8 Step Guide: I Start an Algo Trading System From Scratch

To create an algo trading system, I recommend choosing a strategy, selecting a trading platform, choosing the asset type, selecting the indicators and patterns, backtesting, and refining the strategy.

How I Find and Act On Buy Signals In Stock Trading

A buy signal is essentially an indicator or event that suggests it may be a good time to purchase a particular stock, whether based on technical data, chart patterns, or intrinsic value.

Unveiling the Secret Japanese Trading Tactics of Kagi Charts

Kagi charts provide traders with a unique perspective on price action, filtering out much of the noise and highlighting genuine trends.

Getting a handle on how to use Kagi charts, dialing in the right settings, and understanding how they compare to other chart types can really sharpen your technical analysis and trading decisions.

The Truth About AI Trading & The Strategies & Tools to...

Most AI trading tools do not use real AI machine learning and large language models. The majority of self-proclaimed AI trading tools are algorithmic and do not actually learn.

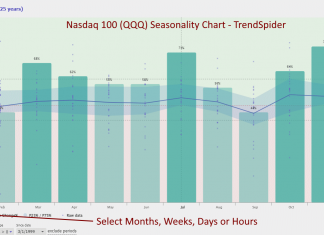

How to Identify & Trade Seasonal Trends in Financial Markets

Seasonal trends refer to certain sectors, like retail, which often perform better during holiday seasons, while agricultural products might see spikes during harvest times.

Video: Stock Rover In-Depth Test & Review – For Serious Investors...

After extensive testing, I’ve rated Stock Rover 4.7 stars. With its advanced screening, research capabilities, and portfolio management tools, it’s a perfect choice for US value, income, and growth investors.

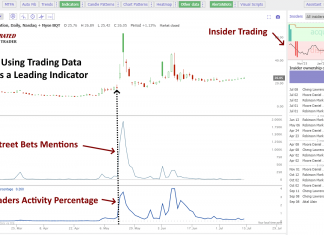

Insider Trading: How to Find, Analyze & Profit From It

Legal insider trading happens when corporate insiders trade their own company's stock following SEC reporting rules. Illegal insider trading, in contrast, involves trading a public company's stock based on nonpublic, material information.

Video: TradingView Review & Test – The Ultimate All-Rounder

After years of testing, I’m giving TradingView an impressive 4.8 stars for its cutting-edge innovation in chart analysis, pattern recognition, screening, and backtesting. It’s hands-down my top pick for both US and international traders.

Study: Musk’s Popularity Drops 14% While Tesla Sales Fall

The study reveals that while Musk and Tesla enjoyed a boost in public perception following Donald Trump’s 2024 re-election, that goodwill has since eroded. The reason? Musk's interference in foreign elections and controversial role in DOGE is killing the brand.

Welcome to the New Stock Market Reality Uncle Sam!

I decided to liquidate all U.S. holdings after carefully evaluating the fundamental outlook and market sentiment using the Liberated Stock Trader Fear and Greed Index.

12 Chart Patterns Proven Profitable

Believe it or not, certain chart price patterns are genuinely effective. While not every pattern is reliable, a select few have consistently proven their worth over time.

Cup & Handle Pattern Video: An Incredibly Reliable Pattern

Two decades of trading research indicate that the cup and handle pattern boasts a 95% success rate in bull markets, yielding an average profit of +54%

Double Bottom Pattern Video: One of the Best Strategies

Decades of research show that the double bottom pattern boasts an 88% success rate in bull markets and offers an average profit potential of +50%.

Inverse Cup & Handle Pattern Video: Highly Profitable

Research spanning two decades shows that the inverse cup and handle pattern boasts an 82% success rate, often resulting in average price declines of 17%. This makes it an excellent pattern for short-selling strategies.

Charts For Traders Video: Which Charts Should You Use?

My research indicates that the most effective chart types for traders are Heikin Ashi, Candlestick, OHLC, Raindrop, and Renko charts. These charts offer an optimal balance of price and trend reversal information, aiding investors in developing successful trading strategies.

Accurate Day Trading Indicators Video: Fully Tested

Our extensive research, spanning 10,400 years of exchange data, reveals that the top day trading indicators are the Price Rate of Change, VWAP, Weighted Moving Average, Hull Moving Average, Simple Moving Average, and RSI.

Heikin-Ashi Video: A Better Way to Use Stock Charts

Through extensive research, I have found that Heikin-Ashi charts surpass traditional candlesticks in maximizing returns for trading strategies. After backtesting 360 years of data across the 30 most significant US stocks, our findings reveal that Heikin-Ashi chart strategies outperform a buy-and-hold approach in 66% of equities.

TradingView vs. MetaTrader Test: Which One Wins?

MetaTrader and TradingView are fundamentally different platforms. MetaTrader excels as a robust desktop-based trading automation and execution platform. TradingView shines as a social-oriented analytical powerhouse with superior charting, indicators, backtesting, and data coverage.

7 Defense Stocks Ready to Boom with Trump’s NATO Reforms

My analysis shows that Palantir, Lockheed Martin, Northrop Grumman Corp, Rheinmetall, and Raytheon Technologies stand to gain from Trump's push for NATO allies to increase defense spending.

9 AI Stocks Ready to Boom with Project Stargate

My research shows that Companies like Nvidia, Palantir, Oracle, and Microsoft are well-positioned to make substantial gains from Project Stargate, given their expertise in hardware and cloud computing solutions.