A cyclical stock’s price is influenced by macroeconomic or systemic changes within the broader economy. These stocks are renowned for mirroring the economic cycles through the growth, boom, bust, and recovery phases.

The terms cyclical, noncyclical, discretionary, and non-discretionary stocks are confusing; let us explain.

What are cyclical stocks?

Cyclical stocks move with the up-and-down cycles of the economy. These stocks are most vulnerable to economic downturns but perform well when the economy is booming. Examples of cyclical stocks include manufacturing, raw material production, and energy companies.

Cyclical stocks will often be some of the first to feel the effects when the economy takes a turn for the worse—because of this, investing in cyclical stocks can be a bit of a gamble. You could see significant gains if you timed your investment right, but if you invest just before a recession, you could see some big losses.

Cyclical stock definition

A cyclical stock’s price is tied to the cyclical movements of the economy. These stocks are often more volatile than non-cyclical stocks, meaning their prices can fluctuate quickly depending on economic conditions.

What are defensive stocks?

Defensive stocks, on the other hand, tend to perform better during economic recessions. These types of stocks represent companies whose products or services are

A cyclical stock is a type of stock that typically performs well when the economy is doing well but falls when the economy declines. Cyclical stocks are often associated with companies that provide long-lasting, durable goods or services, typically automakers, retailers, and airlines.

Cyclical stocks explained

Economies and stock markets move in cycles of growth and decline. When economies grow, people have more money to spend buying durable (long-lasting) goods like cars and homes. Cyclical stocks are those companies that produce big-ticket items that sell well when the economy is good but suffer when the economy declines.

Cyclical Stock Key Takeaways.

- Cyclical stocks are those that grow fast during economic booms.

- Cyclical stocks are also known as consumer durable goods or consumer discretionary.

- When economies decline, people will buy fewer durable/discretionary goods.

- Consumer discretionary means that the products are not essential to life but are more of a life upgrade or luxury purchase.

- Cyclical stocks are homemakers, motor companies, airlines, and producers of luxury goods.

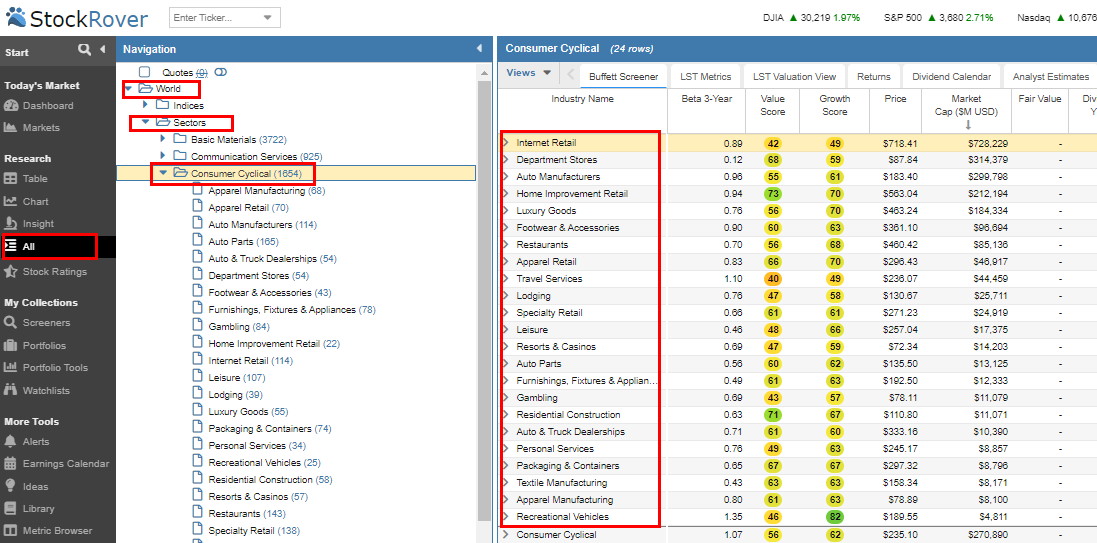

Finding cyclical stocks with Stock Rover

It is easy to get a list of consumer cyclical stocks by following this process:

- Register with Stock Rover for free

- Select All -> World ->Sectors -> Consumer Cyclical

- Review the list of cyclical industries and stocks.

