102 Incredible Unique Stock Market Facts & Statistics 2024

Fun stock facts: Microsoft is worth more than Brazil's stock market. Microsoft, Apple, and Google are worth more than the Chinese stock market. Apple is worth more than the entire GDP of India?

13 Best Ways to Learn Stock Trading Fast In 2024

The best ways to learn stock trading include books, audiobooks, data-backed analytical research, and reputable investing courses taught by industry-certified instructors. It is crucial to exercise caution and steer clear of individuals promoting get-rich-quick schemes promising gains exceeding 25% per year.

11 Real-World Investment Scams to Avoid in 2024

Investment scammers defrauded $8.8 billion from unsuspecting consumers in 2022, a staggering 30% year-on-year surge. Don't fall victim to NFT, Crypto, Forex, Ponzi, or offshore scams.

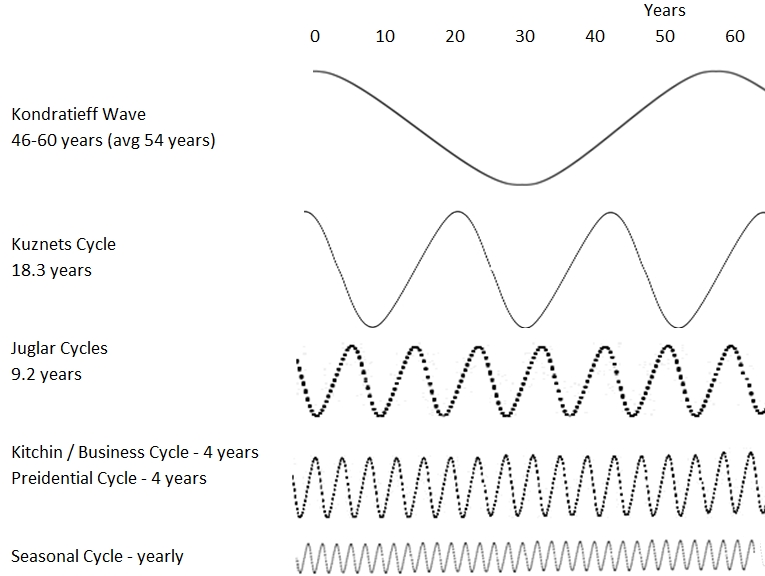

6 Key Business & Economic Cycles Affecting Stocks

Six waves and cycles influence how our economies, businesses, and financial markets expand and contract. The Kondratieff Wave, Kuznets Cycle, Juglar Cycle, Business Cycle, Presidential Cycle, and Seasonal Cycle will change how you see the world.

Bull and Bear Markets: How To Remember The Difference

To remember the direction of bull and bear markets, associate each with the animal it represents. A bull market moves with the upward trajectory of its horns, while a bear market moves with a bear's claws swiping downward.

How the Stock Market Works: Everything Explained

The market is an auction where traders and investors trade company stocks through bids and offers. The spread, the difference between these prices, represents the exchange's profit. Brokers profit from commissions, while investors benefit from stock price growth and dividends.

What is the Futures Market and How Does It Work?

The Futures Market is where individuals and institutions buy and sell contracts to deliver a commodity, currency, or security at an agreed-upon time. These contracts are standardized for quality, quantity, delivery dates, and settlement terms.

Commodity Trading: Is it Profitable/Risky? We Look at the Research!

Commodities are tangible goods such as food, metals, and energy that traders can buy or sell in the financial markets. These commodities are traded on global exchanges, and their prices fluctuate based on supply and demand.

How to Invest in REITs? 5 Smart Tips & Strategies.

Real Estate Investment Trusts (REITs) are publicly-traded entities that own or finance income-generating real estate assets. By investing in REITs, individuals can participate in the real estate market without directly purchasing physical properties.

What is a Stock Split and How to Trade It?

In a stock split, a company divides its existing shares into multiple shares to increase liquidity. A reverse stock split combines several shares into one to reduce outstanding shares.

What’s a Hedge Fund, How They Work & Are They Worth...

A hedge fund is an investment vehicle that pools capital from high-net-worth investors and flexibly invests in a range of assets, including stocks, bonds, commodities, and derivatives.

Common vs. Preferred Stock: Strategy Differences & Examples

Common stock has voting rights and price appreciation in line with market prices, whereas preferred stock does not. However, preferred stock has higher priority dividend payments and liquidity rights in case of insolvency. The downside of preferred stock is that it has no voting rights, and they are callable.

10 Beginner Stock Investing Tips Based on Proven Data

Mainstream finance websites regurgitate mindless tips for beginner investors written by interns. Our advice provides proven research based on decades of analysis, from charts, patterns, and indicators to tested investing growth, dividend, and value investing strategies.

What is a Stock Rally & How To Profit From It!

A stock market rally is a sudden and sustained growth in equity prices. Rallies are triggered by increased investor confidence, reduced risk, and frenzied buying activity. A rally can be cyclical, sector or broad market, and short, medium, or long-term.

What Are OTC Stocks, OTC Markets & Pink Sheet Stocks?

OTC stocks trade outside major exchanges and are less regulated, making them difficult to find and trade. Those looking for bargains could consider over-the-counter...

Are Stocks Liquid Assets & How To Avoid Risky Illiquid Stocks?

Most stocks are considered liquid assets because they are traded on open exchanges. But not all stocks are liquid. Penny stocks trading on over-the-counter (OTC) exchanges can have few buyers and sellers, making them illiquid, high-risk investments.

60 Year Analysis Shows How Interest Rates Affect Stocks

Interest rates significantly impact the stock market. Low rates mean cheap money for businesses and consumers, boosting demand for goods and services. This drives up companies' profits and stock prices. Conversely, with rising rates, borrowing becomes costlier, reducing spending and causing stock prices to fall.

Quad Witching Explained: Trading Volatility & Volume

Quadruple Witching refers to the concurrent expiration of four derivatives: stock index futures, stock index options, stock options, and single stock futures. It occurs quarterly, on the third Friday of March, June, September, and December, bringing unique opportunities for traders.

Stock Futures Explained? What Are They & How to Trade Them

Stock futures are derivative contracts that track the future price of a certain stock. They are agreements to buy or sell a specific stock at a predetermined price on a set date in the future.

Stock Analyst Ratings Explained: Reliable or Inaccuate? We Test It

Stock analyst ratings provide investors with guidance about the future growth and profitability of a company. Unfortunately, our data shows that analyst ratings are 95% inaccurate and are heavily "Buy" or "Strong Buy" biased.

Our Best Training & Strategies

Liberated Stock Trader Pro: Learn Stock Market Investing

Learn stock market investing with the complete online stock trading course by Barry D. Moore, a certified financial analyst from the International Federation of Technical Analysts (IFTA).

ETF Investing Strategy: MOSES Improves Performance & Lowers Risk

The MOSES ETF investing strategy is a powerful suite of indicators meticulously backtested over 100 years. Designed to empower you to outperform the market, it equips you with the tools to navigate major stock market crashes and unlock greater investing performance.

Our LST Strategy Beat the Stock Market’s S&P 500 By 102%...

Decades of research and testing unveiled the Liberated Stock Trader Beat the Market System. Our 9-year, backtested, and proven strategy targets 35 financially healthy high-growth stocks, producing a track record of beating the S&P 500 by 102%.