Investors Guide to Return on Average Equity (ROAE)

Return on Average Equity (ROAE) is a financial performance metric that indicates how effectively a company generates profit relative to its average shareholders' equity.

Investment Turnover for Investors: Examples & Calculation

Investment turnover is calculated by comparing a business's revenue to the sum of its equity and debt, providing insight into the company's management's ability to deploy its financial resources.

Investors Guide to the Long-Term Debt Ratio

The Long-term debt ratio is a financial metric investors use to assess a company's use of long-term debt for financing its operations. A high long-term debt ratio over 25% indicates a higher investing risk, whereas a low ratio indicates a company is in better financial shape.

Investor Guide to Return on Capital Employed (ROCE) Formulas & Examples

By allowing investors and analysts to measure the returns a company generates from its employed capital, ROCE serves as a magnifying glass over the business's operational effectiveness.

Investors Guide to the Debt-to-EBITDA Ratio: Calculator & Examples

The Debt-to-EBITDA ratio assesses a company's ability to pay off its debt. It compares a company's total debt to earnings before interest, taxes, depreciation, and amortization (EBITDA).

Investor Insights: Accounts Payable Turnover Ratio & Liquidity

The accounts payable turnover ratio quantifies how often a company pays off its suppliers within a specific period. To calculate it, one divides the total purchases made on credit by the average accounts payable for the same period.

How To Super-Charge Your Investing with Leading Indicators

Leading indicators in technical analysis are predictive signals that forecast future economic activity and market trends, allowing investors to anticipate changes before they occur.

How to Amplify Your Investing with EPS Growth & Acceleration

The acceleration in the growth of earnings per share (EPS) is the foundation of selecting high-performing growth stocks.

How Profitable are Stocks, Bonds, Gold and Real-Estate?

Our research, using 30 years of data, reveals average yearly profits of 6.8% for gold, Treasuries (4.8%), Corporate Bonds (7.2%), Real-estate (4.8-9.5%), and Stocks (8-13%).

How to Find, Calculate & Trade Stock Float

Float can impact a stock's trading volume, price movements, and volatility. If a company decides to issue additional shares through a secondary offering or stock split, the float will increase. If existing shareholders sell their shares or there is a buyback program in place, the float will decrease.

How to Read the Income Statement Like a Pro Investor

Investors use the income statement to understand a company's key metrics, revenue, expenses, profit, and operating costs. It is one of the most important documents investors use to understand a company's financial performance.

Understanding and Profitably Trading Reverse Stock Splits

Reverse stock splits are typically undertaken by companies seeking to boost their stock price by reducing the number of outstanding shares. Often seen as a sign of weakness, it attracts short-sellers attempting to profit from statistically proven future price declines.

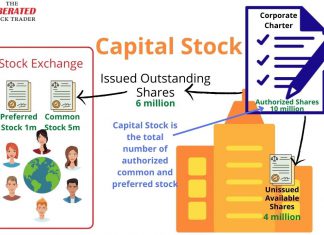

What is Capital Stock? Examples & Use In Research

Capital stock, also called authorized shares or authorized capital, is the maximum number of shares a company can issue to shareholders. A corporation's charter declares the number and type of stock it can issue, so no more than this amount can be issued.

Efficient Market Hypothesis vs. Random Walk Explained

The efficient market hypothesis suggests all available information is already incorporated into a stock's price, but the random walk says current prices are completely independent of past performance.

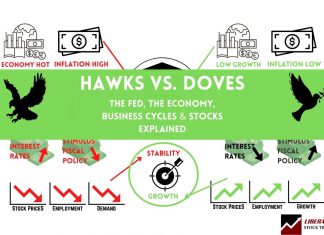

Hawks vs. Doves Explained: How Fed Decisions Impact Investors

Hawks and doves are distinct camps in economics regarding fiscal policy. Hawks lean toward tight monetary policy (high interest rates, low government spending), while doves prefer loose monetary policy (low interest rates, high government spending).

Using Fundamental Analysis to Find High-Quality Stocks

The core objective of fundamental analysis is to determine a stock's true or intrinsic value. This involves assessing the company's financial performance, industry comparisons, and economic factors.

5 Proven Ways To Find The Best Cheap Stocks to Buy...

The best way to find cheap stocks is by using future earnings, asset valuation, discounted cash flow, fair value, and the margin of safety. Do not look at stock price alone to assess if a stock is undervalued; stock price is only useful in combination with other criteria.

How to Use the Price to Earnings Ratio Like a Pro...

The Price to Earnings Ratio is a commonly misunderstood calculation for determining a company's relative value. The PE Ratio is only useful for comparing companies in the same industry with similar business models. It should not be used to compare radically different businesses.

LiberatedStockTrader’s Stock Research Strategies & Tools

To research stocks, investors need to use trustworthy research tools and reports to find good investments. The ability to understand the research and hone an investing strategy is paramount.

Is The Stock Market Overvalued? The Data Says Yes!

According to the Shiller PE Ratio, the US stock market is currently 19.2% overvalued compared to its 200-month moving average. Currently, the PE ratio of the S&P 500 is 31, and the 10-year average is 26.

Our Best Training & Strategies

Liberated Stock Trader Pro: Learn Stock Market Investing

Learn stock market investing with the complete online stock trading course by Barry D. Moore, a certified financial analyst from the International Federation of Technical Analysts (IFTA).

ETF Investing Strategy: MOSES Improves Performance & Lowers Risk

The MOSES ETF investing strategy is a powerful suite of indicators meticulously backtested over 100 years. Designed to empower you to outperform the market, it equips you with the tools to navigate major stock market crashes and unlock greater investing performance.

LiberatedStockTrader’s Strategy Beat the Market By 102%

Decades of research and testing unveiled the Liberated Stock Trader Beat the Market System. Our 9-year, backtested, and proven strategy targets 35 financially healthy high-growth stocks, producing a track record of beating the S&P 500 by 102%.