You can profit from stock market crashes by avoiding the crash, short selling, using stock options, or investing in gold.

Profiting from a stock market crash is a complicated task requiring careful research and strategy. The key to success is understanding why the market crashed in the first place and anticipating which stocks are likely to be most affected by the crash.

1. Avoid the Crash

Using fundamental and technical analysis intelligently can prevent stock market crashes. How do you know when a crash is coming? Well, we have a solution for that.

Beat The Market, Avoid Crashes & Lower Your Risks

Nobody wants to see their hard-earned money disappear in a stock market crash.

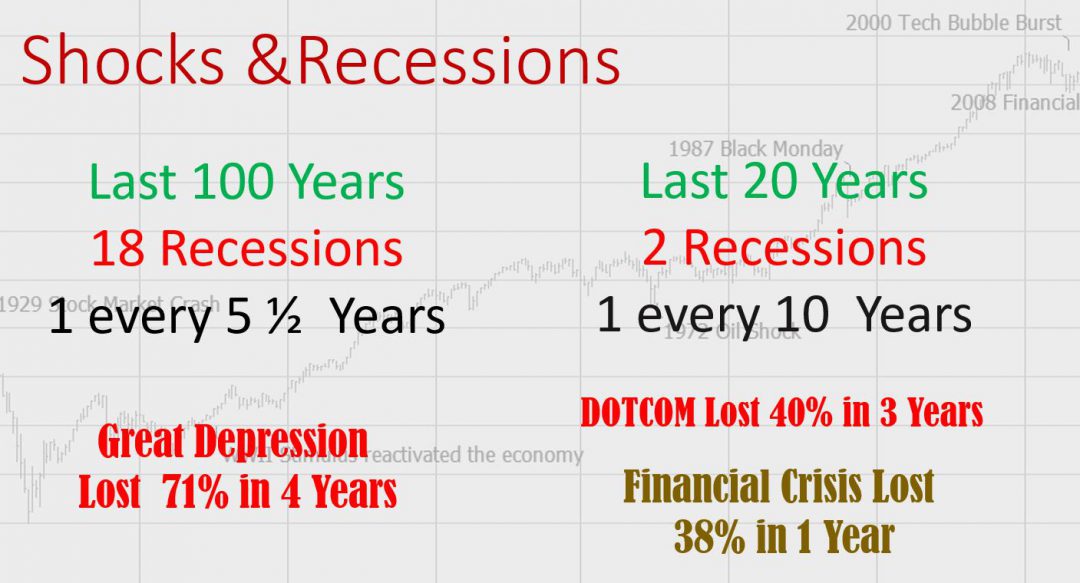

Over the past century, the US stock market has had 6 major crashes that have caused investors to lose trillions of dollars.

The MOSES Index ETF Investing Strategy will help you minimize the impact of major stock market crashes. MOSES will alert you before the next crash happens so you can protect your portfolio. You will also know when the bear market is over and the new rally begins so you can start investing again.

MOSES Helps You Secure & Grow Your Biggest Investments

★ 3 Index ETF Strategies ★

★ Outperforms the NASDAQ 100, S&P500 & Russell 3000 ★

★ Beats the DAX, CAC40 & EURO STOXX Indices ★

★ Buy & Sell Signals Generated ★

MOSES Helps You Sleep Better At Night Knowing You Are Prepared For Future Disasters

MOSES is a stock market index ETF investing system designed to help you beat the market’s performance by avoiding major stock market crashes. There are five core indicators in the Moses strategy; you can use the best approach to eliminate most losses and compound your investments to beat the market.

With MOSES, you will be alerted before the next crash happens so you can take action and protect your portfolio. You will also know when the bear market is over so you can start investing again with confidence.

This system gives you an edge over other investors and helps you stay ahead. It’s easy to follow and use, so you can start immediately.

This system has been backtested over the last 90 years and provides a clear, foolproof way to know when a stock market crash is about to happen.

It helps me sleep better at night.

2. Use Dollar Cost Averaging

Dollar-cost averaging is a commonly used investing strategy. If you regularly contribute to a retirement fund or your investment portfolio, you automatically use dollar-cost averaging. This regular contribution averages out the overall cost of the investment.

If the stock price decreases over time, the investor will receive more shares for their money, meaning the asset’s average price is decreased. This averages down the cost per share, promoting a successful investing outcome. If the stock price increases, they get fewer stocks, increasing the average cost.

