26 Best Warren Buffett Quotes On Investing of All Time

Warren Buffett's best investing quotes are "You might want a larger margin of safety," "Never invest in a business you don't understand," and "Don't bet on miracles."

25 Best Warren Buffett Quotes On Success to Inspire Your Future

Warren Buffett undeniably embodies remarkable success in business, investing, and life. Quotes like "the people who are most successful are those who are doing what they love." are inspirational.

7 Strategies to Find the Best Value Dividend Stocks

Our research combines criteria for selecting value stocks and dividend-paying stocks to create seven strategies for finding under-valued dividend stocks. We include the exact criteria to use and a step-by-step guide to implementing them into a stock screener.

Are Robo-Advisors Safe? Security of Assets Examined

Robo advisors are a relatively new technology, and the safety of their services is still an open question. On the one hand, they can...

Are Robo Advisors Good? Pro and Cons Uncovered!

Robo Advisors can be a great idea for the right person. They are essentially automated financial advisors who use algorithms and computer programs to...

Is Value Investing Dead? We Look at the Data!

Day traders and hedge fund managers would have you believe that value investing is dead, but published research by French and Fama shows value still outperforms growth.

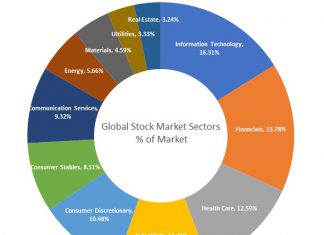

Sector Rotation Explained: Is It Profitable? We Check the Data!

Sector rotation theory and research into market cycles have been around for over 200 years. But is it profitable, and should you implement sector rotation in your stock portfolio?

How to Buy the Total Stock Market Using Global Index Funds

Investing in the total stock market through global index funds can be an excellent strategy for long-term investors seeking broad market exposure, low costs, and diversification.

Ultimate Guide to Dividend Investing with 4 Proven Strategies!

Dividend investing is a low-risk route into the stock market. Your income investing journey starts by grasping dividend yield, payouts, profit expectations, and our trying four time-tested strategies.

How to Invest in REITs? 5 Smart Tips & Strategies.

Real Estate Investment Trusts (REITs) are publicly-traded entities that own or finance income-generating real estate assets. By investing in REITs, individuals can participate in the real estate market without directly purchasing physical properties.

3X Leveraged ETF Trading Strategy & Best ETFs to Trade

Gain insights from a seasoned ex-Wall Street trader with 40 years of experience, as he imparts knowledge on leveraged 3X ETF trading. Explore the intricacies of risks, rewards, and effective strategies.

Commodity Trading: Is it Profitable/Risky? We Look at the Research!

Commodities are tangible goods such as food, metals, and energy that traders can buy or sell in the financial markets. These commodities are traded on global exchanges, and their prices fluctuate based on supply and demand.

Unlock the Secrets of Money Markets: A Beginner’s Guide

Money markets play a crucial role in greasing the wheels of economic activity, ensuring a smooth flow of funds from those who have it to those who need to borrow it. Investors can use money markets to protect capital from inflation.

Portfolio Diversification: The Art of Doing It Right!

Portfolio diversification is a crucial aspect of sound investment management. By properly implementing this strategy, investors can balance risk and reward, ultimately positioning themselves for long-term financial success.

Buy and Hold Strategy: 30-Year Test Proves If It’s Worth It!

Our research suggests that long-term buy-and-hold investing leads to significant profits. Over the past 30 years, annual stock market returns averaged 10.7%, while bonds and real estate yield 4.8%, and gold returns 6.8%.

What Are Bonds & How to Invest in Bonds Profitably?

Typically stocks return 7% to 10% per year over ten years, while bonds return a lower 4-6%. Investments in bonds tend to be less volatile than stocks and, thus, provide more consistent returns.

What Is Qualified Dividend & How Can You Take advantage?

Curious about Qualified Dividends and how they contribute to your long-term stock investment profits? Let's explore their importance and unravel the potential benefits they...

Preferred Stock Dividend Explained & Optimizing Income

Ready to invest in Preferred Stock for stable income? Brace yourself for the seven mind-blowing reasons why Preferred Stock Dividend outshines Ordinary Stock Dividend...

M.O.S.E.S. Investing Strategy Training Dashboard

Welcome to MOSES I hope you see the benefit of avoiding major stock market crashes and preserving the value of your investments.

By Using This...

Our Best Training & Strategies

Liberated Stock Trader Pro: Learn Stock Market Investing

Learn stock market investing with the complete online stock trading course by Barry D. Moore, a certified financial analyst from the International Federation of Technical Analysts (IFTA).

ETF Investing Strategy: MOSES Improves Performance & Lowers Risk

The MOSES ETF investing strategy is a powerful suite of indicators meticulously backtested over 100 years. Designed to empower you to outperform the market, it equips you with the tools to navigate major stock market crashes and unlock greater investing performance.

Our LST Strategy Beat the Stock Market’s S&P 500 By 102%...

Decades of research and testing unveiled the Liberated Stock Trader Beat the Market System. Our 9-year, backtested, and proven strategy targets 35 financially healthy high-growth stocks, producing a track record of beating the S&P 500 by 102%.