The Money Flow Index (MFI) is a technical analysis volume-weighted momentum indicator that helps traders determine the strength of money flowing in and out of a security.

☆ Research You Can Trust ☆

My analysis, research, and testing stems from 25 years of trading experience and my Financial Technician Certification with the International Federation of Technical Analysts.

Unlike other trading indicators that focus solely on price data, the Money Flow Indicator introduces volume as a crucial component for gauging market sentiment.

Based on 13,396 years of data, our money flow indicator testing proves it is a good indicator for traders, producing outsized profitable trades over time.

Find out how to use the Money Flow Index to improve your trading strategies and take advantage of market movements.

Key Takeaways

- The Money Flow Indicator combines price and volume data to measure buying and selling pressure.

- It oscillates between 0 and 100 to provide insights confirming trend strength or warning of reversals.

- An MFI line below 20 is seen as oversold, indicating a potential buy signal.

- An MFI above 80 is considered overbought, a potential sell signal.

- Our rigorous testing suggests the MFI is remarkably profitable, with a success rate of 43%.

- By utilizing the optimal timeframe and settings, the Money Flow Index can prove lucrative.

How to Trade the Money Flow Index (MFI) Indicator

6 Tips for Trading the Money Flow Indicator

To optimally trade using the MFI indicator, traders should look for overbought, oversold, and divergence conditions as key signals. For the best results, consider backtesting your strategy.

