Investing in the total stock market through global index funds can be an excellent strategy for long-term investors seeking broad market exposure, low costs, and diversification.

In this article, we’ll explore the total stock market, how it works, and why it’s a great investment option. We’ll also provide a step-by-step guide to investing in the total stock market using global index funds, covering important considerations such as asset allocation and risk management.

Additionally, we’ll discuss five Total Stock Market Index funds, their tickers, descriptions, pros, and cons, and analyze their performance in recent years. Finally, we’ll provide recommendations, tips, and reminders for investors considering this strategy.

We are not receiving compensation or affiliation with any funds mentioned in this article.

Understanding the Total Stock Market

The total stock market represents a country’s entire universe of publicly traded companies. It includes large, mid, and small-cap stocks across various sectors. The goal of investing in the total stock market is to capture the market’s overall performance rather than individual stocks or sectors.

Why Invest in the Total Stock Market?

Investing in the total stock market offers several advantages, including diversification, growth, lower costs, and efficiency.

- Diversification: By investing in the total stock market, you gain exposure to a wide range of companies across different industries, reducing your reliance on any single stock or sector.

- Long-Term Growth Potential: Historically, the stock market has shown long-term growth, and by investing in the total stock market, you can participate in this growth over time.

- Lower Costs: Index funds generally have lower expense ratios than actively managed funds, which means more of your investment goes towards growing your wealth.

- Efficiency: Investing in index funds allows you to benefit from the expertise of professional fund managers who aim to replicate the performance of a specific index.

What is the total value of the world’s stock markets?

According to recent research, the global domestic equity market’s value has increased significantly over the years. As of 2022, the value of the global domestic equity market was approximately $98.5 trillion. This represents a substantial growth from $65.04 trillion in 2013

The United States holds a substantial portion of the global stock market. As of May 2023, the U.S. stock market represented nearly 60% of the total value of equities worldwide, amounting to an estimated $40 trillion.

Step-by-Step Guide to Investing in the Total Stock Market

- Set Your Investment Goals: Determine your investment objectives, time horizon, and risk tolerance. This will help you determine the appropriate asset allocation.

- Choose a Global Index Fund: Select a Total Stock Market Index fund that aligns with your investment goals. Here are five popular options:

- Vanguard Total Stock Market Index Fund (VTSMX): A low-cost fund that aims to track the performance of the CRSP US Total Market Index.

- Fidelity Nasdaq Composite Index ETF (ONEQ): This fund seeks to provide investment results corresponding to the total return of the NASDAQ Composite stock market.

- Schwab Fundamental U.S. Broad Market Index ETF (FNDB): An index fund that tracks the performance of the broad U.S. Total Stock Market.

- iShares Core S&P Total U.S. Stock Market ETF (ITOT): This ETF seeks to track the investment results of the S&P Total Market Index.

- SPDR Portfolio MSCI Global Stock Market ETF (SPGM): An ETF that aims to provide investment results corresponding to the total return of the Dow Jones U.S. Total Stock Market Index.

- Open an Investment Account: Choose a brokerage firm that offers access to the selected Total Stock Market Index fund and open an investment account.

- Determine Your Asset Allocation: Consider your risk tolerance and diversify your portfolio by allocating a portion of your investment funds to the chosen Total Stock Market Index fund.

- Monitor and Rebalance: Regularly review your investment portfolio and rebalance if necessary to maintain your desired asset allocation.

Researching & Managing an ETF Portfolio

Stock Rover is a good choice for researching and managing an ETF portfolio. It offers a simple-to-use platform that provides data on current market conditions, fund performance, dividend history, and more. Stock Rover also allows you to set up watchlists, rebalance your portfolio, and ensure optimal diversification.

Investing In Stocks Can Be Complicated, Stock Rover Makes It Easy.

Stock Rover is our #1 rated stock investing tool for:

★ Growth Investing - With industry Leading Research Reports ★

★ Value Investing - Find Value Stocks Using Warren Buffett's Strategies ★

★ Income Investing - Harvest Safe Regular Dividends from Stocks ★

"I have been researching and investing in stocks for 20 years! I now manage all my stock investments using Stock Rover." Barry D. Moore - Founder: LiberatedStockTrader.com

