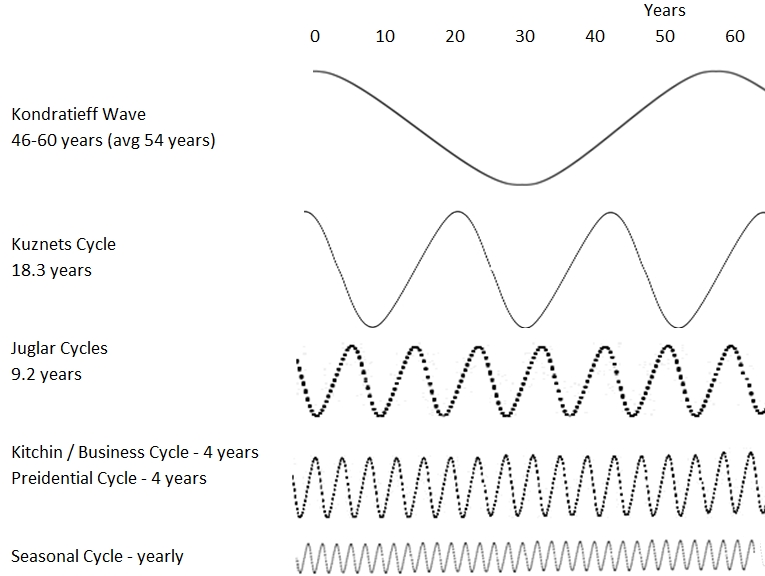

6 Key Business & Economic Cycles Affecting Stocks

Six waves and cycles influence how our economies, businesses, and financial markets expand and contract. The Kondratieff Wave, Kuznets Cycle, Juglar Cycle, Business Cycle, Presidential Cycle, and Seasonal Cycle will change how you see the world.

The Best Month to Buy Stocks: 53 Years of Analysis

According to our research, using 53 years of stock exchange data, the best time to buy stocks is in October, and the best time to sell stocks is in July.

12 Ways to Master Stock Chart Indicators by a Certified Analyst

Professional market analysts build trading strategies using chart indicator techniques like divergences, multi-time frame analysis, indicator combinations, and rigorous backtesting.

Day & Swing Trading vs. Growth & Value Investing Explained.

Day and swing trading uses technical chart analysis to trade short-term price moves, whereas growth and value investing use long-term fundamental financial analysis. The tools and strategies used for these types of trading are completely different.

Fibonacci Retracement Trading Explained: I Test If It Works

In technical analysis, Fibonacci retracement is used by traders to predict levels of support and resistance by drawing horizontal lines according to the Fibonacci sequence. But Does It Work?

Buy and Hold Strategy: 30-Year Test Proves If It’s Worth It!

Our research suggests that long-term buy-and-hold investing leads to significant profits. Over the past 30 years, annual stock market returns averaged 10.7%, while bonds and real estate yield 4.8%, and gold returns 6.8%.

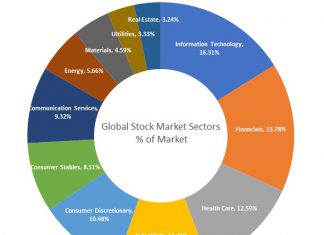

Sector Rotation Explained: Is It Profitable? We Check the Data!

Sector rotation theory and research into market cycles have been around for over 200 years. But is it profitable, and should you implement sector rotation in your stock portfolio?

Commodity Trading: Is it Profitable/Risky? We Look at the Research!

Commodities are tangible goods such as food, metals, and energy that traders can buy or sell in the financial markets. These commodities are traded on global exchanges, and their prices fluctuate based on supply and demand.

What are Market Profile Charts & Best Software To Use?

A market profile chart is a day-trading tool that displays the price activity to identify a time price opportunity (TPO). It helps traders identify the most traded prices and develop strategies to exploit these areas.

How to Day Trade and Is It Worth It? Tools &...

Ultimately, for 95% of speculators, day trading is not worth it. Although day traders can make significant money quickly, statistics show that most day traders lose money. Over a six-month period excessive commissions, poor trading decisions, weak strategies, and bad market timing cause losses.

5 Best Swing Trading Strategies: Backtested & Executed

The 5 important swing trading strategies are trend following, support and resistance, breakouts, momentum, and reversals. Automating the identification, testing, and execution of these strategies is the key to successful swing trading.

What Are Bonds & How to Invest in Bonds Profitably?