1. Overbought and Oversold Levels

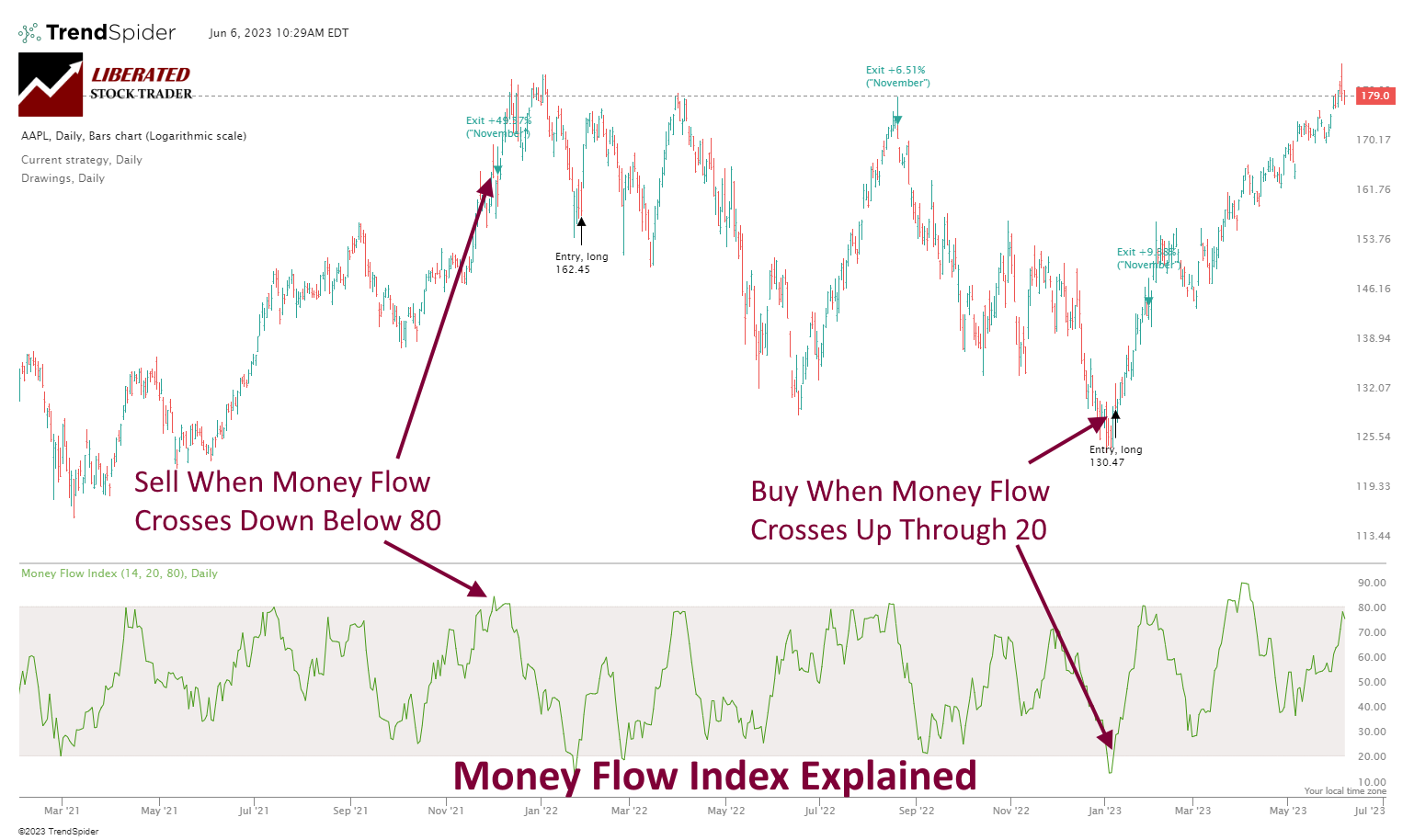

The MFI oscillates between 0 and 100, providing overbought and oversold signals. When the MFI exceeds 80, the market is considered overbought, suggesting prices may fall. Conversely, an MFI below 20 indicates an oversold condition where prices might rise.

Chart Produced with TrendSpider

2. Divergence with Price Action

It would be best if you watched for divergences between the MFI and price action, as they can signal upcoming reversals. A bullish divergence occurs when the price hits a new low, but the MFI does not, potentially forecasting an upward price reversal. Conversely, a bearish divergence is when the price reaches a new high, and the MFI fails to follow, portending a downward price reversal.

3. Failure Swings and Trend Reversals

Failure swings help predict trend reversals. A bullish failure swing happens when the MFI falls below 20, rises above it, and surpasses its prior high. Similarly, a bearish failure swing occurs when the MFI goes above 80, drops below this threshold, and falls below its previous low.

4. Comparison with Other Indicators

Lastly, compare the MFI’s readings with other indicators, such as the Relative Strength Index (RSI), to confirm signals. While the RSI focuses on price alone, the MFI incorporates volume, providing a more comprehensive view of the market’s momentum. Using them in tandem enhances the reliability of your analysis.

Our original trading research is powered by TrendSpider. As a certified market analyst, I use its state-of-the-art AI automation to recognize and test chart patterns and indicators for reliability and profitability.

✔ AI-Powered Automated Chart Analysis: Turns data into tradable insights.

✔ Point-and-Click Backtesting: Tests any indicator, pattern, or strategy in seconds.

✔ Never Miss an Opportunity: Turn backtested strategies into auto-trading bots.

Don't guess if your trading strategy works; know it with TrendSpider.

5. Avoid False Signals

MFI can trigger false signals due to price spikes and unusual market events. Use additional verification measures such as trend lines or moving averages to reduce false signals. Also, consider thresholds such as an MFI reading of 90 for overbought and 10 for oversold to ensure more robust trading signals. This adjusted threshold acts as an extra filter, potentially giving you a higher chance of identifying legitimate market turning points.

6. Backtest the MFI For Your Strategy

As with any technical indicator, it is crucial to backtest the MFI for your trading strategy. It may work well in certain market conditions but fail in others. By analyzing historical data and evaluating its performance, you can determine whether the MFI is reliable for your trading style.

Below is the link to our comprehensive analysis of the money flow index, providing valuable insights and in-depth testing.

Money Flow Index (MFI) Explained: Best Settings & Reliability Tested

Understanding Money Flow

The MFI calculates a ratio between positive and negative money flow using typical price, which is the average of high, low, and close for each period. A rising MFI suggests increasing buying pressure, while a falling MFI indicates increasing selling pressure.

