How to Calculate Warren Buffett’s Margin of Safety: Formula + Excel

Calculating Buffett's margin of safety formula requires understanding cash flow, discounting, and intrinsic value.

Inspire Your Future With 25 Warren Buffett Quotes On Success

Warren Buffett undeniably embodies remarkable success in business, investing, and life. Quotes like "the people who are most successful are those who are doing what they love." are inspirational.

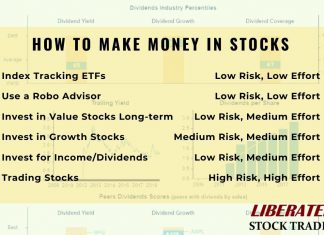

Discover 6 Time-Tested, Proven Ways to Make Money in Stocks

The six time-tested, proven ways to make money in the stock market are investing in long-term ETFs, using a robo-advisor, investing in value stocks, a portfolio of growth stocks, dividends, and stock trading.

138 Inspirational Warren Buffett Investing Quotes Analyzed

My favorite Buffett quotes are "Rule No.1: Never lose money. Rule No.2: Never forget rule No.1." and "The stock market is a device for transferring money from the impatient to the patient."

LiberatedStocktrader’s Guide To Investing in Money Markets

Money markets play a crucial role in greasing the wheels of economic activity, ensuring a smooth flow of funds from those who have it to those who need to borrow it. Investors can use money markets to protect capital from inflation.

S&P 500 Companies List by Sector, Market Cap & PE Ratio...

Our regularly updated S&P 500 companies list shows you what companies are currently in the S&P 500 index and provides the ticker symbol, capitalization, and PE Ratio.

S&P 500 Companies List by Market Capitalization 2024

Our regularly updated S&P 500 companies list shows you what companies are currently in the S&P 500 index and provides the ticker symbol, their industry sector, and market capitalization.

How To Protect Your 401k From a Stock Market Crash

To protect your 401k from a market crash, you can liquidate your assets, use dollar-cost averaging, or diversify and rebalance your portfolio.

20 Inspirational Warren Buffett Quotes on Life

Warren Buffett's quotes on life are inspirational, such as “If you are stuck in a hole, stop digging.” Join us as we explore the Oracle of Omaha's life lessons.

S&P 500 Companies by Number of Employees 2024

A Complete Listing of All The Companies in the S&P 500 Index Sorted By Number of Employees & Industry Sectors

Bull Leveraged 2x & 3x ETFs Lists & Live Charts for...

Leveraged/Long/Bull ETFs Enable You To Increase Your Profit In Bull Markets. We List the Best Leveraged ETFs by Assets, Liquidity & Expense Ratio

NASDAQ 100 Company List by Sector, Market Cap, PE & EPS

Our up-to-date NASDAQ 100 companies lists included ticker, sector classification, market capitalization, PE Ratio, EPS, and employee count. We also show you how to export this list to Excel.

Inverse Short ETFs List with Live Charts | LiberatedStockTrader

Our regularly updated inverse/short ETFs list shows you what ETFs are currently active and provides the ticker, market capitalization, and expense ratios.

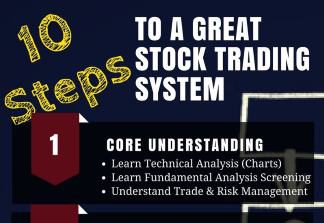

10 Step Guide to Create a Reliable Stock Trading Strategy

Creating a reliable stock trading strategy involves merging logic, expertise, experience, and data. A trader's approach to the market determines their success or failure.

11 Stock Market Sectors & Top Stocks Per Sector 2024

Our ten-year research reveals the best stock market sectors outperforming the S&P 500 are Technology +381%, Consumer Cyclical +181%, and Healthcare +34%. These three sectors significantly beat the market averages.

A Traders Guide to Forex and the Risks of Margin Trading.

Buying and selling currency in Forex trading is for advanced speculators. Because currency fluctuations are so small, a margin is required, making it a volatile and highly risky endeavor.

What Are Cyclical & Noncyclical Stocks & How To Trade Them?

Macroeconomic or systemic changes within the broader economy influence a cyclical stock's price. These stocks are renowned for mirroring the economic cycles through the growth, boom, bust, and recovery phases.

12 Proven Strategies for Buy-and-Hold Stock Investing

Based on our 30-year research, adopting a buy-and-hold stocks strategy is annually 4% more profitable than actively trading stocks or investing in alternative assets such as corporate bonds, real estate, gold, or treasuries.

What Companies Does Warren Buffett Own? BRK Subsidiaries

Through Berkshire Hathaway's subsidiaries, CEO Warren Buffett owns 62 companies and has a major stakeholding in hundreds of companies in a broad market portfolio. Warren Buffett owns many companies via Berkshire Hathaway. He owns stocks and entire companies such as Dairy Queen & GEICO.

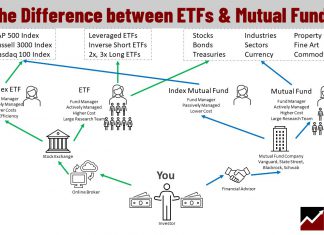

The Difference Between ETFs and Mutual Funds is Capital Flow

The difference between ETFs and mutual funds is ETFs are normally sold and bought on an exchange, while mutual funds are valued, traded, and priced at the end of a trading day. ETFs have lower fees, averaging 0.35%, and Mutual fund fees are over 1%.

Our Best Training & Strategies

Liberated Stock Trader Pro: Learn Stock Market Investing

Learn stock market investing with the complete online stock trading course by Barry D. Moore, a certified financial analyst from the International Federation of Technical Analysts (IFTA).

ETF Investing Strategy: MOSES Improves Performance & Lowers Risk

The MOSES ETF investing strategy is a powerful suite of indicators meticulously backtested over 100 years. Designed to empower you to outperform the market, it equips you with the tools to navigate major stock market crashes and unlock greater investing performance.

LiberatedStockTrader’s Strategy Beat the Market By 102%

Decades of research and testing unveiled the Liberated Stock Trader Beat the Market System. Our 9-year, backtested, and proven strategy targets 35 financially healthy high-growth stocks, producing a track record of beating the S&P 500 by 102%.