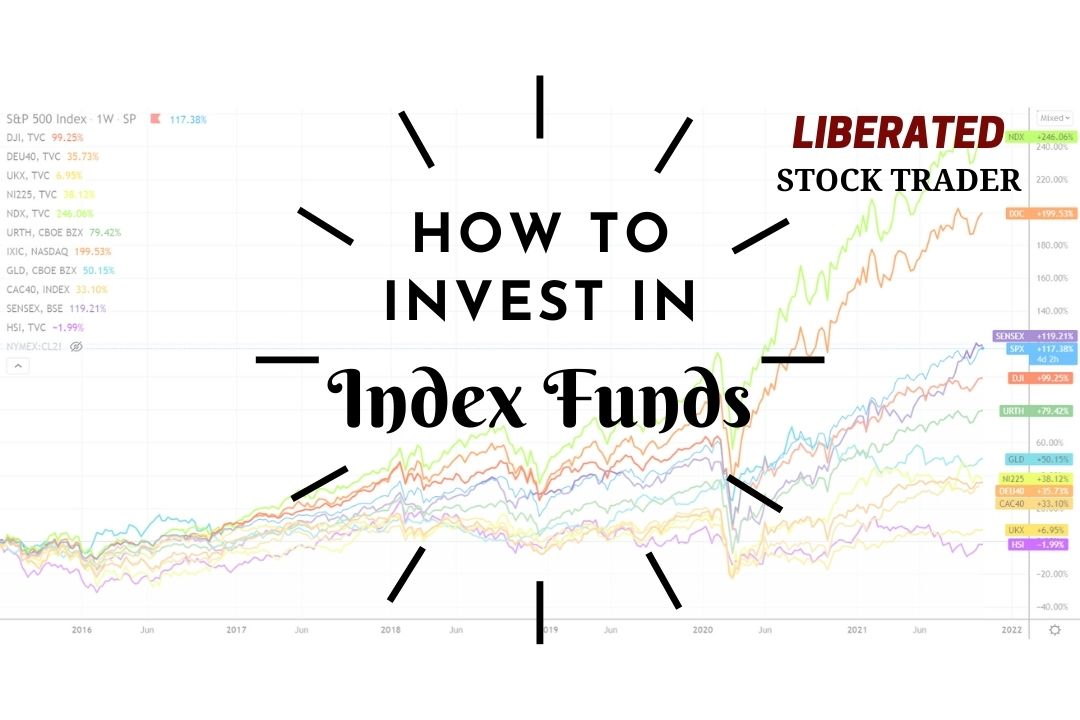

Total Stock Market Index Performance

In the past five years, several index funds have generated varying returns based on the performance of their respective stock market indices. Let’s take a look at the performance of the CAC 40, S&P 500, SENSEX, NASDAQ 100, DAX, and Russell 3000 index funds:

CAC 40

The CAC 40 is a benchmark French stock market index. Over the last five years, the CAC 40 has experienced reasonable growth, with a return of 32.5%.

S&P 500

The S&P 500 represents the performance of 500 large-cap U.S. companies. Over the last five years, the S&P 500 has experienced substantial growth, with a return of 54%.

SENSEX

The SENSEX is India’s benchmark stock index of the Bombay Stock Exchange (BSE).

The SENSEX has shown a positive upward trend in the last five years, with an average return of approximately 70%.

NASDAQ 100

The NASDAQ 100 comprises the largest non-financial companies listed on the NASDAQ stock exchange. Over the past five years, the NASDAQ 100 has displayed impressive growth, 99.54%.

DAX

The DAX is a stock market index representing Germany’s 30 largest and most actively traded companies. In the last five years, the DAX has demonstrated decent performance, with a return of 27%.

Russell 3000

The Russell 3000 is a broad-based stock market index that includes the 3,000 largest publicly-traded U.S. companies. Over the past five years, the Russell 3000 has exhibited solid growth, with a return of 47%.

FAQ

What is the best software for researching total stock market funds?

Stock Rover is a top choice for in-depth research and streamlined ETF portfolio management. Its user-friendly platform offers current market data, fund performance, dividend history, and more. Simplify your investment journey with Stock Rover's robust features and seamless user experience.

What are total stock market index funds?

Total Stock Market Index Funds aim to track the performance of a broad market index, such as the CRSP US Total Market Index, providing investors with exposure to a wide range of stocks across different sectors and market capitalizations.

What are the key features of total stock market index funds?

Total stock market index funds offer diversification by holding many stocks and lower expense ratios than actively managed funds. They also provide easy access to the entire stock market in a single investment.

How do total stock market index funds work?

Total stock market index funds use a passive investment approach, aiming to replicate the performance of the underlying index. They typically hold the same stocks in the same proportions as the index they track.

Who should invest in total stock market index funds?

Total stock market index funds are suitable for long-term investors seeking broad market exposure, diversification, and a low-cost investment strategy.

What factors should I consider before investing in total stock market index funds?

Consider your investment goals, risk tolerance, and time horizon. Review the fund's expense ratio, tracking error, and historical performance. Confirm the fund's diversification and ensure it aligns with your desired exposure.

What are the advantages of investing in total stock market index funds?

The advantages of total stock market funds are low costs and expense ratios, diversification across the entire stock market, and simplicity and ease of investing.

How have Total Stock Market Index Funds performed historically?

Historical performance has shown that Total Stock Market Index Funds tend to deliver returns in line with the overall stock market performance over the long term.

How do Total Stock Market Index Funds compare with actively managed funds?

According to the S&P 500 SPIVA reports, Total Stock Market Index Funds generally outperform a significant percentage of actively managed funds due to their low fees and broad market exposure.

How can I start investing in Total Stock Market Index Funds?

- Open an investment account with a reputable brokerage firm.

- Choose a Total Stock Market Index Fund that aligns with your investment goals.

- Invest by purchasing shares of the fund through your brokerage account.