How to Calculate MFI:

MFI is calculated in a four-step process:

- Typical Price Calculation:

You determine the typical price for each period by adding the high, low, and close prices, then dividing by three. - Raw Money Flow:

The typical price is then multiplied by the volume for the period to calculate raw money flow. - Positive and Negative Money Flow:

You have a positive money flow when the typical price exceeds the previous period’s. If it’s less, you have a negative money flow. MFI cumulates positive and negative money flows over a chosen period, usually 14 days. - Money Flow Ratio and MFI:

The money flow ratio is then found by dividing the total positive and negative money flow. Finally, you use the money flow ratio to calculate MFI through the following formula:

MFI = 100 – (100 / (1 + money flow ratio))

Interpreting MFI:

- Values over 80 typically indicate that the asset is overbought and may be primed for a price decline.

- Values under 20 suggest the asset is oversold and could be headed for a price increase.

Incorporating MFI into your trading strategy can guide you in identifying potential reversals, trend strengths, and entry/exit points.

Money Flow Index Calculation

In this section, you’ll learn how to calculate the Money Flow Index (MFI), a volume-weighted relative strength indicator often used to identify overbought or oversold conditions in a security.

Calculation of Typical Price

To begin, you must determine the Typical Price for each period, which is the average of the high, low, and close prices.

Typical Price = (High + Low + Close) / 3

Calculation of Raw Money Flow

Next, calculate the Raw Money Flow by multiplying the typical price by the volume for the period. This step captures the money flowing into or out of the security.

Raw Money Flow = Typical Price * Volume

Calculation of Money Flow Ratio

The Money Flow Ratio compares the positive and negative money flows over a specified number of periods, typically 14 days.

- Positive Money Flow: Sum of Raw Money Flows on days when the Typical Price exceeds the previous period.

- Negative Money Flow: Sum of Raw Money Flows on days when the Typical Price is lower than the previous period.

Money Flow Ratio = (Sum of Positive Money Flows) / (Sum of Negative Money Flows)

Money Flow Index (MFI) Formula

Finally, the Money Flow Ratio calculates the MFI, which oscillates between 0 and 100.

MFI = 100 – (100 / (1 + Money Flow Ratio))

This calculation considers price and volume, making it a powerful tool for assessing buying or selling pressure.

Technical Indicators Comparison

In technical analysis, different indicators offer unique perspectives on market conditions. Understanding how indicators compare and complement each other can enhance your trading strategies.

MFI vs. RSI

The Money Flow Index (MFI) and the Relative Strength Index (RSI) are both momentum oscillators but incorporate different data sets. The MFI uses both price and volume to measure buying and selling pressure. RSI focuses solely on price movements to assess overbought or oversold conditions.

| MFI vs. RSI | MFI | RSI |

|---|---|---|

| Data Used | Price, Volume | Price |

| Type | Volume-weighted momentum indicator | Momentum oscillator |

| Overbought Range | Above 80 | Above 70 |

| Oversold Range | Below 20 | Below 30 |

Both indicators oscillate between 0 and 100, with high readings suggesting overbought conditions and low readings indicating oversold conditions. However, due to the inclusion of volume, the MFI may provide a more comprehensive view of the momentum by considering the intensity of money flowing in and out of the market.

RSI Indicator Explained: Best Settings & Strategy Researched

Combining MFI with Other Indicators

When you combine the MFI with other indicators, you can confirm trends or foresee potential reversals. Using the MFI alongside trending indicators like moving averages can help you discern the trend’s strength based on volume activity. For instance, a rising moving average with a high MFI could indicate a strong uptrend backed by significant buying pressure.

Additionally, it’s beneficial to compare MFI readings against price action. A divergence occurs when the indicator moves in the opposite direction of the price – signaling a weakening trend that could lead to a reversal. Pairing the MFI with other indicators, such as those related to volatility or price patterns, can give you a more rounded analysis.

Adopting a multi-indicator strategy can help mitigate risks and reinforce decision-making. It’s important to remember that no indicator is foolproof, and combining various indicators can help verify signals and avoid false positives.