Typically stocks return 7% to 10% per year over ten years, while bonds return a lower 4-6%. Investments in bonds tend to be less volatile than stocks and, thus, provide more consistent returns.

How to Research Stocks to Find the Hidden Gems

To research stocks, investors need to use trustworthy research tools and reports to find good investments. The ability to understand the research and hone an investing strategy is paramount.

13 Legendary Investor’s Beat the Market Strategies Explained

To consistently beat the market is difficult but not impossible. O'Neill, Greenblatt, Buffett, and Klarman are legendary investors who have beaten the market. I test the strategies and show you the best ways to implement them.

8 Bearish Chart Patterns Proven Accurate & Reliable

Decades of research prove the most profitable bearish chart patterns are the Inverted Cup and Handle with an average -17% price decrease, Rectangle Top (-16%), Head and Shoulders (-16%), and the Descending Triangle (-15%).

Price Action Trading: Mastering Day & Swing Trading Strategy

Price action trading is a method of day trading that relies on technical analysis but ignores conventional fundamental indicators, focusing instead on the movement of prices.

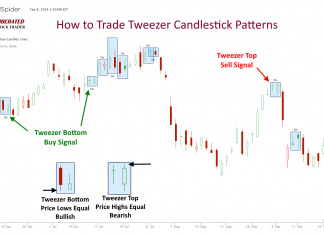

Do Tweezer Top & Bottom Candle Patterns Work? I Test It!

Based on our testing of 1,892 trades, the tweezer top and bottom patterns are highly unreliable and unprofitable. These patterns exhibit a reward-to-risk ratio of only 1.07, with 50% of trades resulting in losses. Relying on tweezers as a trading strategy yields poor results.

21 Gifts for Stock Traders They’ll Totally Love in 2024

Are you looking for that perfect gift for the stock trader in your life? Our curated list of 21 gifts for traders provides inspiration for any special occasion.

Our Best Training & Strategies

Liberated Stock Trader Pro: Learn Stock Market Investing

Learn stock market investing with the complete online stock trading course by Barry D. Moore, a certified financial analyst from the International Federation of Technical Analysts (IFTA).

ETF Investing Strategy: MOSES Improves Performance & Lowers Risk

The MOSES ETF investing strategy is a powerful suite of indicators meticulously backtested over 100 years. Designed to empower you to outperform the market, it equips you with the tools to navigate major stock market crashes and unlock greater investing performance.

Our LST Strategy Beat the Stock Market’s S&P 500 By 102%...

Decades of research and testing unveiled the Liberated Stock Trader Beat the Market System. Our 9-year, backtested, and proven strategy targets 35 financially healthy high-growth stocks, producing a track record of beating the S&P 500 by 102%.

TradingView Review 2024: Tested by LiberatedStockTrader

LiberatedStockTrader's review testing awards TradingView 4.8 stars due to excellent stock chart analysis, pattern recognition, screening, and backtesting. TradingView is our top recommendation for US and international traders.

Stock Rover Review 2024: Tested by LiberatedStockTrader

LiberatedStockTrader's review testing awards Stock Rover 4.7 stars. Its advanced screening, research, and portfolio tools are ideal for US value, income, and growth investors. With 650 financial metrics on 10,000 stocks and 44,000 ETFs, we rate Stock Rover the number one stock screener.

Trade Ideas Review 2024: AI Tested by LiberatedStockTrader

Our in-depth testing shows Trade Ideas is the ultimate black box AI-powered day trading signal platform with built-in automated bot trading. Three automated Holly AI systems pinpoint trading signals for day traders.

TrendSpider Review: Big 2024 Updates! Is It Now The Best?

Our TrendSpider testing finds it is ideal for US traders wanting AI-automated charting, pattern recognition, and backtesting of stocks, indices, futures, and currencies.

Benzinga Pro Review 2024: Tested by LiberatedStockTrader

Our testing shows Benzinga Pro is best for US traders who want a high-speed, actionable, real-time news feed at 1/10th of the price of a Bloomberg terminal. I recommended Benzinga Pro for active day traders and investors who trade news events.

MetaStock Review 2024: Tested by LiberatedStockTrader

Our MetaStock review and test reveal an excellent platform for traders, with 300+ charts and indicators for stocks, ETFs, bonds & forex globally. Metastock has solid backtesting and forecasting, and Refinitiv/Xenith provides powerful real-time news and screening.