The best investment books for beginners are The Little Book that Still Beats the Market, The Intelligent Investor, Liberated Stock Trader’s Complete Stock Market Education, The White Coat Investor, and How to Invest in Real Estate.

Best Investment Books for Beginners

☆ Research You Can Trust ☆

My analysis, research, and testing stems from 25 years of trading experience and my Financial Technician Certification with the International Federation of Technical Analysts.

☆ Research You Can Trust ☆

My analysis, research, and testing stems from 25 years of trading experience and my Financial Technician Certification with the International Federation of Technical Analysts.

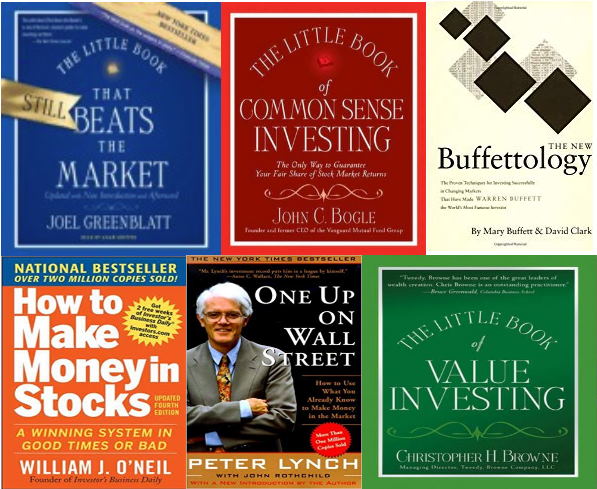

- The Little Book that Still Beats the Market

- The Intelligent Investor

- Liberated Stock Trader

- The White Coat Investor

- How to Invest in Real Estate

- The Fundamentals of Investing

These books will give you the foundation to build your investing knowledge and help you make smarter financial decisions. Additionally, they will provide tips and strategies for successfully investing in stocks, bonds, ETFs, mutual funds, and other investments.

1. The Little Book that Still Beats the Market

Joel Greenblatt’s strategy is called the Magic Formula, and it is based on two specific formulas: the Greenblatt ROC and the Greenblatt Earnings Yield. It is a value-investing strategy that looks for companies with strong fundamentals and buys them at a discount.

The book offers an easy-to-understand explanation of the Magic Formula, case studies, and guidance on how to apply it in practice. The Little Book that Still Beats the Market is one of the most popular books on value investing and offers readers a fascinating look at a specific system that the author declares and proves makes a regular profit.

I have backtested this system personally, and it works very well. It is a little high maintenance, but the lessons in the book are vital.

It is also quite humorous, which is welcome in the dry world of investing. It is a great introduction to a stock market system from an investing legend.

2. The Intelligent Investor

The Definitive Book on Value Investing. A Book of Practical Counsel (Revised Edition)

This updated edition of Benjamin Graham’s 1949 classic is still one of Amazon’s most popular investment books. The Intelligent Investor has received an average rating of four and a half stars on four and a half stars from 11,237 Amazon reviewers.

Many people consider Graham the greatest investment advisor and the creator of value investing. Zweig updates Graham’s stock market bible for modern readers with 21st-century parallels to those in the original.

The Intelligent Investor is still the best introduction to value investing. It is also the best introduction to Warren Buffett’s investment philosophy because Buffett was Graham’s partner and pupil.

Related Articles:

Investing In Stocks Can Be Complicated, Stock Rover Makes It Easy.

Stock Rover is our #1 rated stock investing tool for:

★ Growth Investing - With industry Leading Research Reports ★

★ Value Investing - Find Value Stocks Using Warren Buffett's Strategies ★

★ Income Investing - Harvest Safe Regular Dividends from Stocks ★

"I have been researching and investing in stocks for 20 years! I now manage all my stock investments using Stock Rover." Barry D. Moore - Founder: LiberatedStockTrader.com

3. Liberated Stock Trader’s Complete Stock Market Education

- Best Book & Video Course for Learning Stock Trading & Investing

Designed as a complete education, the book covers everything you need to know to start investing in stocks. Fundamental analysis, technical analysis, stock screening, risk management, and psychology are all covered.

Learn stock market investing with the complete online stock trading course by Barry D. Moore, a certified financial analyst from the International Federation of Technical Analysts (IFTA).

What makes it different is that 16 hours of instructor-led video are included, which turns this training from a book to a full stock market seminar training.

Premium stock market education is expensive, but this training course is extremely cost-effective. It provides a well-rounded education for those who want to take the stock market seriously.

