Decades of research and testing unveiled the Liberated Stock Trader Beat the Market System. Our 9-year, backtested, and proven strategy targets 35 financially healthy high-growth stocks, producing a track record of beating the S&P 500 by 102%. ☆ Research You Can Trust ☆ My analysis, research and testing stems from 25 years of trading experience and my Financial Technician Certification with the International Federation of Technical Analysts.

This system gives you an investing edge by identifying the 35 best growth stocks to buy now. This information can help you beat the S&P500, Nasdaq 100, or Russell 3000 and grow your portfolio.

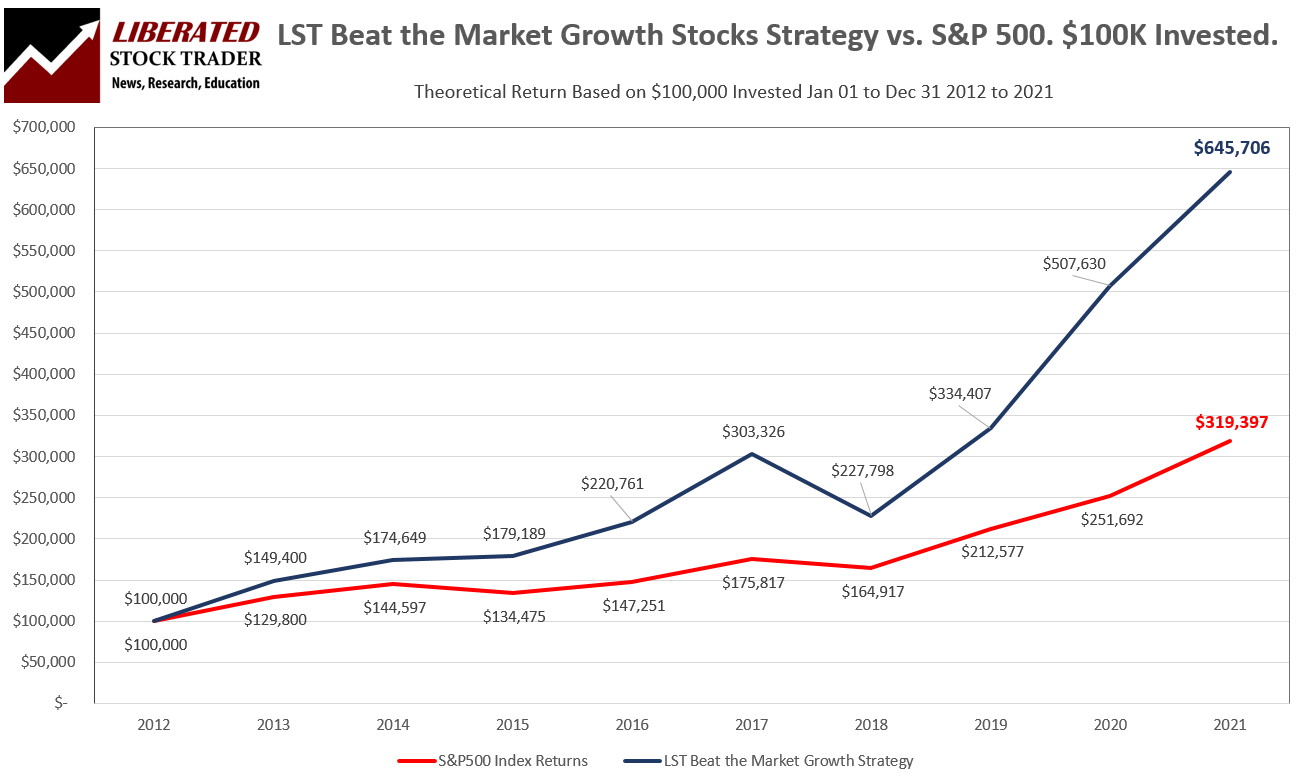

The Liberated Stock Trader Beat the Market (LSTBTM) Growth Stock Strategy has outperformed the S&P500 in 8 of the last nine years, providing a 9-year total return of 546%, beating the S&P500 by 102%.

The Liberated Stock Trader Beat the Market (LSTBTM©) growth stocks strategy identifies the 35 best stocks to buy now with a significant chance of beating the S&P500 returns. The system uses growth in free cash flow and explosive EPS growth. Combining this with Joel Greenblatt’s ROC and Earnings Yield formulas, “the Magic Formula,” we have a selection of stocks that beat the market in 8 of the last 9 years.

