Descending Triangle Video: You Need to Trade This Pattern

Research spanning twenty years highlights that the descending triangle pattern boasts an 87% success rate in bull markets, with an average profit potential of +38%.

Flag Pattern Trading Video: Be Careful How You Trade

While many investing websites recommend traders watch for bull flags as a sign of potential gains, data suggests otherwise. An analysis of 1,028 trades reveals that most bull flags fail at a rate of 55%.

Ascending Triangle Pattern Video: Trade an 83% Win

This video unveils research into the ascending triangle pattern. Based on twenty years of trading research, the ascending triangle pattern boasts an impressive 83% success rate with an average potential profit of 43%.

Triple Bottom Pattern Video: Epic Trading Pattern!

Decades of trading research reveal that the triple-bottom pattern boasts an 87% success rate in bull markets and offers an average profit potential of +45%. Traders should consider using the triple-bottom chart pattern more frequently.

Rising Wedge Pattern Video: A Top Pattern for Traders

Learning to spot and trade rising wedges can give you an edge. They tend to be quite reliable, especially in uptrends.

Rectangle Pattern Video: An 85% Success Rate

This video unveils research into the rectangle pattern. A rectangle is a stock chart pattern in technical analysis in which stock prices oscillate between horizontal support and resistance levels.

Head & Shoulders Pattern Video: A Highly Profitable Pattern

This pattern is renowned for being the most reliable bearish reversal indicator in technical analysis. A H&S pattern suggests an 81% probability of a...

Inverse Head & Shoulders Video: Exceptional Profitability

The inverse head-and-shoulders pattern is among the most reliable reversal formations in technical analysis, boasting an accuracy rate of 89%.

Falling Wedge Pattern Video: A Good Pattern to Trade?

The falling wedge pattern is a bullish chart formation in technical analysis. It occurs when the price consolidates between two descending trendlines.

Research shows that...

Bull Pennant Patterns Video: Research is Surprising

A bull pennant is a technical analysis chart pattern characterized by a sharp rise in a stock's price, a consolidation phase, and then another sharp rise. Traders should exercise caution with bull pennant patterns. Research indicates a low success rate of 54% and a modest price increase of just 7%.

Bearish Pennant Pattern Video: Should You Trade It?

This video unveils research into the bearish pennant pattern. A bearish pennant is a continuation chart pattern employed in technical analysis to forecast potential price movements.

Renko Charts Video: How to Trade Renko Properly

Renko charts filter out unnecessary price fluctuations to provide a clear stock price trend that traders can use in their investing strategies.

Unlike traditional candlestick...

Bear Flag Pattern Video: How to Trade It

This video unveils research into bear flag patterns.

A bear flag is a stock chart pattern used in technical analysis to indicate a potential continuation...

Top Bearish Chart Patterns Video

Decades of research have proven the most predictable bearish patterns are the inverted cup-and-handle, with an average price decrease of 17%, the rectangle top (-16%), head-and-shoulders (-16%), and the descending...

Top Stock Chart Patterns for Traders Video

Research indicates that the most reliable and profitable stock chart patterns include the inverse head and shoulders, double bottom, triple bottom, and descending triangle....

10 Bullish Chart Patterns Video: Verified By Testing

Research shows the most reliable and accurate bullish patterns are the cup-and-handle, with a 95% bullish success rate, head-and-shoulders (89%), double-bottom (88%), and triple-bottom (87%).

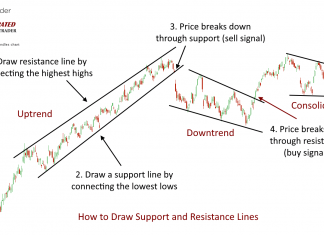

Drawing Trendlines Video: How to Get It Right

Trendlines visually represent the market's trend direction. They are created by connecting two or more significant highs or lows on a stock chart, forming a diagonal line that reflects the asset's general price movement.

Free Video Library: Stock Chart Analysis

Our video library of chart types and analysis techniques contain original research into their accuracy and profitability. Its a valuable resource for investors and traders.

Wyckoff Method Video: Understanding Market Lifecycles

The Wyckoff Method offers a thorough approach to stock market analysis, and it has stood the test of time as a fundamental aspect of technical analysis. Wyckoff's strategy centers on the concept of market cycles, comprising the phases of accumulation, markup, distribution, and markdown.

KDJ Indicator Video: How to Trade It Based on The Data

My comprehensive research highlights that the KDJ can be highly effective, boasting a 63% success rate when properly configured.