Commodity Trading: Is it Profitable/Risky? We Look at the Research!

Commodities are tangible goods such as food, metals, and energy that traders can buy or sell in the financial markets. These commodities are traded on global exchanges, and their prices fluctuate based on supply and demand.

Common vs. Preferred Stock: Strategy Differences & Examples

Common stock has voting rights and price appreciation in line with market prices, whereas preferred stock does not. However, preferred stock has higher priority dividend payments and liquidity rights in case of insolvency. The downside of preferred stock is that it has no voting rights, and they are callable.

Stock Market Beginner’s Guide [2024 Elite Investor Edition]

Understanding stock market basics is a crucial first step for beginners. Understanding exchanges, indexes, buy-and-hold, and diversification is a good start. Risks, rewards, and goals are key to a solid foundation. Finally, charts, patterns, and indicators are the investor's toolbox.

Quad Witching Explained: Trading Volatility & Volume

Quadruple Witching refers to the concurrent expiration of four derivatives: stock index futures, stock index options, stock options, and single stock futures. It occurs quarterly, on the third Friday of March, June, September, and December, bringing unique opportunities for traders.

Bull and Bear Markets: How To Remember The Difference

To remember the direction of bull and bear markets, associate each with the animal it represents. A bull market moves with the upward trajectory of its horns, while a bear market moves with a bear's claws swiping downward.

Should You Trade OTC & Pink Sheet Stocks?

OTC stocks are not traded on a major stock exchange and are less regulated. You can buy and sell them during normal market hours and out-of-hours.

Stock Futures Explained? What Are They & How to Trade Them

Stock futures are derivative contracts that track the future price of a certain stock. They are agreements to buy or sell a specific stock at a predetermined price on a set date in the future.

What is a Stock Rally & How To Profit From It!

A stock market rally is a sudden and sustained growth in equity prices. Rallies are triggered by increased investor confidence, reduced risk, and frenzied buying activity. A rally can be cyclical, sector or broad market, and short, medium, or long-term.

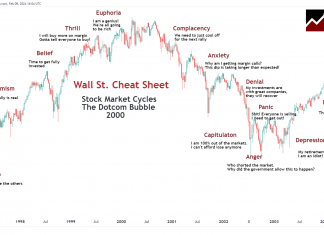

Wall Street Cheat Sheet: Master Your Mind & Market Psychology

The Wall Street Cheat Sheet is a roadmap for navigating the emotional highs and lows investors face during market cycles. Each phase reflects a collective sentiment that can influence financial markets and, subsequently, the price movement of stocks.

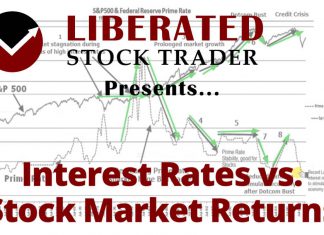

60 Year Analysis Shows How Interest Rates Affect Stocks

Interest rates significantly impact the stock market. Low rates mean cheap money for businesses and consumers, boosting demand for goods and services. This drives up companies' profits and stock prices. Conversely, with rising rates, borrowing becomes costlier, reducing spending and causing stock prices to fall.

How to Perform a Broker/Advisor Background Check in 7 Steps

Checking a broker's or financial advisor's background before investing should not be overlooked. Performing checks with FINRA, IAPD, and the CFP board can help ensure your investments are safe and that you're working with someone trustworthy.

10 Beginner Stock Investing Tips Based on Proven Data

Mainstream finance websites regurgitate mindless tips for beginner investors written by interns. Our advice provides proven research based on decades of analysis, from charts, patterns, and indicators to tested investing growth, dividend, and value investing strategies.

Are Stocks Liquid Assets & How To Avoid Risky Illiquid Stocks?

Most stocks are considered liquid assets because they are traded on open exchanges. But not all stocks are liquid. Penny stocks trading on over-the-counter (OTC) exchanges can have few buyers and sellers, making them illiquid, high-risk investments.

11 Real-World Investment Scams to Avoid in 2024

Investment scammers defrauded $8.8 billion from unsuspecting consumers in 2022, a staggering 30% year-on-year surge. Don't fall victim to NFT, Crypto, Forex, Ponzi, or offshore scams.