Investing in stocks can be difficult, but our strategy makes it easy by providing the research and data needed to make informed decisions. You no longer have to spend hours finding good stocks—we’ve done all that hard work for you!

All you need is the desire to succeed and start using our strategy today.

A Unique Market Beating System

LSTBTM Selects 35 Growth Stocks With A Significant Proven Chance to Outperform The Stock Market

★ Stocks That Have Strong Earnings Growth ★

★ Stocks That Make Great Use Of Their Assets ★

★ Stocks With A Growing Cashflow ★

★ Stocks That Already Beat The Market ★

★ Buy The Stocks & Hold For 12 Months – Then Rotate ★

LSTBTM Takes The Pain Out Of Stock Selection

This research has been made possible due to the fabulous work done by the team at our partner Stock Rover, who created a stock research and screening platform that won our in-depth Best Stock Screener Review for the last two years.

Why is Stock Rover so special when creating superior stock screeners? Because Stock Rover maintains a clean 10-year historical database of hundreds of vital ratios, calculations, and metrics, meaning you can travel back in time to test if your stock selection criteria have worked in the past.

What is Beating the Market?

To beat the market, your growth stock investments must outperform the underlying stock index. In the USA, the market to beat is generally the 8% annual return of the S&P500 index. Anyone could beat the market in a single year, but the key challenge is outperforming the market over the long term.

Beating the market is nirvana for every investor. Typically, it should be, but many investors realize that it can be tough to outperform the stock market’s returns year after year.

LST Beat the Market Growth Stocks Strategy

Outperforming the S&P 500 benchmark is the goal of active fund managers, but 78% failed to achieve it over the last five years, and here are the market statistics to prove it.

“I have been inspired by the work of Joel Greenblatt and William J. O’Neil. But these strategies need something extra,” said Barry D. Moore, Founder of LiberatedStockTrader.com and certified financial technician. “Screening for companies with increasing Cash Flow and Earnings Growth is a well-established best practice. Combined with Earnings Yield and Return on Capital, you have a foundation of financially stable growth stocks.”

“The strategy adds a new twist by selecting companies that have beaten the S&P 500 in the trailing 12 months.”

The goal was to create a simple strategy to make yearly profits that exceed the S&P500’s returns.

The LST Beat the Market strategy has successfully outperformed the S&P 500 in 8 of the last 9 years, providing a total return of 546% versus the S&P 500’s 219%.

The strategy suits individual investors by selecting only 15 to 35 stocks annually.

This system has proven to be very successful in 8 of the last 9 years, but like any stock investing system, there are no guarantees of future success.

The LST Beat the Market Growth Stocks Strategy Performance Chart.

The LST Beat the Market Growth Stocks Strategy Performance Table.

| 9 Year Performance | S&P500 % Gain Jan 1st to Dec 31st | LST Beat the Market Growth Strategy % Gain | Result |