Chart Patterns and MFI

Money Flow Indicator (MFI) is a tool that analyzes both price and volume to measure buying and selling pressure. It’s particularly useful for confirming chart patterns, which can signify potential trend reversals or continuations in a security’s price.

Spotting Price Reversal Patterns

When you use MFI with price reversal patterns on a chart, you can gauge potential reversals in market trends. A common pattern to observe is the Head and Shoulders. You should watch out for this high-probability pattern, as it typically signals a reversal after a bullish trend.

When the MFI diverges, for instance, showing lower highs when the stock price hits higher highs, it suggests a weakening in buying pressure that may precede a trend reversal.

Another key pattern is the Double Top, where the price reaches a high twice but fails to break through. A subsequent drop in MFI indicates reduced buyer enthusiasm and a potential reversal to a bearish trend.

Identifying Continuation Patterns

Continuation patterns are integral to pattern analysis as they indicate that a trend is likely to persist. The flag and pennant formations are your go-to when analyzing charts for these patterns. A flag pattern, noticed by a small rectangular dip in a stock’s price action following a steep rise, suggests that the initial bullish trend may continue. If the MFI stays level or rises during this period, it can confirm the bullish sentiment behind the continuation.

Influence of Market Forces

Your ability to interpret the Money Flow Indicator (MFI) greatly depends on the interplay of market forces.

Impact of Market Volatility

Market volatility refers to the rate at which the price of a security increases or decreases for a given set of returns. High volatility in the market often leads to wider price extremes and may result in price gaps. When evaluating the Money Flow Indicator:

- Price extremes and gaps: You should note that during periods of high volatility, price extremes are magnified, which can cause the MFI to spike or plummet, signaling potential overbought or oversold conditions.

- Trading volume: It is also key to observe that an increase in daily trading volume typically accompanies these price movements, affecting the MFI calculation.

Understanding Volume Dynamics

The MFI is a volume-weighted measure, making understanding volume dynamics crucial. Volume data reflects the number of shares traded over time and encapsulates the strength behind price movements.

- Shares and trading: You’ll notice that when the number of shares traded is high at certain price levels, it suggests strong market interest at those prices, which can impact your interpretation of the MFI’s signals.

- Investors and trading volume: As investors engage with the market, trading volume shifts can indicate changes in market sentiment. The MFI can help you visualize these shifts over time, provided you analyze volume data correctly.

Volume trends and price action can be powerful indicators of how market forces such as supply and demand interact. Keeping a keen eye on these trends will help you understand the power behind the market movements.

Money Flow Trading in Different Markets

Money Flow analysis is a critical tool for gauging the strength of buying and selling pressure across various markets. Quantifying the trade volume in relation to price movements provides a lens through which to interpret the underlying demand or lack thereof for a given asset.

MFI in Stock Markets

Applying the Money Flow Indicator (MFI) in the stock market is a technical oscillator that combines price and volume data to identify overbought or oversold conditions. Here’s a brief guide to using MFI within stock markets:

- Overbought and Oversold Levels: Typically, an MFI above 80 indicates that the stock may be overbought, suggesting a potential price downturn, while an MFI below 20 might signify an oversold condition, hinting at a possible price upswing.

- Divergence: As a trader, watch for divergence between the MFI and price action. If the stock price hits a new high but the MFI fails to peak, it could point to a weakening trend and possibly a reversal.

MFI in Forex and Commodities

The application of MFI in forex and commodities markets involves looking at the global money flow into and out of these assets to spot potential trends or reversals.

- Forex Dynamics: In Forex, you monitor the flow of currencies and analyze the MFI to discern the strength of a particular currency pair movement. High MFI values may indicate substantial buying momentum for a currency, while low values can show strong selling pressure.

- Commodities Patterns: With commodities, MFI can help you understand money flow in assets like gold, silver, or oil. A rising MFI may indicate increasing buying pressure, pointing to a bullish sentiment, whereas a falling MFI often reflects growing selling pressure and a bearish outlook.