Score: 4.8 Stars on Amazon.com & 5/5 Stars on Benzinga.com

Buy on LiberatedStockTrader.com

4. The White Coat Investor

A Doctor’s Guide To Personal Finance And Investing

The White Coat Investor is a comprehensive guide to personal finance for doctors and other high-income professionals. It covers student loan debt, asset protection, retirement planning, and investing basics. Written by Dr. Jim Dahle, an emergency physician and active investor, it provides straightforward advice that even novice investors can understand.

It outlines how to protect your wealth through insurance, asset allocation, and tax minimization strategies. Dahle also provides tips on picking the right mutual funds, stocks, and bonds for your circumstances. The White Coat Investor is an invaluable resource for understanding the basics of personal finance and more advanced topics like real estate investing, options trading, and cryptocurrency.

This fascinating perspective from an amateur investor received an average of five stars in 1,348 Amazon ratings. Dahle offers an investment guide that professionals, entrepreneurs, and freelancers can use.

James M. Dahle, MD, explains investments for people without training or education in investment, finance, business, insurance, and estate planning. He examines stocks, real estate, homes, and other investments from the perspective of a well-paid professional or small businessperson with large debts.

The White Coat Investor describes advanced finance and investment concepts all professionals, business owners, and freelancers need to understand. Most investment books ignore those issues.

5. How to Invest in Real Estate

The Ultimate Beginner’s Guide to Getting Started

This introduction to real estate investing by two popular podcasters received an average Amazon rating of four and a half stars. Dorkin and Turner explain important real estate concepts and tools investors need to understand. They also discuss how to evaluate potential investments and avoid common mistakes.

The authors cover many real estate investing topics, from the basics, like understanding mortgages and rental agreements, to more complex strategies involving options contracts, tax liens, and flipping houses. The book is filled with practical tips and advice for first-time investors.

Dorkin and Turner offer 11 strategies for real estate investment and propose 28 methods for locating great real estate deals.

How to Invest in Real Estate explains basic investment tools, including LLCs and corporations. This “Ultimate Beginner’s Guide” offers advice on investing in real estate while working full-time.

6. The Fundamentals of Investing

The Fundamentals of Investing teaches the core concepts of investing through hands-on practice. This book’s advantage is that it reveals many strategies and techniques for money managers.

Written by Scott B. Smart, The Fundamentals of Investing covers stocks, bonds, mutual funds, and retirement planning.

The Fundamentals of Investing provides an accessible introduction to investing and finance. The book is divided into chapters covering cash flow management, asset allocation strategies, diversification plans, and more. In addition, this guide showcases helpful examples that illustrate how different technologies are used to analyze investments.

With this knowledge, readers can develop the ability to manage their financial future effectively and make informed decisions about where to invest their money.

Amazon reviewers gave this popular textbook an average rating of four and a half stars. Although the authors wrote this easy-to-read textbook for investment professionals, anybody can learn from it. One advantage of The Fundamentals is that it does not promote a fund manager’s agenda, method, or philosophy.

7. The Financial Times Guide to How the Stock Market Really Works

This introduction to the financial markets received an average Amazon review of four and a half stars. The famed Financial Times newspaper created this guide for beginner investors.

The Financial Times Guide to How the Stock Market Really Works provides readers with a comprehensive stock market overview. It covers topics such as how stocks are priced, how stock indices work, and how to read financial news and reports.

The guide also provides an in-depth look at various types of investments, from equities to commodities and derivatives. Additionally, it explains risk management strategies and offers tips on selecting stocks. This book is ideal for beginners looking to understand the stock market before investing money.

One advantage of The Financial Times Guide is that it lacks an agenda or philosophy.

Instead, this book will provide an unbiased examination of the stock market for beginner investors.

8. The Elements of Investing

Easy Lessons for Every Investor

This investment classic received an average rating of four and a half stars on Amazon. The Elements of Investing offers a simple set of rules and principles that any investor can apply.

In The Elements of Investing, Burton G. Malkiel, the author of A Walk Down Wall Street, writes an easy-to-read investment guide beginner investors can understand. Malkiel and Ellis explain basic investment philosophies, including contrarian, behavioral, and value investing for ordinary people.

The Elements of Investing believe anyone can become an investor with proper knowledge and planning. The book provides a simple yet comprehensive introduction to the stock market, starting with basic concepts like stocks and bonds. It covers topics from investing in individual stocks to portfolio diversification and risk management strategies.

With its easy-to-understand illustrations and straightforward language, this book is ideal for beginner investors who want to develop an understanding of the stock market before investing their money. Additionally, it offers advice on selecting stocks and learning about different sectors or industries so that novice investors can make informed decisions regarding stock trading.

