7 Steps to Professional Stock Portfolio Managment

Managing a stock portfolio entails seven crucial tasks: conducting research, analyzing performance, rebalancing holdings, assessing correlations, planning future income, optimizing tax benefits, and analyzing future performance.

What are Index Funds & How Do They Work?

Index funds are the best thing to happen to individual investors since the inception of the stock market. Find out more about index fund and their extensive benefit and negative traits.

LiberatedStockTrader’s Guide to Investing in Index Funds

Investing in index funds is a great way to diversify your portfolio and reduce risk. Index funds track the performance of major stock market indices, such as the S&P 500 or Dow Jones Industrial Average. Index funds are low-cost and have been shown to outperform actively managed mutual funds in the long run.

ETFs vs. Mutual Funds: Compounding, Fees & Performance Examined

ETF tax efficiency, liquidity, and low costs are perfect for independent investors. If you want someone to manage your money then mutual funds.

Important Value Investing Concepts & Strategy Explained

Value investing is a strategic approach to investing where stocks are selected that appear to be undervalued compared to their intrinsic value. The principle is to buy securities at less than their current market value, expecting their price to rise over time, leading to significant returns.

Is Value Investing Dead? LiberatedStockTrader Investigates!

Day traders and hedge fund managers would have you believe that value investing is dead, but published research by French and Fama shows value still outperforms growth.

20 Leading Robo-Advisor Profits & Fees Compared

Our research into robo-advisor fees and returns shows M1 Invest, SigFig, and Wealthfront are innovative leaders in the industry. There are many robo-advisors available now, and the list is growing.

ETFs vs. Mutual Funds vs. Index Funds Explained

The difference between ETFs, mutual funds, and index funds is ETFs trade like stocks on an exchange, mutual funds are actively managed private investments, and an index fund can be either an ETF or a mutual fund.

Which is Better for Investors, ETFs or Stocks?

Exchange-traded funds (ETFs) and stocks represent two popular investments. Stock strategies can produce higher returns but require experience and time to manage. ETFs are simple, easy to buy, and can provide a more diversified portfolio over the long term.

5 Income Generating REITs Worth Investing In & How to Do...

Real Estate Investment Trusts (REITs) are publicly-traded entities that own or finance income-generating real estate assets. By investing in REITs, individuals can participate in the real estate market without directly purchasing physical properties.

Are Robo-Advisors Safe To Use? We Take a Look!

Although robo-advisors are a new technology, those offered by the major investment houses are safe. But that does not mean all are safe.

Robo-advisors offer...

Are Robo-Advisors Worth It? What Are The Alternatives?

Robo-advisors are worth it if you want to automate tax-loss harvesting & low-cost access to ETFs and mutual funds, saving you money. They also provide automatic portfolio construction, rotation & adjustment based on your risk and preferences.

Which is Better, Robo-Advisors or Human Financial Advisors?

Robo-Advisors vs. Financial Advisors: All Pros & Cons Comparing Costs, Fees, Services, Portfolio Management, Rebalancing & Tax Loss Harvesting.

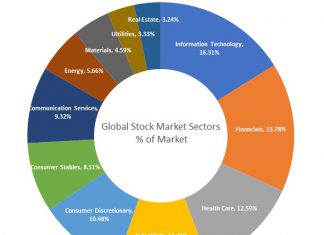

How to Buy the Total Stock Market Using Global Index Funds

Investing in the total stock market through global index funds can be an excellent strategy for long-term investors seeking broad market exposure, low costs, and diversification.

How Do Robo-Advisors & Automated Investing Work?

Robo-advisors automate the complex task of creating and managing a portfolio by selecting investments according to your risk profile. Time-consuming tasks like purchasing stocks, portfolio rotation, and tax loss harvesting are performed automatically by the best robo-advisors.

Robo-Advisors, AI-Advisors and Hybrid-Advisors Explained

A robo-advisor is a fully automated investing service; a hybrid advisor adds the human touch to investing, and the AI robo-advisor uses algorithms and machine learning to make investments on your behalf.

Do Robo-Advisors Outperform the Stock Market?

Robo-advisors do not beat the stock market's average performance. Most Robo-advisors are designed to passively invest in index ETFs and, therefore, have practically no chance to outperform the market.

What is a Hybrid Robo-Advisor & Should You Use One?

A hybrid robo-advisor offers automated investment management services but also provides access to a human financial advisor. Hybrid robo-advisors use algorithms with help from a financial expert.

We Analyze & Decipher Warren Buffett’s 20 Rules of Investing

Warren Buffett's rules of investing include "Never lose money," "Always have a margin of safety," and "Be fearful when others are greedy, and greedy when others are fearful." This timeless wisdom will help you be a better investor.

Is a Sector Rotation Strategy Profitable? We Check the Data!

Sector rotation theory and research into market cycles have been around for over 200 years. But is it profitable, and should you implement sector rotation in your stock portfolio?

Our Best Training & Strategies

Liberated Stock Trader Pro: Learn Stock Market Investing

Learn stock market investing with the complete online stock trading course by Barry D. Moore, a certified financial analyst from the International Federation of Technical Analysts (IFTA).

ETF Investing Strategy: MOSES Improves Performance & Lowers Risk

The MOSES ETF investing strategy is a powerful suite of indicators meticulously backtested over 100 years. Designed to empower you to outperform the market, it equips you with the tools to navigate major stock market crashes and unlock greater investing performance.

LiberatedStockTrader’s Strategy Beat the Market By 102%

Decades of research and testing unveiled the Liberated Stock Trader Beat the Market System. Our 9-year, backtested, and proven strategy targets 35 financially healthy high-growth stocks, producing a track record of beating the S&P 500 by 102%.