Backtesting the Money Flow Index Indicator

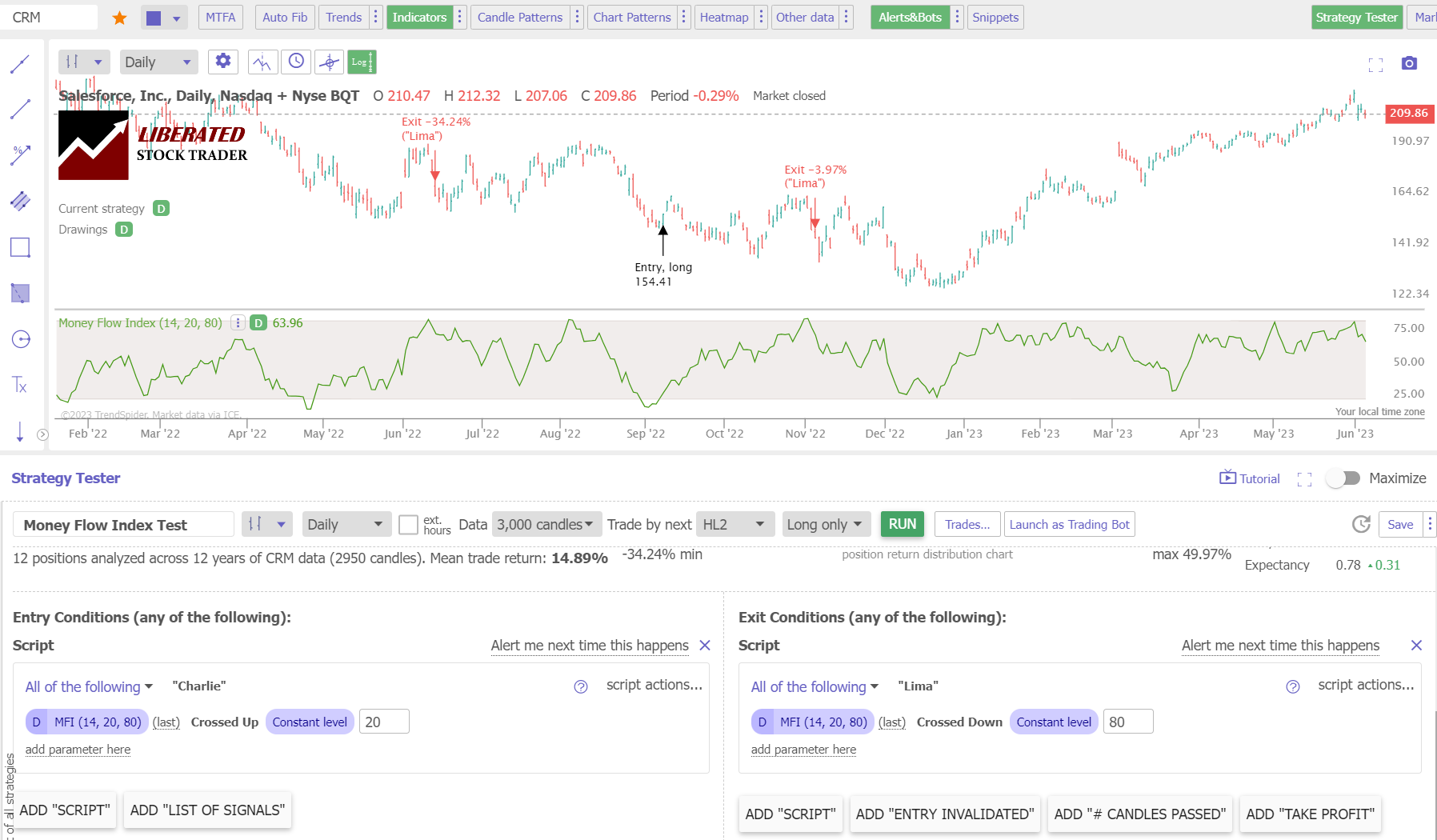

To create a successful trading strategy with the Money Flow indicator, you must backtest the optimal setting for your strategy, timeframe, and asset.

To set up Money Flow Index backtesting in TrendSpider, follow these steps.

