A 5 Step Screening Strategy To Find Top Dividend Growth Stocks

To find the best dividend growth stocks, we need to screen for specific criteria. Find stocks with a 10+ year history of growing dividends, a sustainable payout ratio, 5-year sales growth over 4%, and a margin of safety greater than 0.

LiberatedStockTrader’s Guide to Dividend Investing

Our step-by-step guide covers four dividend strategies: high yield, safe dividends, long-term dividend growth, and dividend value stocks. It also shows you the tools and screening criteria you need to find high-quality dividend stocks.

Find Great Defensive Stocks with Ben Grahams Protection Strategy

The best way to find defensive stocks is by using Benjamin Graham's timeless rules for the defensive investor: Stability, earnings, dividends, price-to-book ratio, and the price-to-Graham number.

Understanding Preferred Stock Dividends

Preferred stock dividends are a form of payment made to preferred stock shareholders. Preferred stock is a type of ownership in a company granting privileges such as priority over common stockholders in the event of bankruptcy or liquidation.

Are Reinvested Dividends Taxable & How To Reduce It?

Reinvested dividends are generally taxable. The tax rate usually depends on the type of dividend received and your income tax bracket. For example, qualified...

Are Dividend Reinvestment Plans (DRIPs) Worth It?

Dividend reinvestment plans are an effective way to reinvest dividends directly with a company to accumulate more shares over time without having to pay commission fees for each transaction. This allows for a steady stream of cost-effective income for the investor and stability for the company.

Common vs. Preferred Stock: Strategy Differences & Examples

Common stock has voting rights and price appreciation in line with market prices, whereas preferred stock does not. However, preferred stock has higher priority dividend payments and liquidity rights in case of insolvency. The downside of preferred stock is that it has no voting rights, and they are callable.

How to Calculate Dividend Yield & Triple Your Income

To calculate dividend yield, divide the stock's annual dividend per share by the stock's current market price. The dividend yield increases as share prices drop, so to triple your yields, buy stock price panic crashes.

3 Tested Strategies To Find High-Yield Dividend Stocks:

High-yield dividend stocks are a double-edged sword. The higher the dividend yield, the harder it is for the company to keep paying the high dividend.

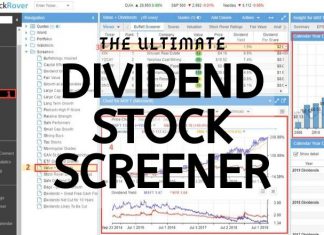

6 Steps to Implement 4 Dividend Stock Screening Strategies

Our research shows you how to create the best dividend stock screener; you must decide on a high-yield, safe, or dividend growth strategy. Next, choose our tested criteria for your screener, like payout ratio, yield, and coverage.

7 Strategies to Find Quality Value Stocks Paying Dividends

Our research combines criteria for selecting value stocks and dividend-paying stocks to create seven strategies for finding under-valued dividend stocks. We include the exact criteria to use and a step-by-step guide to implementing them into a stock screener.

Ordinary vs. Qualified Dividends Less Tax & More Profit

Ordinary dividends are taxed at the individual investor's marginal rate, while qualified dividends are subject to a lower tax rate. Qualified dividends must also meet certain criteria like holding period and stock ownership.

How to Take Advantage of Qualified Dividends

Investors need to ensure that the stocks they hold meet specific criteria set by the IRS to take advantage of qualified dividends. These criteria include holding the stock for 60 days for common stock and 90 days for preferred stock.

4 Experts Reveal Favorite Dividend Investing Strategies

All dividend stocks share one big similarity: their ability to produce earnings. Pay attention to the history and safety of these companies' dividend payments and the potential for these payments to grow, and increasing wealth follows from there.

10 Tips For Investing In Dividend Stocks Like A Pro

The best way to build long-term wealth is to invest discretionary income into high-quality dividend stocks, reinvest dividends, and let the magic of compounding work over time.

Dividend Investing: Strategy, Research & Software for Income Investors.

Dividend investing is a strategy of investing in stocks that regularly pay dividends, with the objective of building a passive income for retirement. It can also be used to generate income in the present while protecting your capital from market volatility.

Our Best Training & Strategies

Liberated Stock Trader Pro: Learn Stock Market Investing

Learn stock market investing with the complete online stock trading course by Barry D. Moore, a certified financial analyst from the International Federation of Technical Analysts (IFTA).

ETF Investing Strategy: MOSES Improves Performance & Lowers Risk

The MOSES ETF investing strategy is a powerful suite of indicators meticulously backtested over 100 years. Designed to empower you to outperform the market, it equips you with the tools to navigate major stock market crashes and unlock greater investing performance.

LiberatedStockTrader’s Strategy Beat the Market By 102%

Decades of research and testing unveiled the Liberated Stock Trader Beat the Market System. Our 9-year, backtested, and proven strategy targets 35 financially healthy high-growth stocks, producing a track record of beating the S&P 500 by 102%.

TradingView Review 2024: Tested by LiberatedStockTrader

LiberatedStockTrader's review testing awards TradingView 4.8 stars due to excellent stock chart analysis, pattern recognition, screening, and backtesting. TradingView is our top recommendation for US and international traders.

Stock Rover Review 2024: Tested by LiberatedStockTrader

LiberatedStockTrader's review testing awards Stock Rover 4.7 stars. Its advanced screening, research, and portfolio tools are ideal for US value, income, and growth investors. With 650 financial metrics on 10,000 stocks and 44,000 ETFs, we rate Stock Rover the number one stock screener.

Trade Ideas Review 2024: AI Tested by LiberatedStockTrader

Our in-depth testing shows Trade Ideas is the ultimate black box AI-powered day trading signal platform with built-in automated bot trading. Three automated Holly AI systems pinpoint trading signals for day traders.

TrendSpider Review 2024: Certified Analyst Test & Rating

Our TrendSpider testing finds it is ideal for US traders wanting AI-automated charting, pattern recognition, and backtesting of stocks, indices, futures, and currencies.

Benzinga Pro Real-time News Tested by LiberatedStockTrader

Our testing shows Benzinga Pro is best for US traders who want a high-speed, actionable, real-time news feed at 1/10th of the price of a Bloomberg terminal. I recommended Benzinga Pro for active day traders and investors who trade news events.

MetaStock Review 2024: Tested by LiberatedStockTrader

Our MetaStock review and test reveal an excellent platform for traders, with 300+ charts and indicators for stocks, ETFs, bonds & forex globally. Metastock has solid backtesting and forecasting, and Refinitiv/Xenith provides powerful real-time news and screening.