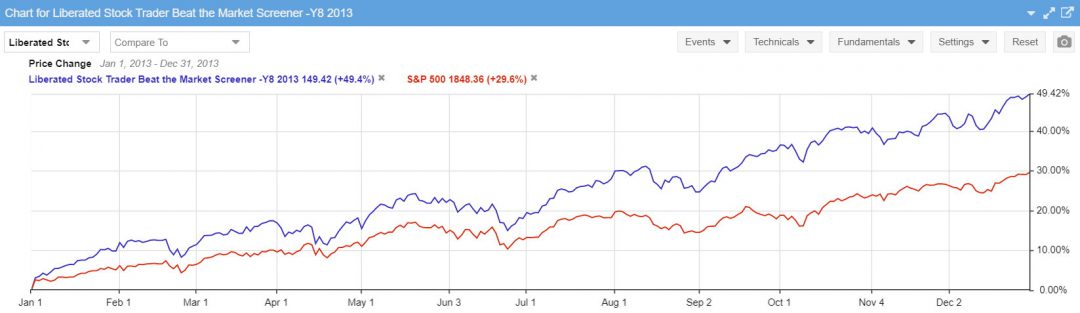

| 2013 | 29.8% | 49.4% | Beat |

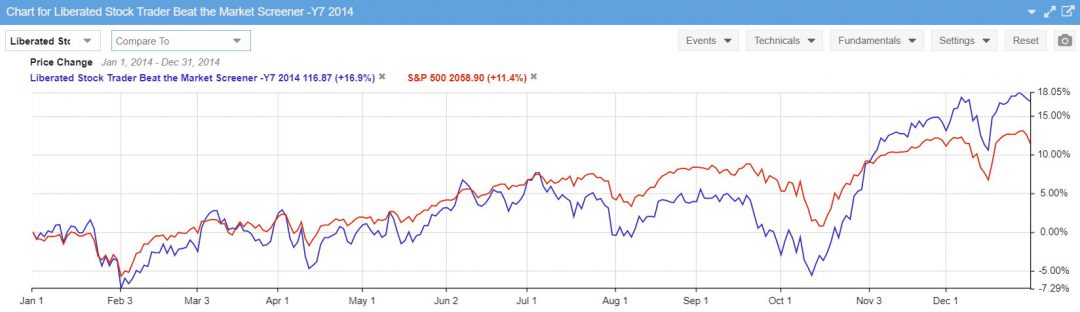

| 2014 | 11.4% | 16.9% | Beat |

| 2015 | -0.7% | 2.6% | Beat |

| 2016 | 9.5% | 23.2% | Beat |

| 2017 | 19.4% | 37.4% | Beat |

| 2018 | -6.2% | -24.9% | Lost |

| 2019 | 28.9% | 46.8% | Beat |

| 2020 | 18.4% | 51.8% | Beat |

| 2021 | 26.9% | 27.2% | Beat |

| Average Yearly Return | 15.27% | 25.6% | Beat |

9-Year Results Based on $100,000 Invested.

| Returns | S&P500 Index Returns | LST Beat the Market Growth Strategy |

| Initial Investment | $100,000 | $100,000 |

| 2013 | $129,800 | $149,400 |

| 2014 | $144,597 | $174,648 |

| 2015 | $134,475 | $179,189 |

| 2016 | $147,250 | $220,761 |

| 2017 | $175,817 | $303,326 |

| 2018 | $164,916 | $227,797 |

| 2019 | $212,577 | $334,407 |

| 2020 | $251,961 | $507,630 |

| 2021 | 319,397 | $645,706 |

| Cumulative 9 Year % Gain | +219% | +546% |

| LST Beat The Market By: | 102% |

As you can see, the S&P500 turned $100,000 into $319,397 over the last 9 years. The LST Beat the Market Growth Stocks Strategy turned $100,000 into $645,706 over the same period. These results show that LSTBTM beat the market by 102%.

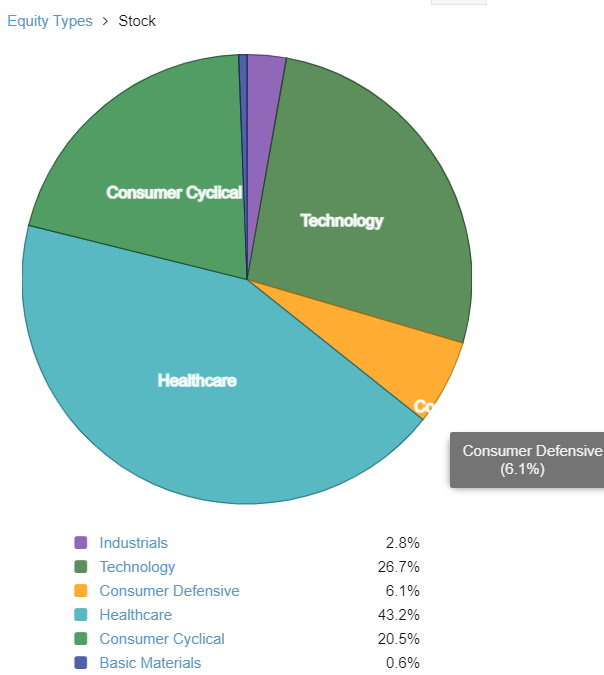

LST Beat the Market Growth Stocks Portfolio Allocation 2021

Stock Rover provides the engine to run the screening criteria and has excellent portfolio analytics. Here, you can see the strategy selected 35 stocks for 2021. The companies selected are heavily weighted toward Technology, Consumer Cyclical, and Healthcare.