- Register for TrendSpider, select Strategy Tester > Entry Condition > Add Script > Add Parameter > Condition > Indicator > Money Flow Index (14) > Crossed Up Through Constant Level 20.

- For the Sell Criteria, select > Add Script > Add Parameter > Condition > Indicator > Money Flow Index (14) > Crossed Down Through Constant Level 80.

- Finally, click “RUN.”

Backtest Your MFI Strategies with TrendSpider

Want to test any indicator, chart pattern, or performance for any US stock? The award-winning TrendSpider software makes it easy! Our Trendspider review unveils insights into discovering the most powerful trading strategy development and testing service.

Practical Tips for Investors

The Money Flow Indicator (MFI) is a potent tool in your trading arsenal, blending price and volume data to gauge buying and selling pressure. Understanding its integration into your trading strategy, tweaking settings for market conditions, and leveraging it for long-term investments can significantly enhance your financial decisions.

Incorporating MFI into a Trading Plan

To effectively integrate MFI into your trading plan, you must first identify your trading style—day trading, swing trading, or position trading. Each style has unique requirements for the duration and sensitivity of technical indicators. MFI can be a confirmation tool within your strategy, signaling when to enter or exit a trade based on overbought or oversold conditions.

- For Swing Traders:

- Use a standard 14-day length to detect medium-term trends and reversals.

- For Day Traders:

- Consider a shorter length, such as a 5 or 7-day period, for quicker responsiveness.

Adjust your thresholds for overbought (>80) and oversold (<20) conditions to align with your risk tolerance and backtest the results to fine-tune your approach.

Adjusting MFI Settings for Different Markets

Different markets may exhibit distinct behavioral patterns, affecting how the MFI should be configured. For instance, a volatile market might require you to adjust the MFI thresholds to reduce false signals, whereas a more stable market could use the standard settings.

- Volatile Markets: Adjust the overbought threshold to 90 and the oversold threshold to 10 to account for extreme fluctuations.

- Stable Markets: You may stay with the conventional 80/20 thresholds.

Remember, while adjusting the length parameter of the MFI, consider the asset’s average market cycles and liquidity to maintain the indicator’s efficacy.

Long-Term Investment Strategies

When applying MFI to long-term investment strategies, it’s crucial to adjust the length of the MFI to reflect the extended investment horizon. A longer-term parameter, such as 21 or 28 days, will smooth out short-term volatility and provide a clearer picture of long-term money flow trends.

- Utilize MFI divergences with price to spot potential long-term trend reversals.

- Apply MFI in conjunction with fundamental analysis for a comprehensive investment strategy.

Concentrating on long-term trends allows the MFI to filter out the noise and focus on the significant flow of funds in and out of securities, which can indicate substantial shifts in market sentiment.

FAQ

How can Money Flow Index be used to analyze the market?

You can use the MFI to discern the strength of money flowing in and out of a security. A high MFI value typically indicates strong buying pressure, while a low MFI suggests strong selling pressure. It is often compared to price action to identify potential reversals or price continuations.

What’s the difference between the Money Flow Index and RSI?

The MFI considers both price and volume, providing a more comprehensive measure of market pressure compared to the RSI, which considers only price changes. The MFI is often seen as a volume-weighted version of the RSI.

What are the optimal settings for the MFI indicator?

Our MFI backtesting research shows using the 14-period timeframe results in higher-than-average success and profitability.

What is the formula for calculating the Money Flow Index?

The formula to calculate the MFI is MFI = 100 - (100 / (1 + Money Flow Ratio)). Here, the Money Flow Ratio equals the 14-period Positive Money Flow divided by the 14-period Negative Money Flow.

How does the Money Flow Index differ from On-Balance Volume (OBV)?

Unlike the MFI, On-Balance Volume (OBV) solely adds or subtracts the volume of a trading period based on the rise or fall in price, not considering the price range itself. MFI assesses the buying and selling pressure by incorporating price and volume data.

How can I use Money Flow for better trading?

The MFI can identify overbought or oversold conditions when it rises above 80 or falls below 20. It is beneficial in confirming trend reversals when divergences between the MFI and price action occur.