3. Short Selling

Short selling is one of the most popular strategies for profiting from a stock market crash. Short selling involves borrowing shares of a stock that you believe will decline in value and then selling them at their current price. If the stock’s price drops as predicted, you can buy back the shares at a lower price and pocket the profit. This strategy requires considerable knowledge of how markets work and careful daily monitoring of prices.

4. Options Contracts

Investors can also use options contracts to make money during a market crash. With an option contract, investors have the right but not the obligation to purchase or sell an underlying asset at a set price at some point in the future. Investors can benefit from potential gains if stocks decline further by purchasing put options during a market downturn.

Again, it is important to understand how markets work before attempting this strategy.

5. Invest In Gold

Finally, investing in gold or other precious metals may help investors protect themselves against losses due to market crashes since gold typically rises when stock prices fall and vice versa. This type of investing tends to provide stability and security in uncertain times. It should only be done after carefully considering which metals will likely give you the best returns.

6. Move to Cash

Surely, if you leave your money on the sidelines and do not invest in stocks all the time, how can you profit? Using the cash position to your advantage is a simple yet incredibly powerful strategy to make money from a downturn.

There are some fundamental questions you need to ask yourself.

- Are you always in the market? By this, I mean, are you always invested in stocks?

- Do you think you will maximize your profit if you are always invested?

- Are you scared of missing some profit if you do not stay in the trade?

The Independent Investors Advantage – Cash

One key advantage of being an independent investor is that we can pull our money out of stocks and move into cash whenever we want to, and we do not have to answer to anyone but ourselves. This is an important advantage over large institutions, which have to leave the bulk of their cash because of their manifesto with their investors. Sometimes, investing your entire portfolio in stocks does not make sense.

1987, 2000, 2008, and 2020 were one of those times.

Your Default Position Should Always Be Cash.

From this position, you buy stocks and hopefully reap the benefits. When things start looking bleak – Sell and move to cash.

There is no Shame in Being in Cash.

Most experienced investors trading their accounts use this to their advantage. Knowing everything about technical and fundamental analysis will not help if you refuse to move to cash when the market enters a serious bear phase. Money management and the preservation of your capital are critical. If you risk too much and lose too much, you will not have enough money to invest when the going gets good.

The more you lose in a downturn, the more you have to make on the upturn just to break even.

Profit From A Market Crash: Lesson

Remember this.

If You Lose 50% in the Stock Market, You Need To Make 100% to Get Back To Even

Example 1. The Strategy of 80% of the people who fail to beat the market.

- Stock A – you BUY 100 shares @ $10 per share = $1,000 investment

- Stock A – Drops to $5 per share (50% loss) = your investment is worth now $500

- Stock A – Moves back to $10 per share.

To get your investment back, this stock will need to move back to $10. This means you need to make a 100% profit just to break even.

Example 2. The Strategy of the 20% of people who beat the market.

- Stock A – Bought 100 shares @ $10 per share = $1,000 investment

- Stock A – Drops to $8.50 per share = you SELL and take the loss of 15% – investment value now $850 – you stay in cash.

- Stock A – Drops to $5 – you BUY 170 shares @ $5 – investing your $850 back into the stock – investment value $850

- Stock A – Increases to $10 – you SELL 170 shares @ $10 = $1700. This is a 70% Profit.

In example 1, you had the stress of being in a losing trade for a long time and making no profit at the end.

In example 2, you took your losses on the chin early. However, you then waited patiently for the right time to get back in, made up for your early loss, and made a significant profit.

The Motto of this Story.

“DO NOT SIT AND HOPE – TAKE ACTION TO PRESERVE YOUR CAPITAL AND WAIT FOR BETTER DAYS.”

Related Articles: Finding Great Stocks With Stock Rover

- 12 Legendary Strategies to Beat the Market That [Really] Work

- Our Beat the Market Screener [Actually] Beats the Market

- 4 Easy Steps to Build The Best Buffett Stock Screener

- 6 Steps to Build an Ethical ESG Investment Portfolio

- All Value Investing Strategies & Articles

- Use a CANSLIM Stock Screener Strategy To Beat the Market

You have got to admit though. It’s tough not getting involved when stocks are crashing all around you. Some shares are moving up and down by 20-30% in a week and there is so much money to be made. I suppose it just depends how prolonged the crash is. We’ll see what happens with the Euro!

Yes sir! Thank you.