Barry D. Moore CFTe

406 POSTS

239 COMMENTS

With a wealth of experience spanning 25 years in stock investing and trading, Barry D. Moore (CFTe) is an author and Certified Financial Technician (Market Analyst) recognized by the International Federation of Technical Analysts (IFTA). Notably, he has also held executive positions in leading Silicon Valley corporations IBM Corp. and Hewlett Packard Inc.

Trade Ideas Review 2024: AI Tested by LiberatedStockTrader

Our in-depth testing shows Trade Ideas is the ultimate black box AI-powered day trading signal platform with built-in automated bot trading. Three automated Holly AI systems pinpoint trading signals for day traders.

Methodology: How to Predict The Next Stock Market Crash

Based on the market and business cycle theory, the next stock market correction will occur in 2027 (Kitchin Cycle) and 2031 (Juglar Cycle). The future crash will have two or more of the six systemic risks of inflation, rising interest rates, asset bubbles, financial mismanagement, political turmoil, or high unemployment.

MOSES: Our Stock Market Crash Early Warning System

A stock market crash early warning system is something every trader needs. Our Early Warning System alerts you to any potential signs of a crash in the markets. We call the system MOSES.

Using the Sharpe Ratio For Risk-Adjusted Investment Returns

The Sharpe Ratio provides insight into the return generated per unit of risk and is vital for both individual investors and financial professionals looking to optimize their portfolios.

TrendSpider Review 2024: Certified Analyst Test & Rating

Our TrendSpider testing finds it is ideal for US traders wanting AI-automated charting, pattern recognition, and backtesting of stocks, indices, futures, and currencies.

LiberatedStockTrader’s 14-Video Guide to Technical Analysis

Our ultimate guide to technical analysis will fast-track your knowledge with our 14 videos covering charts, trends, indicators, patterns, and tools.

6 Innovative Ways to Make Money When Stocks Crash

You can profit from stock market crashes by avoiding the crash, short selling, using stock options, or investing in gold.

Using Earnings Power Value: An Accurate Financial Metric

Earnings power value provides a clear measure of a company's ability to generate profits over time. It looks at consistent income rather than temporary earnings spikes, giving a truer picture of a company's performance.

How to Use Price-to-Book Ratio for Smarter Investing

The P/B ratio compares a company's market value to its book value, revealing how much investors are willing to pay for each dollar of a company's net assets.

How to Trade Futures Using Commitment of Traders (COT) Report

The Commitment of Traders (COT) Report is a valuable tool for traders wanting to understand market sentiment in the futures markets.

Published by the Commodity...

OpenAI Stock Price: Investing in ChatGPT & AI

Open AI does have stock and is not publicly traded on any stock exchange. As a not-for-profit organization, OpenAI does not have the same financial goals as traditional companies and, therefore, does not need to raise capital through public offerings.

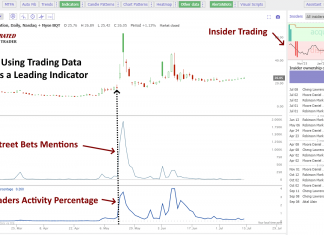

How to Find & Analyze Insider Trading Data for Smart Investing

Legal insider trading happens when corporate insiders trade their own company's stock following SEC reporting rules. Illegal insider trading, in contrast, involves trading a public company's stock based on nonpublic, material information.

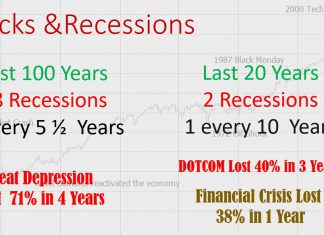

A History of Stock Market Crashes, Causes, Effects & Fixes

Our research shows that asset bubbles, easy access to cheap credit, weak regulation, and poor institutional risk management are the causes of crashes.

A Traders Guide to the Short Sale Rule (SSR)/Uptick Rule

When a stock's price declines significantly, the Short Sale Rule triggers a temporary restriction that prevents investors from shorting the stock unless the price is above the current highest bid.

Investors Guide to the Net Profit Ratio with Examples & Calculations

The Net Profit Ratio is a key financial ratio for better investing, telling us how efficiently a company generates profit compared to its revenue and competitors.

TradingView Review 2024: Tested by LiberatedStockTrader

LiberatedStockTrader's review testing awards TradingView 4.8 stars due to excellent stock chart analysis, pattern recognition, screening, and backtesting. TradingView is our top recommendation for US and international traders.

Is Gold a Good Investment During a Stock Market Crash?

Contrary to popular belief, gold is not a good long-term investment compared to stocks. However, it can provide a good alternative investment asset during the early stages of a stock market crash.

The Ultimate Guide To Stock Screening by LiberatedStockTrader

Professional stock screening requires a clear investing methodology based on growth, value, dividend, or short-term trading. Next, select the right tools and implement your specific criteria.

Stock Rover Review 2024: Tested by LiberatedStockTrader

LiberatedStockTrader's review testing awards Stock Rover 4.7 stars. Its advanced screening, research, and portfolio tools are ideal for US value, income, and growth investors. With 650 financial metrics on 10,000 stocks and 44,000 ETFs, we rate Stock Rover the number one stock screener.

Using Seasonality Stock Charts to Improve Market Timing

Seasonality charts provide predictable patterns that stocks follow during specific days, weeks, and months of the year. These trends are influenced by recurring events or cycles.