23 Best Stock Chart Patterns Proven Reliable By Data Testing

Published research shows the most reliable and profitable stock chart patterns are the inverse head and shoulders, double bottom, triple bottom, and descending triangle. Each has a proven success rate of over 85%, with an average gain of 43%.

10 Best Free TradingView Indicators & How to Trade Them!

Our testing shows the best TradingView indicators for advanced analysis are Volume Profile HD, VWAP, Supertrend, ATR, Relative Volatility, and RSI. TradingView's candlestick and chart pattern recognition also improve trading outcomes.

What are Market Profile Charts & Best Software To Use?

A market profile chart is a day-trading tool that displays the price activity to identify a time price opportunity (TPO). It helps traders identify the most traded prices and develop strategies to exploit these areas.

Bear Flag Pattern: Reliability & Success Rate Based On Data

Be careful when trading bearish flags. According to published research, the bear flag pattern has a low success rate of 45%. This means you are flipping a coin when trading this pattern, as the odds are not in your favor. The high-tight bear flag is the only flag pattern you should trade.

Price Action Trading: Mastering Day & Swing Trading Strategy

Price action trading is a method of day trading that relies on technical analysis but ignores conventional fundamental indicators, focusing instead on the movement of prices.

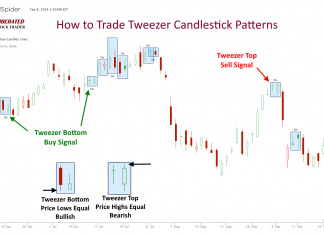

Do Tweezer Top & Bottom Candle Patterns Work? I Test It!

Based on our testing of 1,892 trades, the tweezer top and bottom patterns are highly unreliable and unprofitable. These patterns exhibit a reward-to-risk ratio of only 1.07, with 50% of trades resulting in losses. Relying on tweezers as a trading strategy yields poor results.

Trading a Double Bottom Pattern’s 88% Success Rate

Decades of research reveal the double bottom pattern has an 88% success rate in bull markets and an average profit potential of +50%. The double-bottom chart pattern is one of the most reliable and accurate chart indicators for traders.

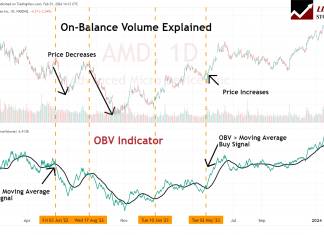

OBV Indicator: Best Settings & Trading Strategy Explained

On-balance volume (OBV) is a cumulative indicator in technical analysis designed to show the volume flow relative to a security's price movements. The OBV reflects the collective buying and selling pressure crystallized through the volume trend.

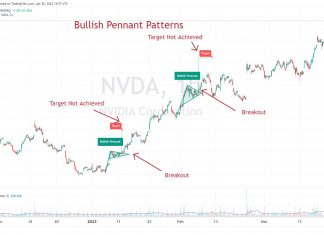

Bull Pennant: Why Traders Lose With This Pattern

Traders must be cautious when trading bull pennants. Published research reveals a low success rate of 54% and a meager price increase of 7%. This implies pattern trading bullish pennants is as good as coin-flipping with unfavorable odds.

9,894 Trades Test a Spinning Top Candle Pattern’s Reliability

Our original research found that the Spinning Top candle is a bullish pattern, with a 55.9% success rate and a 3.7% average winning trade. Trading with a Spinning Top yields an average profit of 0.49%, ranking it the 10th best candle to trade.

Hull Moving Average Trading Tested with 960 Years of Data

The Hull Moving Average (HMA) is a highly responsive technical analysis indicator designed to reduce lag. Our research reveals it outperforms other moving averages.

12 Ways to Master Stock Chart Indicators by a Certified Analyst

Professional market analysts build trading strategies using chart indicator techniques like divergences, multi-time frame analysis, indicator combinations, and rigorous backtesting.

Heikin-Ashi Candles Explained & Reliablility Tested

Our research shows that Heikin-Ashi charts are better than candlesticks for maximizing returns in trading strategies. We backtested 360 years of data across 30 major, and our findings prove that Heikin-Ashi chart strategies outperform 60% of equities vs. a buy-and-hold strategy.

Falling Wedge Pattern: A 74% Chance of a 38% Profit!

A falling wedge is a technical analysis pattern with a predictive accuracy of 74%. The pattern can break out up or down but is primarily considered bullish, rising 68% of the time.

3 Top Momentum Indicators Explained & Tested

In technical analysis, momentum indicators help traders identify the strength and direction of a stock's price. We explain and test three popular momentum indicators for reliability.

Elliott Wave Theory: Usage, Rules & Reliability Tested

Elliott Wave Theory is a scientifically unproven technical analysis indicator used to attempt to predict price movements in financial markets. I highly recommend avoiding this indicator.

Trading a Descending Triangle’s 87% Success Rate

Twenty years of trading research show the descending triangle pattern has an 87% success rate in bull markets and an average profit potential of +38%. The descending triangle pattern is popular because it is reliable, accurate, and generates a good average profit.

Is the Supertrend Indicator Super? 4,052 Test Trades Show How to...

Based on our extensive testing, it has been determined that when used as a standalone indicator, Supertrend does not demonstrate reliability or profitability. With an average profit expectancy of 0.24, it is recommended to combine Supertrend with other indicators.

Tick Charts: Settings, Strategies & Examples Explained

Tick charts are uniquely constructed by plotting price movement after a certain number of transactions occur. Unlike traditional time-based OHLC or candlestick charts representing price action over a set period, tick charts update after a predefined trading volume is reached.

6 Principles of Dow Theory Explained with Examples & Video

Dow theory's six principles underpin technical analysis: The market discounts everything; it has three trends and phases; the averages must confirm each other; volume confirms the trend and a trend continues until it reverses.

Our Best Training & Strategies

Liberated Stock Trader Pro: Learn Stock Market Investing

Learn stock market investing with the complete online stock trading course by Barry D. Moore, a certified financial analyst from the International Federation of Technical Analysts (IFTA).

ETF Investing Strategy: MOSES Improves Performance & Lowers Risk

The MOSES ETF investing strategy is a powerful suite of indicators meticulously backtested over 100 years. Designed to empower you to outperform the market, it equips you with the tools to navigate major stock market crashes and unlock greater investing performance.

Our LST Strategy Beat the Stock Market’s S&P 500 By 102%...

Decades of research and testing unveiled the Liberated Stock Trader Beat the Market System. Our 9-year, backtested, and proven strategy targets 35 financially healthy high-growth stocks, producing a track record of beating the S&P 500 by 102%.