Historical Performance Charts.

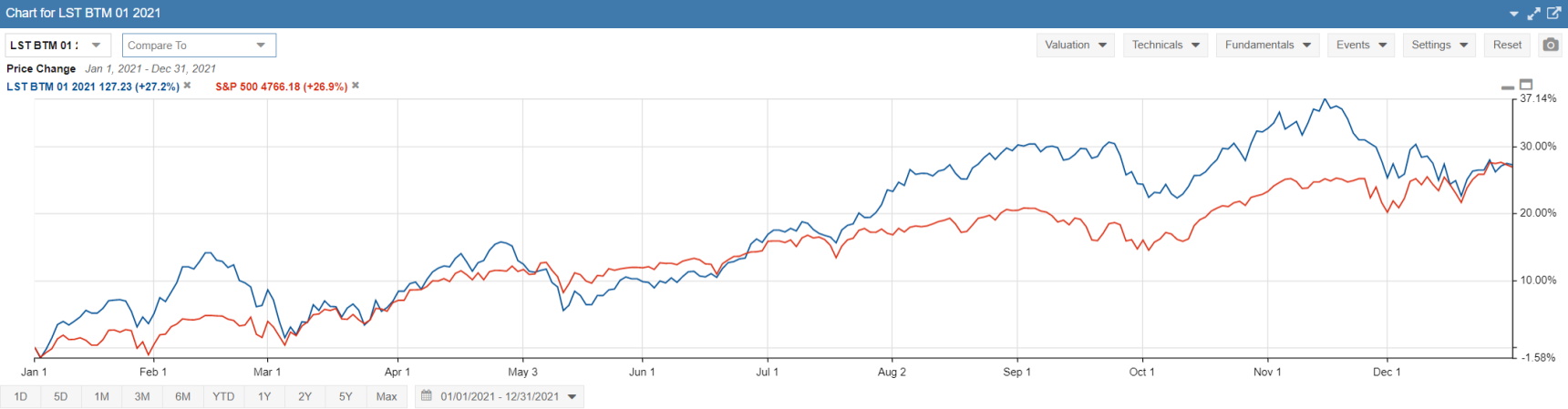

Beat the Market Growth Stocks Strategy Performance vs. S&P500, 2021

For 2021, the LST Beat the Market Growth Stock Strategy outperformed the market by 10% in the second half and marginally outperformed the market by 0.3%. In 2021, 35 stocks met the screening criteria. Since its inception in 2012, the LSTBTM growth stocks strategy has returned 546% versus the S&P500, which gained 219%, for a total outperformance of 102%. This year, the system outperformed the Nasdaq Composite, Nasdaq 100, and the DJ-30.

Beat the Market Growth Stocks Strategy Performance vs. S&P500, 2020

For 2020, the LST Beat the Market Growth Stock Strategy has done very well; although only 13 stocks met the criteria, the LSTBTM growth stocks strategy has returned 51.8% versus the S&P500, which gained 18.4%. An outperformance of 33.4% in a year that was hampered by the COVID-19 outbreak.

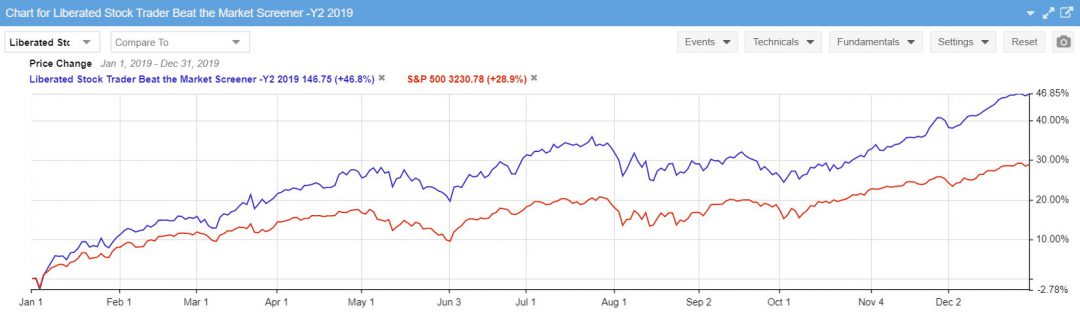

Beat the Market Growth Stocks Strategy Performance vs. S&P500, 2019

In 2019, the clock starts on Jan 1st and ends on Dec 31st. For 2019, the LSTBTM strategy returned 46.8% versus the S&P500 of 28.9%, a beat of 17.9%.