102 Incredible Unique Stock Market Facts & Statistics 2024

Fun stock facts: Microsoft is worth more than Brazil's stock market. Microsoft, Apple, and Google are worth more than the Chinese stock market. Apple is worth more than the entire GDP of India?

1 Penny Doubled for 30 Days: An Exponential Doubling Formula

A penny doubled for 30 days will grow into over $5.3 million, or $5,368,709.12. Doubling your penny for 36 days makes you the world's richest person with $343 billion.

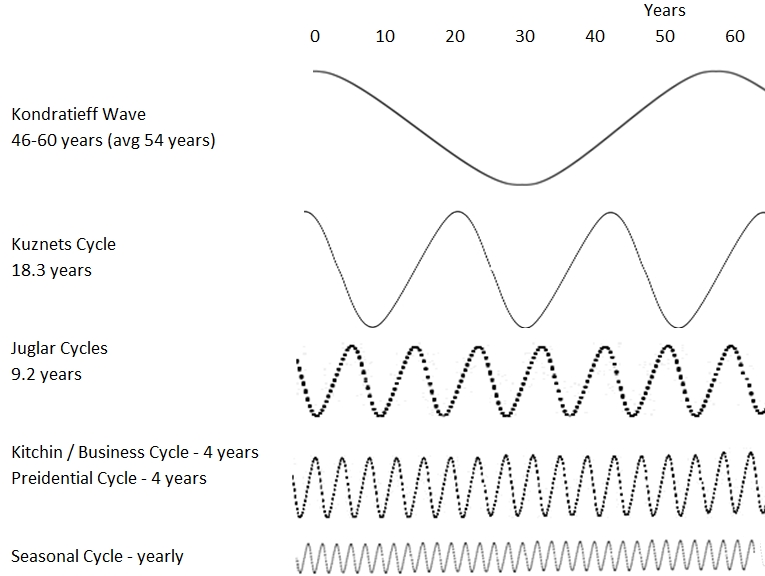

6 Key Business & Economic Cycles Affecting Stocks

Six waves and cycles influence how our economies, businesses, and financial markets expand and contract. The Kondratieff Wave, Kuznets Cycle, Juglar Cycle, Business Cycle, Presidential Cycle, and Seasonal Cycle will change how you see the world.

How to Invest in REITs? 5 Smart Tips & Strategies.

Real Estate Investment Trusts (REITs) are publicly-traded entities that own or finance income-generating real estate assets. By investing in REITs, individuals can participate in the real estate market without directly purchasing physical properties.

What is a Stock Split and How to Trade It?

In a stock split, a company divides its existing shares into multiple shares to increase liquidity. A reverse stock split combines several shares into one to reduce outstanding shares.

Stock Analyst Ratings Explained: Reliable or Inaccuate? We Test It

Stock analyst ratings provide investors with guidance about the future growth and profitability of a company. Unfortunately, our data shows that analyst ratings are 95% inaccurate and are heavily "Buy" or "Strong Buy" biased.

Our Best Training & Strategies

Liberated Stock Trader Pro: Learn Stock Market Investing

Learn stock market investing with the complete online stock trading course by Barry D. Moore, a certified financial analyst from the International Federation of Technical Analysts (IFTA).

ETF Investing Strategy: MOSES Improves Performance & Lowers Risk

The MOSES ETF investing strategy is a powerful suite of indicators meticulously backtested over 100 years. Designed to empower you to outperform the market, it equips you with the tools to navigate major stock market crashes and unlock greater investing performance.

Our LST Strategy Beat the Stock Market’s S&P 500 By 102%...

Decades of research and testing unveiled the Liberated Stock Trader Beat the Market System. Our 9-year, backtested, and proven strategy targets 35 financially healthy high-growth stocks, producing a track record of beating the S&P 500 by 102%.

![Stock Market Beginner’s Guide [2024 Elite Investor Edition] Stock Order Types: Using Market, Limit & Trailing Stops in Trading](https://www.liberatedstocktrader.com/wp-content/uploads/2022/04/stock-trading-answers-324x235.jpg)