Value investing is a strategic approach to investing where stocks are selected that appear to be undervalued compared to their intrinsic value. The principle is to buy securities at less than their current market value, expecting their price to rise over time, leading to significant returns.

Legendary investor Warren Buffett popularized this method, which requires diligent research, forecasting, patience, and a long-term perspective.

The Definition of Value Investing

Value investing means selecting stocks that appear to be undervalued compared to their intrinsic value. The intrinsic value is based on future discounted cash flow (DCF), and the difference between DCF and the current stock price is the value or margin of safety.

Investing in profitable companies that represent excellent value to the buyer is the essence of value investing—essentially, buying a profitable company when its shares trade at a significant discount to its intrinsic value.

What is Value Investing?

“Value investing is a school of investing based on the assumption that the stock market participants do not value a company correctly. Value investors believe they can make a healthy long-term profit by identifying profitable companies that the stock market undervalues.”

Value investing is both a philosophy and a strategy of investment. The philosophy is that an asset’s value is its most important characteristic.

The strategy considers that the market cannot properly value stocks, but well-informed investors can. Value gurus like Warren Buffett believe most stocks are either overvalued or undervalued.

Understanding Value Investing

Understanding the concept of value investing allows investors to make informed decisions about where to allocate their resources, potentially leading to substantial financial gains. Secondly, it promotes financial literacy, helping investors better comprehend the stock market dynamics.

Lastly, it encourages a long-term investment perspective, fostering patience and discipline, key attributes for success in the investment world. By grasping value investing principles, individuals can maximize their wealth and secure their financial future.

The Philosophy Behind Value Investing

Value investing originated in the 1930s, when it was the brainchild of Benjamin Graham and David Dodd, two Columbia Business School professors. In their book Security Analysis, they laid out the framework for this investment philosophy. The principle revolves around the idea that the market overreacts to good and bad news, resulting in stock price movements that do not correspond with a company’s long-term fundamentals.

This discrepancy between the intrinsic value and the market price presents valuable opportunities for investors. Warren Buffett, a student of Graham, later championed this approach and took it to new heights. His success served as a testament to the effectiveness of value investing.

How Value Investing Differs from Other Investing Strategies

Value investing is distinct from other investment strategies in several ways. While growth investing focuses on companies expected to grow at an above-average rate, and momentum investing capitalizes on current market trends, value investing is all about identifying undervalued stocks with strong fundamentals.

This approach involves a meticulous analysis of a company’s financials, looking at aspects like earnings ratios, dividends, and book values, to name a few. Unlike speculative investing, which is akin to gambling on stock price movements, value investing is based on solid, quantifiable data.

It is a systematic, patient, and risk-averse strategy, often requiring a long-term view. This strategy banks on the market, eventually recognizing the true value of the undervalued company, leading to a price correction and, consequently, profits for the value investor.

Key Principles of Value Investing

Buying Stocks Below Their Intrinsic Value

A cornerstone of value investing is purchasing stocks priced below their intrinsic value. In essence, value investors are always on the hunt for “bargains” in the stock market, companies that they believe are undervalued by the market.

They calculate the intrinsic value of a company based on its fundamentals – such as earnings, dividends, and sales – and if the current stock price is below this intrinsic value, they believe the stock is a good buy. This method is grounded in the belief that the market may overreact to positive or negative news, leading to stock price fluctuations that do not align with the company’s long-term value.

How to Calculate the Intrinsic Value of a Stock + Excel Calculator

Therefore, an undervalued stock is seen as an opportunity because the expectation is that, eventually, the market will correct the price to its true value, resulting in a profit for the investor.

Companies with Strong Fundamentals

One key tenet of value investing is focusing on companies with strong fundamentals. This means value investors often comprehensively analyze financial indicators such as earnings growth, return on equity, debt-to-equity ratio, and profit margins. They seek companies that consistently demonstrate strong performance and stability, even during economic downturns.

Moreover, they also pay attention to the company’s competitive advantage or ‘moat,’ which can protect its long-term profits and market share from competitors. Such companies are believed to likely provide steady returns over time, regardless of short-term market fluctuations. This thorough fundamental analysis helps value investors make informed decisions and identify potential investment opportunities before the wider market does.

