There are many reasons why stock market booms and crashes happen. One reason is that people invest based on emotion rather than logic. When the stock market is doing well, investors tend to get caught up in the hype and invest more money than they should. This can lead to a “bubble” where prices become artificially inflated. When the bubble finally bursts, it can cause a sharp decline in stock prices, known as a crash.

Another reason crashes happen is that people tend to buy stocks when they are rising in value and sell them when they fall. This creates a self-fulfilling prophecy where the stock market falls because people are selling, and then people sell because the stock market is falling. This can create a vicious cycle that can lead to a crash.

This lesson covers stock market booms and crashes. We’ll discuss what causes these events and how to prepare for them.

What is a stock market boom?

A stock market boom is when the prices of stocks are rising rapidly. Several factors, such as economic growth or increased investor confidence, can cause this. A stock market boom can lead to an increase in the value of portfolios and create new millionaires. However, it can also be followed by a bust when prices suddenly crash.

What is a stock market crash?

A stock market crash is a sudden and sharp decline in the prices of stocks. This can be caused by economic recession or panic among investors. A stock market crash can decrease the value of portfolios and cause many people to lose money.

How global events can affect your investments

All of our investments are subject to global environmental and economic events. In this section, we explore these factors.

Boom & Bust Cycles

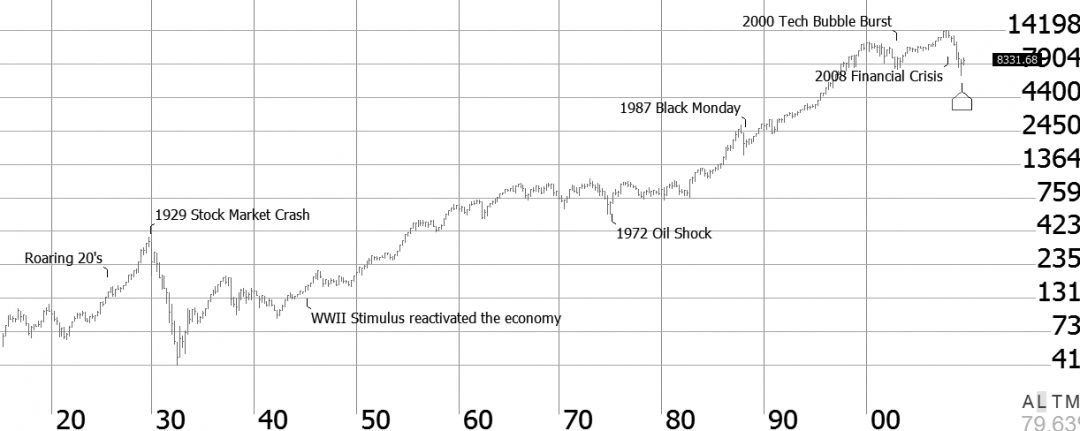

The financial crisis of 2007-2009 or 2022 is nothing new. A crisis occurs every 20 years or so when some event occurs to cause a correction in the markets and widespread panic among investors. The recent credit crisis is different only because the pullback was so rapid and volatile. The SP-500 had pulled back to the 2003 lows in 3 months. When the tech bubble burst in 2000, it took three years for that pullback to happen.

10 Reasons Stock Markets Crash

- A sudden, large sell-off by investors.

- A natural disaster or major event that spooks the markets.

- A change in interest rates by the Federal Reserve signals a slowing economy.

- A terrorist attack or major geopolitical event.

- A sudden, unexpected change in corporate earnings.

- A scandal or major mismanagement within a company.

- An inflationary or deflationary spiral.

- A market bubble that suddenly bursts.

- A long period of slow economic growth.

- The outbreak of a major war.

The Latest Crash – Corona 2020

Studying historical market behavior is always helpful to put into perspective what could happen in the current market climate.

For this analysis, I use Gann Boxes, a great drawing tool from TradingView.

Although each market cycle differs in duration, boom, and bust, they share one common characteristic.

The ability to be unpredictable, erratic, and wipe out wealth.

Another trait they share is ushering in a new era of wealth-building.

Only the new era we face may be built on inflation, significantly weakened currencies, and potentially a new world order. Additionally, in the West, the distribution of wealth is very seriously skewed toward the super-rich. Things will need to change.

Anatomy of wealth creation and destruction.

- The 60s and 70s ended with an 80% loss of gains accumulated.

- The 80s ended with Black Monday, which wiped out 38% of gains

- The Dotcom Bust wiped out 60% of gains

- The Financial Crisis wiped out 100% + of gains

The Corona Crash was fast and volatile but was thwarted by massive government intervention.

The question you must ask yourself is:

Is this the end of the crash? Is the retracement of the market commensurate with the actual economic activity & jobs market collapse?

No one knows the future, as humans are notoriously bad at predictions.

How Long Until Stock Markets Recover From A Crash?

Our analysis of six major US stock market crashes in the last 100 years shows that it takes 9.8 years to recover. The average peak loss of these crashes was 57%. This can be somewhat misleading, though. The 1929 crash was exceptional in its size and duration. Additionally, governments and central banks have realized that they can manage inflation and stimulate the economy to speed up economic and stock market crash recovery.

Over the last 20 years, we have had three major crashes, with an average loss of 62% but an average recovery time of 7 years.

| Stock Market Crash (Year) | Size of Crash % | # Years to Recover |

| 1929 | -89% | 23 |

| 1973 | -46% | 10 |

| 1987 | -35% | 2 |

| 2000 | -83% | 16 |

| 2008 | -54% | 5 |

| 2020 | -38% | 1 |

| Average | -57% | 9.8 |

Table 1: Stock Market Crashes & Their Impact

Video: Stock Market Booms, Crashes & Crisis

Video From The Liberated Stock Trader Pro Masterclass Course

Read our Stock Market Crash article for an in-depth understanding of booms and busts.

This was great

I’m starting to understand how the markets work.