Barry D. Moore CFTe

406 POSTS

239 COMMENTS

With a wealth of experience spanning 25 years in stock investing and trading, Barry D. Moore (CFTe) is an author and Certified Financial Technician (Market Analyst) recognized by the International Federation of Technical Analysts (IFTA). Notably, he has also held executive positions in leading Silicon Valley corporations IBM Corp. and Hewlett Packard Inc.

Find Great Defensive Stocks with Ben Grahams Protection Strategy

The best way to find defensive stocks is by using Benjamin Graham's timeless rules for the defensive investor: Stability, earnings, dividends, price-to-book ratio, and the price-to-Graham number.

Understanding Preferred Stock Dividends

Preferred stock dividends are a form of payment made to preferred stock shareholders. Preferred stock is a type of ownership in a company granting privileges such as priority over common stockholders in the event of bankruptcy or liquidation.

What’s a Hedge Fund, How They Work & Are They Worth...

A hedge fund is an investment vehicle that pools capital from high-net-worth investors and flexibly invests in a range of assets, including stocks, bonds, commodities, and derivatives.

Our 5 Step Guide to Screening for CANSLIM Growth Stocks

The best CANSLIM stock screeners to accurately find growth stocks are Stock Rover for US investors and TradingView for international traders. Stock Rover has 3 pre-built CANSLIM screeners, and one is available for free.

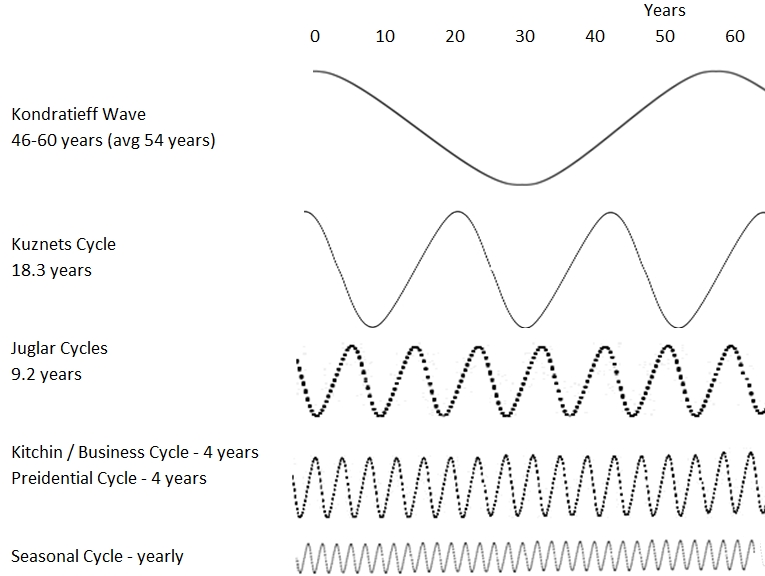

6 Key Business & Economic Cycles Affecting Stocks

Six waves and cycles influence how our economies, businesses, and financial markets expand and contract. The Kondratieff Wave, Kuznets Cycle, Juglar Cycle, Business Cycle, Presidential Cycle, and Seasonal Cycle will change how you see the world.

The Smart Way To Invest in Bonds Profitably

Typically stocks return 7% to 10% per year over ten years, while bonds return a lower 4-6%. Investments in bonds tend to be less volatile than stocks and, thus, provide more consistent returns.

What is CANSLIM Investing & Does It Work? I Test It!

CANSLIM is an active investment strategy that utilizes specific screening criteria such as earnings, market leadership, product innovation, institutional ownership, and stock price trends. These key criteria play a vital role in the process of stock selection.

How to Ensure Your Portfolio is Diversified & Balanced

A well-diversified stock portfolio should have a low correlation to the broader market. This means that your portfolio won't necessarily follow suit when the broad market goes down.

How To Implement 13 Legendary Stock Portfolio Examples

Our years of performance testing reveal the world's best-performing stock portfolios are Berkshire Hathaway, CANSLIM, GreenBlatt's Magic Formula, and the FAANG portfolio. We share examples and show you how to implement them.

How to Calculate Stock Beta: Formula & Examples Explained

To calculate Beta or (β) you need to divide the variance of an equity's return by the covariance of a stock index's return.

11 Real-World Investment Scams to Avoid in 2024

Investment scammers defrauded $8.8 billion from unsuspecting consumers in 2022, a staggering 30% year-on-year surge. Don't fall victim to NFT, Crypto, Forex, Ponzi, or offshore scams.

Are Reinvested Dividends Taxable & How To Reduce It?

Reinvested dividends are generally taxable. The tax rate usually depends on the type of dividend received and your income tax bracket. For example, qualified...

35 Best Growth Stocks To Buy Now To Beat The Market

Find the best growth stocks to buy now using a 9-year tested and proven strategy system that selects stocks that outperform the S&P 500. Instead of following stock tips from financial websites, you can adopt a structured approach to find stocks with a proven track record of beating the market.

Are Dividend Reinvestment Plans (DRIPs) Worth It?

Dividend reinvestment plans are an effective way to reinvest dividends directly with a company to accumulate more shares over time without having to pay commission fees for each transaction. This allows for a steady stream of cost-effective income for the investor and stability for the company.

Value vs. Growth Stocks: Which is Better? We Test The Data!

Our data analysis for the past decade shows that growth stocks have outperformed value stocks. Growth investing has shown a remarkable return rate of 523%, while value investing has yielded 247%.

Common vs. Preferred Stock: Strategy Differences & Examples

Common stock has voting rights and price appreciation in line with market prices, whereas preferred stock does not. However, preferred stock has higher priority dividend payments and liquidity rights in case of insolvency. The downside of preferred stock is that it has no voting rights, and they are callable.

How to Calculate Dividend Yield & Triple Your Income

To calculate dividend yield, divide the stock's annual dividend per share by the stock's current market price. The dividend yield increases as share prices drop, so to triple your yields, buy stock price panic crashes.

3 Tested Strategies To Find High-Yield Dividend Stocks:

High-yield dividend stocks are a double-edged sword. The higher the dividend yield, the harder it is for the company to keep paying the high dividend.

6 Steps to Implement 4 Dividend Stock Screening Strategies

Our research shows you how to create the best dividend stock screener; you must decide on a high-yield, safe, or dividend growth strategy. Next, choose our tested criteria for your screener, like payout ratio, yield, and coverage.

13 Professional Stock Options Trading Insights

To trade stock options successfully, you should have a strong foundation in basic stock market knowledge and an understanding of how options work. Options are contracts that give the buyer the right, but not the obligation, to buy or sell a specific stock at a predetermined price on or before a certain date.