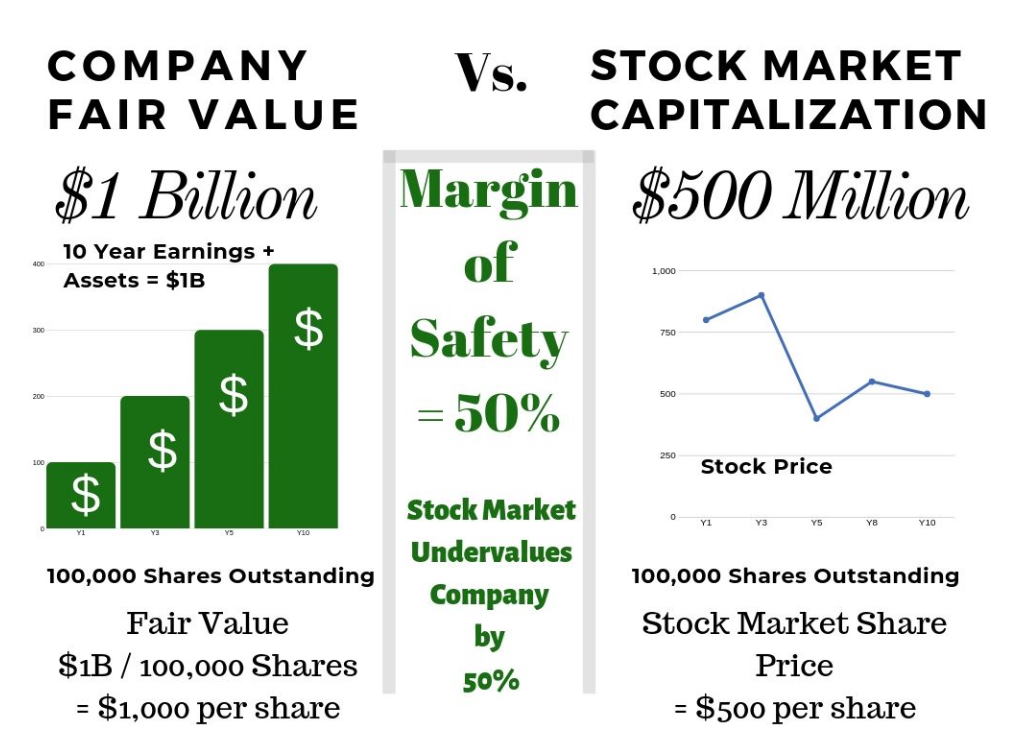

The Importance of a Margin of Safety

A crucial principle in value investing is the concept of a “margin of safety.” This term, coined by Benjamin Graham, refers to the difference between a stock’s intrinsic value and market price. Essentially, the margin of safety acts as a buffer against the uncertainties and fluctuations inherent in the stock market.

Investors can limit their downside risk by purchasing stocks at prices significantly below their calculated intrinsic value. This is because the investor is less likely to lose money even if the intrinsic value is overestimated or the price does not rise as much as expected. Conversely, if the stock’s price corrects upwards to match its intrinsic value, the investor stands to gain substantially.

The margin of safety principle is a testament to the risk-averse nature of value investing. It emphasizes the profit potential and, more importantly, the minimization of loss.

Long-Term Investment Perspective

Value investing is not a quick scheme for financial gains; it necessitates a long-term investment perspective. This strategy believes in corporations’ inherent value and potential to grow and prosper over time. Value investors patiently wait for the market to correct any discrepancies between a stock’s market price and its intrinsic value, a process that can take years.

During this period, they may face apparent underperformance compared to other strategies. However, they maintain their positions, firmly believing in their analysis and the fundamental strength of the companies they have invested in. This unwavering patience and long-term view differentiate value investors from others, even in the face of short-term market volatility. This perspective has led to the impressive long-term success of renowned value investors such as Warren Buffett and Benjamin Graham.

How to Identify Value Stocks

Value investing involves using various financial metrics to assess a company’s worth and potential profitability. These metrics provide insight into a company’s financial condition and help determine whether its stock is undervalued.