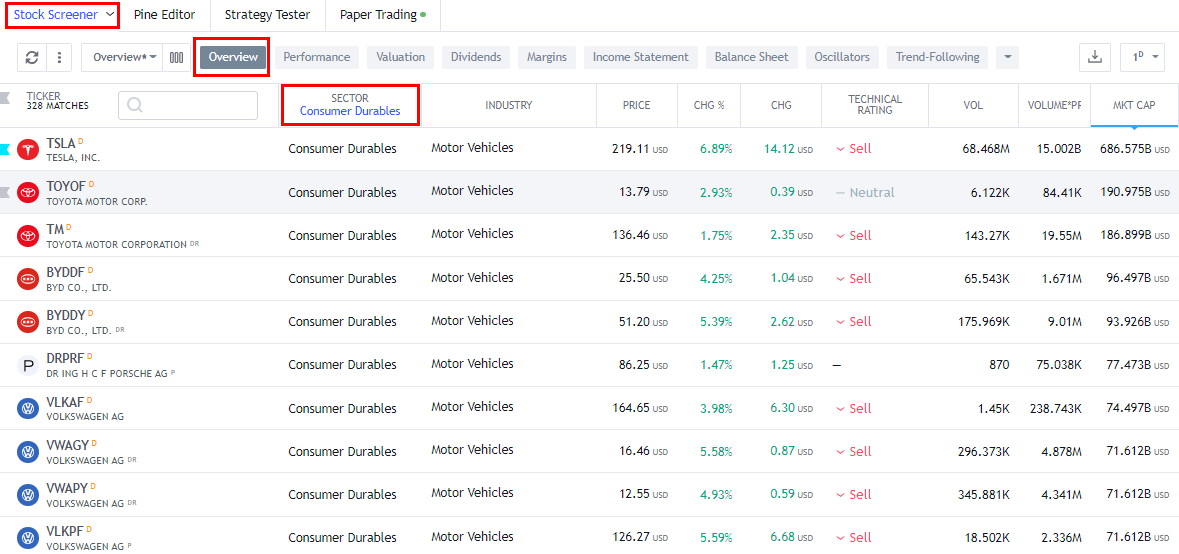

Finding cyclical stocks with TradingView

- Try TradingView for free

- Select Stock Screener -> Filter -> Sector -> Consumer Durables

- Review the list of cyclical industries and stocks.

Buy cyclical stocks at the end of a recession

To maximize returns, buying cyclical stocks like airlines, automakers, and real estate investment trusts (REITs) is best when the economy starts to grow again. This means buying cyclical stocks at the end of a recession because they will be undervalued, cheap, and usually experience market-beating performance.

What are noncyclical stocks?

Noncyclical stocks are stocks that tend to do well during all economic conditions. They are often considered safer investments, as they are less volatile than cyclical stocks. Noncyclical stocks can be a good option for investors who want to protect their portfolios from losses during recessions and periods of economic volatility. Some good examples of noncyclical stocks include consumer goods companies, healthcare providers, and telecommunications companies.

Noncyclical stock explained

Noncyclical stocks are those companies producing goods that people always need regardless of whether the economy is booming or declining; people will always buy non-discretionary/non-durable goods like food, drink, and basic clothing.

Noncyclical Stock Key Takeaways

- Noncyclical stocks perform well in all market conditions.

- Noncyclical stocks are also known as consumer non-durable goods or consumer non-discretionary.

- Non-durable means that products, such as food, beverages, gasoline, and basic apparel, do not last long.

- Consumer non-discretionary means that people do not have a choice; they must buy food, water, electricity, and medicine.

- Noncyclical stocks are food, beverage, and utility companies.

Cyclical, durable & discretionary stocks cheat sheet

| Stock Type | Sector | Industry | Performance |

| Cyclical & discretionary stocks | Consumer durable |

|

Rise & Fall With the Economy |

| Noncyclical & non-discretionary | Consumer non-durable |

|

Perform well in all conditions |

| Counter-cyclical | Healthcare/Defence |

|

Out-perform in economic decline |

A list of consumer cyclical stocks

- Automakers – Ford, General Motors, Tesla

- Travel: AirBnB, Booking.com, Trip.com

- Retail: Amazon, Alibaba, Etsy, eBay

- Restaurants: Starbucks, Wendy’s, Chipotle

- Transportation: Delta Airlines, United Airlines

What is a consumer noncyclical stock?

A consumer noncyclical stock is a type of stock that typically performs well regardless of the economic climate. These stocks are often associated with companies that produce goods or services essential to human survival, such as utilities, food, beverage, and footwear producers.