9. How to Make Money in Stocks

Combining technical and fundamental Analysis, this best-selling book by William O’Neil gives you a good framework for building your stock market investing approach—one of the best-investing books ever written.

Packed full of clear examples and a very structured approach. The CANSLIM approach is easy to remember as a Stock Screening approach to finding good stocks and shares to invest in.

He also includes examples of real-world investments to illustrate his points. “How to Make Money in Stocks” is a comprehensive guide to investing in the stock market that will help readers succeed in the stock market.

These ideas are integrated into our training courses and outlined in the Stock Market Strategy Blueprint. The book heavily promotes using Investors.com as a tool.

You do not need to purchase this service; you can create your stock screeners for free to achieve the same goal.

10. Bonds: An Introduction to the Core Concepts

This examination of the bond market received an average Amazon review score of four and a half stars. An Introduction is valuable because Mobius examines bonds and global financing markets.

Bonds: An Introduction to the Core Concepts is an introductory guide to the principles of bonds and bond trading. It covers topics such as the basics of bond pricing, understanding bond strategies, and building a portfolio of bonds. It also contains information on assessing credit ratings and selecting the best bonds for your investment goals.

The book also provides helpful illustrations that help visualize the concepts discussed in each chapter. Finally, the author explains how the different types of bonds can be combined to create a well-balanced portfolio that caters to different investment goals.

Beginners will find Bonds useful because Mobius offers clear definitions of many financial terms, transactions, and products. Mobius also offers real-life examples of bond transactions and explains how they work.

Bonds was intended as a textbook for the Mark Mobius Master Class, but it contains enough information to serve as a standalone resource. This book is a market guide and a how-to guide for bond trading.

11. An Introduction to Mutual Funds Worldwide

This guide to global mutual funds received an average of four and a half stars from Amazon reviewers. An Introduction describes both open-ended and closed-ended mutual funds.

The book also describes the differences between international markets. It examines emerging market investments through mutual funds. It provides a basic history of mutual funds and an industry and market overview.

Ray Russell’s work provides a comprehensive overview of mutual funds for beginners and an interesting introduction to international investing.

You want to be a successful stock investor but don’t know where to start.

Learning stock market investing on your own can be overwhelming. There’s so much information out there, and it’s hard to know what’s true and what’s not.

Liberated Stock Trader Pro Investing Course

Our pro investing classes are the perfect way to learn stock investing. You will learn everything you need to know about financial analysis, charts, stock screening, and portfolio building so you can start building wealth today.

★ 16 Hours of Video Lessons + eBook ★

★ Complete Financial Analysis Lessons ★

★ 6 Proven Investing Strategies ★

★ Professional Grade Stock Chart Analysis Classes ★

12. Introduction to Investing

A Guide to Stocks, Mutual Funds, and ETFs

This overview of the financial markets received an average of four and a half stars from Amazon reviewers. Charles Sherwood’s book is advantageous because it examines mutual funds, exchange-traded funds (ETFs), and stocks.

It also provides a great introduction to the basics of investing, such as risk management and asset allocation. The book aims to provide readers with the knowledge needed to make informed decisions about investing.

The authors present the material easily, making complex concepts easier to understand. They also offer many helpful tips on investing wisely and getting started worldwide.

Sherwood describes all three investment classes and explains popular beginner investing strategies. Sherwood also offers strategies for beginning investors and explains brokerage accounts.

It is one of the most comprehensive investment guides on the market today.

13. If You Can: How Millennials Can Get Rich Slowly

This short e-book for people under 40 received an average rating of four and a half stars from 593 Amazon reviewers. Bernstein offers an introduction to investing and retirement savings for younger people.

He explains the importance of saving early for retirement, using tax-advantaged investment accounts such as IRAs and 401(k)s.

Bernstein also covers the basics of stocks, bonds, and mutual funds, how to avoid common investing mistakes, and additional information on investing online. If You Can is a great resource for anyone looking to get started in investing. This short work could be the best introduction to investments available today.

14. The Necessity of Finance

An Overview of the Science of Management of Wealth for an Individual, a Group, or an Organization

This overview of wealth management received an average Amazon review of five and a half stars. Criniti explains and clarifies financial concepts and economics for ordinary people.

Dr. Anthony M. Criniti explains the important difference between finance and economics. The Necessity of Finance is an investment book because it introduces ordinary people to wealth management.

The Necessity of Finance defines key investment concepts such as risk and return. It also explains classes of investments and the vital difference between wealth and money. Criniti’s book is a great resource for beginners who want a more advanced look at the financial markets.