Price-to-Book (P/B) Ratio

Another important metric is the price-to-book (P/B) ratio. It is calculated by dividing a company’s current share price by its book value per share, which is the value of a company’s assets minus its liabilities. A lower P/B ratio could suggest that the stock is undervalued.

Dividend Yield

Dividend yield is another important measure. It is calculated by dividing a company’s annual dividend payout by its current share price. A higher dividend yield is generally better for investors as it indicates a larger return on their investment.

Fair Value

Fair value estimates what a company is worth based on its current and future earnings capacity. Investors use various methods to calculate fair value, including discounted cash flow (DCF) analysis and the Gordon Growth Model.

Intrinsic Value

Calculating a stock’s intrinsic value involves estimating a business’s future cash flow (FCF) over ten years. This cash flow is discounted in each subsequent year, taking into account variables like interest and inflation. The resulting total discounted cash flow (DCF) is then divided by the number of outstanding shares to determine the per-share intrinsic value. This approach enhances clarity and facilitates a deeper understanding of the stock’s true worth.

Get Stock Rover – The Best for Value Investors

Margin of Safety

Finally, the margin of safety is the difference between a company’s intrinsic value and its current market price. This principle, central to value investing, acts as a buffer against the stock market’s uncertainties and fluctuations. By buying stocks with a substantial margin of safety, investors can limit their downside risk.

Business Model and Industry Position

To identify potential value stocks, investors need to understand a company’s business model and its position within its industry.

The business model reveals how a company generates its revenue and major costs. A solid business model indicates a company has a steady, reliable source of income and a plan for future growth. Furthermore, understanding a company’s position in its industry involves evaluating its market share, competitive landscape, and industry trends.

A company with a strong position in a growing industry indicates potential for future earnings growth. It’s crucial to consider these factors alongside financial metrics to understand a company’s true value and potential for long-term success.

The Role of Market Cycles in Value Investing

Market cycles significantly influence the strategy of value investing. These cycles, consisting of periods of economic expansion and contraction, create fluctuations in stock prices. During periods of economic prosperity, stock prices may inflate beyond their intrinsic value due to optimistic investor sentiment, thereby reducing the likelihood of finding undervalued stocks.

Conversely, pessimism can cause stock prices to fall below their intrinsic value during economic downturns, providing potential opportunities for value investors. By understanding and responding to these market cycles, value investors can identify when stocks are likely undervalued, enabling them to buy low and sell high. However, value investors must remain patient and adhere to their strategy even when market cycles make it challenging to find value opportunities. This is where the margin of safety becomes even more critical, serving as a buffer against the unpredictability of the market cycles.

Pros and Cons

Higher Returns

One of the primary advantages is the potential for high returns. Investing in undervalued stocks can reap significant benefits as the market corrects itself. When the market recognizes the intrinsic value of stocks, their prices rise, leading to considerable profits for the value investor. Therefore, This strategy can offer greater return potential than other investment strategies, especially over the long term.

Reduced Risk

Another significant advantage of value investing is the reduced risk associated with the margin of safety principle. By purchasing stocks at a price below their intrinsic value, investors create a buffer against potential losses if the market doesn’t react as expected. This safety net allows value investors to weather market volatility and reduces the chance of losing capital. Essentially, the margin of safety is an insurance policy against market unpredictability and investment misjudgment, making value investing a more conservative, risk-averse strategy.

Possibility of Value Traps

While value investing has its merits, it’s important to understand the potential pitfalls, including the risk of falling into a ‘value trap.’ A value trap occurs when an investor identifies and invests in a stock that appears undervalued based on fundamental analysis metrics. Still, the stock’s price has not increased as anticipated. This could happen if the market has correctly assessed that the company’s future earnings potential is declining despite the current metrics suggesting the stock is undervalued. In such cases, what appears to be a bargain is not a good investment.

These traps are especially common during periods of economic downturn when many stocks appear undervalued. Avoiding value traps requires thorough analysis, a deep understanding of the company and its industry, and a good deal of investor patience and discipline.