A list of consumer noncyclical stocks

- Utilities: American Electric Power, Duke Energy, American Water Works

- Beverages: Coca-Cola, Pepsico

- Consolidated Edison, Crown Castle International, Deere & Company

Many investors are still willing to take on the risk associated with cyclical stocks. And there are some benefits to investing in cyclical stocks. So, if you’re considering adding cyclical stocks to your portfolio, here’s what you need to know.

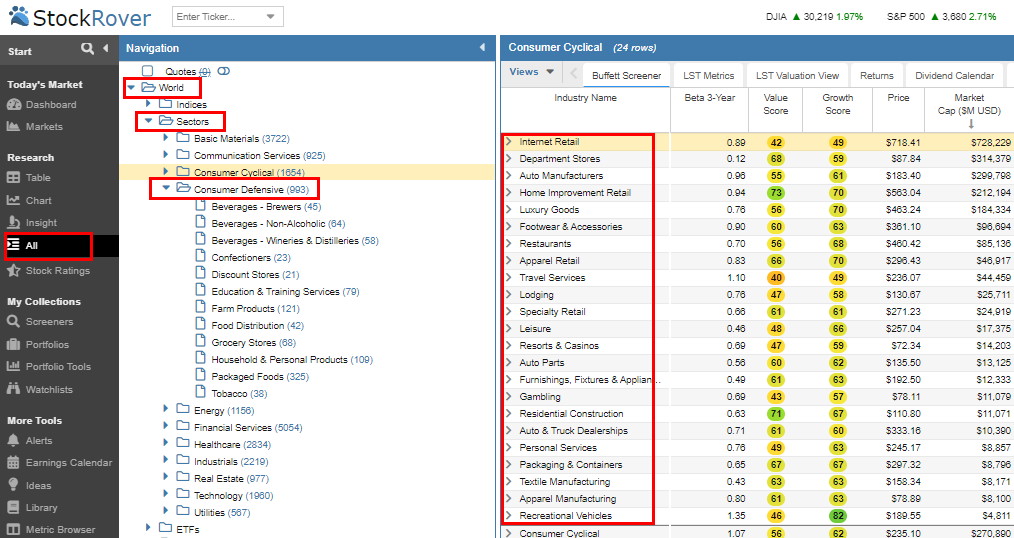

Finding noncyclical stocks with Stock Rover

It is easy to get a list of consumer noncyclical stocks by following this process:

- Register with Stock Rover for free

- Select All -> World ->Sectors -> Consumer Defensive

- Review the list of cyclical industries and stocks.