15. The ETF Book

All You Need to Know About Exchange-Traded Funds

This introduction to Exchange Traded Funds (ETFs) received an average rating of four and a half stars on Amazon. ETFs are funds that trade like stocks.

ETFs are one of the fastest-growing investment sectors, and Richard A. Ferri explains how they work. Ferri explains the ETF terminology, including such terms as Exchange-Traded Product. He covers the basics of risk and return, taxation, and investing in ETFs.

The book provides valuable information on where to find ETF data, such as Yahoo! Finance or MarketWatch. It is a great resource for those who want to learn more about how to get started with investing in exchange-traded funds and understand the potential risks and associated rewards.

In The ETF Book, Ferri examines and explains exchange-traded portfolios (ETFs) and explores a wide selection of ETFs. Ferri also offers ETF trading and investing strategies and explains the concept of sector rotation. The ETF Book is for you if you want to learn what ETFs are and how they work.

16. The Fund Industry

How Your Money is Managed

The Fund Industry received an average Amazon rating of five stars. Beginning investors need to read The Fund Industry because the authors take readers on a tour of the fund management business.

The authors explain the roles of mutual funds, fund advisors, and fund sponsors. This book also details the different types of fees investors pay and strategies for actively managing funds. This book is a great resource for those interested in learning more about investing and how their money is managed.

Hamacher and Pozen explain the inner workings of funds for readers. Importantly, The Fund Industry explains how funds invest in stocks and bonds and evaluate the risks and returns. Pozen and Hamacer look at funds’ operations and government regulation of funds.

All investors need to read The Fund Industry because mutual fund companies are among today’s biggest investors. Those considering mutual funds need this book on their shelves.

17. Understanding Wall Street

This popular guide to America’s financial industry received an average Amazon review of four out of five stars.

Jeffrey Little takes investors on a tour of Wall Street and explains its institutions. Little helps readers conquer the intimidating world of finance and understand its complexities.

The book covers everything from stock exchanges, investment banks, mutual funds, and junk bonds. Investors must understand Wall Street to make sound decisions about their portfolios.

Understanding Wall Street provides valuable insight into how the market works so investors can stay ahead.

The latest edition examines exchange-traded funds (ETFs), the link between Wall Street and Main Street, and the risks and rewards of the global economy. Little also explains online investment research strategies for ordinary people.

If you want to learn what Wall Street is and how it works, Little’s book is an excellent place to start your research.

18. All About Bonds, Bond Mutual Funds, and Bond ETFs

This comprehensive guide to bonds received an average Amazon rating of four out of five stars. All About Bonds explains how bonds have gone from one of the safest investments to a dangerous instrument.

A detailed introduction explains everything from basic bond characteristics to fixed-income investment techniques. Learn important concepts such as yield, liquidity, duration, convexity, and emerging markets.

Esme E. Faerber answers many of the questions bond investors will ask. All About Bonds helps beginners by offering practical advice on the percentage of bonds in a portfolio, how to find new bond products, and the risks of bond ETFs and mutual funds.

If you want to learn how to pick and invest in bonds, All About Bonds is for you.

19. Mutual Fund Industry Handbook

This overview of the mutual fund industry received four and a half stars from Amazon reviewers. Lee Gremillion offers an in-depth examination of the mutual fund industry and market. Learn about mutual fund operations, how to value a product, and advanced material on leveraged ETFs.

The book also includes detailed case studies and examples to help readers better understand the concepts. Whether you are a beginner or an experienced investor, the Mutual Fund Industry Handbook is a valuable resource for understanding the ins and outs of this popular investment option.

20. A Beginner’s Guide to the Stock Market

Everything You Need to Start Making Money Today

This book gives a comprehensive stock market overview, outlining how to buy and sell stocks, bonds, mutual funds, and ETFs. It also covers risk management and money management strategies.

Matthew Kratter’s popular introduction to stocks received an average rating of four and a half stars in 3,269 Amazon reviews. The Beginner’s Guide offers a simple introduction to stocks and the market for ordinary people.

Kratter teaches the basics of value investment and explains important concepts such as momentum stocks. Kratter also offers a few basic stock analysis methods and stock-picking tips.

The Beginner’s Guide is a good place to start your investment journey.

Summary: The Best Investing Books for Beginners

For beginners seeking investment knowledge, some highly recommended books include “The Little Book that Still Beats the Market,” “The Intelligent Investor,” “Liberated Stock Trader’s Complete Stock Market Education,” “The White Coat Investor,” and “How to Invest in Real Estate.” These valuable resources offer valuable insights and guidance for those looking to venture into investing.