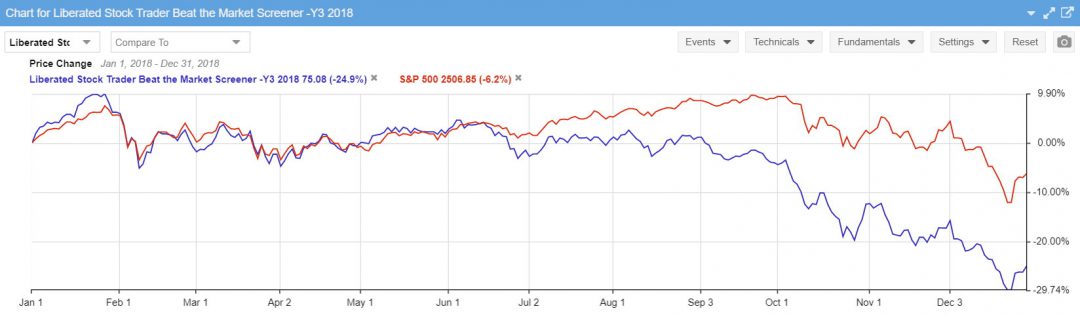

Beat the Market Growth Stocks Strategy Performance vs. S&P500, 2018

2018 was the only year in the backtest where the LST Beat the Market strategy lost significantly to the S&P500. While it was a losing year for both the strategy and the market, the S&P returned -6.2%, while the LSTBTM lost 24.9%.

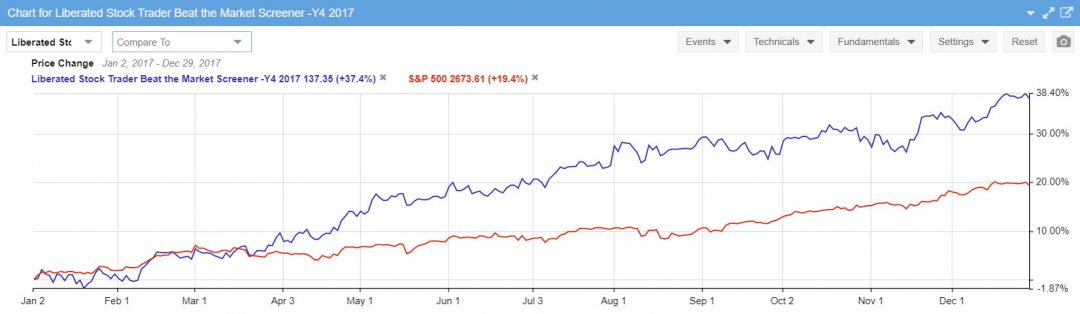

Beat the Market Growth Stocks Strategy Performance vs. S&P500, 2017

2017 was another good year for the LSTBTM growth stocks strategy, beating the market by 17.8%. The S&P500 had a solid year, returning 19.4%, while the LSTBTM returned 37.4%.

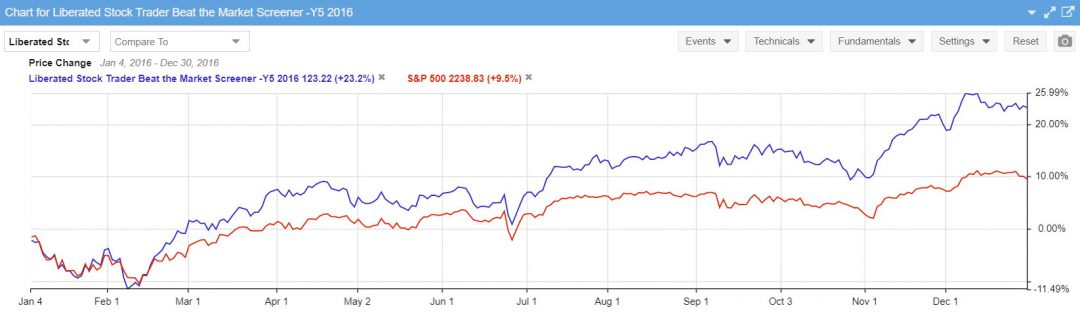

Beat the Market Growth Stocks Strategy Performance vs. S&P500, 2016

2016 was an average year for the market, with the S&P500 returning 9.5% while the Beat the Market Growth Stock Strategy made a profit of 23.2%.