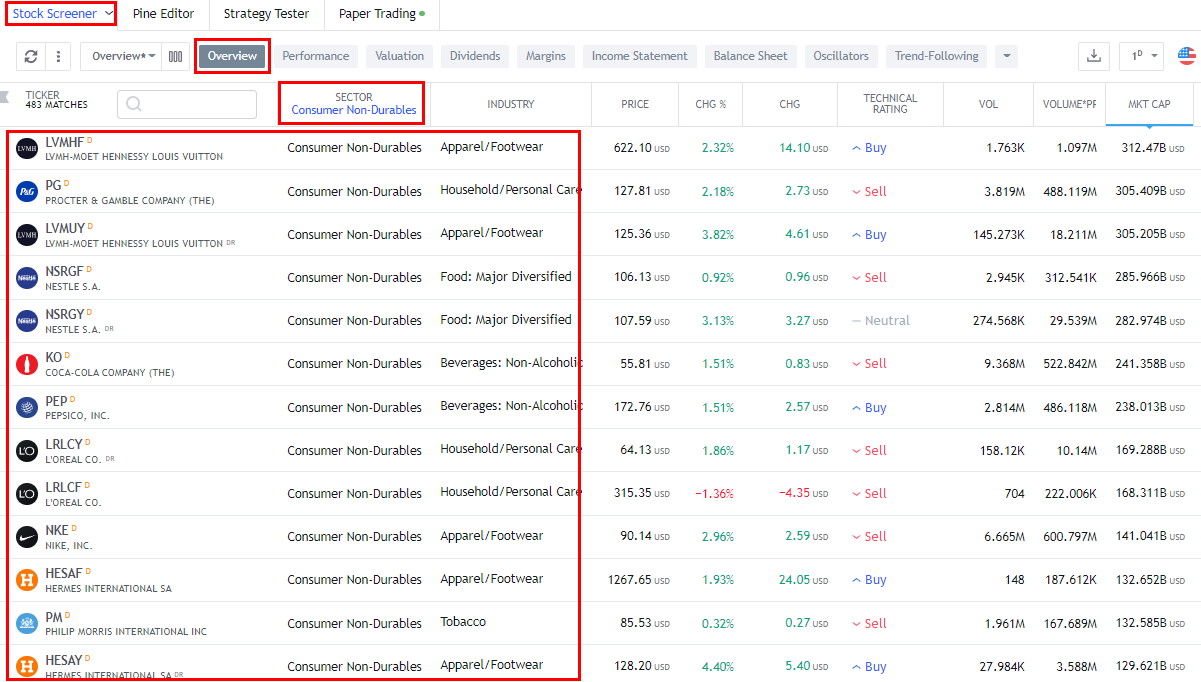

Finding noncyclical stocks with TradingView

- Try TradingView for free

- Select Stock Screener -> Filter -> Sector -> Consumer non-durables

- Review the list of cyclical industries and stocks.

When to buy noncyclical stocks?

Noncyclical stocks are a good investment in any economic cycle; during a market boom, they might not perform as well as cyclical stocks but will still make money. Noncyclical stocks are a good defensive investment when the economy turns from boom to bust.

Cyclical stock pros

1. They offer the potential for high returns.

You can see significant gains when the economy and cyclical stocks perform well. If you’re looking for a high-risk/high-reward investment, cyclical stocks might be worth considering.

2. They offer diversification.

Adding cyclical stocks to your portfolio can help diversify your investment portfolio and protect you from losses in other market areas.

3. They can be a good hedge against inflation.

Cyclical companies often have pricing power, which means they can increase prices without losing customers. This can be a good hedge against inflationary pressures.

Investing In Stocks Can Be Complicated, Stock Rover Makes It Easy.

Stock Rover is our #1 rated stock investing tool for:

★ Growth Investing - With industry Leading Research Reports ★

★ Value Investing - Find Value Stocks Using Warren Buffett's Strategies ★

★ Income Investing - Harvest Safe Regular Dividends from Stocks ★

"I have been researching and investing in stocks for 20 years! I now manage all my stock investments using Stock Rover." Barry D. Moore - Founder: LiberatedStockTrader.com

Cyclical stocks cons

1. They’re volatile.

Cyclical stocks can be very volatile, which means they can experience sudden and significant swings in price. If you’re uncomfortable with volatility, cyclical stocks might not be right for you.

2. They underperform during recessions.

During economic downturns, consumers spend less on discretionary items like cars and vacations. This leads to lower demand for the products and services offered by cyclical companies and often results in lower stock prices.

3. They require careful timing.

Because they tend to move in cycles, it’s important to time your investment. Investing too early or too late in the cycle could lead to losses. For example, if you invest just before a recession, you could see your investment lose value quickly. On the other hand, if you wait until after the economy has begun to rebound, you may have missed out on some of the biggest gains.

4. There’s no guarantee they’ll recover.

Just because an industry or sector has been through a downturn doesn’t mean it will automatically recover when the economy improves. In some cases, companies may not be able to adapt to changes in consumer behavior and end up going out of business. This happened during the last recession when many traditional retailers could not compete with online retailers like Amazon. As a result, many stores closed their doors for good.

Is investing in cyclical stocks profitable?

The profitability of investing in cyclical stocks will depend on various factors, including the individual stock, the sector it belongs to, and the overall health of the economy. However, in general, investing in cyclical stocks does offer the potential for higher returns than investing in other types of stocks. However, this comes with a higher degree of risk, and there is no guarantee that these stocks will recover when the economy improves.

What are counter-cyclical stocks?

Counter-cyclical stocks are stocks that tend to perform well during economic downturns. They are often considered safer investments during recessions, as their services are generally in more demand. Counter-cyclical stocks can be a good option for investors who want to protect their portfolios from losses during recessions.

Understanding counter-cyclical stocks

Consider an economy is in sharp decline, more people are unemployed, feeling poorer, less secure, and have fewer opportunities, and well-being is declining. What services will be more in demand? Healthcare, prison services, home security, and the defense industry all profit during strong economic decline.

Counter-cyclical Stock Key takeaways.

- Counter-cyclical stocks perform well in declining economies and poorly in growing economies.

- Counter-cyclical stocks are a good investment in declining economies.

- Counter-cyclical stocks are goods and services purchased during bad times.

