How to Trade the Rising Wedge Pattern’s 81% Success Rate

According to multi-year testing, the rising wedge pattern has a solid 81% success rate in bull markets with an average potential profit of +38%. The ascending wedge is a reliable, accurate pattern, and if used correctly, gives you an edge in trading.

A Historical Analysis of the 1929 Stock Market Crash

The 1929 stock market crash was caused by an equities bubble fueled by lax monetary policy and easy access to credit.

People believed the US...

Price Action Trading: Mastering Day & Swing Trading Strategy

Price action trading is a method of day trading that relies on technical analysis but ignores conventional fundamental indicators, focusing instead on the movement of prices.

Stochastic Oscillator Explained: Best Strategy & Settings Tested

The Stochastic Oscillator momentum indicator compares an asset's closing price to a range of its previous prices. It oscillates between 0 and 100; below 20 indicates oversold, and above 80 suggests an overbought market.

3 Tested Strategies To Find High-Yield Dividend Stocks:

High-yield dividend stocks are a double-edged sword. The higher the dividend yield, the harder it is for the company to keep paying the high dividend.

Leading Indicators: Super-Charging Your Investing Strategy

Leading indicators are predictive signals that forecast future economic activity and market trends, allowing investors to anticipate changes before they occur.

Money Flow Index (MFI) Explained: Best Settings & Reliability Tested

The Money Flow Index (MFI) is a momentum indicator in technical analysis that measures the in and outflows of money into a stock. It oscillates between 0 to 100 and is used to identify price reversals, market tops, and bottoms.

Our 5 Step Guide to Screening for CANSLIM Growth Stocks

The best CANSLIM stock screeners to accurately find growth stocks are Stock Rover for US investors and TradingView for international traders. Stock Rover has 3 pre-built CANSLIM screeners, and one is available for free.

Is the S&P 500 200-Day Moving Average Profitable? I Test It!

Our testing of the 200-day MA on the S&P500 over 16 years revealed that using this indicator is a losing proposition. A buy-and-hold strategy made a profit of 192% vs. the 200-day MA, which made only 152%.

Scalping Trading Strategy, Tools & Techniques Explained

Scalping trading is a fast-paced strategy focusing on achieving profits from small price changes in the securities market. Traders who utilize scalp trading are known as scalpers, and they aim for a high volume of trades that individually yield small gains.

23 Best Stock Chart Patterns Proven Reliable By Data Testing

Published research shows the most reliable and profitable stock chart patterns are the inverse head and shoulders, double bottom, triple bottom, and descending triangle. Each has a proven success rate of over 85%, with an average gain of 43%.

Santa Claus Rally Explained: Is it Real? We Test It!

According to our data, the Santa Rally is a real occurrence. Our evidence shows mean stock price increases in October +1.74%, November +2.40%, and December +0.56%. Weekly evidence shows week 52 is the strongest, with 68% increasing an average of 0.86%.

Trading Parabolic Stocks: Definition & Examples

Parabolic stocks are defined by a rapid and steep uptrend in price, increased volume, and limited price pullbacks. These moves are typically short-lived, with prices skyrocketing and quickly reversing course.

How To Implement 13 Legendary Market Beating Strategies

To consistently beat the market is difficult but not impossible. O'Neill, Greenblatt, Buffett, and Klarman are legendary investors who have beaten the market. I test the strategies and show you the best ways to implement them.

How to Backtest Trading Strategies in 2024 with Examples & Tools

Experienced investors backtest their trading strategies to optimize their portfolios. Backtesting is a critical step that enables traders to assess the potential viability of a trading strategy by applying it to historical data.

Quad Witching Explained: Trading Volatility & Volume

Quadruple Witching refers to the concurrent expiration of four derivatives: stock index futures, stock index options, stock options, and single stock futures. It occurs quarterly, on the third Friday of March, June, September, and December, bringing unique opportunities for traders.

Our Best Training & Strategies

Liberated Stock Trader Pro: Learn Stock Market Investing

Learn stock market investing with the complete online stock trading course by Barry D. Moore, a certified financial analyst from the International Federation of Technical Analysts (IFTA).

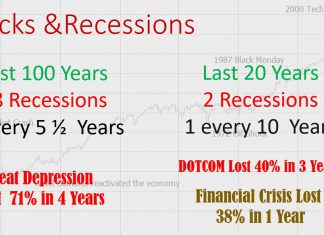

ETF Investing Strategy: MOSES Improves Performance & Lowers Risk

The MOSES ETF investing strategy is a powerful suite of indicators meticulously backtested over 100 years. Designed to empower you to outperform the market, it equips you with the tools to navigate major stock market crashes and unlock greater investing performance.

LiberatedStockTrader’s Strategy Beat the Market By 102%

Decades of research and testing unveiled the Liberated Stock Trader Beat the Market System. Our 9-year, backtested, and proven strategy targets 35 financially healthy high-growth stocks, producing a track record of beating the S&P 500 by 102%.

TradingView Review 2024: Tested by LiberatedStockTrader

LiberatedStockTrader's review testing awards TradingView 4.8 stars due to excellent stock chart analysis, pattern recognition, screening, and backtesting. TradingView is our top recommendation for US and international traders.

Stock Rover Review 2024: Tested by LiberatedStockTrader

LiberatedStockTrader's review testing awards Stock Rover 4.7 stars. Its advanced screening, research, and portfolio tools are ideal for US value, income, and growth investors. With 650 financial metrics on 10,000 stocks and 44,000 ETFs, we rate Stock Rover the number one stock screener.

Trade Ideas Review 2024: AI Tested by LiberatedStockTrader

Our in-depth testing shows Trade Ideas is the ultimate black box AI-powered day trading signal platform with built-in automated bot trading. Three automated Holly AI systems pinpoint trading signals for day traders.

TrendSpider Review: Big 2024 Updates! Is It Now The Best?

Our TrendSpider testing finds it is ideal for US traders wanting AI-automated charting, pattern recognition, and backtesting of stocks, indices, futures, and currencies.

Benzinga Pro Real-time News Tested by LiberatedStockTrader

Our testing shows Benzinga Pro is best for US traders who want a high-speed, actionable, real-time news feed at 1/10th of the price of a Bloomberg terminal. I recommended Benzinga Pro for active day traders and investors who trade news events.

MetaStock Review 2024: Tested by LiberatedStockTrader

Our MetaStock review and test reveal an excellent platform for traders, with 300+ charts and indicators for stocks, ETFs, bonds & forex globally. Metastock has solid backtesting and forecasting, and Refinitiv/Xenith provides powerful real-time news and screening.