Stock Rover Review 2024: Tested by LiberatedStockTrader

LiberatedStockTrader's review testing awards Stock Rover 4.7 stars. Its advanced screening, research, and portfolio tools are ideal for US value, income, and growth investors. With 650 financial metrics on 10,000 stocks and 44,000 ETFs, we rate Stock Rover the number one stock screener.

Keynes vs. Hayek: How Economics Shapes the Stock Market

From the "General Theory of Employment, Interest, and Money" to "The Road to Serfdom", both Hayek and Keynes provide a unique perspective on managing the economy.

10 Best Stock Screeners of 2024: Tested by LiberatedStockTrader

After comprehensive hands-on testing, we have identified the best stock screeners as TrendSpider (4.8/5 Stars), Stock Rover (4.7), TradingView (4.5), and Trade Ideas (4.4).

How to Calculate Stock Beta: Formula & Examples Explained

To calculate Beta or (β) you need to divide the variance of an equity's return by the covariance of a stock index's return.

Day & Swing Trading vs. Growth & Value Investing Explained.

Day and swing trading uses technical chart analysis to trade short-term price moves, whereas growth and value investing use long-term fundamental financial analysis. The tools and strategies used for these types of trading are completely different.

102-18 Cash Flow Statement Explained with Examples & Ratios

Cash flow is the lifeblood of a company, and the cash flow statement shows how much money was generated and spent during a given period, which makes it invaluable for investors looking to invest in a company.

Using Fundamental Analysis to Find Great Stocks

The core objective of fundamental analysis is to determine a stock's true or intrinsic value. This involves assessing the company's financial performance, industry comparisons, and economic factors.

5 Proven Ways To Find The Best Cheap Stocks to Buy...

The best way to find cheap stocks is by using future earnings, asset valuation, discounted cash flow, fair value, and the margin of safety. Do not look at stock price alone to assess if a stock is undervalued; stock price is only useful in combination with other criteria.

P/E Ratio: Use the Price to Earnings Ratio Like a Pro...

The Price to Earnings Ratio is a commonly misunderstood calculation for determining a company's relative value. The PE Ratio is only useful for comparing companies in the same industry with similar business models. It should not be used to compare radically different businesses.

How to Research Stocks to Find the Hidden Gems

To research stocks, investors need to use trustworthy research tools and reports to find good investments. The ability to understand the research and hone an investing strategy is paramount.

Is The Stock Market Overvalued? The Data Says Yes!

According to the Shiller PE Ratio, the US stock market is currently 19.2% overvalued compared to its 200-month moving average. Currently, the PE ratio of the S&P 500 is 31, and the 10-year average is 26.

How to Read Financial Statements for New Investors

The three main types of financial statements are the balance sheet, income statement, and cash flow statement. Each one provides a different perspective on a company's finances.

Efficient Market Hypothesis vs. Random Walk Explained

The difference between the Efficient Market Hypothesis and Random Walk is that the former suggests that all available information is already incorporated into a stock's price, whereas the latter states that current prices are completely independent of past performance.

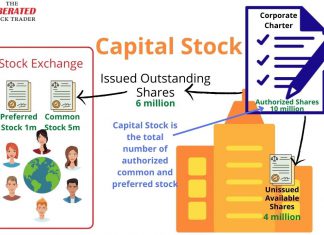

What is Capital Stock? Examples & Use In Research

Capital stock, also called authorized shares or authorized capital, is the maximum number of shares a company can issue to shareholders. A corporation's charter declares the number and type of stock it can issue, so no more than this amount can be issued.

How to Read the Income Statement Like a Pro Investor

Investors use the income statement to understand a company's key metrics, revenue, expenses, profit, and operating costs. It is one of the most important documents investors use to understand a company's financial performance.

Find the Best Defensive Stocks: Ben Grahams Protection Strategy

Defensive stocks withstand economic recessions and bear markets by providing critical human services. The best way to find defensive stocks is by using Benjamin Graham's timeless rules for the defensive investor: Stability, earnings, dividends, price-to-book ratio, and the price-to-Graham number.

A Smart Investors Guide to Reading Balance Sheets

To read a balance sheet effectively, start by focusing on three main sections: assets, liabilities, and equity. Assets represent what the company owns, liabilities show what the company owes, and equity reflects its net worth.

39 Screening Criteria To Find Great Value Stocks

The most useful screening criteria for finding value stocks are intrinsic value, margin of safety, the PE ratio, and earnings power value. Used in combination, these metrics can find good undervalued companies.

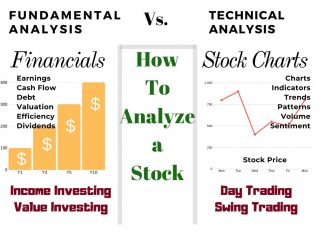

How To Analyze Stocks with Fundamental & Technical Analysis

There are two ways to analyze stocks. Fundamental analysis, which evaluates criteria such as PE ratio, earnings, and cash flow. Technical analysis, which involves studying charts, stock prices, volume, and indicators.

Creating the Best Buffett Stock Screener for Value Portfolios

The best Buffett and Graham stock screener is Stock Rover, which provides eight fair value, intrinsic value, and forward cash flow calculations to help you build a great portfolio.

Our Best Training & Strategies

Liberated Stock Trader Pro: Learn Stock Market Investing

Learn stock market investing with the complete online stock trading course by Barry D. Moore, a certified financial analyst from the International Federation of Technical Analysts (IFTA).

ETF Investing Strategy: MOSES Improves Performance & Lowers Risk

The MOSES ETF investing strategy is a powerful suite of indicators meticulously backtested over 100 years. Designed to empower you to outperform the market, it equips you with the tools to navigate major stock market crashes and unlock greater investing performance.

Our LST Strategy Beat the Stock Market’s S&P 500 By 102%...

Decades of research and testing unveiled the Liberated Stock Trader Beat the Market System. Our 9-year, backtested, and proven strategy targets 35 financially healthy high-growth stocks, producing a track record of beating the S&P 500 by 102%.