Famous Value Investors

Warren Buffett

Warren Buffet, often called the “Oracle of Omaha,” is perhaps the most well-known embodiment of value investing principles. As the chairman and CEO of Berkshire Hathaway, Buffett has built his fortune by meticulously adhering to the tenets of value investing, which have been instrumental in his unprecedented success.

Buffet’s methodology is deeply rooted in the teachings of his mentor, Benjamin Graham, the pioneer of value investing. Buffett is known for his relentless focus on a company’s intrinsic value, investing only in businesses he thoroughly understands and those he believes are undervalued in the market.

Buffet’s strategy involves a long-term approach. He holds onto investments for many years, sometimes decades, allowing the market to recognize the company’s true worth over time. He advocates investing in companies with strong fundamentals, excellent management, and significant growth potential, even if the market undervalues them.

Despite the fluctuations and unpredictability of the stock market, Buffet’s value investing approach has proven extraordinarily successful. His ability to identify undervalued companies and patiently wait for the market to recognize their intrinsic value has made him one of the world’s wealthiest and most respected investors. His success underscores the potential of value investing as a strategy for building long-term wealth.

Peter Lynch

One such investor is Peter Lynch, who managed the Fidelity Magellan Fund from 1977 to 1990. During his tenure, Lynch averaged a 29.2% annual return, consistently doubling the S&P 500 market index and making it the best-performing mutual fund in the world. His investment philosophy involved investing in undervalued companies with good fundamentals and strong historical performances.

Seth Klarman

Another significant figure in value investing is Seth Klarman, the CEO of the Baupost Group, known for his strict value investing strategy. Klarman is renowned for his conservative approach, prudence, and a keen eye for potential bargains. His book, “Margin of Safety: Risk-Averse Value Investing Strategies for the Thoughtful Investor,” is considered a classic among value investors.

Walter Schloss

Finally, there’s Walter Schloss, another disciple of Benjamin Graham, who followed a strict value-investing strategy throughout his career. From 1955 to 2002, Schloss’s investments yielded a compounded annual return of 15.3%, outpacing the S&P 500 and proving the effectiveness of his value-oriented approach.

Joel Greenblatt

Another proponent of value investing is Joel Greenblatt, whose book “The Little Book That Beats the Market” has made him a household name. In his book, Greenblatt advocates for an approach to value investing that emphasizes finding stock with high returns on assets and low earnings yields. By following these two metrics, investors can uncover undervalued stocks and generate long-term returns that outperform the market.

Value Investing Tools and Resources

Value investors rely on various tools to help them identify undervalued stocks and make informed investment decisions. Tools such as Finviz, Value Line, Morningstar, and Zacks research are popular among value investors. But instead of using multiple tools to perform value investing research and financial analysis, you can use Stock Rover, which does it all.

Stock Rover: Best for Value, Dividend & Growth Investors

Stock Rover is our recommended software for value investors because it is the only platform that can screen for the full suite of value-investing calculations:

- Fair Value

- Margin of Safety

- Discounted Cash Flow

- Greenblatt Earnings Yield & ROC

- Price of Graham Number

- Price to Lynch Fair Value

- Cash Ratio

- Cash to Total Assets

Investing In Stocks Can Be Complicated, Stock Rover Makes It Easy.

Stock Rover is our #1 rated stock investing tool for:

★ Growth Investing - With industry Leading Research Reports ★

★ Value Investing - Find Value Stocks Using Warren Buffett's Strategies ★

★ Income Investing - Harvest Safe Regular Dividends from Stocks ★

"I have been researching and investing in stocks for 20 years! I now manage all my stock investments using Stock Rover." Barry D. Moore - Founder: LiberatedStockTrader.com

Related Articles: Finding Great Stocks With Stock Rover

- 12 Legendary Strategies to Beat the Market That [Really] Work

- Our Beat the Market Screener [Actually] Beats the Market

- All Value Investing Strategies & Articles

- Use a CANSLIM Stock Screener Strategy To Beat the Market

Further Learning Resources

Liberated Stock Trader offers in-depth value investing articles, strategies, and research for interested investors.

Value Investing Mastery: A Complete Strategy Workbook +eBook/pdf

How to Screen for Value Stocks? 39 Criteria for Success In A Turbulent Stock Market