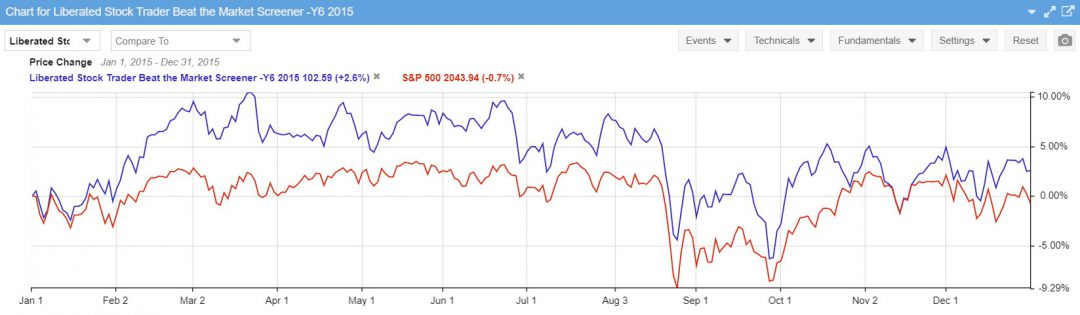

Beat the Market Growth Stocks Strategy Performance vs. S&P500, 2015

2015 was a battle to make a profit for the system and the S&P500. While the LST system led the S&P500 for the entire year, the S&P500 lost 0.7%, while the LSTBTM squeezed a profit of 2.8%.

Beat the Market Growth Stocks Strategy Performance vs. S&P500, 2014

Although the S&P500 was leading LSTBTM for most of the year, in October 2014, things turned around, and the selected stocks surged to beat the market again by 16.9% vs. 11.4%.

Beat the Market Growth Stocks Strategy Performance vs. S&P500, 2013

2013 was the furthest year back we could backtest. The main reason is that we use three years of data in the growth stock screener’s criteria, and Stock Rover maintains a 10-year historical database, thus seven years of backtesting. 2013 saw LSTBTM return an impressive 49.4%, while the S&P500 increased by 29.6%.

Are You Ready To Choose Great Stocks?

What Is Included in the LST Beat The Market Strategy?

★ 5 Module Video Training Course ★

★ System Integrated In Stock Rover* ★

★ The LST Beat the Market eBook ★

★ All the Criteria & Logic to Implement Into Any Software ★

★ Email Support ★

★ Lifetime Access to All Videos and Tools ★

Buy Now & Don’t Forget If You Are Not Completely Happy, You Get a Full Refund. Just Let Me Know Within 90 Days.

Imagine what it would feel like to have beaten the market for nine years. Wouldn’t that be incredible?

Now is your chance to make that happen.

Pay Securely With PayPal or Credit Card $299 Now $199

If you have any questions on the course or issues with the payment process, please get in touch with me directly on

✉ support (at) liberatedstocktrader.com.

LST Beat the Market Strategy: The Best Stocks to Buy Now

Find the best growth stocks to buy now using a 9-year tested and proven strategy system that selects stocks that outperform the S&P 500. Instead of following stock tips from financial websites, you can adopt a structured approach to find stocks with a proven track record of beating the market.

Course Provider: Organization

Course Provider Name: Liberated Stock Trader

Course Provider URL: https://www.liberatedstocktrader.com/best-growth-stocks-to-buy-now/

Course Mode: Online

Course Workload: PT5H

Duration: PT3H

Repeat Count: 1

Repeat Frequency: Daily

Course Type: Paid

Course Currency: USD

Course Price: 199

4.98

Warranty

As with any stock market investing system, nothing is guaranteed to work in the future as it did in the past. The more institutions that utilize a system, the more ineffective it becomes. So this beat the market growth stocks strategy, and LiberatedStockTrader.com accepts no liability for your use of this work. Liberated Stock Trader does not recommend purchasing specific stocks and accepts no liability for any losses incurred. By using this or any other published article for investing purposes, you agree to our disclaimer.

- You will need a Stock Rover Premium Plus subscription to use the system with Stock Rover.

To date (2022), this system has proven very effective, but there is no guarantee of future performance.