- Counter-cyclical stocks are security services, repossession and eviction services, prison security, and defense products.

Examples of counter-cyclical stocks

Some good examples of counter-cyclical stocks include utilities, security, and healthcare companies. Utility companies do well during recessions, as consumers tend to stick with their pre-existing utilities rather than changing providers during financial stress. Food producers also tend to do well during recessions, as people still need to eat despite spending less money. Healthcare providers are another good option during recessions, as people often put off medical procedures when money is tight but still need access to healthcare.

Are defense stocks cyclical?

No, defense stocks are not cyclical; they are considered counter-cyclical, meaning they tend to perform well during economic downturns. This is because governments tend to invest more in defense during times of uncertainty and volatility.

Are there any cyclical ETFs?

Yes, several cyclical ETFs are available for investors, including the SPDR S&P Transportation Index ETF and the VanEck Vectors Morningstar Wide Moat ETF. These ETFs invest in cyclical stocks, so they offer the potential for higher returns but also come with a higher degree of risk.

Final Thoughts

Overall, there are both pros and cons to investing in cyclical stocks. Whether or not they’re right for you will ultimately depend on your individual risk tolerance and investment goals. If you’re considering adding cyclical stocks to your portfolio, research first and always remember to stay diversified.

FAQ

What is the best platform for trading cyclical stocks?

TradingView is considered to be the best platform for trading cyclical stocks. TradingView provides extensive research tools, powerful charts, and real-time global exchange data. Plus, it has a large community of traders who share ideas.

What are cyclical stocks?

Cyclical stocks represent companies whose profits and stock prices are directly affected by the overall economy. They tend to perform well when the economy is expanding and poorly during economic downturns.

Can you give examples of cyclical stocks?

Cyclical stocks often include companies in sectors like:

- Automotive

- Consumer discretionary

- Travel and leisure

- Housing

- Durable goods

How do cyclical stocks perform in various economic conditions?

During periods of economic growth, cyclical stocks generally perform well as consumers have more disposable income. Conversely, in a downturn or recession, these stocks usually underperform.

Why invest in cyclical stocks?

Investing in cyclical stocks can provide significant returns during economic upswings. They offer the potential for capital appreciation and sometimes dividends, contributing to portfolio diversification.

What are the risks involved with cyclical stocks?

The main risk with cyclical stocks is their sensitivity to economic fluctuations. They can suffer severe declines during economic downturns, potentially leading to substantial losses.

How can I identify cyclical stocks?

Identifying cyclical stocks involves understanding the business cycle and recognizing industries that closely follow its trends. Financial statements can also reveal patterns of cyclicality.

What’s the difference between cyclical and non-cyclical stocks?

Cyclical stocks are sensitive to the business cycle, while non-cyclical stocks tend to perform more consistently regardless of economic conditions. Non-cyclical stocks include staples, utilities, and other defensive industries.

When is the best time to buy cyclical stocks?

The best time to buy cyclical stocks is typically at the beginning of an economic recovery, when consumer spending is expected to increase, driving up company revenues and stock prices.

When should I sell cyclical stocks?

Ideally, cyclical stocks should be sold when the economy appears to be peaking, and a downturn seems imminent. This is often when these stocks have reached their highest prices.

How do cyclical stocks impact my portfolio?

Cyclical stocks can enhance portfolio returns during economic expansions and increase volatility and potential losses during downturns. They should be balanced with non-cyclical stocks for diversification.

Are all stocks cyclical?

No, not all stocks are cyclical. Some stocks, known as defensive or non-cyclical stocks, tend to perform consistently regardless of the state of the economy.

How do interest rates affect cyclical stocks?

Rising interest rates can negatively impact cyclical stocks as they increase borrowing costs, potentially reducing consumer spending and corporate profits.

Are tech stocks considered cyclical?

While traditionally considered non-cyclical, some tech stocks have shown cyclical behavior as their performance can depend on economic conditions and discretionary spending.

What are some examples of cyclical stocks?

Some common examples of cyclical stocks include retailers like Walmart and Target, automobile companies like General Motors and Ford, homebuilders like Lennar Corporation, airlines like American Airlines and Delta Air Lines, and energy companies like ExxonMobil and Chevron.

How much of my portfolio should be in cyclical stocks?

The proportion of cyclical stocks in your portfolio depends on your risk tolerance, investment goals, and market outlook. Diversification across different stock types is generally recommended.